- Home

- Community

- Erfahrene Trader

- What is the most effective way to look for a PAMM fund manag...

Advertisement

Edit Your Comment

What is the most effective way to look for a PAMM fund manager?

Mitglied seit Mar 29, 2017

1 Posts

Mitglied seit Jan 05, 2016

1097 Posts

Dec 15, 2019 at 07:54

Mitglied seit Jan 05, 2016

1097 Posts

Two brand new accounts with only 1 post each....

1st post is someone trying to recruit "fund managers" to join their program, and then the second post is someone who just happens to be looking to join.

That's highly questionable at best....

Real "fund managers" don't try recruiting random people on the internet.

There are numerous certifications and licenses that are required to legally operate a financial institution such as a hedge fund or similar investor focused business.

1st post is someone trying to recruit "fund managers" to join their program, and then the second post is someone who just happens to be looking to join.

That's highly questionable at best....

Real "fund managers" don't try recruiting random people on the internet.

There are numerous certifications and licenses that are required to legally operate a financial institution such as a hedge fund or similar investor focused business.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Dec 24, 2019 at 10:58

(bearbeitet Dec 24, 2019 at 10:58)

Mitglied seit Jul 29, 2019

7 Posts

Professional4X posted:

Two brand new accounts with only 1 post each....

1st post is someone trying to recruit "fund managers" to join their program, and then the second post is someone who just happens to be looking to join.

That's highly questionable at best....

Real "fund managers" don't try recruiting random people on the internet.

There are numerous certifications and licenses that are required to legally operate a financial institution such as a hedge fund or similar investor focused business.

PAMM and hedge fund are legally a completely different thing. And they are not fund managers looking to recruit people, they are LOOKING FOR fund managers and YES, they do recruit random people over the internet, its pretty common. All a potential fund manager needs is a trading history.

I am on the market for 10+ years and still learning and still analyzing every trade and still working on improvements.

Mitglied seit Dec 18, 2019

33 Posts

Dec 25, 2019 at 17:39

Mitglied seit Dec 18, 2019

33 Posts

Professional4X posted:

Two brand new accounts with only 1 post each....

1st post is someone trying to recruit "fund managers" to join their program, and then the second post is someone who just happens to be looking to join.

That's highly questionable at best....

Real "fund managers" don't try recruiting random people on the internet.

There are numerous certifications and licenses that are required to legally operate a financial institution such as a hedge fund or similar investor focused business.

YOU SPOKE MY MIND, AND HEDGE FUND MANAGERS DO NOT ADVERTISE

Trender

Mitglied seit Jan 05, 2016

1097 Posts

Dec 26, 2019 at 23:01

Mitglied seit Jan 05, 2016

1097 Posts

247mm posted:Professional4X posted:

Two brand new accounts with only 1 post each....

1st post is someone trying to recruit "fund managers" to join their program, and then the second post is someone who just happens to be looking to join.

That's highly questionable at best....

Real "fund managers" don't try recruiting random people on the internet.

There are numerous certifications and licenses that are required to legally operate a financial institution such as a hedge fund or similar investor focused business.

PAMM and hedge fund are legally a completely different thing. And they are not fund managers looking to recruit people, they are LOOKING FOR fund managers and YES, they do recruit random people over the internet, its pretty common. All a potential fund manager needs is a trading history.

I never said PAMM and hedge funds as being the same thing.

You claim :

All a potential fund manager needs is a trading history

Fund managers need a lot more than just a trading history.

There are NUMEROUS regulations, certifications, licenses, back ground checks, and business registrations that need to be addressed if a person is going to operate as a legal fund manager.

I strongly suggest you consult with an attorney who primarily works in the financial sector.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Dec 28, 2019 at 13:11

Mitglied seit Mar 10, 2019

55 Posts

All a potential fund manager needs is a trading history

I strongly suggest you consult with an attorney who primarily works in the financial sector.

Although, in general, it's absolutely correct - there are a differences between the US and the rest of the world in therms of running financial services. In f.e. Europe, in a particular case of PAMM, a manager does not need to have any licences/certifications etc but MAM manager does need (from not so far ago)... Funny that PAMM are not used in the USA (am I wrong?)... Also, to open a small private (hedge) fond is relatively easy in the USA and very difficult in Europe.

every beautiful garden has a strong hedge around

Dec 28, 2019 at 23:27

Mitglied seit Dec 28, 2019

3 Posts

As yet another 1st time poster with a new account (today) I wanted to add a comment to the conversation.

It seems the guy is not looking for a Fund Manager in the classic sense, but someone who might trade an account and have his trades copied to client accounts at appropriate sizes based on balance, equity, or some other multiple. While this can be construed as fund management there are subtle differences in that a client still has a significant degree of overall control (the account is in his name, only he can withdraw funds, the manager has no access, and the client can immediately terminate the arrangement at any time of his choosing).

Of course, in some jurisdictions that would still be a regulated activity as he would arguably be directing client funds, but trade copying is a grey area in a surprising number of "first-world" jurisdictions and can therefore be done in many places by an individual with no license, no certificates, no registrations.

Basically the guy is asking for people who fit the bill in terms of the trading experience and expertise, what kind of revenue-share deal is on offer, the broker location, the manager location, and the regulatory structure that binds one or both of them.

A fund manager? No way. A PAMM trader? Entirely possible. I know of two people trading with a fully Regulated (including UK FCA) broker with a PAMM/Copying structure, perfectly legally.

I do agree though, it's an odd way to go about hooking up with suitable traders. I would have thought a broker would be monitoring client accounts to identify who the best traders were and approaching them to offer them an opportunity.

It seems the guy is not looking for a Fund Manager in the classic sense, but someone who might trade an account and have his trades copied to client accounts at appropriate sizes based on balance, equity, or some other multiple. While this can be construed as fund management there are subtle differences in that a client still has a significant degree of overall control (the account is in his name, only he can withdraw funds, the manager has no access, and the client can immediately terminate the arrangement at any time of his choosing).

Of course, in some jurisdictions that would still be a regulated activity as he would arguably be directing client funds, but trade copying is a grey area in a surprising number of "first-world" jurisdictions and can therefore be done in many places by an individual with no license, no certificates, no registrations.

Basically the guy is asking for people who fit the bill in terms of the trading experience and expertise, what kind of revenue-share deal is on offer, the broker location, the manager location, and the regulatory structure that binds one or both of them.

A fund manager? No way. A PAMM trader? Entirely possible. I know of two people trading with a fully Regulated (including UK FCA) broker with a PAMM/Copying structure, perfectly legally.

I do agree though, it's an odd way to go about hooking up with suitable traders. I would have thought a broker would be monitoring client accounts to identify who the best traders were and approaching them to offer them an opportunity.

This is trading, not gambling

Mitglied seit Jan 05, 2016

1097 Posts

Dec 29, 2019 at 02:38

Mitglied seit Jan 05, 2016

1097 Posts

Lingsbord posted:

It seems the guy is not looking for a Fund Manager in the classic sense, but someone who might trade an account and have his trades copied to client accounts at appropriate sizes based on balance, equity, or some other multiple.

Read the original post again, because that's NOT what it said.

The original post said:

It's someone who works for a brokerage and they're trying to start a PAMM program and they don't know how to do it.

As such there ARE numerous legal and ethical issues that need to be addressed.

There are registrations, licenses, and various related certifications and regulations that need to be handled by the firms legal department.

Think about this for a moment, do you want to trust a brokerage and it's hired financial managers if they don't understand the basic legal requirements to provide services such as this one? It's absurd to think it's ok to conduct business like that.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Dec 29, 2019 at 10:25

Mitglied seit Mar 10, 2019

55 Posts

Professional4X posted:

There are registrations, licenses, and various related certifications and regulations that need to be handled by the firms legal department.

Think about this for a moment, do you want to trust a brokerage and it's hired financial managers if they don't understand the basic legal requirements to provide services such as this one? It's absurd to think it's ok to conduct business like that.

you looks at PAMMs from a US res point of view... In the rest of the world a PAMM manager doesn't need certificates etc legally :( They and members sign T&Cs and vuala! (A MAM man from the other hand does need certs etc)... Despite of lack of proper legs we have good a PAMM structure f.e. Alpari Global... runs for 20 years or so... I personally prefer cT's Copy service (sadly not available in the US) - also based on simple T&Cs and much more flexible for investors...

every beautiful garden has a strong hedge around

Mitglied seit Jan 05, 2016

1097 Posts

Dec 30, 2019 at 23:25

Mitglied seit Jan 05, 2016

1097 Posts

tacet posted:Professional4X posted:

There are registrations, licenses, and various related certifications and regulations that need to be handled by the firms legal department.

Think about this for a moment, do you want to trust a brokerage and it's hired financial managers if they don't understand the basic legal requirements to provide services such as this one? It's absurd to think it's ok to conduct business like that.

you looks at PAMMs from a US res point of view... In the rest of the world a PAMM manager doesn't need certificates etc legally :( They and members sign T&Cs and vuala! (A MAM man from the other hand does need certs etc)... Despite of lack of proper legs we have good a PAMM structure f.e. Alpari Global... runs for 20 years or so... I personally prefer cT's Copy service (sadly not available in the US) - also based on simple T&Cs and much more flexible for investors...

NO. You're absolutely wrong, and you don't understand my point of view at all.

I'm looking at it from an industry wide point of view not a US residence point of view.

No legitimate Brokerage is going to hire someone to manage their investment portfolios and the investment portfolios of their clients without considerable industry experience and the appropriate financial markets education and legal protections.

Hiring someone with NO EXPERIENCE who clearly states they have no idea what they are doing, is an extremely questionable business practice at best. To allow an individual or group of individuals with an admitted lack of experience to manage the funds of others, and if the brokerage allows the unrestricted access to client funds for trading to their own "fund managers", then I would consider this an extremely unethical and people have gone to prison for a long time for the mismanagement of funds in scenarios like this one.

Regardless of the scenario though, you aren't the original poster, so I don't really see the need for you to defend their illegal and unethical business practices.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Dec 31, 2019 at 11:20

Mitglied seit Mar 10, 2019

55 Posts

Professional4X posted:tacet posted:Professional4X posted:

There are registrations, licenses, and various related certifications and regulations that need to be handled by the firms legal department.

Think about this for a moment, do you want to trust a brokerage and it's hired financial managers if they don't understand the basic legal requirements to provide services such as this one? It's absurd to think it's ok to conduct business like that.

you looks at PAMMs from a US res point of view... In the rest of the world a PAMM manager doesn't need certificates etc legally :( They and members sign T&Cs and vuala! (A MAM man from the other hand does need certs etc)... Despite of lack of proper legs we have good a PAMM structure f.e. Alpari Global... runs for 20 years or so... I personally prefer cT's Copy service (sadly not available in the US) - also based on simple T&Cs and much more flexible for investors...

NO. You're absolutely wrong, and you don't understand my point of view at all.

I'm looking at it from an industry wide point of view not a US residence point of view.

No legitimate Brokerage is going to hire someone to manage their investment portfolios and the investment portfolios of their clients without considerable industry experience and the appropriate financial markets education and legal protections.

Hiring someone with NO EXPERIENCE who clearly states they have no idea what they are doing, is an extremely questionable business practice at best. To allow an individual or group of individuals with an admitted lack of experience to manage the funds of others, and if the brokerage allows the unrestricted access to client funds for trading to their own "fund managers", then I would consider this an extremely unethical and people have gone to prison for a long time for the mismanagement of funds in scenarios like this one.

Regardless of the scenario though, you aren't the original poster, so I don't really see the need for you to defend their illegal and unethical business practices.

... what I've done wrong? - I thought my post was in support of yours - silly me! I was describing the situation with PAMM here (outside of the US).... and cT Copy service - both are not available in your country, thus it was difficult for you to comment on them... NOBODY ARGUES AGAINST A PROPERLY DONE REGULATION.... Happy New Year!

every beautiful garden has a strong hedge around

Dec 31, 2019 at 15:12

Mitglied seit Apr 25, 2019

25 Posts

It seems to me that there are three main characteristics worth assessing for this purpose. First, you should find out what kind of capital he works with personally and look at his statistics, not only with his capital but also with the capital of his clients. Secondly, I would definitely avoid a person who shows incredible profits that do not fit into the generally accepted framework. Still, you have to look at the situation realistically, 1000% per annum is complete nonsense. Thirdly, I would require written or documentary proof of all indicators. Because demo accounts are at my own risk, I also know how to disperse, but it does not make me a great trader.

Jan 01, 2020 at 11:54

Mitglied seit Mar 10, 2019

55 Posts

Dumuro posted:

It seems to me that there are three main characteristics worth assessing for this purpose. First, you should find out what kind of capital he works with personally and look at his statistics, not only with his capital but also with the capital of his clients. Secondly, I would definitely avoid a person who shows incredible profits that do not fit into the generally accepted framework. Still, you have to look at the situation realistically, 1000% per annum is complete nonsense. Thirdly, I would require written or documentary proof of all indicators. Because demo accounts are at my own risk, I also know how to disperse, but it does not make me a great trader.

even that is not enough :) because of this rule in trading: past performance does not guaranty the future one :)

every beautiful garden has a strong hedge around

Jan 09, 2020 at 03:11

Mitglied seit Dec 30, 2019

17 Posts

There are too many scam advertisement on the internet, you should better have a friend who's a professional trader. However, you can ask for your broker for recommending some professional account managers, if your broker provide MAM accounts, there must be lots of account managers.

Mitglied seit Sep 13, 2017

148 Posts

Jan 09, 2020 at 10:41

Mitglied seit Sep 13, 2017

148 Posts

Well established MAM/PAMM brokers already exist. Trying to get these asset managers to join your brokerage will require equal or better trading conditions and an incentive to open an account at your brokerage. For example darwinex backs traders with their capital. If your brokerage can do something like that, then traders will want to join.

Be humble

Jan 21, 2020 at 16:05

Mitglied seit Aug 09, 2019

7 Posts

AllenLi posted:

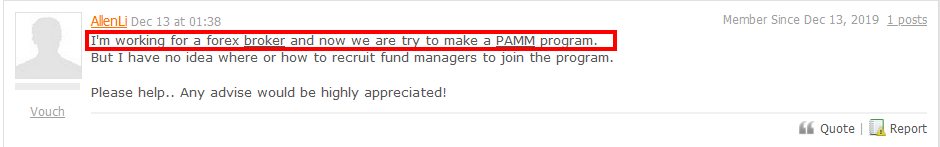

I'm working for a forex broker and now we are try to make a PAMM program.

But I have no idea where or how to recruit fund managers to join the program.

Please help.. Any advise would be highly appreciated!

there are many ways, you can ask for evaluation 1month with loss limit / profit limit and restrict on news trading/hedging/EA and lot size limitations if someone pass (with strict IP rules/ device) the he/she can enter in PAMM....

tucshop8@

Mitglied seit Sep 13, 2017

148 Posts

Mitglied seit Jan 29, 2021

4 Posts

Mar 30, 2021 at 10:43

Mitglied seit Jan 29, 2021

4 Posts

The initial phase in PAMM speculation is to choose a decent fund manager; there are things that should be completely checked prior to choosing one:

Experience

Just like recruiting a worker, you need to ensure that the fund manager has satisfactory involvement with the board field; for this reason, check how long the record is being overseen by the fund manager. The record ought to be 3-4 years old.

Past Trading Record

Try not to take a gander at large numbers and enormous benefits; what you need to check is the drawdown; this will provide you with some insight into the degree of risk included. Overlook fund managers whose trading history shows high drawdown.

Experience

Just like recruiting a worker, you need to ensure that the fund manager has satisfactory involvement with the board field; for this reason, check how long the record is being overseen by the fund manager. The record ought to be 3-4 years old.

Past Trading Record

Try not to take a gander at large numbers and enormous benefits; what you need to check is the drawdown; this will provide you with some insight into the degree of risk included. Overlook fund managers whose trading history shows high drawdown.

Mitglied seit Apr 02, 2021

7 Posts

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.