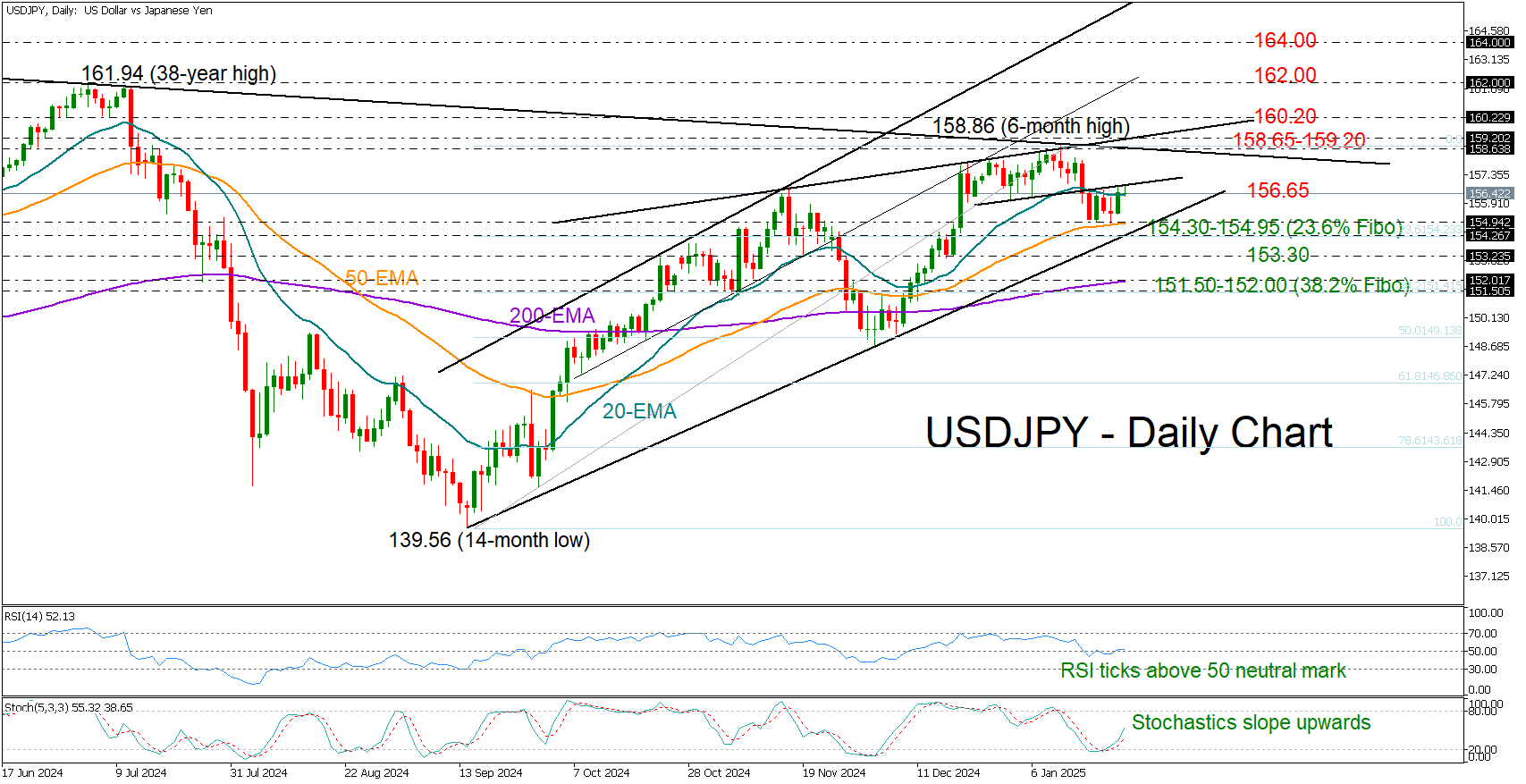

USDJPY stubbornly tests 156.65 barrier

USDJPY found fresh buying interest near its 50-day exponential moving average (EMA) around 154.70 and gently rose back to the key resistance area of 156.65 ahead of the Bank of Japan’s rate decision on Friday. Analysts expect a 25-bps rate hike to 0.50% - this will be the third increase since March 2024. Japan’s national CPI figures will also be out earlier in the day.

The technical indicators have started to look a bit more promising, with the RSI entering the bullish area above 50 and the stochastic oscillator starting a new positive cycle.

But for the bulls to get excited, the pair will need to knock down the wall around 156.65. If that proves to be the case, the price could advance straight to the 158.65-159.20 constraining territory, which has functioned as a ceiling recently. Beyond that, the rally could stretch toward the 160.20 handle, which was a key obstacle to price movements in April and July 2024, and then fight for the 162.00 level.

Should selling pressures resurface, with the price tumbling below the support trendline and the 23.6% Fibonacci retracement of the September-January upleg at 154.30, the 153.30 zone may attempt to pause the fall. If not, the decline could stretch toward the 200-day EMA at 152.00 and the 38.2% Fibonacci of 151.50. A deeper pullback could see a test near the 50% Fibonacci of 149.13.

In a nutshell, USDJPY has not overcome downside risks despite exhibiting improving technical signals. A close above 156.65 could be a good sign, but only a break above 158.65-159.20 would put the pair back in an uptrend.