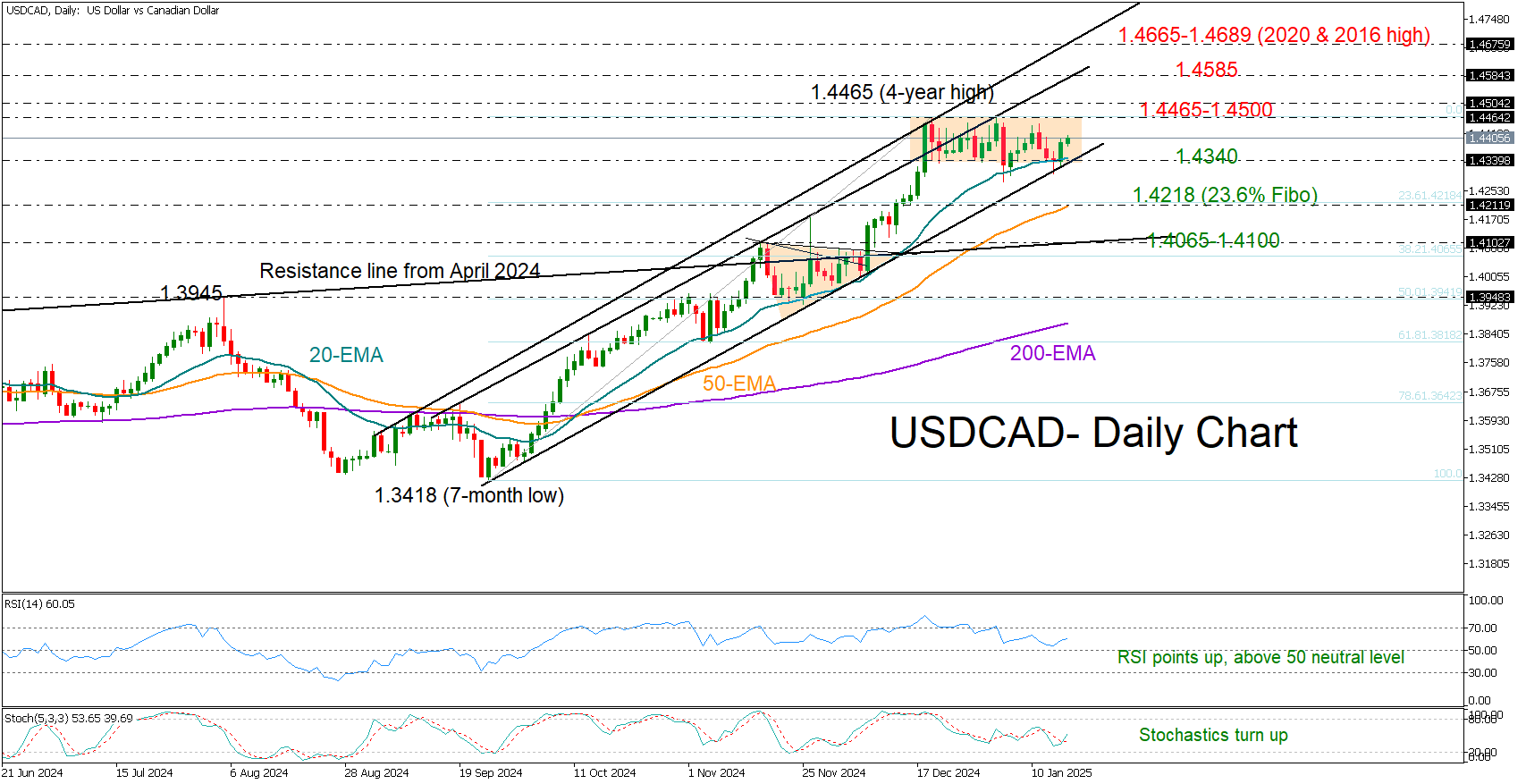

USDCAD: Ready for a new bullish wave?

USDCAD found solid footing near its 20-day exponential moving average (EMA) around 1.4340 for the second time this month, sparking optimism that the ongoing sideways move could give way to an upward move. Note that the 20-day EMA has been an important pivotal point since November.

In other encouraging signs, the RSI has turned up above its 50 neutral mark, and the stochastic oscillator has also posted a positive cross, both suggesting increasing buying interest.

If buyers manage to break the short horizontal trajectory above the 1.4465-1.4500 ceiling, the resistance trendline at 1.4585 could add some pressure ahead of the 2020 and 2016 highs registered within the 1.4665-1.4689 zone. More gains from there could stall near the 1.4800 barrier taken from 2003.

On the flip side, if sellers squeeze the price below the 1.4340 base, the 23.6% Fibonacci retracement of the September-December upleg could come to the rescue along with the 50-day EMA at 1.4218. A step lower could retest the former constraining line at 1.4100 and perhaps the 38.2% Fibonacci mark of 1.4065. Then, the spotlight could shift to the 50% Fibonacci of 1.3940.

All in all, USDCAD seems to have set the stage for a bullish breakout. Traders could wait for a close above the top of 1.4465 before expecting further upward price movement.