EBC Markets Briefing | Yuan lower after Trump tempered rhetoric

China's yuan dipped on Tuesday after Trump's watered down rhetoric against tariffs on China raised hopes of de-escalation in tensions between the two economic heavyweights.

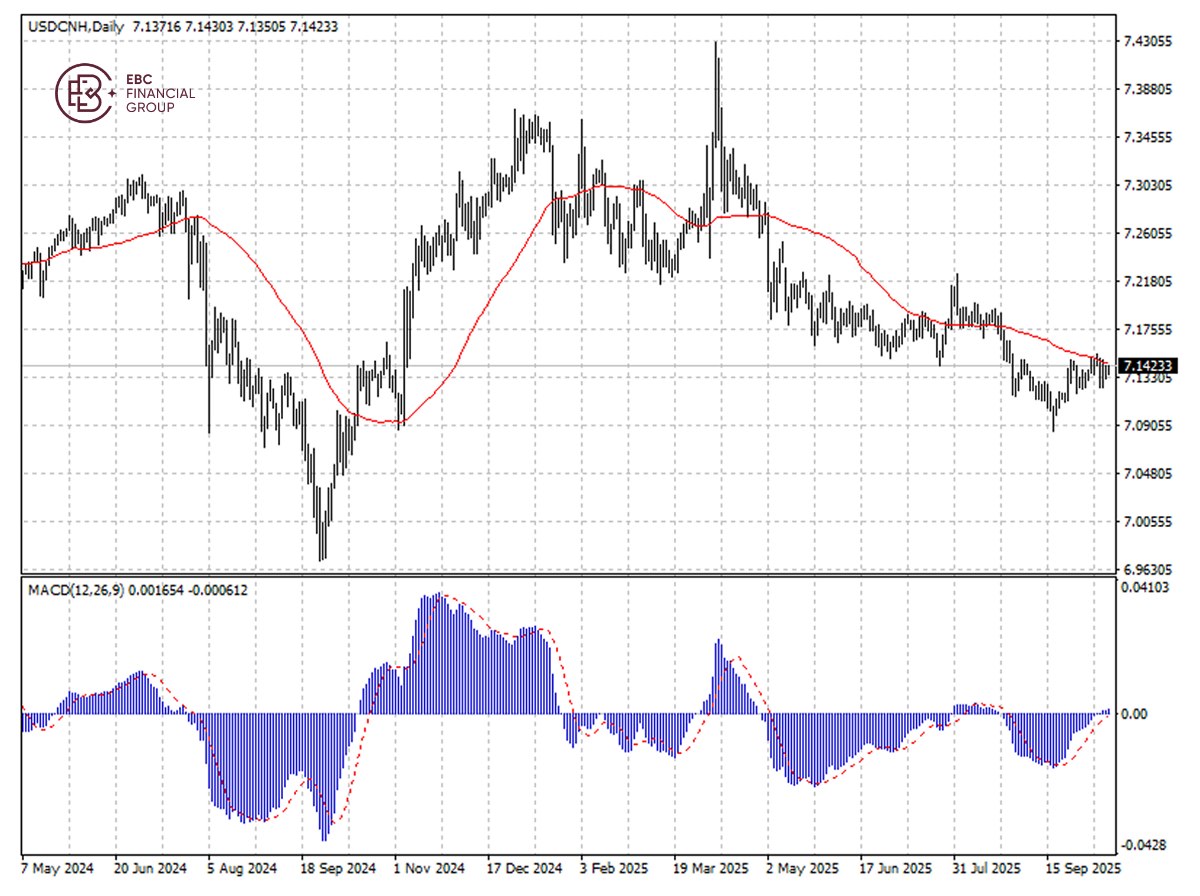

The PBOC set the midpoint rate at 7.1007 per dollar, its strongest since November 2024. The official guidance rate was 203 pips firmer than a Reuters' estimate of 7.1210, signalling its preference for currency stability.

Any sustained weakness in the yuan is typically negative for Asian currencies because the yuan has long been seen as an anchor for the region. Emerging-Asian currencies have underperformed most of their EM peers this year.

Customs figures released Monday showed that China's imports and exports were 7.4% and 8.3% higher respectively than a year earlier, both surpassing economists' estimate.

The question now is whether both sides can again come to an understanding before tariffs rise to levels that again threaten to usher in a wider decoupling between the US and China.

The US is limiting shipments of semiconductors and AI chips needed by China, while China is curbing exports of critical materials and magnets wanted by the US.

The yuan continued to consolidate around 50 SMA, and the bearish MACD divergence suggests downside potentials. We expect it to retest 7.1480 per dollar in the short term.

EBC Financial Group Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC Global Financial Collaboration or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.