Edit Your Comment

gold advise

Member Since Jul 10, 2014

1114 posts

Jan 09, 2018 at 16:56

Member Since Jul 10, 2014

1114 posts

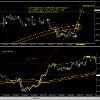

The trend is still bullish indeed, but the retracement may reach $1,300 before Gold continues moving to the upside.

Member Since Nov 30, 2016

11 posts

Member Since Jul 10, 2014

1114 posts

Jan 10, 2018 at 17:50

(edited Jan 10, 2018 at 17:51)

Member Since Jul 10, 2014

1114 posts

Gold is consolidating sideways between $1,310 and $1,330, whether it will continue rising or falling depends on which level it will break out above or below.

Member Since Jul 10, 2014

1114 posts

Jan 11, 2018 at 18:27

Member Since Jul 10, 2014

1114 posts

The sideways consolidation continues, but Gold has also formed a very notable inverted hammer candlestick on the daily time-frame at $1,310, so there may be a breakout to the upside.

Member Since Jul 10, 2014

1114 posts

Jan 12, 2018 at 17:38

Member Since Jul 10, 2014

1114 posts

Gold broke out above $1,330 and it will probably continue moving to the upside towards the next target which is around $1,350.

Member Since Oct 11, 2013

769 posts

Member Since Jul 10, 2014

1114 posts

Jan 15, 2018 at 17:49

Member Since Jul 10, 2014

1114 posts

alexforex007 posted:

Gold rallies to the 1339 level with amazing strength. the rally may continue further, the next resistance level could be the high at the 1357 level.

I agree, the move to the upside will likely continue at least to $1,350 or, as you said, to $1,357. The question is whether it will keep moving to the upside after that.

Member Since Jul 10, 2014

1114 posts

Jan 16, 2018 at 18:26

Member Since Jul 10, 2014

1114 posts

Gold retraced from the high at $1,345, but considering the inverted hammer candlestick on the four-hour time-frame at $1,330 there will likely be a new move to the upside.

Member Since Jul 10, 2014

1114 posts

Jan 18, 2018 at 17:16

Member Since Jul 10, 2014

1114 posts

Gold is consolidating sideways and unless fundamentals give it a push tomorrow there likely won't be any major changes before the weekend.

Member Since Jul 10, 2014

1114 posts

Jan 19, 2018 at 18:26

Member Since Jul 10, 2014

1114 posts

Gold bounced off from $1,335 yet again, there will probably be a new move to the downside towards $1,320.

Member Since Jul 10, 2014

1114 posts

Jan 22, 2018 at 17:49

Member Since Jul 10, 2014

1114 posts

Gold is stuck in a very tight consolidation around $1,330, hopefully the fundamentals later this week will end it.

Member Since Jul 10, 2014

1114 posts

Jan 23, 2018 at 18:06

Member Since Jul 10, 2014

1114 posts

Gold may move to the upside towards $1,345 again but the sideways consolidation continues for now.

Member Since Jul 10, 2014

1114 posts

Jan 24, 2018 at 17:50

Member Since Jul 10, 2014

1114 posts

It finally broke out above $1,345 and the sideways consolidation ended. Next target is probably at $1,360.

Member Since Jul 10, 2014

1114 posts

Jan 25, 2018 at 18:19

Member Since Jul 10, 2014

1114 posts

Gold broke out above $1,360, next target is likely around the last high at $1,375.

Member Since Jul 10, 2014

1114 posts

Jan 26, 2018 at 17:54

Member Since Jul 10, 2014

1114 posts

Gold bounced off from $1,365 but next week the move to the upside will likely continue.

Member Since Jul 10, 2014

1114 posts

Jan 29, 2018 at 17:32

Member Since Jul 10, 2014

1114 posts

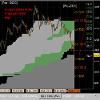

The retracement continues for now, Gold will likely reach the support at $1,335, which is the (MA)89 indicator on the four-hour time-frame.

Member Since Jul 10, 2014

1114 posts

Jan 30, 2018 at 16:19

Member Since Jul 10, 2014

1114 posts

Gold bounced off from the support at $1,335 but it will likely test that level once again soon. If it breaks out below it next target will probably be at $1,320.

Member Since Aug 16, 2016

24 posts

Member Since Jul 22, 2013

123 posts

Jan 31, 2018 at 15:48

Member Since Jul 22, 2013

123 posts

palladium show us possible up trend ..

as fundamental you can see there was no any reaction on non-farm US & Chicago PMI index ..

so I think from current 1343-44 we go minimum at 1355 or upper ..

as fundamental you can see there was no any reaction on non-farm US & Chicago PMI index ..

so I think from current 1343-44 we go minimum at 1355 or upper ..

SNF-Complex system - build in 2007 \ Tested from 1970.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.