- Sākumlapa

- Kopiena

- Pieredzējuši treideri

- Prove your trading worth... 100% weekly on a consistent basi...

Reklāma

Edit Your Comment

Prove your trading worth... 100% weekly on a consistent basis - long-term?

Biedrs kopš

444 ieraksti

Jan 31, 2015 at 19:44

Biedrs kopš

444 ieraksti

Question about"Whatever your strategy is, 90% of time, a system will crash one day because the way it trades is wrong."

Is what you are saying is that only 10% of the available systems are relativily safe? Briefly had a little trouble following your thread of thought. It's because for one, RISE's equity is always below the profit curve, it was designed that way. It works just fine and is safer than most. Anyway, please clear that up for me, if you will.

Bob

Is what you are saying is that only 10% of the available systems are relativily safe? Briefly had a little trouble following your thread of thought. It's because for one, RISE's equity is always below the profit curve, it was designed that way. It works just fine and is safer than most. Anyway, please clear that up for me, if you will.

Bob

where research touches lives.

Biedrs kopš

1601 ieraksti

Jan 31, 2015 at 19:59

(labots Jan 31, 2015 at 20:02)

Biedrs kopš

1601 ieraksti

If I had to pick up in between 2 swing traders to manage my account, then the first thing I would look at is equity from both accounts.*

It tells how your money will be managed... which is the most important.

I would prefer to invest with the one who gets Equity above Growth with growth = -10% rather than the other account with +30% where Equity = +10%

Sometimes I wonder why Myfxbook stats doesn't care about Equity rather than Growth.... At least ForexFactory isn't wrong and include it into account.

=> Probably because people enjoy watching green figures rather than looking to real red figures?

*

Equity is valuable data only for swing trading style, as you can't find difference in between Equity & Growth for scalping or day trading strategy.

It tells how your money will be managed... which is the most important.

I would prefer to invest with the one who gets Equity above Growth with growth = -10% rather than the other account with +30% where Equity = +10%

Sometimes I wonder why Myfxbook stats doesn't care about Equity rather than Growth.... At least ForexFactory isn't wrong and include it into account.

=> Probably because people enjoy watching green figures rather than looking to real red figures?

*

Equity is valuable data only for swing trading style, as you can't find difference in between Equity & Growth for scalping or day trading strategy.

forex_trader_202879

Biedrs kopš

378 ieraksti

Jan 31, 2015 at 20:01

Biedrs kopš

378 ieraksti

CrazyTrader posted:

- x%/day

- pip drawdown

- or any other criterias like this aren't the key and can't garantee success for the long term

Whatever your strategy is, 90% of time, a system will crash one day because the way it trades is wrong.

No one talks about equity curve that must be always (as much as possible) above growth.

The most important thing is the way it trades...

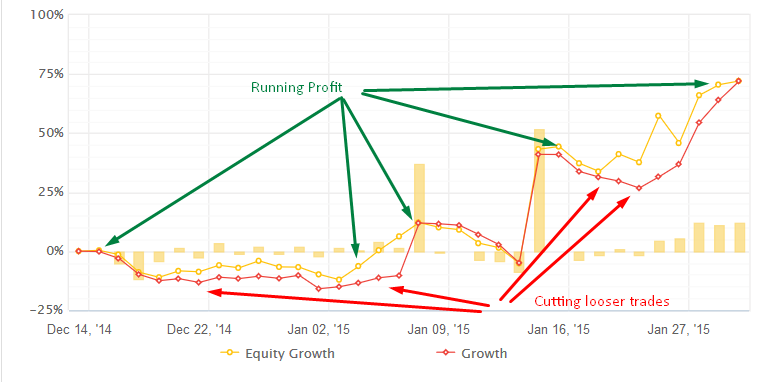

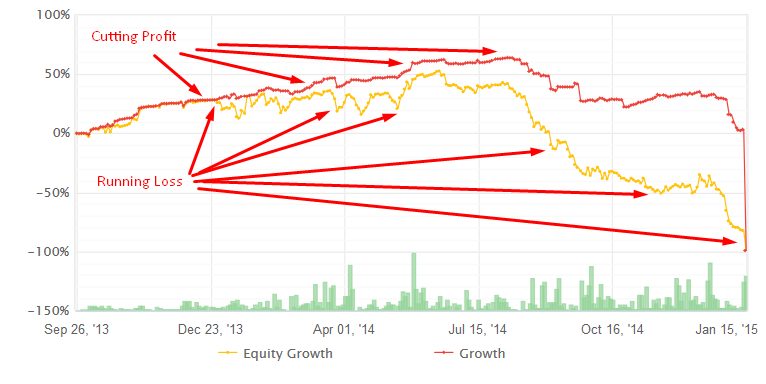

Any system trading this way will have much more chance to survive into this jungle rather than the way 90% traders trade... cutting profit too quickly and running looser trader.

VS

What kind of curve do you fancy?

When Equity is above Growth, system tends to go up and vice versa

That is where you are 100% wrong, and the equity curve has to do with pip-drawdown 100% Here is why....

The only key factor in forex is PIPs would't you agree? Pips is what allows your p/l to fluctuate. In turn, the Pip-drawdown is what creates the equity curve which you deem to be important. For those of you who have no clue about how the equity curve is calculated please read the following post. https://www.investopedia.com/terms/e/equity-curve.asp

What everyone should focus on is Pip-drawdown as it is the only REAL statistic which reveals how accurate a system's entry is. The lower the pip-drawdown, then the less time you spend in red, which of course would mean you have free equity to place new trades should you decide to do so.

Say a person trades with 0 stop loss. A person could have a 99.99% rate, but that .01% chance of loss could spell doom to the account, so looking at win% isn't at all a good stat to follow. Should a person decide to focus on an accurate entry, instead of those stupid R:R which ever deems important, then you have a much better chance of winning in forex during the "long term" as your primary objective in taking a position is gaining an accurate entry, instead of the profit you make.

The higher the accuracy (lower pip-drawdown) then the more leverage a person can use, as it would be much harder for any one order to be margin called, since the person doesn't normally give to the market x amount of pips.

I believe myfxbook should add a "pip-drawdown" counter, which allows us to see the person's avg pip-drawdown within a certain lot size range. Example. Say a person has a 25kusd account. And takes wagers from .01 lots to 10.00 lots. The avg pip-drawdown for lots say 5.00 lots or higher is much more important then the avg pip - drawdown between .01 to 1.00 lot size with that account size.

Pip - drawdown is used to caluculate your equity curve and even your DD%. Those who ignore accuracy are the ones who end up blowing up the accounts "sooner or later", but even if I end up blowing an account, and I am able to earn 3% a day for 3 months straight, then margin calling the account isn't a key factor as long as I am withdrawing my profits.

Biedrs kopš

1601 ieraksti

Jan 31, 2015 at 20:21

Biedrs kopš

1601 ieraksti

Cholipop posted:

That is where you are 100% wrong, and the equity curve has to do with pip-drawdown 100% Here is why....

you are right but wrong... and I will tell you why.

Obviously having a very good Pip-drawdown is probably the best thing to get in order to maintain an Equity Curve above Growth, but it doesn't mean Pip-drawdown itself is sufficient. You could have the best entry in every single trade, if you close too early, what a shame?

What is described here could be picture 2 if you leave the wrong trade opened despite good Pip Drawdown

Now you would be amazed to see someone not good as you to open trade in the right momentum to get perfect entry accurancy, if he knows which positions to close before it's too late (blowing account) and he runs profit with profitable orders, then his equity is above gorwth despite the awfull pip-drawdown.

what is described here could be Picture 1 despite bad Pip-Drawdown

forex_trader_202879

Biedrs kopš

378 ieraksti

Jan 31, 2015 at 20:36

Biedrs kopš

378 ieraksti

CrazyTrader posted:Cholipop posted:

That is where you are 100% wrong, and the equity curve has to do with pip-drawdown 100% Here is why....

you are right but wrong... and I will tell you why.

Obviously having a very good Pip-drawdown is probably the best thing to get in order to maintain an Equity Curve above Growth, but it doesn't mean Pip-drawdown itself is sufficient. You could have the best entry in every single trade, if you close too early, what a shame?

What is described here could be picture 2 if you leave the wrong trade opened despite good Pip Drawdown

Now you would be amazed to see someone not good as you to open trade in the right momentum to get perfect entry accurancy, if he knows which positions to close before it's too late (blowing account) and he runs profit with profitable orders, then his equity is above gorwth despite the awfull pip-drawdown.

what is described here could be Picture 1 despite bad Pip-Drawdown

It would then appear that the trader has a "trade management problem" As if a person as an accurate entry, and is in green x amount of pips, why would the trade then allow the trade to go deep in red assuming they are trading with low leverage. Also recall that Pip-drawdown calculates the highest amount of pips you were in red before you closed the position for profit,loss or BE. Which goes back to what I mentioned before about it being important. Most focus on the the expected profit EXPECTED R:R instead of the REAL R:R which has everything to do with the accuracy of the system.

forex_trader_202879

Biedrs kopš

378 ieraksti

Jan 31, 2015 at 20:40

Biedrs kopš

378 ieraksti

Accounts like these https://www.myfxbook.com/members/DrVodka/mt4-1027730/1143844

In which everything is hidden, I completly ignore. As the stats which he is hiding is key in determining if I want to follow a person or not. I mean Drvodka could easily be a tilt monkey and have gone all in on every trade using an insane amount of leverage, which isn't as important to me as him being a tilt monkey, with insane leverage who focuses on accuracy. That to me is by far the most important thing to me as a trader.

In which everything is hidden, I completly ignore. As the stats which he is hiding is key in determining if I want to follow a person or not. I mean Drvodka could easily be a tilt monkey and have gone all in on every trade using an insane amount of leverage, which isn't as important to me as him being a tilt monkey, with insane leverage who focuses on accuracy. That to me is by far the most important thing to me as a trader.

Biedrs kopš

1601 ieraksti

Jan 31, 2015 at 21:13

Biedrs kopš

1601 ieraksti

Cholipop posted:

It would then appear that the trader has a "trade management problem"

Here we go, call it as you like, but it is symptomatic of 100% retail traders that have experienced blowing account so do I

People blows accounts not because they are bad traders, simply because they run loss instead of the opposite.

Regarding this account:

https://www.myfxbook.com/members/DrVodka/mt4-1027730/1143844

This guy may not be your friend, however 2 days aren't long enough but what we can see is ok to me so far:

Strenght:

No custum date

Equity > Growth

Best trade in Pips > Worst trade in Pips (*6)

Disavantages:

Hidding closed trades

Biedrs kopš

444 ieraksti

Feb 01, 2015 at 02:12

Biedrs kopš

444 ieraksti

"f I had to pick up in between 2 swing traders to manage my account, then the first thing I would look at is equity from both accounts.*"

Oh, thanks, that's what iwas missing.

Bob

Oh, thanks, that's what iwas missing.

Bob

where research touches lives.

Biedrs kopš

1447 ieraksti

Feb 01, 2015 at 05:57

Biedrs kopš

1447 ieraksti

CrazyTrader posted:

- x%/day

- pip drawdown

- or any other criterias like this aren't the key and can't garantee success for the long term

Whatever your strategy is, 90% of time, a system will crash one day because the way it trades is wrong.

No one talks about equity curve that must be always (as much as possible) above growth.

The most important thing is the way it trades...

Any system trading this way will have much more chance to survive into this jungle rather than the way 90% traders trade... cutting profit too quickly and running looser trader.

VS

What kind of curve do you fancy?

When Equity is above Growth, system tends to go up and vice versa

good points and great examples:)

Biedrs kopš

2 ieraksti

Feb 01, 2015 at 07:19

Biedrs kopš

2 ieraksti

I did not understand where I can find and download this EA, I would like to test it.

Thank you in advance.

Thank you in advance.

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 01, 2015 at 15:38

Biedrs kopš

378 ieraksti

CrazyTrader posted:Cholipop posted:

It would then appear that the trader has a "trade management problem"

Here we go, call it as you like, but it is symptomatic of 100% retail traders that have experienced blowing account so do I

People blows accounts not because they are bad traders, simply because they run loss instead of the opposite.

Regarding this account:

https://www.myfxbook.com/members/DrVodka/mt4-1027730/1143844

This guy may not be your friend, however 2 days aren't long enough but what we can see is ok to me so far:

Strenght:

No custum date

Equity > Growth

Best trade in Pips > Worst trade in Pips (*6)

Disavantages:

Hidding closed trades

So now the question is why do they let losses run?

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 01, 2015 at 15:38

Biedrs kopš

378 ieraksti

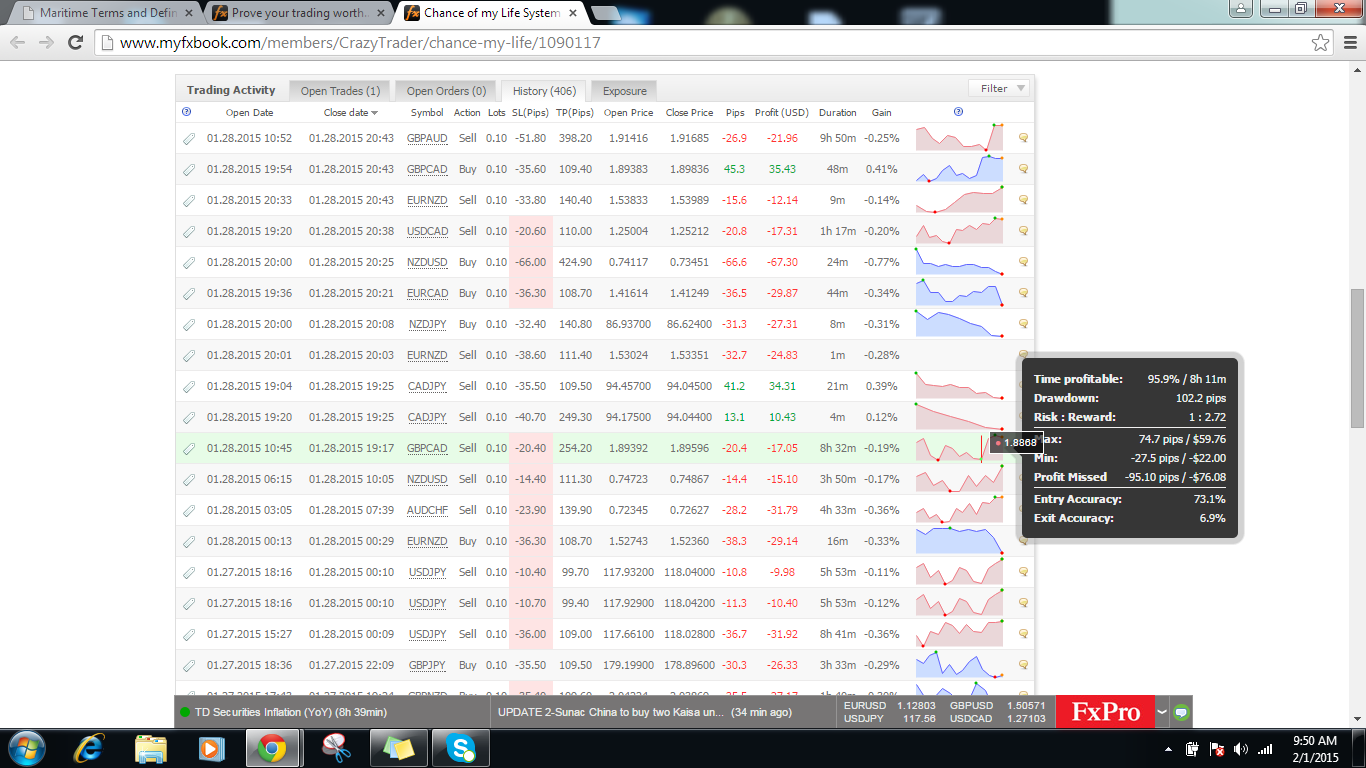

Better yet crazytrader...Let us have a look at your real account....

https://www.myfxbook.com/members/CrazyTrader/chance-my-life/1090117

Explain why your equity curve has taken such a nose dive? Based on your answer maybe we can begin to understand what your problem as a trader is.

https://www.myfxbook.com/members/CrazyTrader/chance-my-life/1090117

Explain why your equity curve has taken such a nose dive? Based on your answer maybe we can begin to understand what your problem as a trader is.

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 01, 2015 at 15:40

Biedrs kopš

378 ieraksti

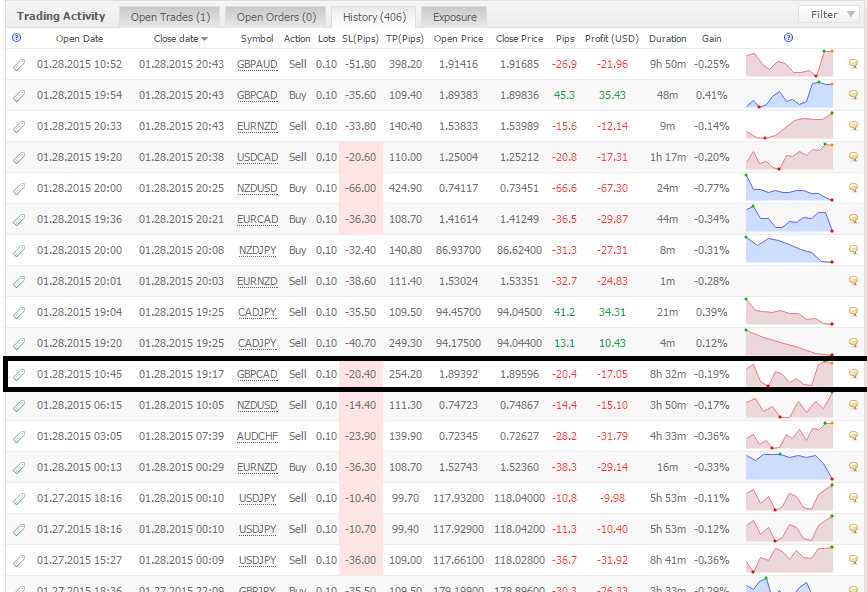

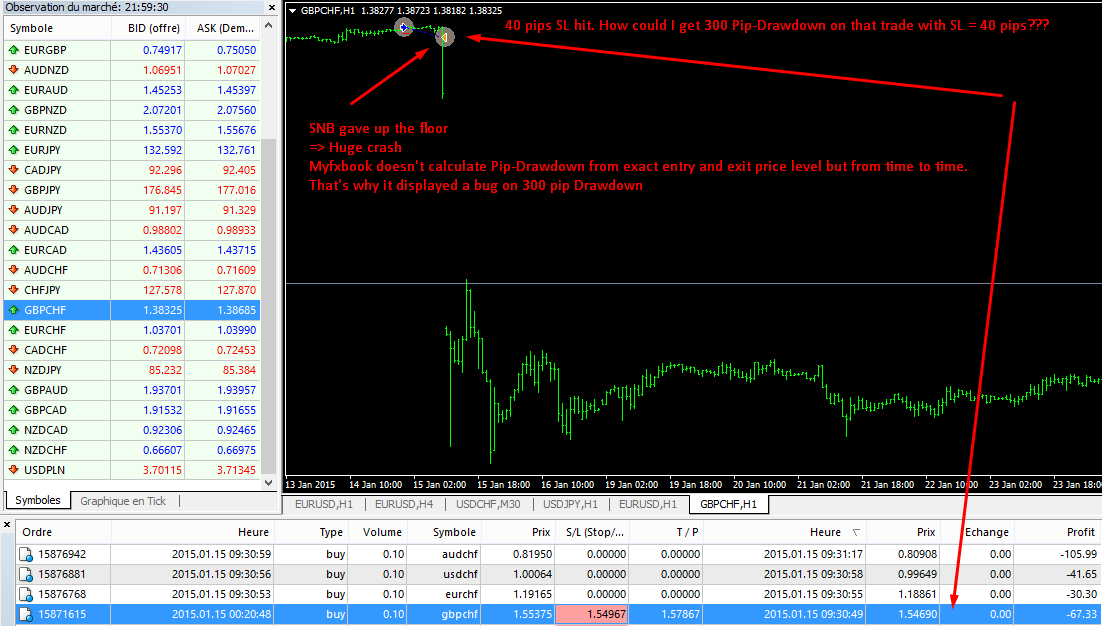

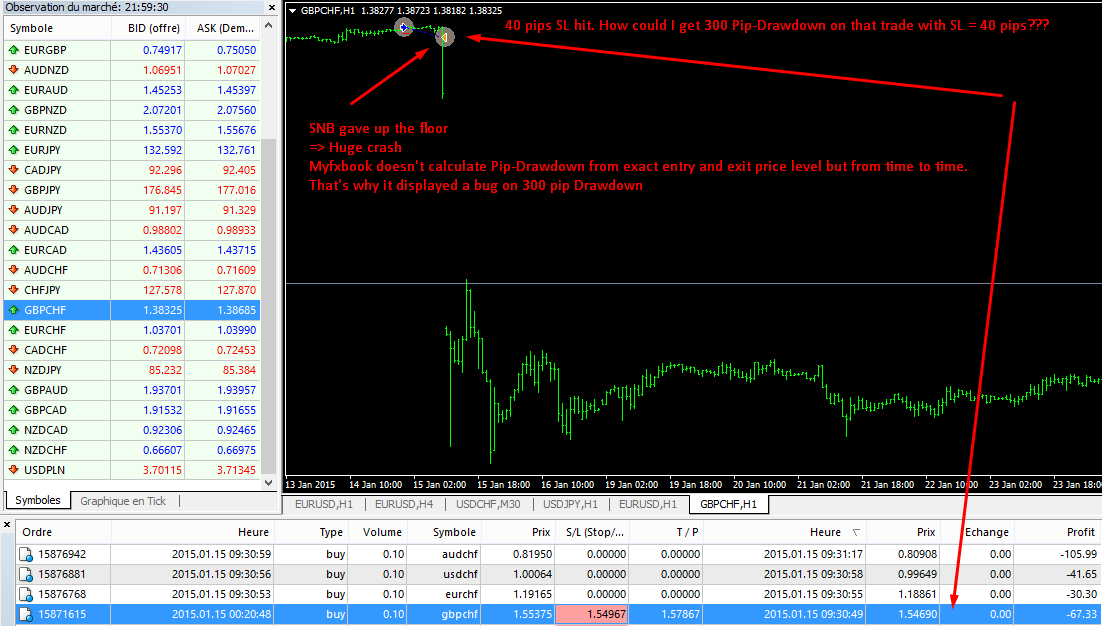

Here is a snapshot of your LIVE ACCOUNT.

The box which is highlighted in red simply shows a lost correct? Yet if the small box to the far right was highlighted it will show the following.

It shows that after entering the position, you were in green as much as 74 pips, and you ended up closing that position for a loss. Yes a loss! You didn't set your trail stop to BE or even a round number like 50 or 60. So that one simple trade says a lot about you as a trader, and what is worse is that you are managing someone else's account.

Plus you mentioned that most traders issues is not letting the profits run. Well you let you profit run, and it turned into a red position.

The link above shows that you allowed a trade to go in red over 300 pips..... What is your excuse for letting it run in red for so many pips? Why didn't you stick to your sl plan? Well you didn't stick to your sl plan because after you entered you were in green as much as only 8 pips, and your bias and simple focus on your tp caused you to hold it and ignore price action. Those actions will cause you to margin call this account sooner then later.

The box which is highlighted in red simply shows a lost correct? Yet if the small box to the far right was highlighted it will show the following.

It shows that after entering the position, you were in green as much as 74 pips, and you ended up closing that position for a loss. Yes a loss! You didn't set your trail stop to BE or even a round number like 50 or 60. So that one simple trade says a lot about you as a trader, and what is worse is that you are managing someone else's account.

Plus you mentioned that most traders issues is not letting the profits run. Well you let you profit run, and it turned into a red position.

The link above shows that you allowed a trade to go in red over 300 pips..... What is your excuse for letting it run in red for so many pips? Why didn't you stick to your sl plan? Well you didn't stick to your sl plan because after you entered you were in green as much as only 8 pips, and your bias and simple focus on your tp caused you to hold it and ignore price action. Those actions will cause you to margin call this account sooner then later.

Biedrs kopš

1601 ieraksti

Feb 01, 2015 at 16:35

Biedrs kopš

1601 ieraksti

Do you really have to show to everyone that you are frustrated by being wrong?

I don't even see why you screen shot my account... this ins't the topic.

But anyway, once more I will have to explain why you are wrong again.

1) GBPCAD

- First thank you for illustrating what I'm saying:

Indeed, this account is running by my EA and so it trades as I coded and it respects what I said "Maximizing profit & cutting the loss"

therefore, I'm not afraid to loose 20 pips if I was targetting 200 pips. (If I decided not to use trail Stop, it's because i don't want to)

- Secondly, you see by this trade that I'm chillaxing.. as Pip-Drawdown is awesome and it reflects most of the trades.

"Plus you mentioned that most traders issues is not letting the profits run. Well you let profit run, and it turned into a red position. "

=> I f I was doing the opposite, I would be worried about my strategy

Conclusion for case 1, yes you are right, you showed what I have said.

2) GBPCHF

You are so silly only looking at Pip-Drawdown displayed by Myfxbook.

You haven't noticed that the trade has 40 pips SL.

Conclusion for case 2, sorry for you to be wrong again.

You are like all the noobs trying to critize what i do here... and like all other you are wrong and you guys get frustrated.

By the way, I have tested enough my 2 demo strategies and so i decided to start to mirror thoses trades into my live account.

I guess soon you will never post back my account.... I can feel your frustration climbing like a bullish trend : )

I don't even see why you screen shot my account... this ins't the topic.

But anyway, once more I will have to explain why you are wrong again.

1) GBPCAD

- First thank you for illustrating what I'm saying:

Indeed, this account is running by my EA and so it trades as I coded and it respects what I said "Maximizing profit & cutting the loss"

therefore, I'm not afraid to loose 20 pips if I was targetting 200 pips. (If I decided not to use trail Stop, it's because i don't want to)

- Secondly, you see by this trade that I'm chillaxing.. as Pip-Drawdown is awesome and it reflects most of the trades.

"Plus you mentioned that most traders issues is not letting the profits run. Well you let profit run, and it turned into a red position. "

=> I f I was doing the opposite, I would be worried about my strategy

Conclusion for case 1, yes you are right, you showed what I have said.

2) GBPCHF

You are so silly only looking at Pip-Drawdown displayed by Myfxbook.

You haven't noticed that the trade has 40 pips SL.

Conclusion for case 2, sorry for you to be wrong again.

You are like all the noobs trying to critize what i do here... and like all other you are wrong and you guys get frustrated.

By the way, I have tested enough my 2 demo strategies and so i decided to start to mirror thoses trades into my live account.

I guess soon you will never post back my account.... I can feel your frustration climbing like a bullish trend : )

Biedrs kopš

8 ieraksti

Feb 01, 2015 at 22:17

Biedrs kopš

8 ieraksti

Hi,

What do you think about this trader?

https://www.myfxbook.com/members/trader000/high-returns-manual-trading/1144503

I asked him a few questions two days ago but haven't received any reply yet.

Looks like he/she can double the account with proper money management (I've noticed stops are set). I'm thinking about putting some small eggs into this type of trading and take out profits after doubling my account. Rinse and repeat. 😎

I'd appreciate any feedback from experienced traders.

trot

What do you think about this trader?

https://www.myfxbook.com/members/trader000/high-returns-manual-trading/1144503

I asked him a few questions two days ago but haven't received any reply yet.

Looks like he/she can double the account with proper money management (I've noticed stops are set). I'm thinking about putting some small eggs into this type of trading and take out profits after doubling my account. Rinse and repeat. 😎

I'd appreciate any feedback from experienced traders.

trot

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 02, 2015 at 07:39

Biedrs kopš

378 ieraksti

CrazyTrader posted:

Do you really have to show to everyone that you are frustrated by being wrong?

I don't even see why you screen shot my account... this ins't the topic.

But anyway, once more I will have to explain why you are wrong again.

1) GBPCAD

- First thank you for illustrating what I'm saying:

Indeed, this account is running by my EA and so it trades as I coded and it respects what I said "Maximizing profit & cutting the loss"

therefore, I'm not afraid to loose 20 pips if I was targetting 200 pips. (If I decided not to use trail Stop, it's because i don't want to)

- Secondly, you see by this trade that I'm chillaxing.. as Pip-Drawdown is awesome and it reflects most of the trades.

"Plus you mentioned that most traders issues is not letting the profits run. Well you let profit run, and it turned into a red position. "

=> I f I was doing the opposite, I would be worried about my strategy

Conclusion for case 1, yes you are right, you showed what I have said.

2) GBPCHF

You are so silly only looking at Pip-Drawdown displayed by Myfxbook.

You haven't noticed that the trade has 40 pips SL.

Conclusion for case 2, sorry for you to be wrong again.

You are like all the noobs trying to critize what i do here... and like all other you are wrong and you guys get frustrated.

By the way, I have tested enough my 2 demo strategies and so i decided to start to mirror thoses trades into my live account.

I guess soon you will never post back my account.... I can feel your frustration climbing like a bullish trend : )

I sorry for having upset you, and if you as if I am a noob it is besides the point. The reality is MOST of your trades have a very high pip-drawdown, and in most of your trades which were in red, you had a pretty good profit, and you didn't even secure your principle by breaking even. Yes, that is the way you coded your "EA", but it is evident that you lack the skills on doing so.

Based on your prior comments about people letting their losses run, and not their profits seems to be something that you are very good at doing. The sad part is you don't even gain much profit, and it is evident based on your clients account being in red over 10%

Oh and for the record, you had a 300 pip drawdown on that trade based on the spread getting wacky due to what happened to SNB. Yet, I can clearly post more trades in which you allowed your profits to run, and for not securing it you ended up with a red position.

Your also no longer trading in a demo account my friend... You are now trading in a live account with real money, and from the looks of it you are doing very very bad. If this week has another side ways range you can bet your bottom dollar that you will margin this account in less then 2 months.

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 02, 2015 at 07:40

Biedrs kopš

378 ieraksti

Traders who love to use demo because they don't have the funds to trade for themself always seem to get some poor noob to look at his demo accounts and assume that he will be able to do the same on live...

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 02, 2015 at 07:51

Biedrs kopš

378 ieraksti

trot posted:

Hi,

What do you think about this trader?

https://www.myfxbook.com/members/trader000/high-returns-manual-trading/1144503

I asked him a few questions two days ago but haven't received any reply yet.

Looks like he/she can double the account with proper money management (I've noticed stops are set). I'm thinking about putting some small eggs into this type of trading and take out profits after doubling my account. Rinse and repeat. 😎

I'd appreciate any feedback from experienced traders.

trot

You are going to follow that person with only 24 trades.

forex_trader_202879

Biedrs kopš

378 ieraksti

Feb 02, 2015 at 07:52

Biedrs kopš

378 ieraksti

Ohhhh And crazytrader..... Myfxbook does calculate pip-drawdown from the time you get in to the time you get out. It has nothing to do with if you make your account update every 5 mins or 3 days.

Biedrs kopš

1288 ieraksti

Feb 02, 2015 at 08:21

(labots Feb 02, 2015 at 08:30)

Biedrs kopš

1288 ieraksti

Cholipop posted:

Ohhhh And crazytrader..... Myfxbook does calculate pip-drawdown from the time you get in to the time you get out. It has nothing to do with if you make your account update every 5 mins or 3 days. So please stop making things up to make yourself look like you know what you are doing.

Take your own advice for once and stop focusing on other people. You should open up your own thread to bash pps in (really, what is your problem? Why are you only focused on attacking people individually, instead of focusing on criticising strategies? Your resorting to name-calling and ignorant insults says much about you as a person).

BTW Cholipop: your example https://www.myfxbook.com/members/CrazyTrader/chance-my-life/1090117 was not good. This thread asks for "real accounts which can show consistent "phenomenal" results over an extended period of time". Please try harder next time (hint: green = positive returns) 😀

@CrazyTrader Nice comparisons with the Equity/Growth charts... you raise a good point in a very illustrative manner.

*Spams netiks pieļauts, un tā rezultātā var slēgt kontu.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.