EBC Markets Briefing | US stocks lower but positivity remains

Wall Street's main indexes ended lower on Monday with all eyes on US-China trade developments. Trump delayed high tariffs on Chinese goods from snapping back into place for another 90 days, a White House official said.

He also urged China to quadruple soy bean purchase, though analysts questioned the feasibility of any such deal. The thing is China has not shown any concerns about a soybean shortage yet.

Investors expect the recent shakeup at the Fed and signs of labour market weakness could nudge the central bank into adopting a dovish monetary policy stance later this year, fuelling much of the optimism.

BofA Securities said on Tuesday that US equity flows among clients turned broadly positive last week, with a total of $1.7 billion in inflows, marking a notable shift in positioning.

Institutional investors led the move, posting their first inflows in six weeks. Hedge funds were modest net buyers, while private clients extended their buying streak to five consecutive weeks.

Meanwhile, equity ETF flows turned negative for the first time in nine weeks. Value ETFs extended their inflow streak to 26 weeks, signalling improved economic outlook amid easing trade tensions.

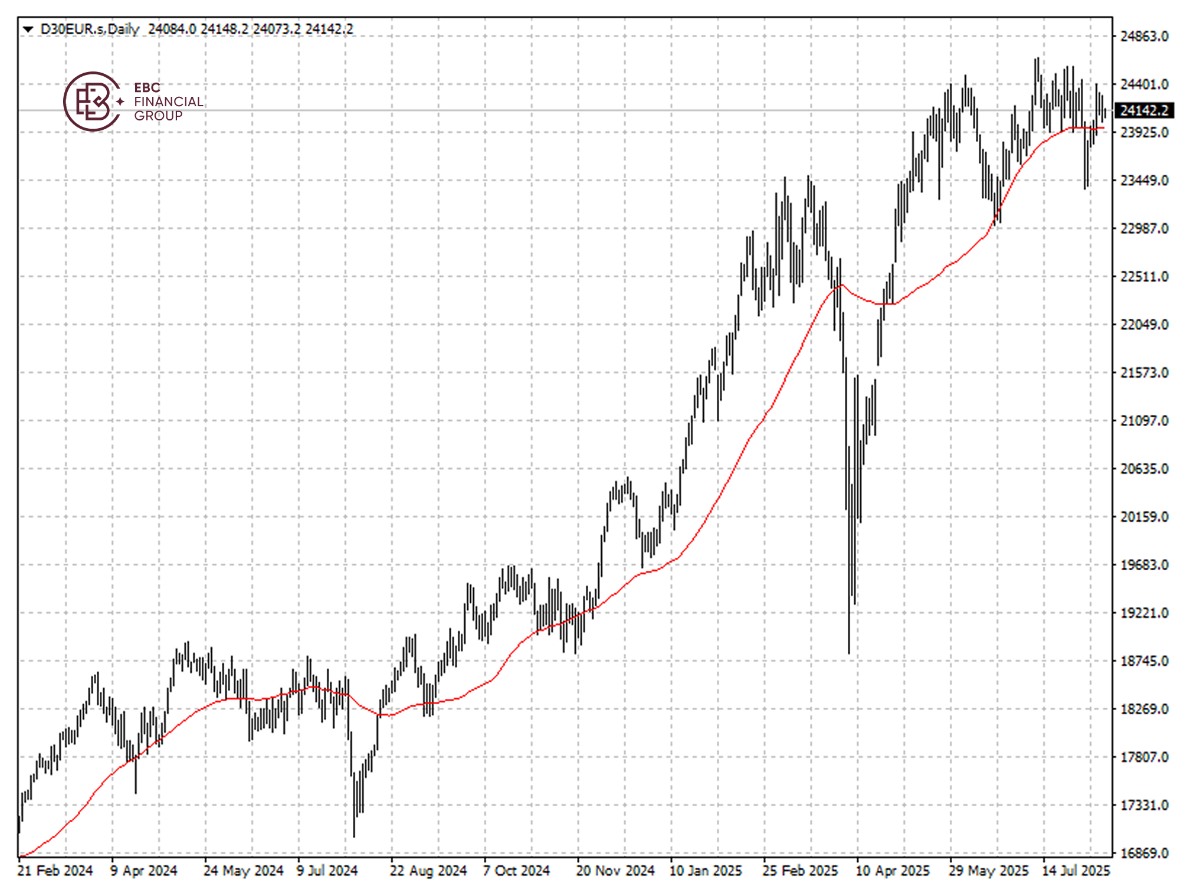

The Dow has underperformed due to Big Tech resurgence, and lower highs and lower lows still pointed to downside. But 50 SMA could still act as support and lay the foundation for another leg higher.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.