The boiling point of the US labour market

The boiling point of the US labour market

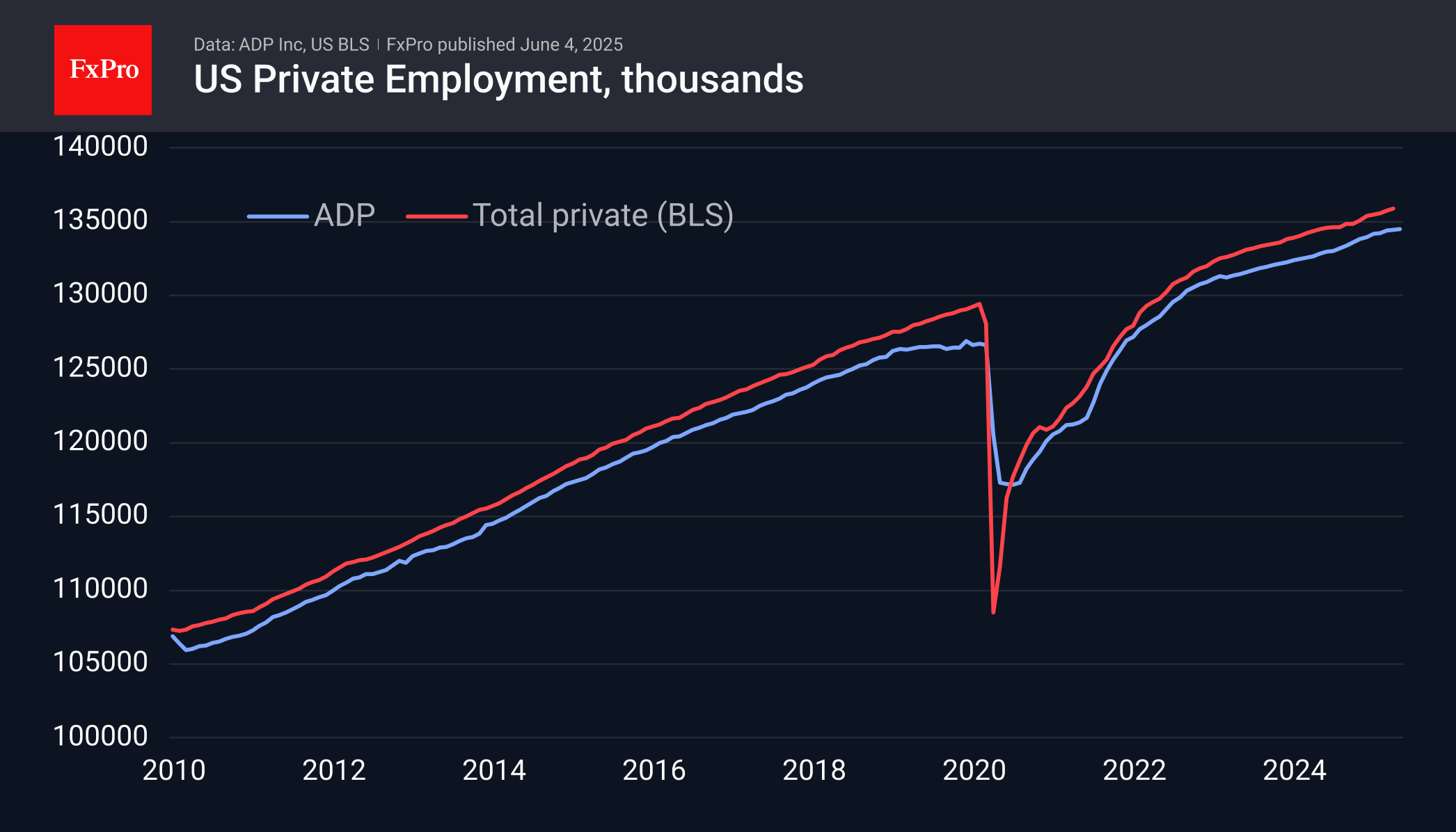

Alternative employment data points to a sharp slowdown ahead of Friday's official employment report. ADP reports private sector employment growth of 37K, the lowest since March 2023 and well below the 6- and 12-month averages of around 150K.

Judging by this indicator, the US private sector labour market may be close to boiling point, where it was last seen for about a year from the first quarter of 2019 when the increase was barely noticeable. Employment is close to full capacity, but this is not causing wage growth to accelerate or fuelling inflation.

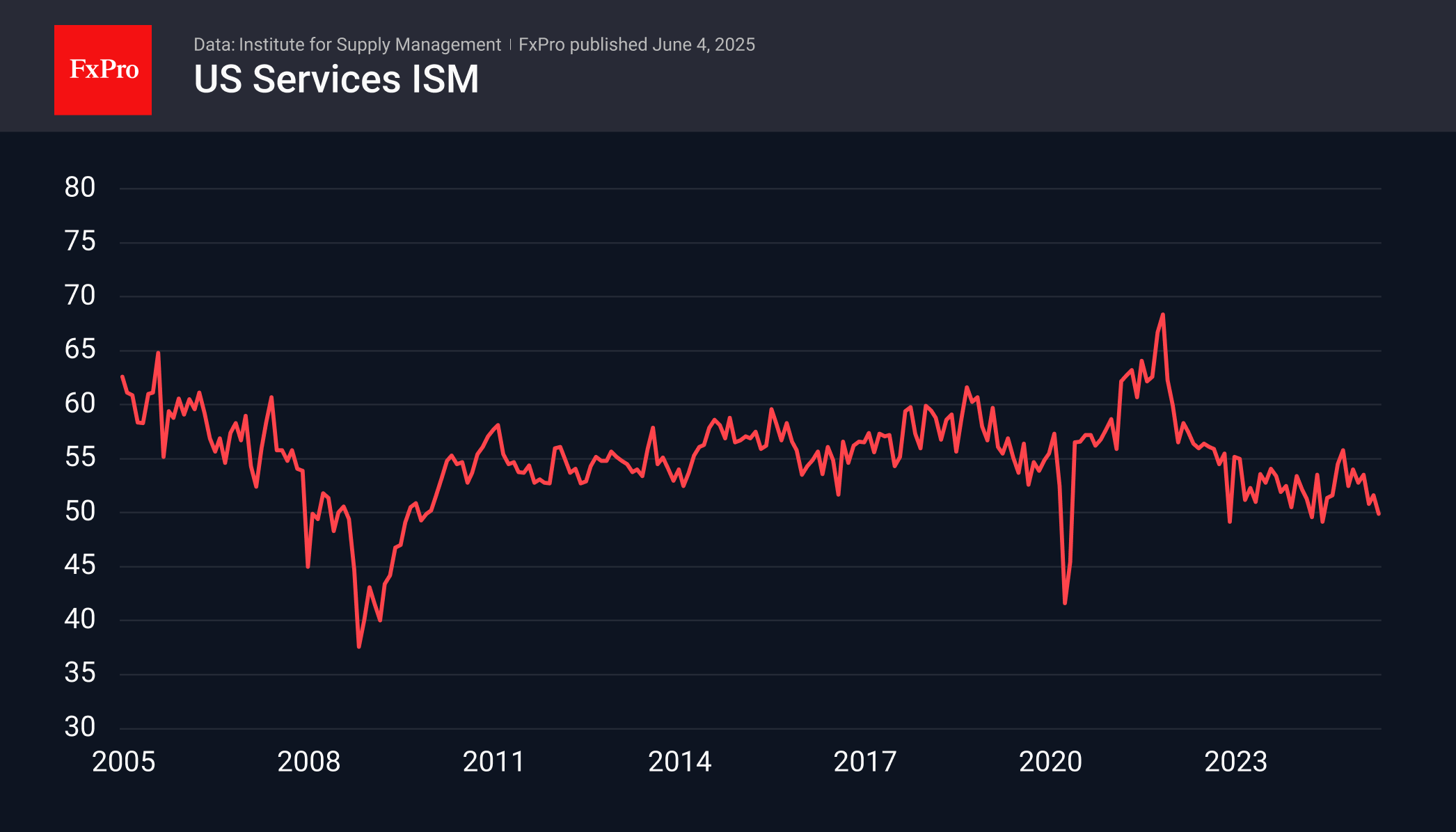

According to another report, the US services sector moved into contraction last month, as the ISM index fell to 49.9 from 51.6 a month earlier. Tariff uncertainty in April and May appears to be the main reason why order components are pulling the index down.

At the same time, the main obstacle to the Fed cutting rates remains, as the price component stands at 68.7 (the highest since November 2022), with prices rising in 16 out of 18 sectors. Earlier this week, the manufacturing ISM also reported some of the highest price growth rates since the beginning of 2022.

Most likely, the Fed will prefer to pause rather than move to easing policy, as the US president demands based on the data released. In theory, this is bearish news for the markets, but they are rising in the hope that the planned call on Friday between the leaders of the two largest economies will reverse the trend of recent months.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)