Edit Your Comment

GBP/USD daily outlook

Member Since Mar 28, 2016

94 posts

Jun 13, 2016 at 06:37

Member Since Mar 28, 2016

94 posts

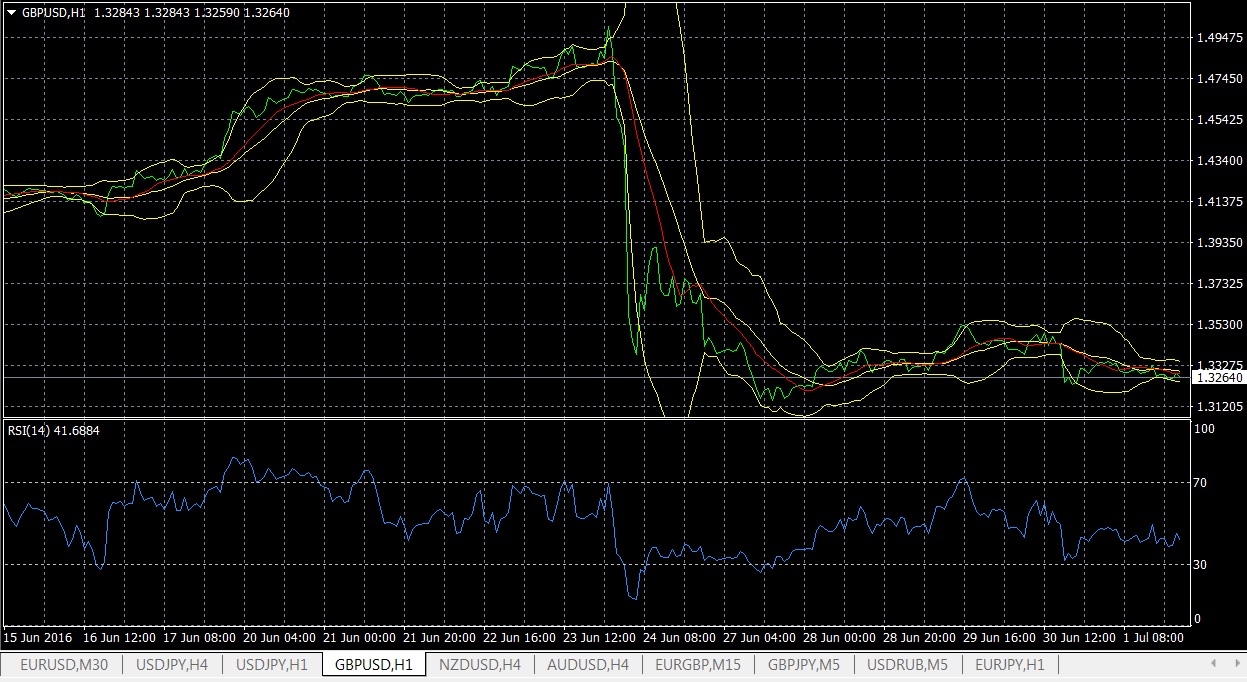

The GBPUSD attempted to push higher last week topped at 1.4659 but whipsawed to the downside and closed lower at 1.4264 and hit 1.4158 earlier today. Price broke below my “range area” as you can see on my daily chart below suggests a potential bearish scenario targeting 1.4000 this week. The bias is bearish in nearest term testing 1.4100. Immediate resistance is seen around 1.4225. A clear break above that area could lead price to neutral zone in nearest term but as long as stay below 1.4350 I prefer a bearish scenario at this phase and any upside pullback should be seen as a good opportunity to sell. get daily signls by mail visit my profile.

Member Since Dec 04, 2010

1447 posts

Jun 19, 2016 at 21:28

Member Since Dec 04, 2010

1447 posts

huge weekend gap over 100pips up on Friday's closing price. Now trading at 1.44700 odd

Member Since Oct 11, 2013

769 posts

Member Since Mar 28, 2016

94 posts

Jun 21, 2016 at 06:31

Member Since Mar 28, 2016

94 posts

GBPUSD

The GBPUSD had a bullish momentum yesterday topped at 1.4717 but traded lower earlier today hit 1.4630. The bias is bullish in nearest term but 1.4700 area is a good place to sell with a tight stop loss. Immediate support is seen around 1.4615. A clear break below that area could lead price to neutral zone in nearest term testing 1.4550 or lower. On the upside, a clear break and daily close above 1.4700 would activate my bullish mode.

Jun 24, 2016 at 12:46

Member Since Dec 09, 2015

823 posts

Like everyone else, I too thought there would be a major drop if Brexit actually came to pass, but I admit I wasn't expecting the drop to be that huge, though in retrospect maybe I should have. Considering the current situation, the decline is likely to continue.

Member Since Oct 02, 2014

905 posts

Member Since Oct 11, 2013

769 posts

Member Since Mar 28, 2016

94 posts

Jun 28, 2016 at 06:57

Member Since Mar 28, 2016

94 posts

The GBPUSD continued its bearish momentum yesterday bottomed at 1.3119 but traded higher earlier today hit 1.3327. The bias is neutral in nearest term probably with a little bullish bias testing 1.3475 – 1.3500 region. Immediate support is seen around 1.3220. I feel the effect of the Brexit referendum is still out there in the market so I will keep stand aside for now.

Member Since Oct 02, 2014

905 posts

Jul 03, 2016 at 16:10

Member Since Nov 16, 2015

708 posts

Jul 03, 2016 at 17:18

Member Since Apr 09, 2016

419 posts

On Thursday, the Bank of England's Governor Mark Carney said that the uncertainty caused by Brexit, can put pressure on the UK economy for some time. To support it, the British regulator considers to mitigate the monetary policy until the end of the summer. Probably, the Bank of England in the first place will reduce the key interest rate by 25 basis points, and this will decrease the pound below $1.3.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.