AUD/USD hovers around 200-day SMA after decline halts

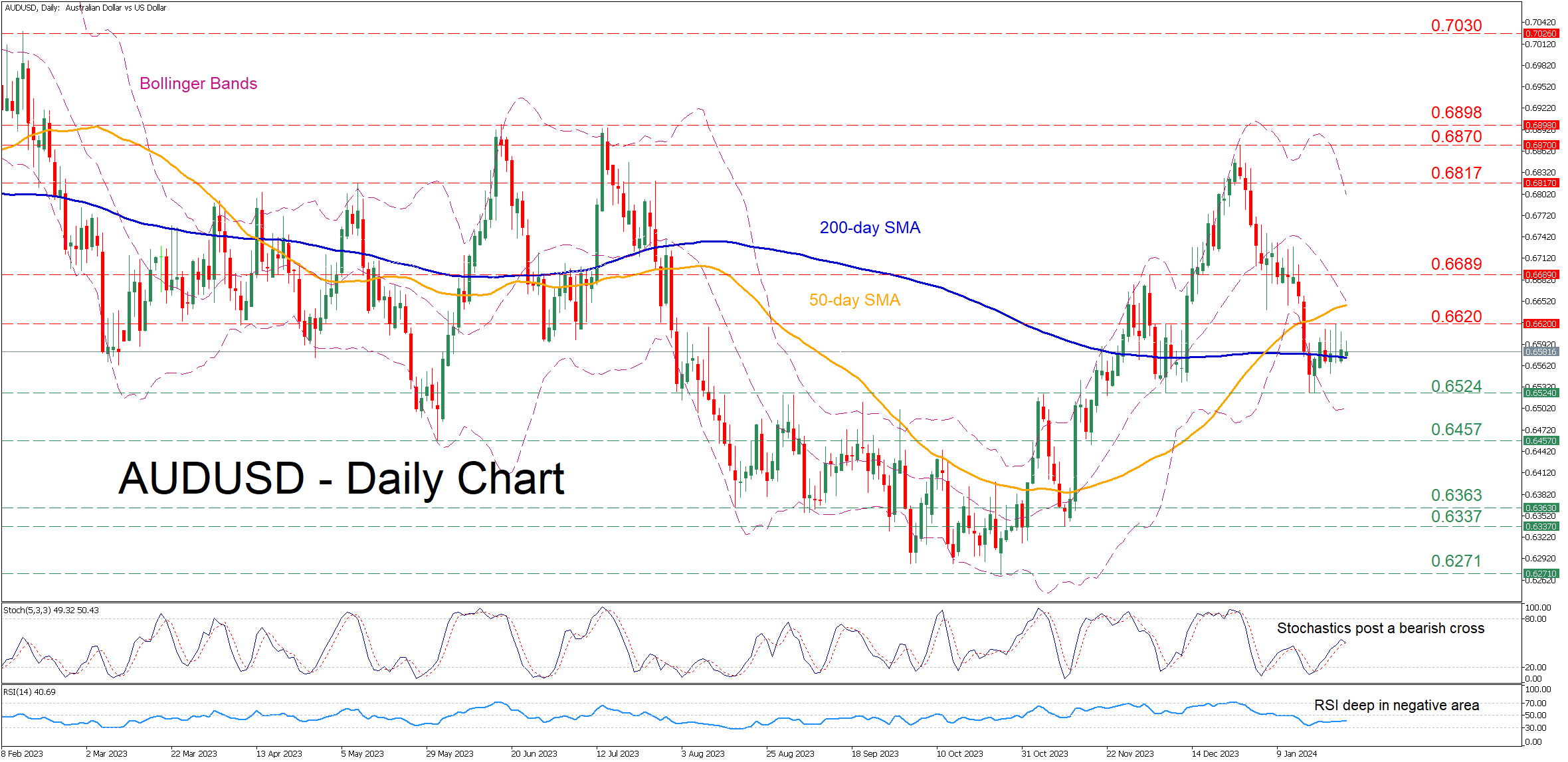

AUDUSD experienced a vast selloff following its December peak of 0.6870, breaking below both its 50- and 200-day simple moving averages (SMAs). Although the pair managed to halt its retreat at the double bottom of 0.6524, its rebound has been repeatedly held down by the 200-day SMA.

Given that both the RSI and stochastics are providing bearish signals, the price could revisit its January bottom of 0.6524. Diving below that zone, the pair might challenge the May low of 0.6457, which also provided support in November. A violation of that region could open the door for the August bottom of 0.6363. On the flipside, if the pair conquers the 200-day SMA, the recent resistance of 0.6620 could prove to be a strong barricade for the bulls to claim. Further advances could then cease at the December resistance of 0.6689 ahead of the May peak of 0.6817. Should that hurdle also fail, the spotlight could turn to the December high of 0.6870.

On the flipside, if the pair conquers the 200-day SMA, the recent resistance of 0.6620 could prove to be a strong barricade for the bulls to claim. Further advances could then cease at the December resistance of 0.6689 ahead of the May peak of 0.6817. Should that hurdle also fail, the spotlight could turn to the December high of 0.6870.

Overall, AUDUSD has attempted to recoup some losses in the near term, but the 200-day SMA has been acting as a strong ceiling. A failure to claim the latter could pave the way for the continuation of the short-term selloff.