Edit Your Comment

Carry Traders

Dec 14, 2024 at 15:55

Member Since Sep 05, 2024

3 posts

Looking to bring together a group op professional Carry Traders , low interest rate pairs/ against high interest rate pairs , Long term Trades / Position Traders ( Investment) , share ideas,

, Education.

, Education.

If it is a business it takes time , if you gamble then you want to make it big fast , I am no gambler,

Dec 14, 2024 at 17:53

Member Since Sep 05, 2024

3 posts

Ladies and Gentlemen , with the upcoming interest rate decision of USD/JPY and Sterling , I'm must say they are looking appealing so far for possible opening of positions for Carry Traders , Positions , ( patience ) depending on the data released by the Fed and BoJ. Will post a few screenshots and analysis , your input would be great, ( I never base my position or timing on news , options or advice, Yet I do listing, take into consideration and also always open to grow my skills via other experience trades and investors. Participants are always welcome, Iron sharpens Iron . I'm open for corrections and additions ,

I will first focus on USD/JPY then will go to GBP/ JPY ( Gold )

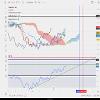

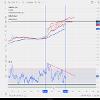

WEEKLY CHART USD/JPY

- The Carry Traders did well the past few years Going Long USD/JPY with Low JPY interest rates

- We do have however divergence on RSI 21 , yet price has broken a critical level @ 152.000 and RSI 21 is above 50% level still bulls momentum present

-Weekly candle found support on the EMA 50

-When data released and RSI 21 momentum breaking the 55% level , I feel comfortable to start looking at 1 Day chart for a position to open Long , my reason for waiting on confirmation on weekly data is due to the divergence present on weekly and could be placing risk on the table, so I will wait , Fundamentals is my 1st priority 2de Technical , but will keep Technical info of analysis in consideration .

# I will pull the Trigger on 4HR chart only when momentum is present and price is supported and or above Tenkan Sen , or a bounce of the Kijun Sen , ( I don't enter if there is no momentum strength present Reason : I keep my risk @ minimal , with momentum present then I can place a SL in a profit zone +0.5% or Brake even 0.0 much faster Taking ALL RISK OFF THE TABLE , Then riding the Carry possion out into maximum possible Bullish ( Analysis coming for exit , later if Fundamentals of JPY = If we have No big surprizes like BoJ taking a Interest Rate Hike 0.5 % + That could confirm the technical analysis with the Divergence on RSI 21 that could give the Bears a play.

I will first focus on USD/JPY then will go to GBP/ JPY ( Gold )

WEEKLY CHART USD/JPY

- The Carry Traders did well the past few years Going Long USD/JPY with Low JPY interest rates

- We do have however divergence on RSI 21 , yet price has broken a critical level @ 152.000 and RSI 21 is above 50% level still bulls momentum present

-Weekly candle found support on the EMA 50

-When data released and RSI 21 momentum breaking the 55% level , I feel comfortable to start looking at 1 Day chart for a position to open Long , my reason for waiting on confirmation on weekly data is due to the divergence present on weekly and could be placing risk on the table, so I will wait , Fundamentals is my 1st priority 2de Technical , but will keep Technical info of analysis in consideration .

# I will pull the Trigger on 4HR chart only when momentum is present and price is supported and or above Tenkan Sen , or a bounce of the Kijun Sen , ( I don't enter if there is no momentum strength present Reason : I keep my risk @ minimal , with momentum present then I can place a SL in a profit zone +0.5% or Brake even 0.0 much faster Taking ALL RISK OFF THE TABLE , Then riding the Carry possion out into maximum possible Bullish ( Analysis coming for exit , later if Fundamentals of JPY = If we have No big surprizes like BoJ taking a Interest Rate Hike 0.5 % + That could confirm the technical analysis with the Divergence on RSI 21 that could give the Bears a play.

If it is a business it takes time , if you gamble then you want to make it big fast , I am no gambler,

Member Since Apr 16, 2023

28 posts

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.