Mideast conflict escalates as US strikes Iran but oil pares gains

Fears Iran will block Strait of Hormuz

Middle East tensions continue to send jitters through markets as investors once again woke up to a new crisis in the region on Monday. After a lot of mixed signals last week by President Trump on whether or not the United States will enter the war between Israel and Iran, Saturday’s strikes on three Iranian nuclear sites came as a somewhat, but not totally unexpected, surprise.

The dangerous escalation not only risks dragging the US into a messy conflict, but there are also fears that Trump has unleashed ‘Pandora’s box’, amid intense speculation about how Iran will retaliate. Iran’s parliament has already approved measures to close the Strait of Hormuz, which carries a fifth of the world’s oil supply.

Washington has reportedly asked China’s help to prevent Tehran from shutting down the vital shipping route. A blockade would be damaging for China, whose oil imports from Iran are thought to exceed 1.8 million barrels per day.

Oil spikes but recedes amid lack of clarity

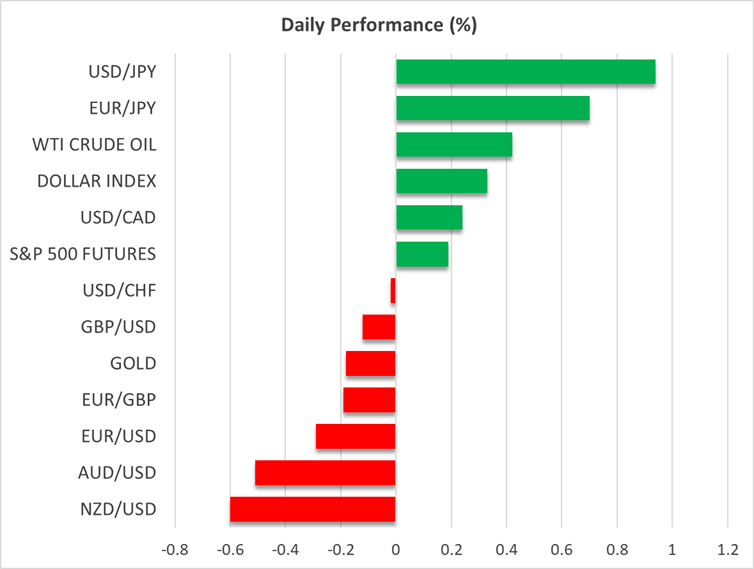

Doubts about whether Iran will be allowed to cause disruption in the Strait of Hormuz are likely to be one reason why oil futures are already pulling back from their intra-day highs, having spiked more than 5% at the start of trading to five-month highs. WTI and Brent crude futures are currently up less than 1% from their Friday close.

However, the huge uncertainty about the situation may also be keeping some traders on the sidelines amid concerns that Iran could carry out attacks on US soil through its network of sleeper cells, or strike American assets overseas such as US military bases in the Middle East.

Things could easily get a lot worse, or they could de-escalate as world leaders urge for restraint. The main question mark about America’s involvement is how successful the strikes were.

There are reports suggesting that Iran managed to move its enriched uranium from the key Fordow plant to a secret location before the attack, while there are also doubts about how much destruction the B-2 stealth bombers really caused. All this is adding to the nervousness in the markets, as it’s unclear how things will unfold.

Dollar resumes recovery ahead of Fed speakers

As seen from Israel’s attack on Iran 10 days ago, the US dollar, followed by the Swiss franc, are the main beneficiaries in the FX market from this conflict. The dollar briefly brushed a near two-week high against a basket of currencies earlier today, gaining the most against the Japanese yen.

America’s energy independence is fuelling safe-haven demand for the greenback, as the US economy would take less of a hit from a new oil price shock, while currencies like the euro and yen are seen to be more vulnerable due to the Eurozone’s and Japan’s reliance on energy imports.

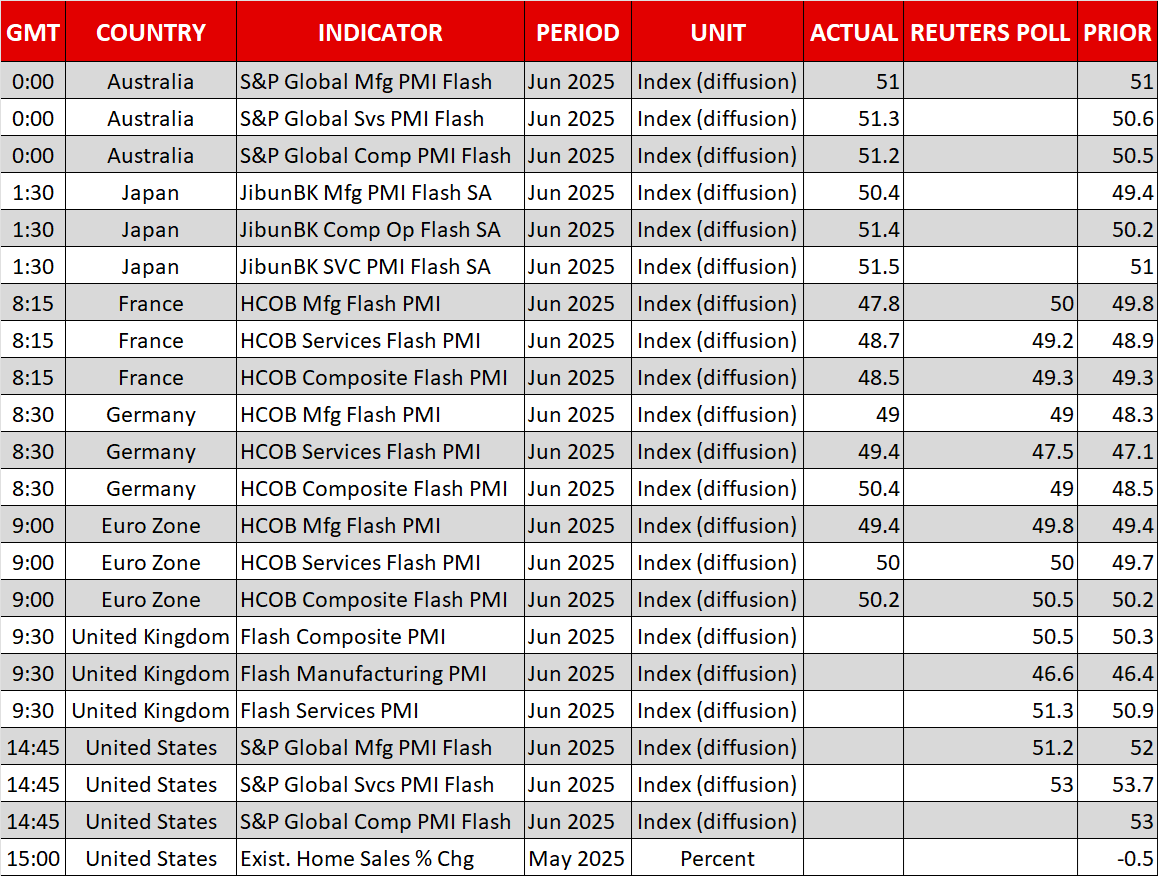

The euro has slipped back below $1.1500 and against the yen, the dollar has surged above 147.00. Helping the euro recover somewhat from earlier lows, were stronger-than-expected PMIs for June out of Germany, although the flash figures for the euro area as a whole were mixed.

UK PMIs, meanwhile, exceeded the forecasts, supporting the pound above $1.3400. The S&P Global PMIs for the US will be watched later in the day, with a slew of Fed speakers also on the agenda.

Fed Governor Waller appears to be diverging from other FOMC members after he opened the door to a rate cut as early as July on Friday. Subsequent comments from San Francisco Fed President Mary Daly suggest other officials don’t share his dovish view. But nevertheless, this puts even more spotlight on what Chair Powell will say during his two-day testimony before lawmakers on Tuesday and Wednesday.

Gold subdued but no panic in equities

With the dollar enjoying renewed momentum, gold continues to be shunned by investors during the current flight to safety. The precious metal is hovering around $3,360, as it struggles to attract safe-haven interest.

In contrast, equities have suffered only a mild selloff, with US futures trading higher during the European session.

.jpg)