Edit Your Comment

"Just Oil"

Member Since Jan 14, 2010

2279 posts

Member Since Jan 14, 2010

2279 posts

Jul 25, 2012 at 00:32

Member Since Jan 14, 2010

2279 posts

closed gbp/aud. seems like some aud related pairs are reversing aud is weakening.

moved stops to be on 2 new trades. been +16% unrealized on demo and 9% on live and full size trades have not gone too far yet. going to start locking profits once I have reason for it. for now looking for the moment to move stops to be on the rest of the trades.

moved stops to be on 2 new trades. been +16% unrealized on demo and 9% on live and full size trades have not gone too far yet. going to start locking profits once I have reason for it. for now looking for the moment to move stops to be on the rest of the trades.

Jul 25, 2012 at 06:32

Member Since Jan 02, 2012

44 posts

I'm thinking the EUr/AUD trade is over for now...the EUR has a hard time going lower and if it goes lower I think AUD will do ot faster since there anren't so many shorts around there

I'm going to start looking for some YEN buying

Have a difficult week since the deadline for my thesis is today, actually don't have time to trade anymore this week :((( I will put some limit orders :D

I'm going to start looking for some YEN buying

Have a difficult week since the deadline for my thesis is today, actually don't have time to trade anymore this week :((( I will put some limit orders :D

Member Since Jan 14, 2010

2279 posts

Jul 25, 2012 at 19:22

Member Since Jan 14, 2010

2279 posts

Better not to think 😀 what do you know. went to bed with 15% floating unrealized profit on demo and almost 9% floating on live and it is now only half of that, but I think it is only the bump on the road. Some sort of overnight news when i was sleeping regarding Eur and which is not on FF schedule. I am hanging and decided to move 2 BE stops on new trades back to previous levels, I would better lose than miss the trend if it is developing.

eur/aud is in a monster trend. very strong trend.

eur/aud is in a monster trend. very strong trend.

Member Since Jan 14, 2010

2279 posts

Jul 26, 2012 at 14:56

Member Since Jan 14, 2010

2279 posts

Oh yeah, that's quite a ride. got stopped on aud/jpy. and the rest went against me. stops are tight so I will do nothing.

on day trading account got BE, then stopped out at loss and then got 3:1 winner. had to forget my short bias to go long.

Generally speaking, I am going to change nothing on long term trading. i am doing everything as I must consistently and let profits run, cut losses. Got myself a rule when I will close trades manually. I set ema 12 for this purpose. so that when ema 12, cross ema 7, and I am on profitable trade, I will close that trade. to wait for 7 cross 25 would leave a lot on the table.

on day trading account got BE, then stopped out at loss and then got 3:1 winner. had to forget my short bias to go long.

Generally speaking, I am going to change nothing on long term trading. i am doing everything as I must consistently and let profits run, cut losses. Got myself a rule when I will close trades manually. I set ema 12 for this purpose. so that when ema 12, cross ema 7, and I am on profitable trade, I will close that trade. to wait for 7 cross 25 would leave a lot on the table.

Member Since Jan 14, 2010

2279 posts

Jul 26, 2012 at 14:59

Member Since Jan 14, 2010

2279 posts

Obviosuly i am upset. +16% turning into 2-3% floating or from +9% on live to -1-2% floating it is very upsetting but I know if I continue doing whatevr I am doing I will have a very big hits too. been 3000 pips on all trades just 2 days ago.

If things reverse I might get back to it, the trend is still tecically down for me on those trades I am in, but if I get signal in opposite direction i will go with signal.

If things reverse I might get back to it, the trend is still tecically down for me on those trades I am in, but if I get signal in opposite direction i will go with signal.

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 26, 2012 at 19:26

Member Since Jun 06, 2012

1434 posts

it is a dirty stick on both end.

from which side you hold it you get dirt.

your desecion is waiting untill a reversal signal. respect.

here is the issue;

when you are waiting to enter with a logic you missed lets say ~%30 of the trend. and when also waiting for a exit signal you will loose another ~%30 of it.

So you are waiting a really big winners. I guess the best way is exiting ona certain level and getting the profit in to the wallet. lets say 1000 pip for EU.

from which side you hold it you get dirt.

your desecion is waiting untill a reversal signal. respect.

here is the issue;

when you are waiting to enter with a logic you missed lets say ~%30 of the trend. and when also waiting for a exit signal you will loose another ~%30 of it.

So you are waiting a really big winners. I guess the best way is exiting ona certain level and getting the profit in to the wallet. lets say 1000 pip for EU.

Chikot posted:

Obviosuly i am upset. +16% turning into 2-3% floating or from +9% on live to -1-2% floating it is very upsetting but I know if I continue doing whatevr I am doing I will have a very big hits too. been 3000 pips on all trades just 2 days ago.

If things reverse I might get back to it, the trend is still tecically down for me on those trades I am in, but if I get signal in opposite direction i will go with signal.

Member Since Jan 14, 2010

2279 posts

Jul 26, 2012 at 23:33

Member Since Jan 14, 2010

2279 posts

1000 is very good. so far I got close only on gbp/aud. i also should cut size and increase stop like I was doing on demo from the start. i wonder how the rest of the trades will do. so far no other signals to tarde but may be few are coming next week.

Member Since Jan 14, 2010

2279 posts

Jul 26, 2012 at 23:35

Member Since Jan 14, 2010

2279 posts

The whole thing is news at the wrong time but news can also hit in my direction and cause I can let profits run I will hit pay dirt too.

Member Since Jan 14, 2010

2279 posts

Jul 27, 2012 at 13:10

(edited Jul 27, 2012 at 13:11)

Member Since Jan 14, 2010

2279 posts

Member Since Jan 14, 2010

2279 posts

Jul 27, 2012 at 13:17

Member Since Jan 14, 2010

2279 posts

got move up. the last stop is trailing stop 1.5;1. r:r. in the beginning shorted but got out, was a good tarde, whipsawed for small losses and last 2 tardes were 3:1 and 2:1 r:r. pretty good. got stopped on nzd/usd and closed gbp/nzd myslef. 2 trades left on live and fe wmore on demo. will be looking next week iof there is signals

Member Since Jan 14, 2010

2279 posts

Jul 28, 2012 at 09:19

Member Since Jan 14, 2010

2279 posts

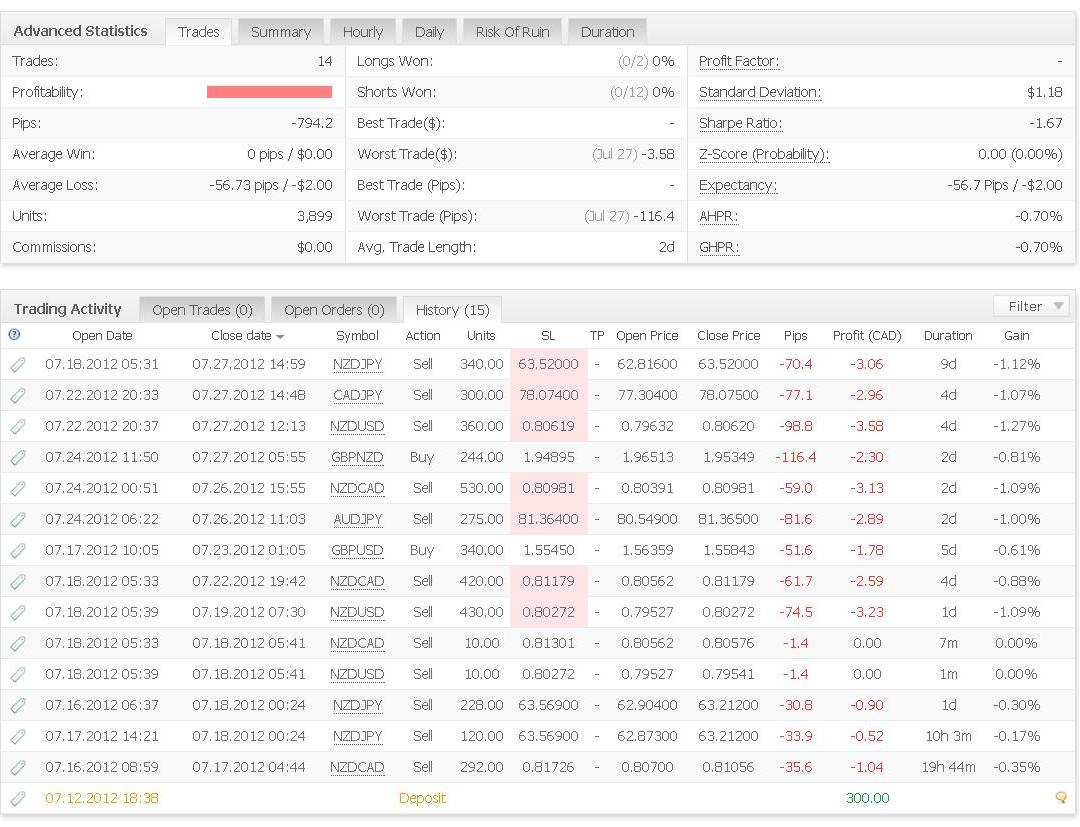

I have been thinking and here my conclusion. Despite this DD that I have got, I believe I was doing everything right. The only mistakes was not to move stops to BE after news started moving markets against my positions. I used sound trade management, cut my losses short and let my profits run. Unlike the vast majority of traders on myfxbook I was growing fat dick not fat tail.

Statistics of unrealized profits on myfxbook clearly shows I never let losses run against me and my floating unrealized balance was always bigger than real equity. I want to point that news could move market in my direction which they often do as market senses things before news and moves it along the trend.My only mistake was not to move stops after news and even on 2 pairs where I moved stops I moved them back to let trades breath as I was confident that trend is developing now.

Stops I believe I should make a little wider. I use 1ATR for past 40 days stop plus spread. I would add another 10-15%. say if ATR and spread is 55 pips. I will make it 65-70 pips. I believe leaving possibility for bigger R:R is important as I saw it on Tuesday and new trades moved only 1.5 to 2.5% R:R. imagine 4-6:1 R:R or even more.

Hence, I am going to continue what i have been doing the only thing will be moving stop to BE once I am around 1.5-2:1 R:R in profit and there is some kind of news.

Looking forward to new trading opportunities.

Statistics of unrealized profits on myfxbook clearly shows I never let losses run against me and my floating unrealized balance was always bigger than real equity. I want to point that news could move market in my direction which they often do as market senses things before news and moves it along the trend.My only mistake was not to move stops after news and even on 2 pairs where I moved stops I moved them back to let trades breath as I was confident that trend is developing now.

Stops I believe I should make a little wider. I use 1ATR for past 40 days stop plus spread. I would add another 10-15%. say if ATR and spread is 55 pips. I will make it 65-70 pips. I believe leaving possibility for bigger R:R is important as I saw it on Tuesday and new trades moved only 1.5 to 2.5% R:R. imagine 4-6:1 R:R or even more.

Hence, I am going to continue what i have been doing the only thing will be moving stop to BE once I am around 1.5-2:1 R:R in profit and there is some kind of news.

Looking forward to new trading opportunities.

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 28, 2012 at 12:09

Member Since Jun 06, 2012

1434 posts

Chikot

you were not doing anything wrong!

now this will be my longest post ever.

1- every winning period is most most most probably followed by a loosing steak.

look at the BT graph. every group of winners followed by the loosers.

every trader should stop for sometimes after a winner period.

2- you have done everything wright. but the instruments were wrong. thats why all your live trades have lost.

now;

you had a winner period at demo and you were menthally ready to go live. thats correct

but technically it was the worst time. due every winner period most probably follows by a looser perid.

if any one can determine that correctly he/she become zillionarie in years.

trading with too many curr pairs does not mean anything.

trade only one currency pair, increase your lot size, focus only 1 trade. which you feel yourself most comfotable.

and find a Max unrlated instrument from your broker ( not currency pair,not oil, not gold, something else wheat, soybeans, apple, google, what ever it is)

EURUSD is the needle of compass. when it fails all other curr paris WILL fail.

you are making good trade desecions, but IMO trading with too many max related instruments.

I hope this helps

walker

you were not doing anything wrong!

now this will be my longest post ever.

1- every winning period is most most most probably followed by a loosing steak.

look at the BT graph. every group of winners followed by the loosers.

every trader should stop for sometimes after a winner period.

2- you have done everything wright. but the instruments were wrong. thats why all your live trades have lost.

now;

you had a winner period at demo and you were menthally ready to go live. thats correct

but technically it was the worst time. due every winner period most probably follows by a looser perid.

if any one can determine that correctly he/she become zillionarie in years.

trading with too many curr pairs does not mean anything.

trade only one currency pair, increase your lot size, focus only 1 trade. which you feel yourself most comfotable.

and find a Max unrlated instrument from your broker ( not currency pair,not oil, not gold, something else wheat, soybeans, apple, google, what ever it is)

EURUSD is the needle of compass. when it fails all other curr paris WILL fail.

you are making good trade desecions, but IMO trading with too many max related instruments.

I hope this helps

walker

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 28, 2012 at 12:12

Member Since Jun 06, 2012

1434 posts

this also may help.

how can we HEDGE our trades!!

if I am trading eg with EU first I should find a instrument that is MAX UNRlated with EU. et least it must not be a currency pair.

eg soybeans, wheat or what ever it is

here the logic is depending on trader capanilty of trading.

we can trade 2 different unrlated instrument.

at that point due to tading instruments are unrlated they will not effect from each other atleast on min level.

if I am over average trader then it is not very possible to have both trade desecions wrong.

on the other hand when one fails other can succeed and they hedge each other.

if they both wins then it is big goal.

so basicly hedging between currencies like USDCHF vs EURUSD means nothing.

walker

how can we HEDGE our trades!!

if I am trading eg with EU first I should find a instrument that is MAX UNRlated with EU. et least it must not be a currency pair.

eg soybeans, wheat or what ever it is

here the logic is depending on trader capanilty of trading.

we can trade 2 different unrlated instrument.

at that point due to tading instruments are unrlated they will not effect from each other atleast on min level.

if I am over average trader then it is not very possible to have both trade desecions wrong.

on the other hand when one fails other can succeed and they hedge each other.

if they both wins then it is big goal.

so basicly hedging between currencies like USDCHF vs EURUSD means nothing.

walker

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 28, 2012 at 12:17

Member Since Jun 06, 2012

1434 posts

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 28, 2012 at 12:21

Member Since Jun 06, 2012

1434 posts

dont change antyhing what you ever done while demo trading.

just stop after a winner period. and hedge yourself.

walker

just stop after a winner period. and hedge yourself.

walker

Member Since Jan 14, 2010

2279 posts

Jul 28, 2012 at 13:36

Member Since Jan 14, 2010

2279 posts

Hi Steve, I tend to agree with you on almost everything. I do need to reduce number of pairs to 10. Actually it is what the guy who shared this approach with me is doing. 10 majors. I already have idea which one they will be.

Eur/Usd, Aud/Usd, Eur/Jpy, Nzd/Usd, Nzd/Jpy, Aud/Jpy, Gbp/Usd, Gbp/Jpy, Eur/Aud and Aud/Nzd most probably, may be will make a couple of changes.

On the other hand to stop trading doe snot mean anything...I had a short losing period which turned winning again and it was a piece of news that reversed my second winning wave but those news could push price in my direction and it often does because news often push market along the trend. Generally speaking, most guys sweep they floating unrealized losses under table until there is huge move against them and they are goners. in my case my trading is skewed exactly in opposite direction. which means some huge move along the trend will make my account swell with cash. The law of probabilities will cause it sooner or later. even in may 2010 it is those who traded against the trend lost trend traders got huge wins as market fell that day along the trend on daily. so, stopping trading is not an option as Ed Seykota once told that those who want to avoid losses should not trade.

I also finds it strange that stats shows only around 11-12% floating balance while the highest I saw $16 000 floating which was 16% on demo and $25 on live which is 8.3%.

have no idea what's the problem.

so, I am definitely going to cut a number of pairs to avoid trading too many related pairs.

I also moved the rest of my oil funds to Oanda and will trade live 2 more accounts. The bigger one will be day trading and another one I will be doing same method as I am doing here live and demo on daily but only on smaller time frame which I call anti whipsaw on daily account 😉

it will be trading on 8H TF and only 2 pairs. Eur/Usd and Aud/Usd.

Day trading will be going eur/usd only with max risk of 0.4-0.6% per trade with entries of 0.2% each scaling into trades.

I will not connect accounts here until i have enough track record preferably until the end of this year. Then if I connect them here it will mean i am ready to introduce myself to investors. Results must be achieved with right trading practices.

Eur/Usd, Aud/Usd, Eur/Jpy, Nzd/Usd, Nzd/Jpy, Aud/Jpy, Gbp/Usd, Gbp/Jpy, Eur/Aud and Aud/Nzd most probably, may be will make a couple of changes.

On the other hand to stop trading doe snot mean anything...I had a short losing period which turned winning again and it was a piece of news that reversed my second winning wave but those news could push price in my direction and it often does because news often push market along the trend. Generally speaking, most guys sweep they floating unrealized losses under table until there is huge move against them and they are goners. in my case my trading is skewed exactly in opposite direction. which means some huge move along the trend will make my account swell with cash. The law of probabilities will cause it sooner or later. even in may 2010 it is those who traded against the trend lost trend traders got huge wins as market fell that day along the trend on daily. so, stopping trading is not an option as Ed Seykota once told that those who want to avoid losses should not trade.

I also finds it strange that stats shows only around 11-12% floating balance while the highest I saw $16 000 floating which was 16% on demo and $25 on live which is 8.3%.

have no idea what's the problem.

so, I am definitely going to cut a number of pairs to avoid trading too many related pairs.

I also moved the rest of my oil funds to Oanda and will trade live 2 more accounts. The bigger one will be day trading and another one I will be doing same method as I am doing here live and demo on daily but only on smaller time frame which I call anti whipsaw on daily account 😉

it will be trading on 8H TF and only 2 pairs. Eur/Usd and Aud/Usd.

Day trading will be going eur/usd only with max risk of 0.4-0.6% per trade with entries of 0.2% each scaling into trades.

I will not connect accounts here until i have enough track record preferably until the end of this year. Then if I connect them here it will mean i am ready to introduce myself to investors. Results must be achieved with right trading practices.

Jul 29, 2012 at 15:10

Member Since Jan 02, 2012

44 posts

Hi there,

A lot of volatility this week due to "news", actually just a statement from Draghi was enough to create a short squeeze, I had this feeling in the beginning of the week of a possible short squeeze, and it happened (look at posts from monday) ! I had different conflicting feelings, i couldn't let a trade run because i had a 'bad feeling'. This resulted in me taking shorts on EUR and other correlated pairs but with a very tight mental stop, on thursday i closed everything, just on time!! Let's see what the next weeks will bring...I HATE this news events, it makes trading so much more difficult

@Chikot: i can agree with walker in that you took good decisions when you opened your trades, but your exits are not good, you where caught by the news (that's why when I close my trades before news). You had 16% floating equity!!! That is huge, I would take my profits earlier or at least partially, because in the end trading is also about taking profits...I remember my first trades on stocks, when I was 19 my parents gave me 10k, i decided to trade stocks, succesfully for 2 years, in that time i once had a floating equity of +40%! I was making 4000 euros and didn't took profit, in the end I closed it with 1000 profit left, things like that happened all the time

So I think you should make some incremental changes like taking partial profit or complete earlier, take less risk (which also means less gains), don't open to many trades that are correlated, like walker says the EUR/$ is the compass, if it moves against you and you took all you trades in one direction then you will get hit hard

Good luck next week guys

A lot of volatility this week due to "news", actually just a statement from Draghi was enough to create a short squeeze, I had this feeling in the beginning of the week of a possible short squeeze, and it happened (look at posts from monday) ! I had different conflicting feelings, i couldn't let a trade run because i had a 'bad feeling'. This resulted in me taking shorts on EUR and other correlated pairs but with a very tight mental stop, on thursday i closed everything, just on time!! Let's see what the next weeks will bring...I HATE this news events, it makes trading so much more difficult

@Chikot: i can agree with walker in that you took good decisions when you opened your trades, but your exits are not good, you where caught by the news (that's why when I close my trades before news). You had 16% floating equity!!! That is huge, I would take my profits earlier or at least partially, because in the end trading is also about taking profits...I remember my first trades on stocks, when I was 19 my parents gave me 10k, i decided to trade stocks, succesfully for 2 years, in that time i once had a floating equity of +40%! I was making 4000 euros and didn't took profit, in the end I closed it with 1000 profit left, things like that happened all the time

So I think you should make some incremental changes like taking partial profit or complete earlier, take less risk (which also means less gains), don't open to many trades that are correlated, like walker says the EUR/$ is the compass, if it moves against you and you took all you trades in one direction then you will get hit hard

Good luck next week guys

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 29, 2012 at 15:12

Member Since Jun 06, 2012

1434 posts

I take profits early, Chikot takes it late. 🙄

forex_trader_79941

Member Since Jun 06, 2012

1434 posts

Jul 29, 2012 at 15:14

Member Since Jun 06, 2012

1434 posts

any MM not tested is very dangerous.

my conclusion is ( for my self ) to trade straight forward. same lot size same tp same sl. but this does not mean that if trade miss TP with 2 pips I will not exit and wait until stop.

walker

my conclusion is ( for my self ) to trade straight forward. same lot size same tp same sl. but this does not mean that if trade miss TP with 2 pips I will not exit and wait until stop.

walker

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.