USD/JPY hopes for some recovery

USDJPY kicked off Wednesday’s session on a strong positive note ahead of the much-awaited US CPI inflation figures, building on its rebound from a five-month low of 146.52 to a weekly high of 148.59.

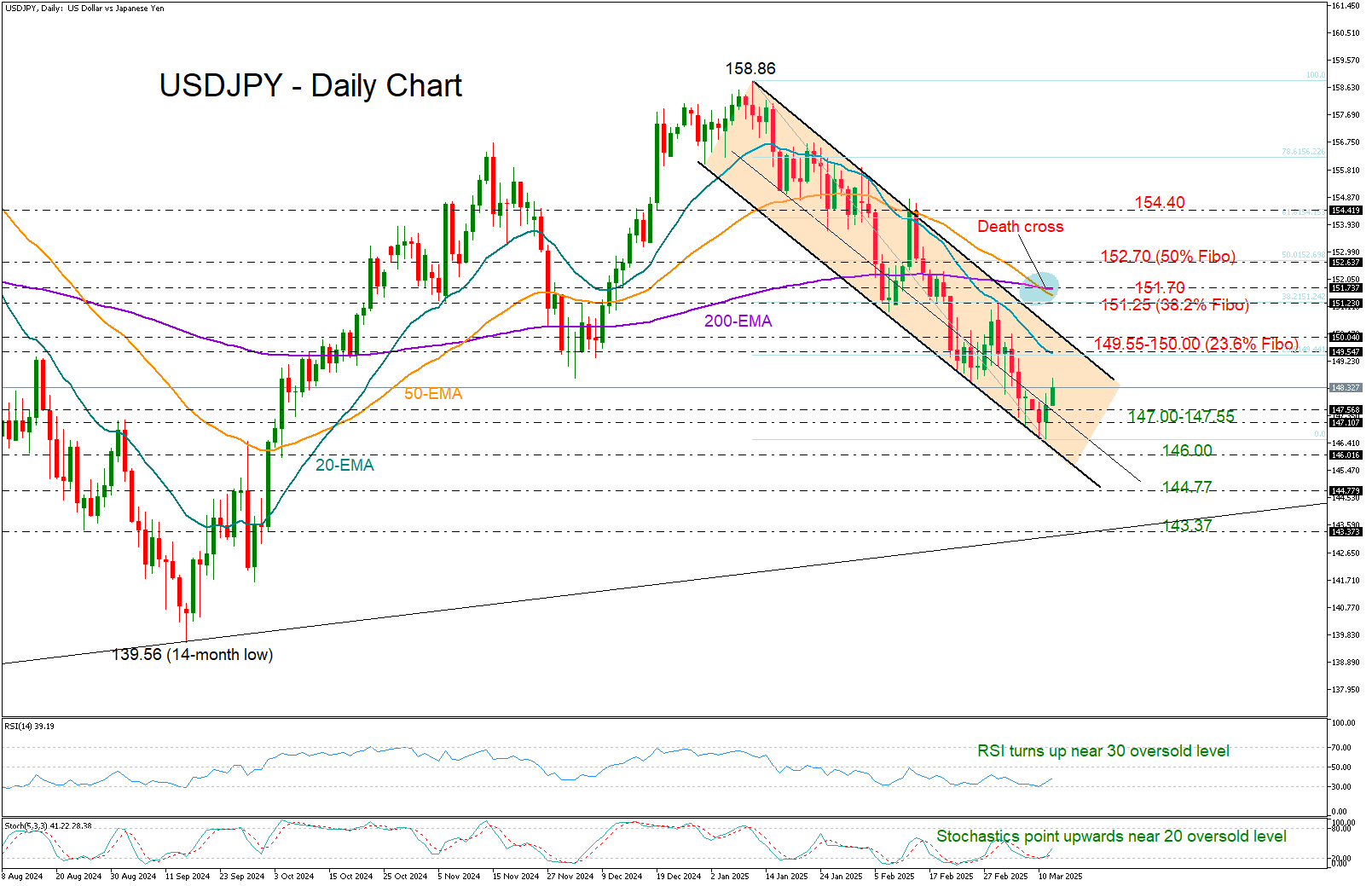

There is hope for further gains as both the RSI and stochastic oscillator are pivoting from oversold levels, signaling that recent selling pressures may have been excessive.

However, the pair remains trapped within a bearish channel, suggesting that any bullish attempts might be short-lived and limited below the 149.55-150.00 resistance zone. The bearish outlook is further reinforced by the death cross created between the 50- and 200-day exponential moving averages (EMAs), limiting the potential for a trend reversal.

If the rally manages to break above the 150.00 level, the next key resistance could emerge within the 151.25-151.70 zone, where the 23.6% Fibonacci retracement of the 2025 downfall and the 50- and 200-day EMAs are currently positioned. A sustained push higher could pave the way for a test of 152.70, aligning with the 50% Fibonacci mark, followed by a potential surge toward the 154.40 ceiling.

In the event the bears retake control, the focus could shift back to the 147.00-147.55 support region. A deeper decline may challenge the lower boundary of the bearish channel near 146.00, with further losses likely targeting the constraining zone of 144.77.

Overall, while USD/JPY is showing signs of a bullish revival, this recovery may still be a temporary correction within the broader 2025 downtrend.

.jpg)