Trump attacks Powell again; dollar hits new low, techs rally

Trump resumes criticism of Powell

US President Donald Trump took centre stage on Wednesday as he not only dominated the NATO summit in the Netherlands following his successful brokering of a ceasefire between Israel and Iran, but he also stole the limelight from Jay Powell’s Congressional hearing by renewing his attack on the Fed chair.

Speaking during his second day of semi-annual testimony on Capitol Hill, this time before Senators, Powell repeated his concerns about the impact of tariffs on inflation, saying “it’s very hard to predict that in advance”. But Powell’s unwavering caution seems to have aggravated Trump further.

The President lashed out at Powell during the NATO press conference, calling him “terrible” and “stupid” and telling reporters he has “three or four people” in mind about possible replacements, possibly as early as September or October. Powell's term isn't due to expire until May 2026 and so an early appointment of his successor could create tension.

US data eyed amid dovish Fed bets

Markets quickly reacted by pricing in additional basis points of rate cuts for 2025, pushing the total bets to more than 60 bps. The most significant move, though, was for the July meeting, with the odds for a 25-bps cut rising from near zero to almost 25%.

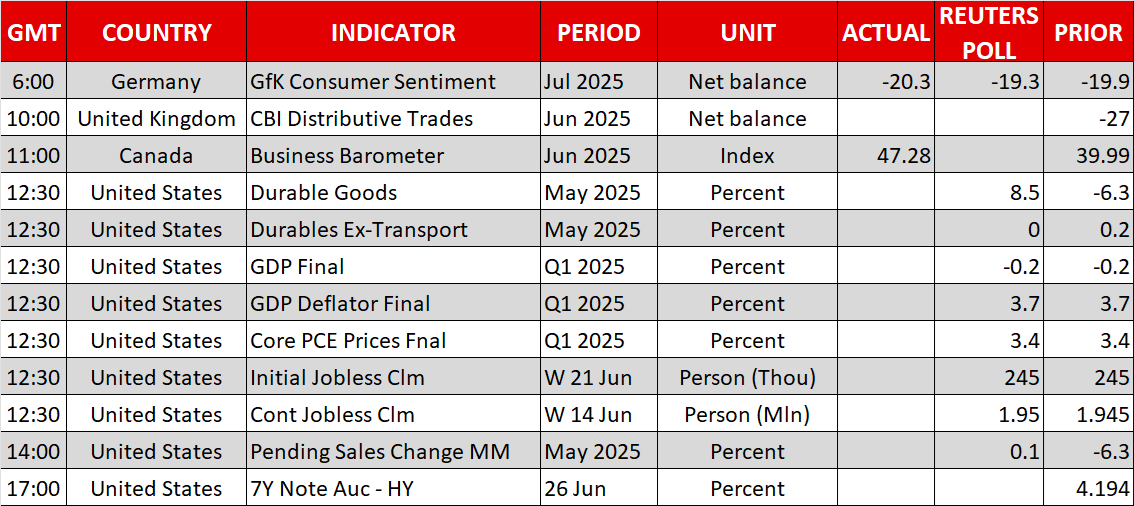

Trump’s latest intervention has essentially put investors on standby for any soft data that could potentially boost expectations for a summer cut. Such data could arrive as early as today when the weekly jobless claims, durable goods orders and the final estimate of Q1 GDP are due. The former, in particular, could add to expectations of a July reduction, as the four-week average has been steadily creeping higher over the past few weeks, pointing to deteriorating conditions in the labour market.

However, tomorrow’s PCE inflation report could swing the pendulum in either direction, hence, some volatility in FX and bond markets is likely during the next couple of sessions.

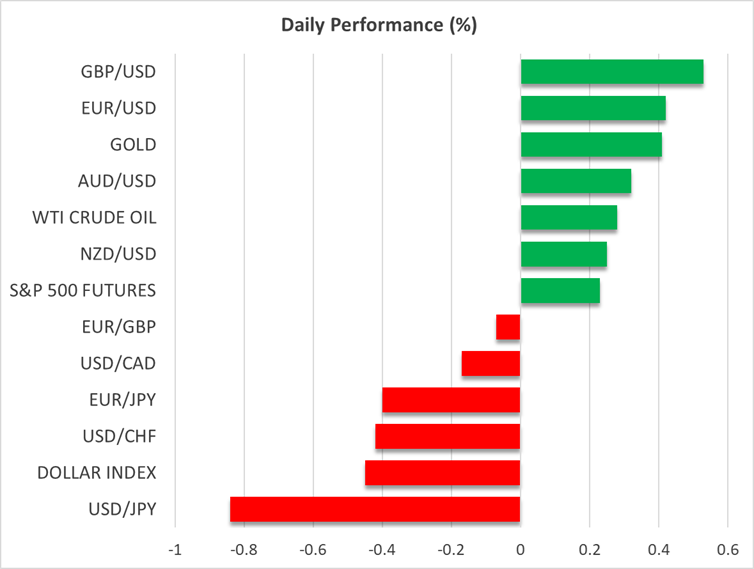

Dollar selloff accelerates, gold finds some solace

For now, there’s a clear market bias for a dovish tilt at the Fed, and this is weighing heavily on the US dollar amid a sharp retreat in Treasury yields this week. Although the decline in long-term yields hasn’t been as big as that for shorter-term ones, the size of the drop in the 10-year yield has nevertheless been surprising given the de-escalation of tensions in the Middle East and the unease about Trump’s interference with Fed policy.

The dollar is plunging to new three-year lows against a basket of currencies today, slipping below 97.10.

All this is helping gold to get onto a firmer footing following the ceasefire-led selloff on Tuesday. The precious metal has been slowly recovering from two-week lows over the past couple of sessions, climbing above $3,345/oz today. However, unless there are signs that the fragile truce between Israel and Iran is in danger of being violated or Trump again calls the Fed’s independence into question, gold’s gains in the near term are likely to be modest.

Nvidia leads the Big Tech charge, cryptos rally too

In equity markets, a third day of rally in US tech stocks on Wednesday provided some lift to stocks in Asia and Europe today. Still, risk appetite has made a stronger comeback on Wall Street than globally this week. US futures are currently trading between 0.2%-0.4% higher, putting the Nasdaq 100 on track to close at a record high for the third straight day.

The S&P 500 is also fast approaching its all-time peak from February, but its slight underperformance compared to the Nasdaq highlights how the latest gains are mostly being led by the Big Tech.

Notably, Nvidia soared by 4.3% yesterday after the company’s CEO Jensen Huan sounded very bullish about AI-driven demand for its chips.

Cryptos have also been having a good week. Bitcoin is up more than 8% so far this week and Ether has rallied by almost 14%. The improved risk sentiment combined with the weaker greenback and strong institutional demand are supporting the bullish picture.

.jpg)