Indicators point to a weak NFP

One of the most timely and unpredictable economic reports, the US Nonfarm Payrolls report for March, will be released on Friday. Market participants will look to other publications to shed light on the situation.

The average forecast among market participants is for the economy to have created 230K jobs in March, down from 311K the previous month. However, these forecasts were made about a week ago, and the data that has come in since then suggests that the actual number will be much weaker.

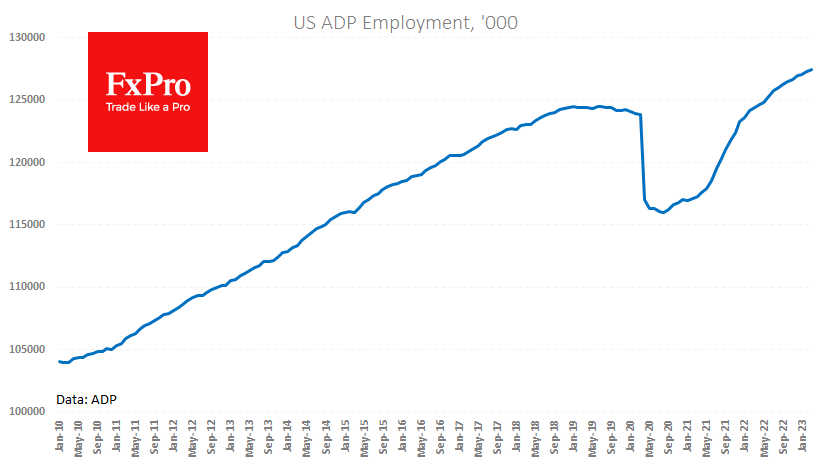

The change in ADP private sector employment, the closest indicator to the headline NFP figure, missed expectations, showing a gain of 145K after 261K the previous month versus expectations of 208K and an official reading of 443K.

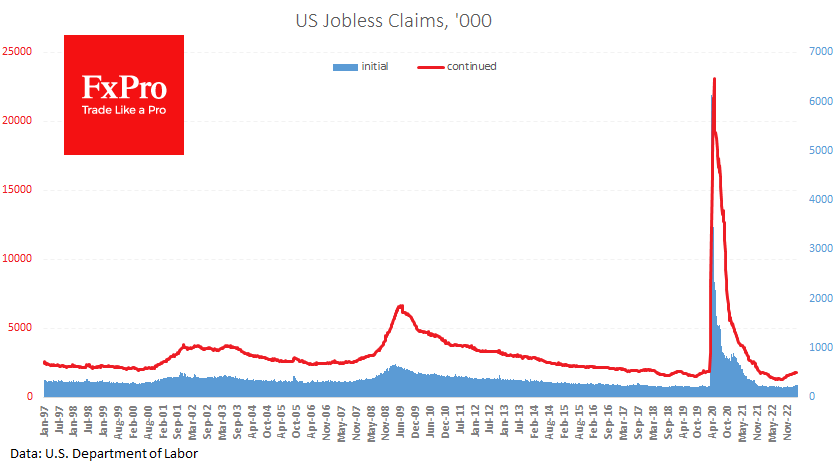

Weekly jobless claims fell from 246K to 228K last week but remained in an uptrend since late January from a low of 194K. Initial claims have been on an uptrend since September and have increased by 42K in the last four weeks.

At the same time, according to estimates by Challenger, Gray & Christmas, there continues to be an impressive year-on-year increase in planned redundancies. Companies reported plans to cut 89.7K jobs, 3.2 times higher than a year ago and 15% higher than last month. Again, it's hard to see signs of sustained strength in the labour market.

By the FxPro analyst team

-11122024742.png)

-11122024742.png)