Edit Your Comment

EUR/USD

Member Since Jul 10, 2014

1114 posts

May 28, 2015 at 17:31

(edited May 28, 2015 at 17:32)

Member Since Jul 10, 2014

1114 posts

Abdul2012 posted:

The EUR/USD moved today between two levels 1.0853 support and 1.0950 resistance in the 4H chart , waiting to break one of them to know the next target.

EUR/USD broke above the resistance at 1.0900 and is currently headed for the resistance level at 1.0950. Should it break above that level it will likely reach 1.0980.

Member Since Jun 08, 2014

454 posts

May 28, 2015 at 23:41

Member Since Jun 07, 2011

372 posts

Tsipras, may be trying to calm the population in order to slow down the massive outflow of deposits, Greek banks after the ECB's decision on Wednesday, which rejected the request for liquidity support to banks increased Greeks.

I hope that Tsipras has even assign, anyway, if the minister can an agreement in the Greek parliament will be another matter.

I hope that Tsipras has even assign, anyway, if the minister can an agreement in the Greek parliament will be another matter.

Member Since Apr 08, 2014

1140 posts

May 29, 2015 at 08:12

Member Since Apr 08, 2014

1140 posts

EURUSD had a high volatile session yesterday but manage to close in the green near the high of the day. The currency has to the upside strong resistance at the 10 and 50-day moving averages although the stochastic is showing an oversold market and is displaying a slight bullish momentum.

"I trade to make money not to be right."

Member Since Oct 27, 2014

53 posts

Member Since Nov 19, 2014

157 posts

May 29, 2015 at 15:30

Member Since Nov 19, 2014

157 posts

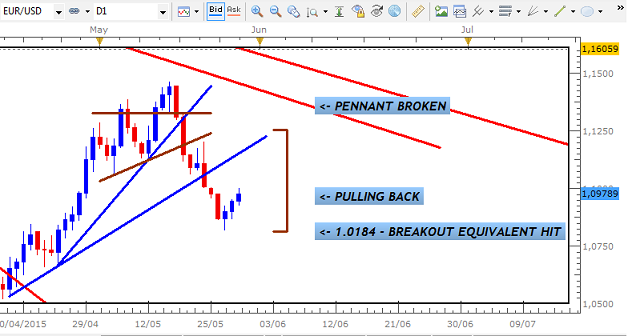

/MAY_4_EURO_B.E._1.png" target="_blank" rel="noopener noreferrer nofollow">

A few days later, the pullback started as predicted...

This Breakout Equivalent is a target to which all Consolidations head towards. At this area, the market will tend to pullback before either continuing the current trend or reverse to start a new trend.

With this EURO USD, we are likely to see this pullback give way to another Bearish signal given the strength of the overall Downtrend.

Trade Less, Earn More

Member Since Sep 25, 2013

23 posts

Member Since Oct 27, 2014

53 posts

Member Since Apr 22, 2015

14 posts

May 30, 2015 at 10:46

Member Since Apr 22, 2015

14 posts

https://twitter.com/goldenfxtrading/status/602249884016578560

this is what I predicted last week and what do we have on weekly ? a PIN BAR

now next 2 weeks bullish on EURUSD

also check my usdchf and usdcad setups

bearish on USDCHF and USDCAD.

Member Since Jul 10, 2014

1114 posts

May 30, 2015 at 10:57

Member Since Jul 10, 2014

1114 posts

EUR/USD broke above the resistance at 1.0980. It's very likely that next week the pair will continue climbing at least until it reaches 1.1100.

Member Since Jun 08, 2014

454 posts

May 31, 2015 at 20:14

Member Since Apr 09, 2014

832 posts

We have event-driven high risk week ahead of us, there are items on the calendar on both side that are very likely increase volatility around Eur/Usd, of course Friday the 5th of June will be crucial. I think by the end of next week, we should have a clear picture of which way this pair will be trading in the future.

Member Since Apr 08, 2014

1140 posts

Jun 01, 2015 at 08:43

Member Since Apr 08, 2014

1140 posts

On Friday session the EURUSD rallied to the 10 and 50-day moving and closed in the green near the high of the day, on a narrow range day but below the 10 and 50 day moving averages. So today, a break above the 10 and the 50 day moving averages could trigger a rally to a Fibonacci retracement (38.2) at 1.10584 or a break below the Fibonacci retracement (50) at 1.0955 could push the currency downward to another Fibonacci retracement (61.8) at 1.0852.

"I trade to make money not to be right."

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.