EBC Markets Briefing | Tech fatigue and market complacency worry investors

The S&P 500 and Nasdaq 100 closed marginally lower on Friday, weighed down by a decline in Nvidia shares for a second straight day. Some signs of big tech exhaustion emerged in the past week.

Goldman Sachs has recently raised the S&P 500 index's end-of -year target to 5,600 points, mainly due to robust earnings advancements seen by some of the biggest tech companies.

Stifel’s Barry Bannister says the US stock benchmark has a shot at reaching the 6,000 mark before the end of 2024. The average year-end target among strategists tracked by Bloomberg is about 5,297.

Huge price gains have stirred worries that the tech rally might be overheated. Optimism is high among retail and institutional investors, another alarming sign that the market is prone to a retreat.

Sentiment among fund managers in the latest survey by BofA Global Research was at its highest level since late 2021, with investors trimming cash positions and increasing equity allocations.

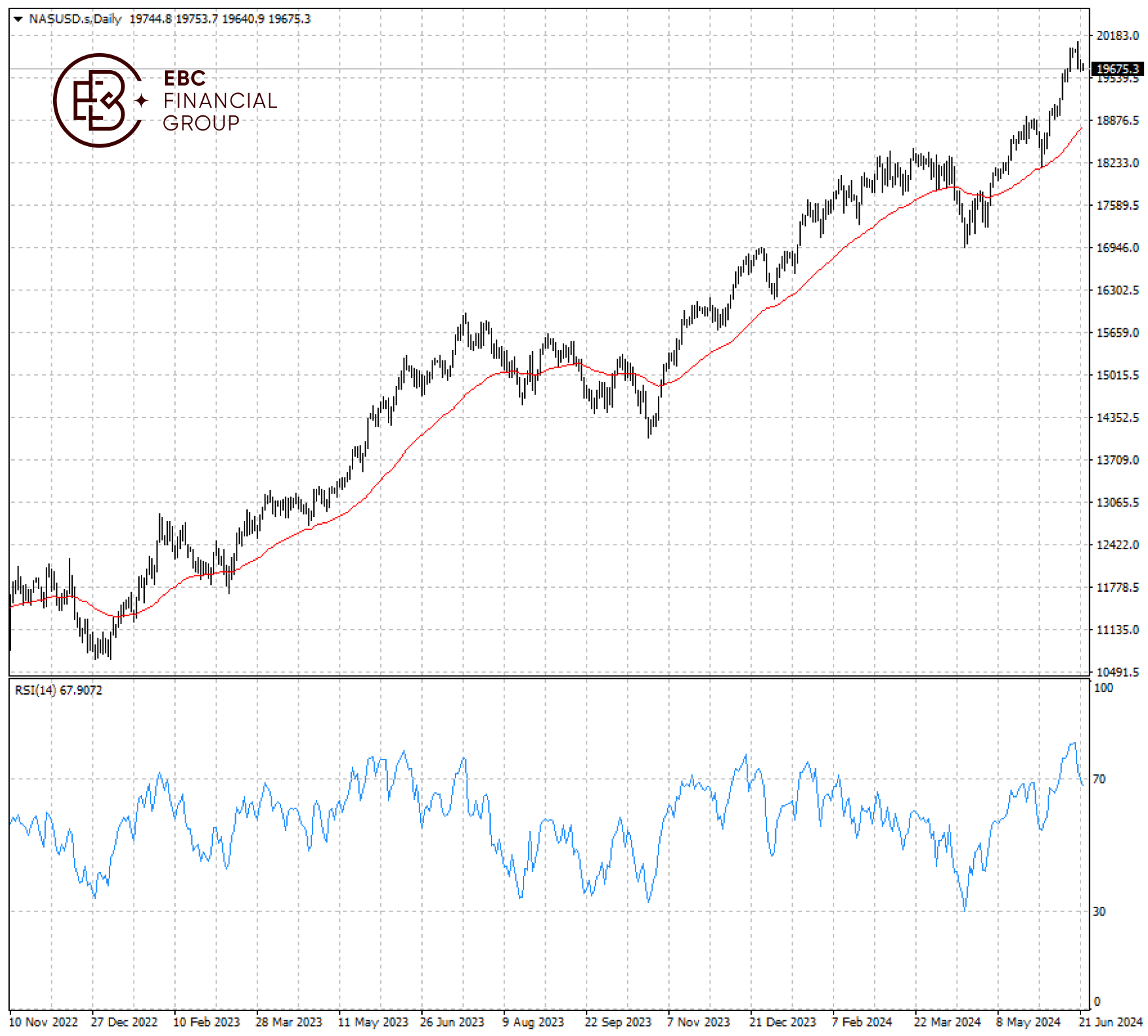

The AAII Sentiment Survey was at 44% in the week ended June 19, about 8% above its historical average. But the Nasdaq 100 only took five weeks to reach a new high after falling 9% in April, proving its resilience.

The tech-heavy index saw strong resistance at a key psychological level. Given that RSI has eased below 70, a retest of the 20,000 is likely if it stays above 19,500.

EBC Economic Research Findings Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Financial News or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.