Bitcoin vs Gold in 2025: The safe-haven showdown intensifies

As financial uncertainty looms over 2025, the age-old debate resurfaces: Is gold still the ultimate safe-haven asset, or has Bitcoin finally earned that title? Recent price fluctuations have reignited discussions, with Bitcoin holding near $81,000 after a modest 2.6% decline, while gold surged past $2,917 as investors sought stability amid economic concerns.

Market divergence: Gold holds strong, Bitcoin faces volatility

Bitcoin has long been touted as "digital gold," yet its recent performance suggests otherwise. Since President Trump’s inauguration in January, Bitcoin has lost 25% of its value despite a policy push for regulatory clarity and the establishment of a strategic Bitcoin reserve. Gold, on the other hand, has climbed steadily as inflation fears and economic uncertainty drive investors toward traditional safe-haven assets.

“Bitcoin still reacts more like a high-risk asset than a defensive one,” says Mena Theodorou, Co-founder of Coinstash. Its strong correlation with tech stocks reinforces this, making it more sensitive to macroeconomic trends than a traditional store of value.

Bitcoin: A safe haven in the making?

Historically, gold has dominated as the go-to asset during market crises. The 2020 COVID-19 crash saw gold soar to record highs, while Bitcoin plunged nearly 50% in a single day before rebounding—a testament to its volatility rather than stability.

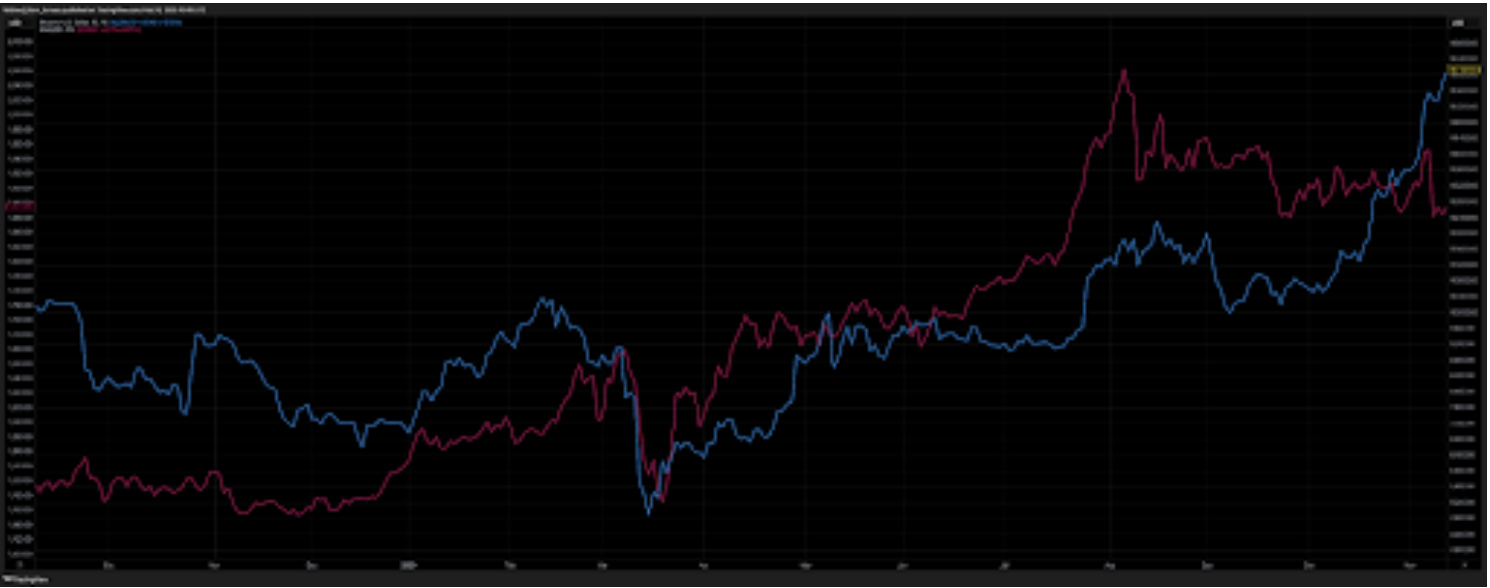

BTC- Red Gold- Blue

Source: Trading view

While Bitcoin's decentralization and ease of transfer offer unique advantages, its price swings remain a deterrent for risk-averse investors. “Bitcoin’s corrections often present great buying opportunities, but its volatility is still a major hurdle,” notes Mark Hiriart of Zerocap.

Gold vs. Bitcoin: A side-by-side comparison

Gold: A physical asset with centuries of proven stability, widely accepted, and backed by central banks.Bitcoin: A digital asset with a fixed supply, enabling borderless transactions but still facing regulatory uncertainty and extreme price swings.The road ahead: Can BTC evolve into a true safe haven?Short-term forecasts remain cautious, with some analysts predicting a potential drop below $70,000, with key support levels around $69,000-Bitcoin’s previous all-time high. Theodorou warns that Bitcoin’s strong connection to equities may keep volatility high in a risk-averse market.

However, Bitcoin’s long-term outlook is promising. Institutional adoption continues to rise, regulatory frameworks are taking shape, and Bitcoin’s inherent scarcity enhances its appeal as an inflation hedge. Some experts argue that Bitcoin and gold may eventually coexist rather than compete, with Bitcoin serving as a modern complement to the age-old stability of gold.

Technical analysis: Key levels to watch

On the daily chart, Gold is showing bullish signs as prices remain well above the moving average, as RSI rises steadily. Key levels to watch on the upside are $2,930 and $2,951. On the downside, key levels to watch on the downside are $2,880 and $2,861.

Source: Deriv MT5

Disclaimer:

The information contained within this article is for educational purposes only and is not intended as financial or investment advice. It is considered accurate and correct at the date of publication. Changes in circumstances after the time of publication may impact the accuracy of the information.

The current performance figures quoted are only estimates and may not be a reliable indicator of future performance. The past performance figures quoted refer to the past and are not a guarantee of future performance or a reliable guide to future performance.

No representation or warranty is given as to the accuracy or completeness of this information. Do your own research before making any trading decisions.