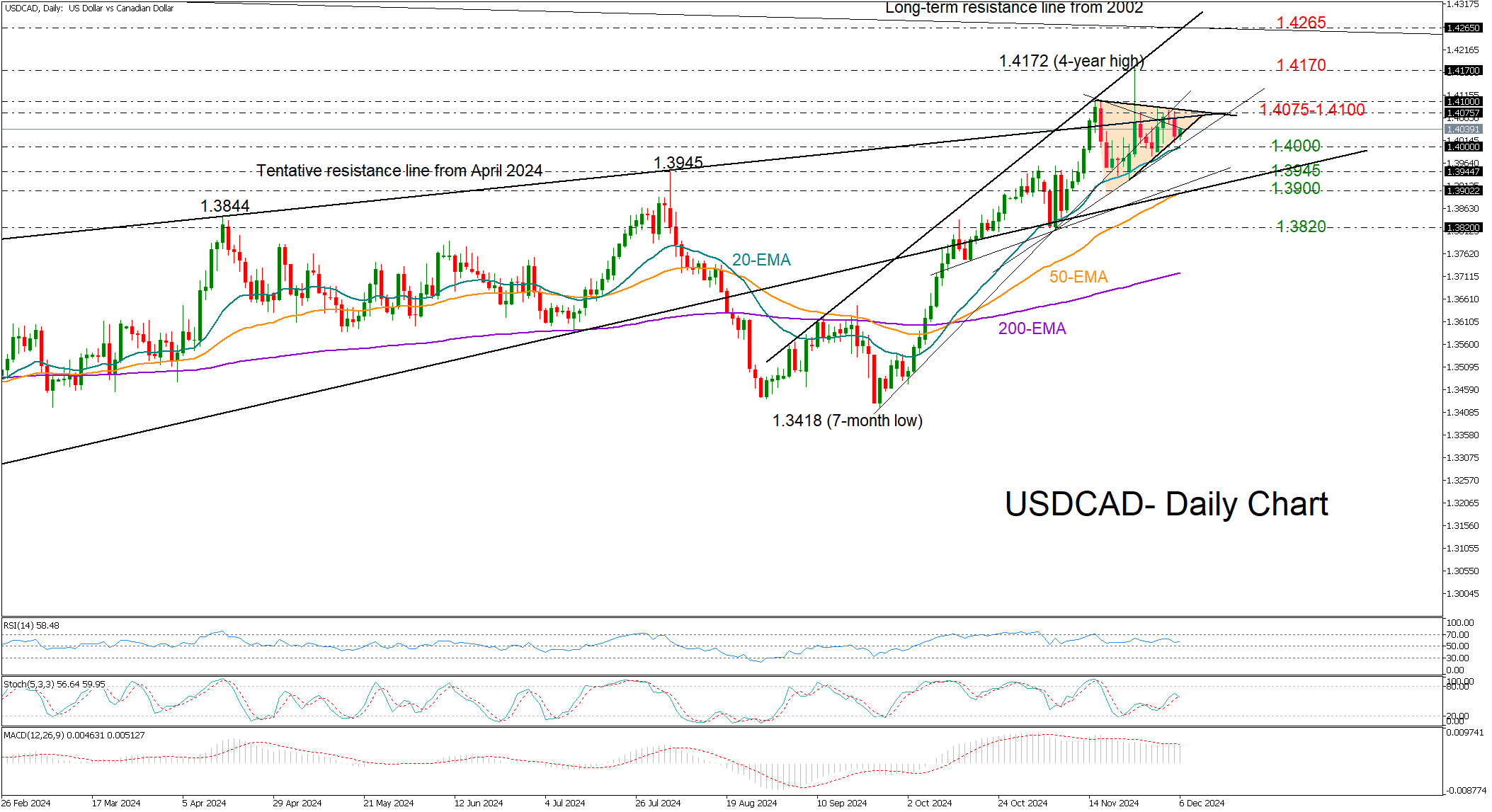

USDCAD battles for direction within triangle

USDCAD is currently treading water, caught in a neutral symmetrical triangle at the top of the two-month-old uptrend as traders are holding their breath ahead of the release of key U.S. and Canadian jobs data.

The technical indicators suggest the short-term bias is leaning to the downside as the stochastic oscillator is set for a negative reversal and the MACD continues to decelerate below its red signal line. Nevertheless, traders may stay patient until the price breaks above the 1.4075-1.4100 area or falls below 1.4000.

In the event of a bullish breakout, the pair may re-challenge November’s four-year high of 1.4172 and if this proves easy to overcome this time, it could speed up toward the resistance line at 1.4265. Next, the rally could pause around the 1.4370 region if the 1.4300 psychological mark gives the green light.

On the downside, a step below the 20-day exponential moving average (EMA) at 1.4000 could activate selling orders toward the 1.3945 barrier, while a deeper pullback could take a breather near the 50-day SMA currently at 1.3900. If the bears claim the latter, the downfall could stretch aggressively to 1.3820.

Summing up, USDCAD is holding a neutral-to-bearish bias, monitoring the 1.4000 and 1.4100 levels, as a break in either direction could determine the next significant move.