- ホーム

- コミュニティ

- 経験豊富なトレーダー

- USDCHF

Advertisement

Edit Your Comment

USDCHF

Jul 09, 2017 at 07:24

Dec 31, 2014からメンバー

102 投稿

The USDCHF had a bearish momentum yesterday bottomed at 0.9601 and hit 0.9595 earlier today in Asian session. The bearish pin bar I showed you yesterday gave us a valid bearish signal. The bias is bearish in nearest term testing 0.9550 – 0.9450 key support area which remains a good place to buy with a tight stop loss below 0.9450 as a clear break and daily/weekly close below that area would expose 0.9250 region next week. Fundamental focus today will be on the US NFP number.

Top Forex Robot

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Aug 01, 2017 at 14:39

Dec 31, 2014からメンバー

102 投稿

The USDCHF was indecisive yesterday. The bias is neutral in nearest term. Overall price is still in a bullish phase since bounced-off 0.9450 key support but unable to make a clear break above 0.9700 resistance so far as you can see on my daily chart below. Immediate support is seen around 0.9620. A clear break and daily close below that area could trigger further bearish pressure testing 0.9550 region but key support remains at 0.9450. On the upside, a clear break above 0.9700 would expose 0.9765 – 0.9807 key resistance area which remains a good place to sell.

Top Forex Robot

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 02, 2014からメンバー

905 投稿

Oct 26, 2017 at 06:59

Jul 05, 2017からメンバー

6 投稿

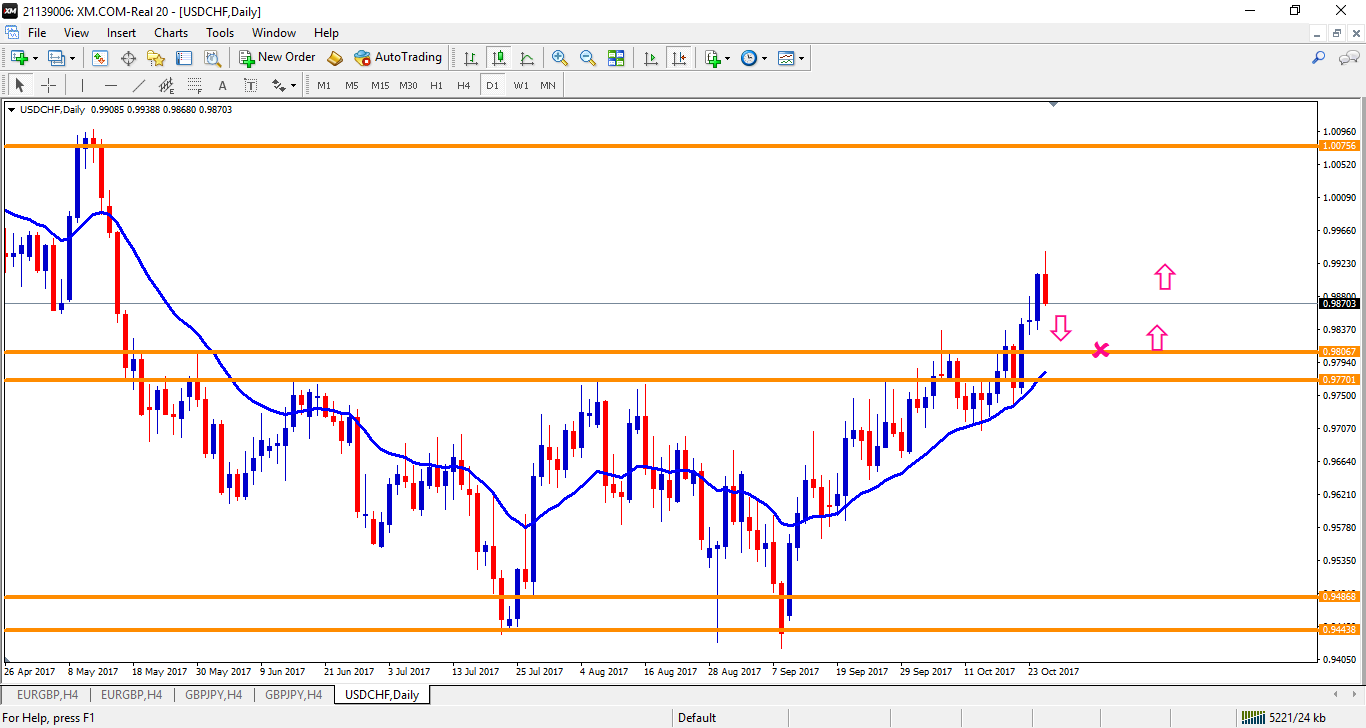

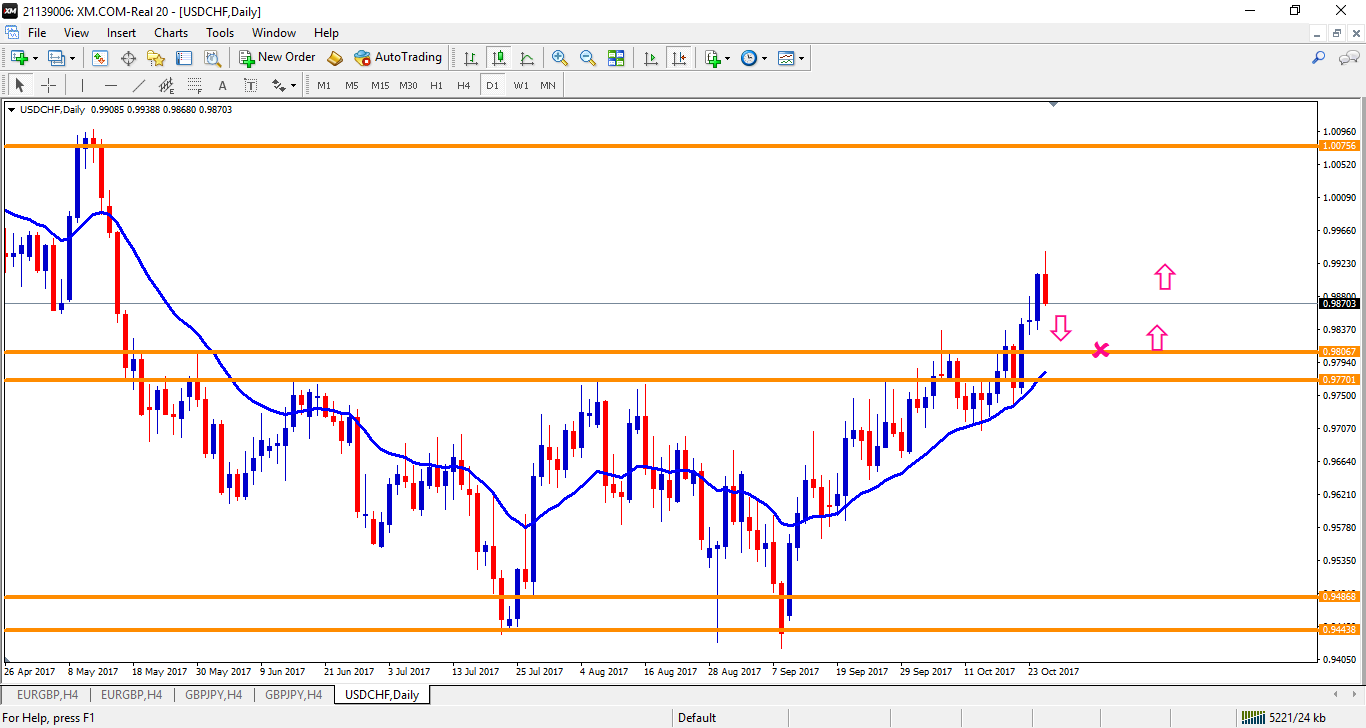

USDCHF Trade Setup

The daily Break the top of a corrective structure ( Range ) was starting from May 2017

The daily is Bullish turn into bullish

So my trade idea will be on the retest of the S/R zone ( the top of CR ) (( 0.98067-0.97701))

will have 2 entries as buy pending order first @ 0.98067 , Second @ 0.97701

SL for both @0.97200

TP for both @1.00700

The daily Break the top of a corrective structure ( Range ) was starting from May 2017

The daily is Bullish turn into bullish

So my trade idea will be on the retest of the S/R zone ( the top of CR ) (( 0.98067-0.97701))

will have 2 entries as buy pending order first @ 0.98067 , Second @ 0.97701

SL for both @0.97200

TP for both @1.00700

asser.badrawy@

Oct 02, 2014からメンバー

905 投稿

*商用利用やスパムは容認されていないので、アカウントが停止される可能性があります。

ヒント:画像/YouTubeのURLを投稿すると自動的に埋め込まれます!

ヒント:この討論に参加しているユーザー名をオートコンプリートするには、@記号を入力します。