The yen is about to become a favourite

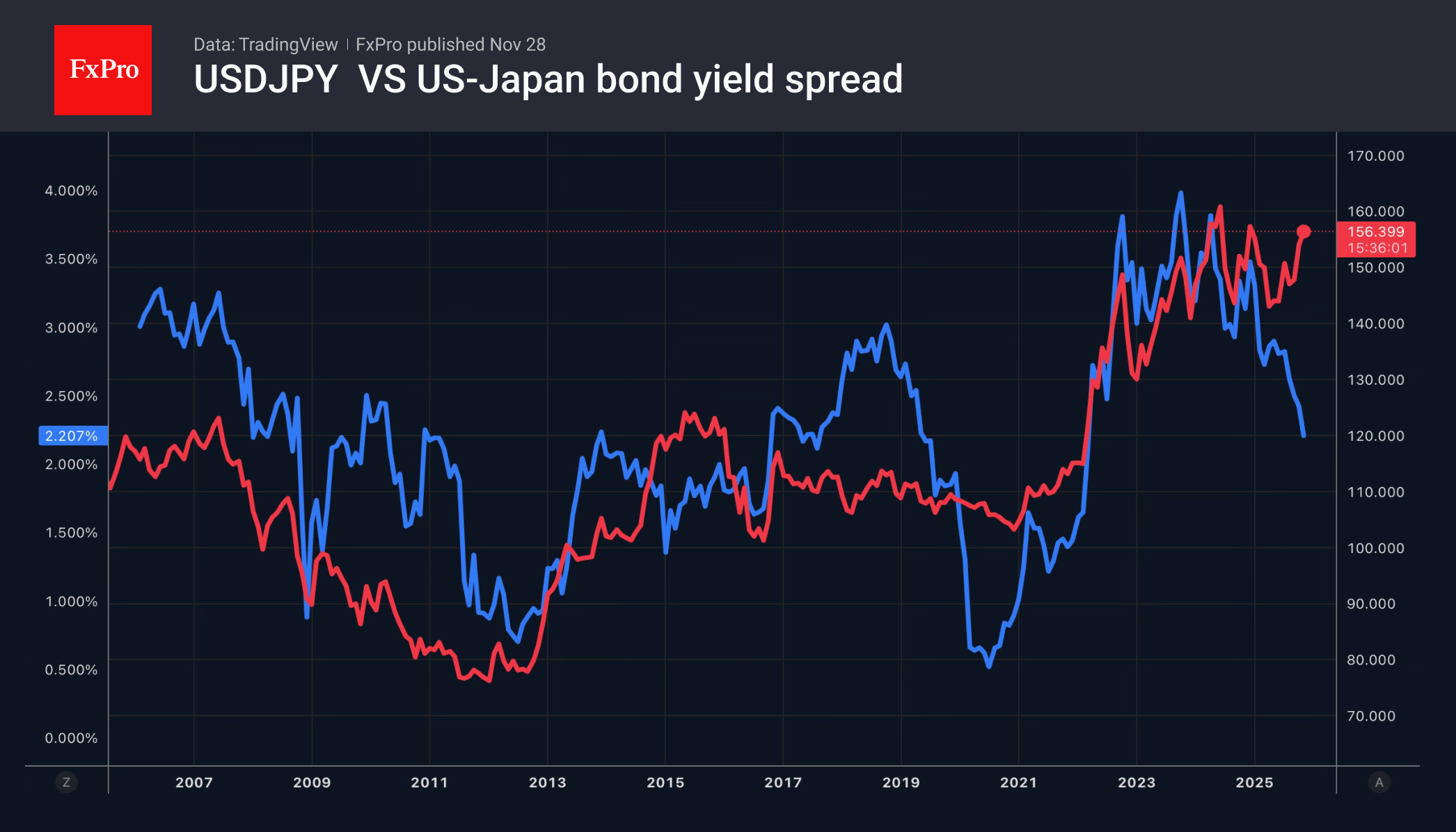

Expectations of an easing of the Fed's monetary policy remain a key factor weighing on the US dollar, with Kevin Hassett increasingly likely to be appointed as Fed chairman. Derivative prices reflect expectations of a 90-basis-point cut in the key rate over the next year.

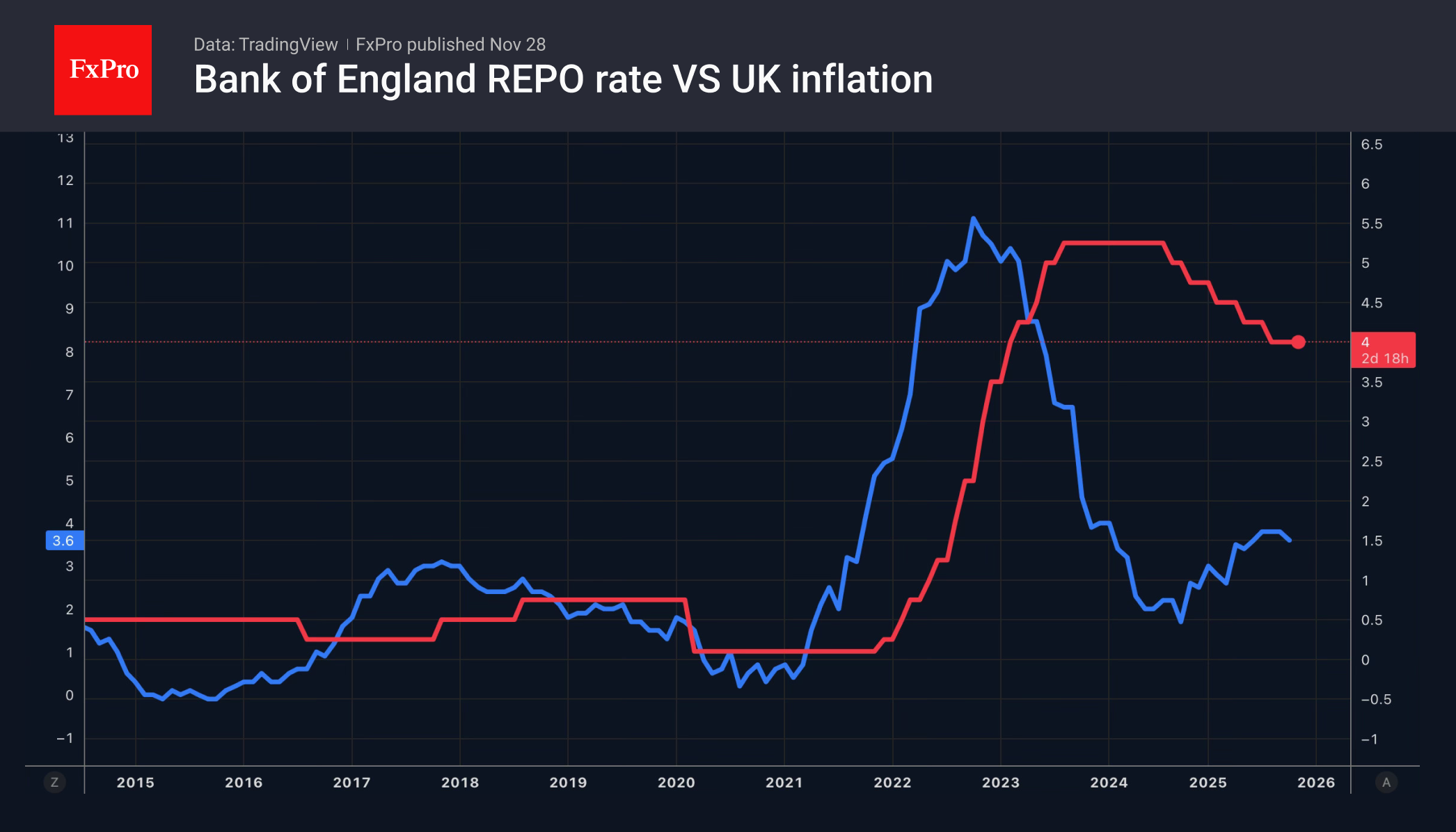

The pound reacted as financial markets usually do: shoot first, think later. The rise in GBPUSD was driven by investor optimism about Labour's draft budget. Rachel Reeves essentially postponed all the pain of tax increases, signed another minimum wage increase, and even loosened fiscal policy for the coming years. The Office for Budget Responsibility predicts that these measures will slow inflation by 0.5 percentage points in the second quarter of 2026, but investors are sceptical.

Pessimists, including Morgan Stanley, believe it is time to take profits on GBPUSD. Tax increases will slow down the British economy and force the Bank of England to cut its key rate further. The futures market disagrees, pricing in a 64-basis-point cut by the end of 2026, with a 90% probability of a cut in the repo rate from 4% to 3.75% in December. This leads to another cut next year, with a slight chance of two cuts. This is a striking contrast to the US, which promises to push the pound higher if this difference persists.

Pessimists, including Morgan Stanley, believe it is time to take profits on GBPUSD. Tax increases will slow down the British economy and force the Bank of England to cut its key rate further. The futures market disagrees, pricing in a 64-basis-point cut by the end of 2026, with a 90% probability of a cut in the repo rate from 4% to 3.75% in December. This leads to another cut next year, with a slight chance of two cuts. This is a striking contrast to the US, which promises to push the pound higher if this difference persists.

USDJPY bears are attempting to capitalise on the weakness of the US dollar. Previously, the BoJ emphasised the uncertainty of the US economy, but now it is focusing on the weak yen. Reuters claims that this change in rhetoric by the Bank of Japan is a signal of its readiness to raise rates in December. The chances of this outcome have increased after Kazuo Ueda met with Sanae Takaichi, where the Prime Minister did not directly prohibit policy tightening.

USDJPY bears are attempting to capitalise on the weakness of the US dollar. Previously, the BoJ emphasised the uncertainty of the US economy, but now it is focusing on the weak yen. Reuters claims that this change in rhetoric by the Bank of Japan is a signal of its readiness to raise rates in December. The chances of this outcome have increased after Kazuo Ueda met with Sanae Takaichi, where the Prime Minister did not directly prohibit policy tightening.

Divergence in monetary policy could make the yen the favourite for 2026. The futures market expects the overnight rate to rise by 75 basis points by the end of next year.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)