Kalkulačka finanční páky

Pomocí kalkulačky pákového efektu rychle zjistíte, jaký pákový efekt potřebujete na otevření pozice.

Co je to Forex páka?

Pákový efekt je investice peněz s vypůjčenými prostředky. Na rozdíl od běžného obchodu, kde nakupujete za 10 dolarů, ve Forexu můžete použít pákový efekt na nákup (nebo prodej) stejné hodnoty za méně peněz, například koupit 10 dolarů s marží 1 dolar (pákový efekt 10: 1).

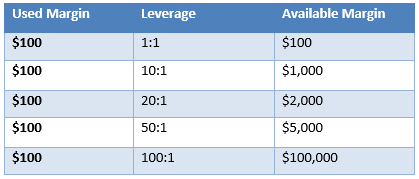

Příklad pákového efektu na účet 100 dolarů:

Pákový efekt zvyšuje potenciál obchodování se ziskem, avšak jak se zvyšuje pákový efekt, riziko se zvyšuje, a proto můžete ztratit více.

Pákový efekt je poměr mezi pomyslnou hodnotou obchodu a měnou použitou na otevření obchodu, obvykle místní měnou účtu. Například evropský obchodník bude mít základní měnu euro, zatímco americký obchodník bude mít základní měnu americký dolar.

Výška pákového efektu, který použijete na svém obchodním účtu, určuje úroveň marže, kterou musíte udržet (jinak můžete dostat výzvu k dodatkové úhradě).

Jak vypočítat ukazatel finanční páky?

Výpočet poměru finanční páky je náročný, ale s naší kalkulačkou finanční páky stačí zadat několik hodnot a snadno je vypočítat:

Měnový pár - měna, se kterou obchodujete

Měna účtu - měna vkladu na účtu

Marže - kolik marže chcete použít na obchod

Velikost obchodu - velikost kontraktu nebo počet obchodovaných jednotek (1 lot=100 000 jednotek)

Po vypočítání uvidíte přesný pákový efekt potřebný k otevření obchodu. Mějte na paměti, že uvedený pákový efekt je minimálním pákovým efektem - nižší pákový efekt neumožní otevřít obchod, zatímco vyšší pákový efekt je možné použít, pokud to váš broker dovolí.

Jak vypočítat provozní pákový efekt?

Provozní pákový efekt je účinný pákový efekt použitý na účtu na držení otevřených pozic.

Jinými slovy, toto je poměr mezi celkovými čistými otevřenými pozicemi a celkovou marží vašeho vkladu.

Efektivní nebo pracovní pákový efekt nemůže překročit maximální pákový efekt vašeho obchodního účtu.

Například: pokud máte otevřený obchod EURUSD na 0.5 lotu a vklad 1 000 EUR a použijete marži 50 EUR, to znamená, že váš účinný pákový efekt je 1 000/50=20. To znamená, že každých 10 EUR v hodnotě obchodní pozice je krytých 5 EUR zůstatku na účtu.

Jaký pákový efekt bych měl použít?

To bude záviset na vaší toleranci vůči riziku. Páka 50:1 znamená, že 2% změna ceny by mohla vymazat váš účet (50 * 2=100%).

Nepoužívejte na své pozice nadměrný pákový efekt a nadále používejte pákový efekt, který vyhovuje vašemu obchodnímu stylu. Vysoká páka se obvykle používá s malými účty nebo s krátkodobými obchodními metodami, jako je skalpování (protože kolísání cen je omezené), zatímco systémy dlouhodobého obchodování, jako je sledování trendů (protože cena může výrazně kolísat) nebo velké účty, používají nižší pákový efekt.

Jaký pákový efekt bych měl použít?

To bude záviset na několika faktorech:

- Jakou část svého vkladu jste ochotni ztratit?

- Máte fungující a úspěšný obchodní systém?

- Obchodujete na plný úvazek nebo jen jako hobby?

Asi jste už slyšeli větu - "Nikdy neinvestujte peníze, které si nemůžete dovolit ztratit", a to je klíčové pravidlo, které musíte dodržovat. Pokud jste vložili všechny své úspory na svůj obchodní účet, používejte co nejmenší pákový efekt, protože nechcete, aby vaše úspory ovlivnilo nadměrné riziko.

Také jste úplně a důkladně otestovali a odzkoušeli svůj obchodní systém na demo a reálném účtu předtím, než jste šli all-in? Pokud ne, je nejlepší možností držet se při zemi a obchodovat s malým množstvím a / nebo nízkým pákovým efektem.

Nakonec, jaký je účel vašeho obchodního účtu? Pokud je to jen vedlejší koníček, s největší pravděpodobností jste investovali pouze malé množství finančních prostředků, se kterými se můžete hrát a nevadí vám prohra, pokud jste však obchodníkem na plný úvazek, v závislosti na zisku na vašem účtu, je nízká páka způsob, jak obchodovat.

Je vyšší pákový efekt lepší?

Rozhodně ne. Ztrátový obchodní systém ztratí rychleji s vyšším pákovým efektem, takže musíte použít vhodný pákový efekt pro správný scénář. Důležitým faktorem, který je třeba zvážit, je, že s pákovým efektem můžete ztratit více, než investujete - v závislosti na politice vašeho brokera, takže i když je velmi lákavé vybrat si nejvyšší dostupný pákový efekt, není to vždy nejlepší volba.