Edit Your Comment

Bitcoin (BTC) analysis thread

Member Since Jul 20, 2020

385 posts

Member Since Jul 20, 2019

338 posts

Oct 01, 2022 at 14:10

Member Since Jul 20, 2019

338 posts

CraigMcG2020 posted:marco_mmbiz posted:marco_mmbiz posted:

I don't expect anything before August... 😄

Oh, well... 😀

It looks ripe to clear the liquidity resting below them lows before a move up. Hopefully its just a wick swipe and then bullish from there

With 17-22k we might be in the best buying zone right now. Like we did before with 27-32k.

patience is the key

Member Since Jul 20, 2020

385 posts

Oct 17, 2022 at 15:50

Member Since Jul 20, 2020

385 posts

marco_mmbiz posted:CraigMcG2020 posted:marco_mmbiz posted:marco_mmbiz posted:

I don't expect anything before August... 😄

Oh, well... 😀

It looks ripe to clear the liquidity resting below them lows before a move up. Hopefully its just a wick swipe and then bullish from there

With 17-22k we might be in the best buying zone right now. Like we did before with 27-32k.

I think so, its at the previous ATH which seems to be a psychological support, Range bound for months now

Member Since Jan 13, 2021

50 posts

Oct 23, 2022 at 19:35

Member Since Jan 13, 2021

50 posts

CraigMcG2020 posted:marco_mmbiz posted:CraigMcG2020 posted:marco_mmbiz posted:marco_mmbiz posted:

I don't expect anything before August... 😄

Oh, well... 😀

It looks ripe to clear the liquidity resting below them lows before a move up. Hopefully its just a wick swipe and then bullish from there

With 17-22k we might be in the best buying zone right now. Like we did before with 27-32k.

I think so, its at the previous ATH which seems to be a psychological support, Range bound for months now

Yeah interesting it’s stopped around its previous ath. If it sets a new ath I wonder if it will then drop to the 60k or wherever it got to

Member Since Apr 09, 2019

516 posts

Member Since Jul 20, 2020

385 posts

Nov 07, 2022 at 18:23

Member Since Jul 20, 2020

385 posts

momo3HC posted:sebking1986 posted:

Interest move the last couple of days counter to the dollar dying. Let's see if it pushes on or comes back into the range.

FED will help it take the decision next week I think. 😉

Looks like FED are signally a soft pivot after the latest hike. You think this could be good for BTC?

Member Since Jul 20, 2020

385 posts

Member Since Apr 09, 2019

516 posts

Nov 25, 2022 at 12:35

Member Since Apr 09, 2019

516 posts

No higher time frame breaks of structure so it baffles me why people keep looking up rather than down. Add to that the macro economic state of the world right now. I said months ago that in its life, BTC hasn't had to deal with recession. This won't be a short bear market.

If you can't spot the liquidity then you are the liquidity.

Member Since Jul 20, 2019

338 posts

Dec 26, 2022 at 15:03

Member Since Jul 20, 2019

338 posts

marco_mmbiz posted:marco_mmbiz posted:

I don't expect anything before August... 😄

Oh, well... 😀

It looks like my 16700-support-area was correct. Strong support/resistance between 16k and 18k these days.

Merry Christmas and Happy New Year!

patience is the key

Member Since Dec 08, 2022

13 posts

Jan 05, 2023 at 12:17

Member Since Jan 03, 2023

2 posts

There are so many people predicting that 2023 will be the year of Bitcoin and we will see a rally. I am not into such predictions but I do believe that we might see a major recovery this year. Let’s see what the year has in store for crypto enthusiasts.

Member Since Aug 26, 2022

3 posts

Member Since Dec 08, 2022

13 posts

Jan 20, 2023 at 05:51

Member Since Dec 08, 2022

13 posts

Which crypto's you own?

Blast will definetly depend on the kind of crypto you are investing in so majority of the crypto are expected to do blast and some of are not. Moreover the new events like genesis going to bankruptcy is also gonna affect the crypto market.

Blast will definetly depend on the kind of crypto you are investing in so majority of the crypto are expected to do blast and some of are not. Moreover the new events like genesis going to bankruptcy is also gonna affect the crypto market.

Member Since Dec 08, 2022

13 posts

Jan 25, 2023 at 12:30

Member Since Dec 08, 2022

13 posts

Felhagamand posted:

Honestly I do not believe that the BTC will be somewhere around that levels anyway. How we can go further with that matter totally and completely? I wish I was able to invest in BTC when it was worth peanuts and will sit now and discuss what to do with it honestly.

Thats a good thought but came late

Member Since Dec 08, 2022

13 posts

Jan 25, 2023 at 12:31

Member Since Dec 08, 2022

13 posts

momo3HC posted:

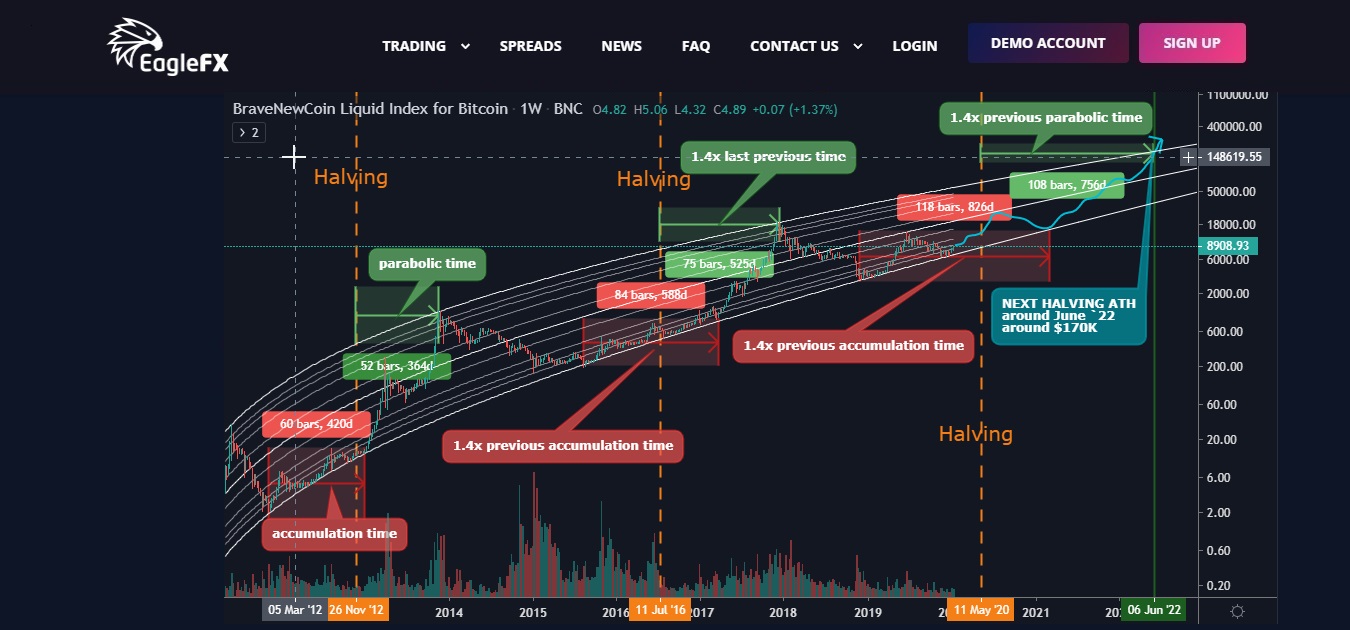

Hi all and Happy New Year. Wishing you an awesome and profitable one to be. As first BTC analysis for the year it will be more really long term so let`s get to the point.

It was a good price movement lately and I really believe that the $6.4K level was the bottom.

Everything which i`ll say from here is situated on historical PA and a bit of math. From now i`m expecting the 2nd small parabolic move which must take place till the next summer may be, followed by descending before the 3rd big parabolic move which must take us to the next halving cycle ATH. That`s the first PA, which I can call it “1,2,3 steps”, move made by BTC in previous halving cycles. The second one is the bigger accumulation/parabolic periods in BTC`s PA history. Every time they`re getting 1.4 times longer than previous one.

So judging by this two PA I can assume that the next BTC All Time High will be… in June 2022 and the price will be somewhere around… $170K. That`s insane!!!

I just want to say 3 more things:

1. This is just a prognosis. It`s 50:50. It can become real or no but at this point that`s how i`m seeing the BTC PA future and that`s only my (or may be not only my) opinion.

2. I`m not talking about May`s halving and the price then cuz it`s coming very soon and i`m a really long term HODLer.

3. Starting from the previous two points that`s a really long term analysis. I`ll be more specific in short or mid-term period into next week analysis.

Genesis Seeks $20.9M From ‘Bitcoin Jesus’ Over Crypto Options Trades That Weren’t Settled

Member Since Jan 31, 2023

13 posts

Feb 02, 2023 at 08:36

Member Since Jan 31, 2023

13 posts

The price of Bitcoin is not predictable with certainty. The price of Bitcoin and other cryptocurrencies is influenced by a multitude of factors including supply and demand, economic and political factors, investor sentiment, and technological developments, among others. These factors can be difficult to predict and can change rapidly, making the future price of Bitcoin uncertain.

dom perignon

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.