BoE unlikely to stop hiking as UK inflation remains high

Inflationary pressures in the UK are easing, although they remain the highest among the G7 countries, as sellers are in no hurry to cut prices.

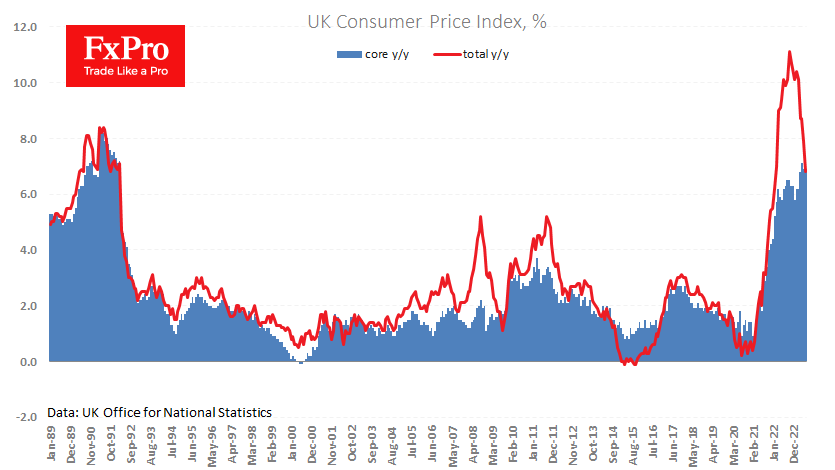

UK CPI fell 0.4% in July (-0.5% expected), the first decline since January. The year-over-year price growth rate fell to 6.8%, the lowest since February 2022. The Retail Price Index last month was 9.0% higher than a year before, slowing to single digits for the first time since March 2022.

Core inflation remained at 6.9% y/y, just 0.2 percentage points below the peak two months earlier.

These latest price data are above market expectations and higher than those of the other G7 countries, which puts the most significant pressure on the Pound's purchasing power. Such figures will unlikely stop the Bank of England from raising interest rates.

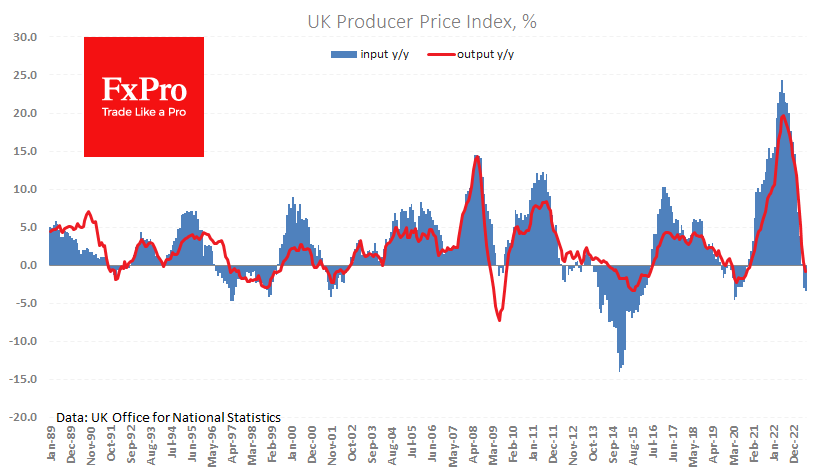

Meanwhile, producer prices are falling at an accelerating rate. Input Producer Price Index fell 0.4% in July and is now at -3.3% y/y, the lowest since May 2020. Output PPI was 0.8% lower than 12 months ago.

Producer prices are under pressure after commodities. However, a tight labour market and elevated inflationary pressures in the services sector keep inflation higher than the central bank would like.

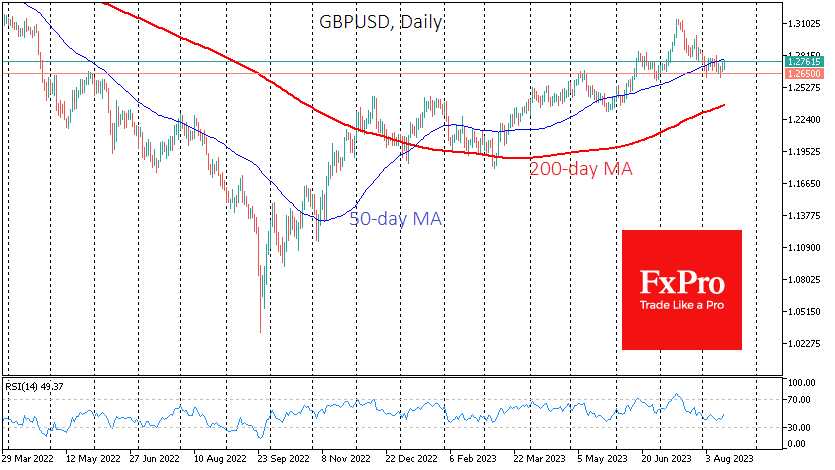

Cooling the economy through recession and rising unemployment is a desirable quick fix in this environment. But it is politically unpalatable and can quickly have a knock-on effect on the economy. The Bank of England has not yet reached the peak of interest rates, which we estimate to be around 6%. Given the entrenched inflationary processes, it will also have to keep rates at their peak for longer. This is good news for the Pound, which has had a chance to lick its wounds after a month of decline against the USD.

The technical picture for the GBPUSD is also interesting. The recent reversal in the pair's growth from 1.2650 based on pro-inflationary data from the labour market and consumer prices could be both a temporary respite and a turning point. The bulls' ability to push the pair above 1.2800 could attract more buyers to the GBP. A return below 1.2650 this week would signal a new round of weakness.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)