The euro's second chance

The de-escalation of the US-China trade conflict has shifted market attention to central bank monetary policy. Finance Minister Scott Bessent said that the negotiations had created a successful framework for the two countries' leaders to sign a deal. Beijing says a preliminary consensus has been reached. The risks of a trade war have receded, US stock indices have hit new highs, global risk appetite has increased, and the EURUSD has risen.

The futures market gives a 98% probability of a cut in the federal funds rate to 4% in October and a 95% chance of a cut to 3.75% in December. Derivatives expect a further cut in March. The ECB is expected to pause rate cuts until 2027. The deposit rate last fell to 2% in June. Since the summer, Christine Lagarde said the European Central Bank feels comfortable.

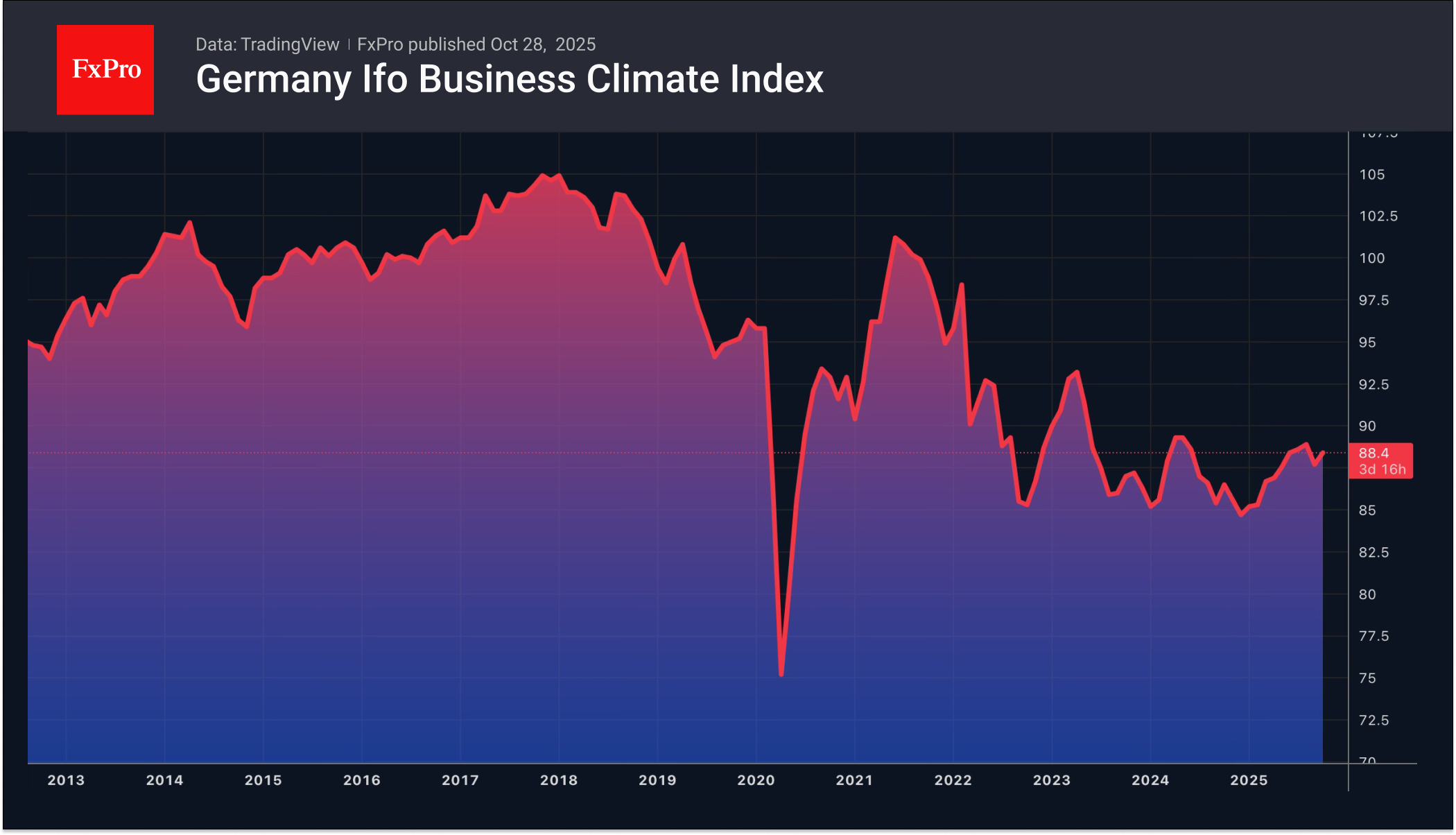

Some Bloomberg experts predict a rate hike in 2026. This would require an improvement in the European economy. Pleasant surprises from eurozone business activity and German business sentiment indicate positive GDP growth in the fourth quarter. In July-September, gross domestic product most likely grew by 0.1%.

The divergence in monetary policy between the ECB and the Fed, coupled with positive signals from the European economy, gives EURUSD bulls hope for a recovery in the uptrend. However, events in France continue to dampen the euro. The Socialists do not rule out a new vote of no confidence in the government if parliament do not accept their proposal to raise taxes on the rich to reduce the budget deficit.

While EURUSD awaits the results of the Fed and ECB meetings, the yen is strengthening thanks to verbal interventions. Government officials have stated that they will continue to closely monitor the dynamics of the yen on the international currency market. Finance Minister Satsuki Katayama noted that monetary policy issues were not directly discussed at the meeting with Scott Bessent. If they were discussed indirectly, the risks of currency intervention may increase. Investors preferred to play it safe and close some of their long positions on USDJPY.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)