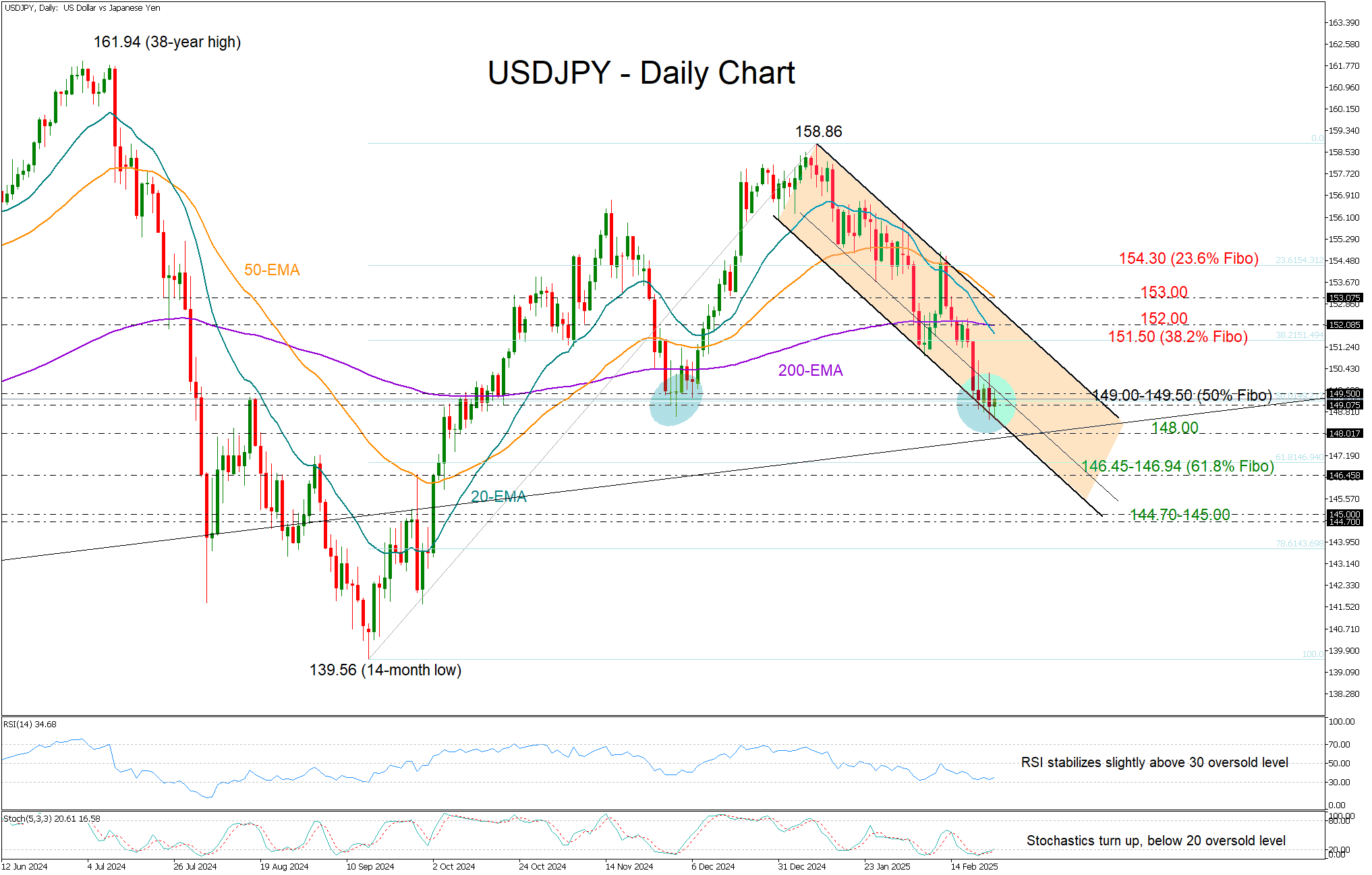

USDJPY holds the line at 149.00

USDJPY slid to a four-month low of 148.59 on Tuesday but managed to close just around the 149.00 psychological level, where the price found significant support back in December.

There is growing speculation now about whether the pair can replicate its December-January rally after shedding nearly 6% from its peak of 158.86.

The technical indicators are flagging oversold conditions as the RSI is forming a double bottom slightly above its 30 level and the stochastic oscillator is set for an upside reversal from below 20. However, the recent bearish crossover of the 20- and 200-day exponential moving averages (EMAs) – the first since August – is feeding concerns that any recovery may be short-lived.

The 149.50 barrier, which switched from support to resistance, must give way for an advance towards the 20- and 200-day EMAs seen within the 151.50-152.00 area. The 38.2% Fibonacci retracement of the December-January upleg is also in the neighborhood, while the descending trendline coming from January’s peak could cement that ceiling too. In the event of a bullish breakout above the 50-day EMA at 153.00, the rally could pick up steam towards the 23.6% Fibonacci of 154.30.

In the opposite case where the price closes below 149.00, the 148.00 mark may attempt to prevent a drop into 146.45-146.94, where the 61.8% Fibonacci level resides. A step lower could see a test within the 144.70-145.00 area.

Overall, USDJPY bulls may have another chance for an upside reversal, but confirmation above 149.50 remains crucial.

.jpg)