Technical Analysis – GBPUSD slides but remains stuck in rangebound pattern

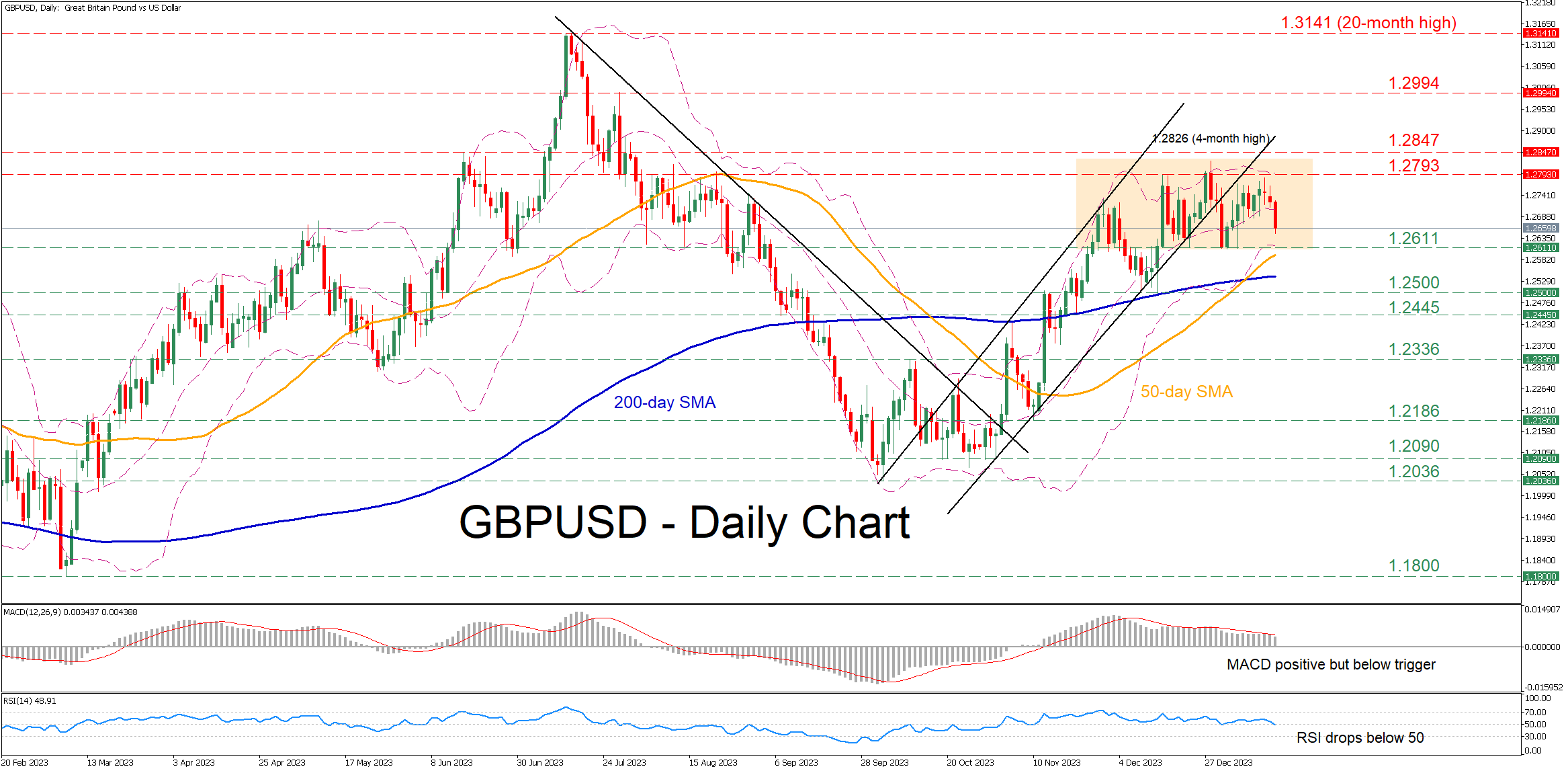

GBPUSD had been trending higher within an upward sloping channel, posting a fresh four-month peak of 1.2826 in late December. Nevertheless, the rally seems to have taken a breather, with the price trading without a clear direction since the beginning of the year.

Given that the short-term oscillators are providing cautiously negative signals, the bears could attempt to push the price below 1.2611, which is the lower end of the recent range. Piercing through that floor, the price may test the December bottom of 1.2500. A violation of that hurdle could pave the way for 1.2445, a region that provided both support and resistance throughout 2023.

Alternatively, if the pair storms back higher, the December resistance of 1.2793 could prove to be the first barricade for buyers to overcome. Breaching that area, the price might test the four-month peak of 1.2826 before it faces the June 2023 high of 1.2847. Further upside attempts could then stall at the July resistance of 1.2994.

In brief, GBPUSD remains a prisoner within its tight range, appearing unable to adopt strong directional impetus. However, negative pressures seem to be intensifying as the RSI has fallen below 50 for the first time since early November.