- Domů

- Forex kalkulačky

- Pip kalkulačka

Pip kalkulačka

| Měna | Standardní Lot | Mini Lot | Mikro Lot | Cena | Hodnota pipu |

| AUDCAD | - | - | - | 0.91680 | 0.00 |

| AUDCHF | - | - | - | 0.52679 | 0.00 |

| AUDJPY | - | - | - | 101.910 | 0.00 |

| AUDNZD | - | - | - | 1.144 | 0.00 |

| AUDSGD | - | - | - | 0.84943 | 0.00 |

| AUDUSD | - | - | - | 0.65499 | 0.00 |

| CADCHF | - | - | - | 0.57456 | 0.00 |

| CADJPY | - | - | - | 111.157 | 0.00 |

| CHFJPY | - | - | - | 193.445 | 0.00 |

| CHFSGD | - | - | - | 1.612 | 0.00 |

| EURAUD | - | - | - | 1.773 | 0.00 |

| EURCAD | - | - | - | 1.625 | 0.00 |

| EURCHF | - | - | - | 0.93392 | 0.00 |

| EURCZK | - | - | - | 24.151 | 0.00 |

| EURGBP | - | - | - | 0.87846 | 0.00 |

| EURHUF | - | - | - | 380.654 | 0.00 |

| EURJPY | - | - | - | 180.670 | 0.00 |

| EURMXN | - | - | - | 21.258 | 0.00 |

| EURNOK | - | - | - | 11.758 | 0.00 |

| EURNZD | - | - | - | 2.028 | 0.00 |

| EURPLN | - | - | - | 4.229 | 0.00 |

| EURSEK | - | - | - | 10.972 | 0.00 |

| EURSGD | - | - | - | 1.506 | 0.00 |

| EURTRY | - | - | - | 49.329 | 0.00 |

| EURUSD | - | - | - | 1.161 | 0.00 |

| EURZAR | - | - | - | 19.849 | 0.00 |

| GBPAUD | - | - | - | 2.018 | 0.00 |

| GBPCAD | - | - | - | 1.850 | 0.00 |

| GBPCHF | - | - | - | 1.063 | 0.00 |

| GBPJPY | - | - | - | 205.675 | 0.00 |

| GBPMXN | - | - | - | 24.198 | 0.00 |

| GBPNOK | - | - | - | 13.383 | 0.00 |

| GBPNZD | - | - | - | 2.308 | 0.00 |

| GBPSEK | - | - | - | 12.488 | 0.00 |

| GBPSGD | - | - | - | 1.714 | 0.00 |

| GBPTRY | - | - | - | 56.128 | 0.00 |

| GBPUSD | - | - | - | 1.322 | 0.00 |

| NOKJPY | - | - | - | 15.347 | 0.00 |

| NOKSEK | - | - | - | 0.93244 | 0.00 |

| NZDCAD | - | - | - | 0.80145 | 0.00 |

| NZDCHF | - | - | - | 0.46055 | 0.00 |

| NZDJPY | - | - | - | 89.092 | 0.00 |

| NZDUSD | - | - | - | 0.57261 | 0.00 |

| SEKJPY | - | - | - | 16.426 | 0.00 |

| SGDJPY | - | - | - | 119.971 | 0.00 |

| USDCAD | - | - | - | 1.400 | 0.00 |

| USDCHF | - | - | - | 0.80429 | 0.00 |

| USDCNH | - | - | - | 7.071 | 0.00 |

| USDCZK | - | - | - | 20.797 | 0.00 |

| USDHUF | - | - | - | 327.758 | 0.00 |

| USDJPY | - | - | - | 155.587 | 0.00 |

| USDMXN | - | - | - | 18.307 | 0.00 |

| USDNOK | - | - | - | 10.124 | 0.00 |

| USDPLN | - | - | - | 3.641 | 0.00 |

| USDRUB | - | - | - | 77.724 | 0.00 |

| USDSEK | - | - | - | 9.448 | 0.00 |

| USDSGD | - | - | - | 1.297 | 0.00 |

| USDTHB | - | - | - | 32.007 | 0.00 |

| USDTRY | - | - | - | 42.448 | 0.00 |

| USDZAR | - | - | - | 17.093 | 0.00 |

| XAGAUD | - | - | - | 87.205 | 0.00 |

| XAGEUR | - | - | - | 49.192 | 0.00 |

| XAGUSD | - | - | - | 57.124 | 0.00 |

| XAUAUD | - | - | - | 6,436.940 | 0.00 |

| XAUCHF | - | - | - | 1,770.700 | 0.00 |

| XAUEUR | - | - | - | 3,631.080 | 0.00 |

| XAUGBP | - | - | - | 3,189.640 | 0.00 |

| XAUJPY | - | - | - | 655,996 | 0.00 |

| XAUUSD | - | - | - | 4,216.530 | 0.00 |

| XPDUSD | - | - | - | 1,429.220 | 0.00 |

| XPTUSD | - | - | - | 1,651.190 | 0.00 |

| ZARJPY | - | - | - | 9.092 | 0.00 |

Co jsou pipy?

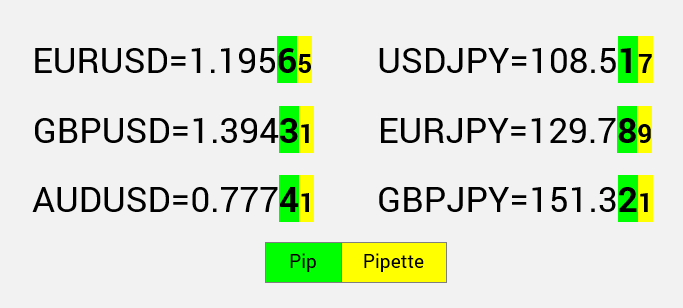

Pip je nejmenší změna ceny měnového páru na Forexu. V průběhu let Forex brokeři zavedli zlomková body nebo "pipety", aby obchodníkům nabídli nejlepší nákupní a prodejní ceny při obchodování, které ve skutečnosti tvoří menší zlomek pipu.

Na identifikaci pipu v měnovém páru by to záviselo na páru. Některé páry mají pip na 4ém desetinném místě, zatímco některé na 2ém desetinném místě. Frakční pip nebo Pipette vždy následuje umístění pipu, takže by bylo v 5ém a 3ím desetinném místě.

Co je hodnota pipu?

Například při ceně EURUSD 123456 číslice "5" představuje umístění pipu, zatímco číslice "6" představuje částečný pip. Pohyb ceny o 1 pip by tedy znamenal 1.23456 + 0.0001=1.23466.

Pokud cena klesne na 1.23443, je to 1.23456-1.23443=0.00013, změna o 1.3 pipů.

Stejný výpočet funguje pro měnové páry, kde jsou pipy reprezentovány jiným desetinným místem.

Hodnota pipu v peněžním vyjádření je pro obchodníky na Forexu kritická, protože pomáhá analyzovat a porozumět růstu (nebo ztrátě) účtu v jednoduchém formátu, jakož i vypočítat stop loss a stanovit cíle zisku. Pokud například pro svůj obchod nastavíte stop loss 10 pipů, může to znamenat ztrátu 100 nebo 1 000 dolarů v závislosti na velikosti lotu, kterým obchodujete.

Mějte na paměti, že hodnota pipu se bude pro různé měnové páry vždy lišit podle měny kotace. Například při obchodování s EURUSD se hodnota pipu zobrazí v USD, při obchodování s EURGBP bude v GBP.

Jak používat kalkulačku pipů?

Měna účtu: měna vkladu vašeho účtu, může být AUD, CAD, CHF, EUR, GBP, JPY, NZD nebo USD.

Velikost obchodu: velikost obchodu, se kterou obchodujete v lotech nebo jednotkách, kde 1 lot=100 000 jednotek.

Jakmile vyberete měnu účtu a velikost obchodu, kalkulačka vypočítá hodnotu pipu se standardními, mini a mikro loty s aktuálními tržními kurzy.

Jak vypočítat hodnotu pipu?

V závislosti na základní měně účtu budete muset odpovídajícím způsobem převést hodnotu pipu.

Hodnota pipu=(1 pip / Kurz měny k měně účtu) * Velikost lotu v jednotkách

Například hodnota pipu EURUSD je 10 dolarů za pip se standardní velikostí lotu a účtem USD:

Hodnota pipu=(0.0001 / 1) * 100000=$10.

Pokud je však váš účet vedený v EUR, budete muset rozdělit 10 dolarů podle kurzu EURUSD, což by mělo za následek hodnotu pipu 8.92 EUR:

(například EURUSD=1.1200)

Hodnota pipu=(0.0001 / [1.1200]) * 100000=EUR 8.92.