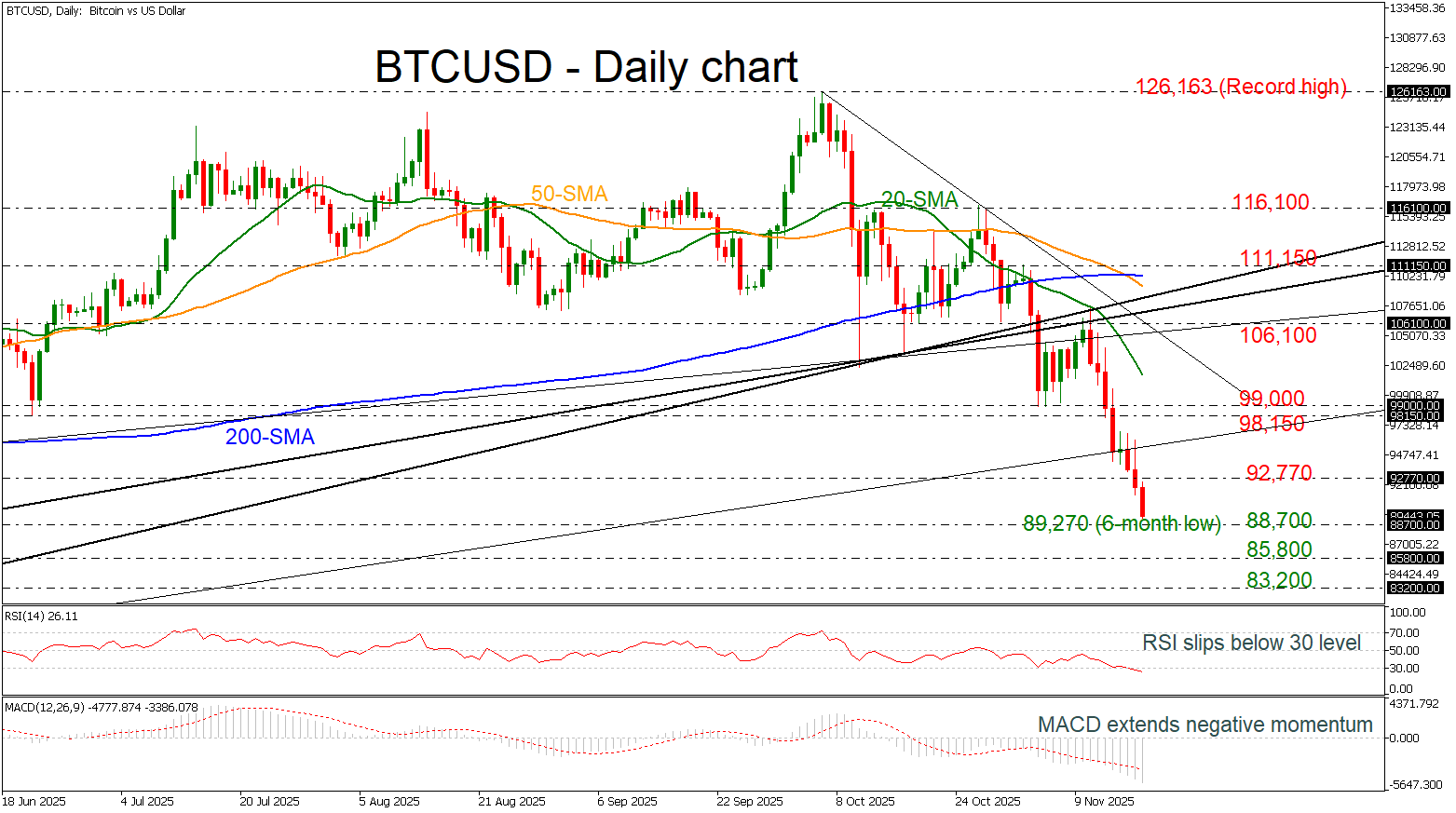

BTCUSD’s freefall; 6-month low signals bearish momentum

BTCUSD plunged to its lowest level in six months, hitting 89,270 and losing around 30% from its October peak. The decline was driven by shrinking liquidity and institutional derisking, as ETFs, corporate treasuries, and long-term holders pulled back, while fading expectations of a December U.S. rate cut and cooling tech stocks dampened risk appetite.

The drop below long-term uptrend lines increases the likelihood of further losses. A break beneath the immediate support at 88,700 could open the way toward 85,800, followed by 83,200, last seen in mid-April.

On the flip side, a rebound may attempt to recover some ground, targeting resistance at 92,770 and the 98,150–99,000 zone. To restore a strong bullish outlook, traders would look for a daily close above the key region of around 106,000, which aligns with diagonal trend lines. Additionally, the bearish cross between the 50- and 200-day simple moving averages (SMAs) near 110,000 remains a critical zone to monitor.

The RSI is deep in oversold territory, while the MACD continues to indicate its negative momentum below both its trigger and zero lines.

Summarizing, oversold conditions hint at a potential short-term bounce, while the broader uptrend remains vulnerable unless key resistance levels are reclaimed.

.jpg)