Edit Your Comment

Can forex trading make you rich ?

Biedrs kopš

20 ieraksti

Jan 03, 2018 at 08:12

Biedrs kopš

20 ieraksti

benjamin6109 posted:BluePanther posted:

I'm sorry... what? Give your account some time... maybe you have found it! wink

Don't be so discouraged. Profit is easier than you think.

What percentage do you risk per trade?

Excuse me for my bad english.

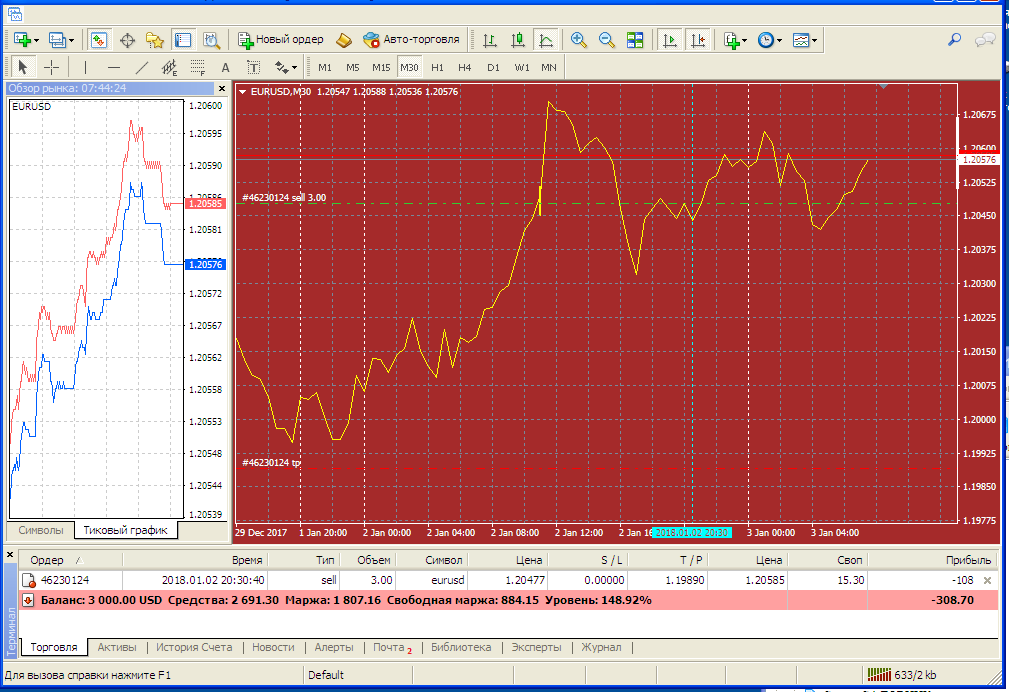

I'm ready to risk about 50%. " My forecast is perfectly visible in the screenshot.

Do you agree with my opinion? Do you think that I take a lot of risk?

Biedrs kopš

2 ieraksti

Jan 03, 2018 at 13:21

Biedrs kopš

2 ieraksti

Hi

I would advise you never to expose more than 10% of balance for margin (this is how you can determine the trading volumes) and 5% of the balance for risk, with a risk-reward ratio of at least 1:1.5. A set of rules should be a basic condition for you as a trader. After this look at the chart, draw some trend channels, some levels, resistance and support trend lines, use an indicator to look for divergences, etc. If all conditions are met, then and only then take the trade; otherwise don't. The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;)

I would advise you never to expose more than 10% of balance for margin (this is how you can determine the trading volumes) and 5% of the balance for risk, with a risk-reward ratio of at least 1:1.5. A set of rules should be a basic condition for you as a trader. After this look at the chart, draw some trend channels, some levels, resistance and support trend lines, use an indicator to look for divergences, etc. If all conditions are met, then and only then take the trade; otherwise don't. The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;)

Biedrs kopš

1288 ieraksti

Jan 03, 2018 at 13:25

Biedrs kopš

1288 ieraksti

Ciprian_Moraru posted:

Hi

I would advise you never to expose more than 10% of balance for margin (this is how you can determine the trading volumes) and 5% of the balance for risk, with a risk-reward ratio of at least 1:1.5. A set of rules should be a basic condition for you as a trader. After this look at the chart, draw some trend channels, some levels, resistance and support trend lines, use an indicator to look for divergences, etc. If all conditions are met, then and only then take the trade; otherwise don't. The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;)

Market may be here next decade, but many folks want to be rich tomorrow. 😉

Biedrs kopš

2 ieraksti

Jan 04, 2018 at 07:27

Biedrs kopš

2 ieraksti

Higat posted:benjamin6109 posted:BluePanther posted:

I'm sorry... what? Give your account some time... maybe you have found it! wink

Don't be so discouraged. Profit is easier than you think.

What percentage do you risk per trade?

Excuse me for my bad english.

I'm ready to risk about 50%. " My forecast is perfectly visible in the screenshot.

Do you agree with my opinion? Do you think that I take a lot of risk?

So you lose two trades in a row and you're out of the game?

Cant judge your strategy because i don't know it at all, but your risk/money management seems just crazy

Biedrs kopš

30 ieraksti

Jan 04, 2018 at 07:31

Biedrs kopš

30 ieraksti

I recently withdrew 89k usd over the last two months but only because of one small change to my tradi ng. What was the change? Simply me telling myself " Stick to your system". Clearly if I do that then I am one of the best scalpers on the net but sef defeating actions will hurt you eventually. Clearly one has to have a good system but taking trades against your system will stunt your g rowth as a trader especially with being able to make modifications to your system to avoid future loses.

Biedrs kopš

11 ieraksti

Jan 04, 2018 at 07:35

Biedrs kopš

11 ieraksti

FX can make you rich tomorrow but you'd need to take on HUGE risk. Which is more like gambling

Biedrs kopš

57 ieraksti

Jan 04, 2018 at 07:51

Biedrs kopš

57 ieraksti

Can forex trading make you rich ?

When you see how many peapole loose in Forex you can easy understand that few peapole are very rich with forex , but they are not on MT4 who is a real scam build

Forex it's not a game

If you want to be rich stop to play and trade for real on real platform, with real broker ( for real platform you need to pay it, like trade station) the rest is gambling for brokers market makers be rich

Good luck

When you see how many peapole loose in Forex you can easy understand that few peapole are very rich with forex , but they are not on MT4 who is a real scam build

Forex it's not a game

If you want to be rich stop to play and trade for real on real platform, with real broker ( for real platform you need to pay it, like trade station) the rest is gambling for brokers market makers be rich

Good luck

Biedrs kopš

20 ieraksti

Jan 04, 2018 at 08:02

Biedrs kopš

20 ieraksti

Ciprian_Moraru posted:

Hi

I would advise you never to expose more than 10% of balance for margin (this is how you can determine the trading volumes) and 5% of the balance for risk, with a risk-reward ratio of at least 1:1.5. A set of rules should be a basic condition for you as a trader. After this look at the chart, draw some trend channels, some levels, resistance and support trend lines, use an indicator to look for divergences, etc. If all conditions are met, then and only then take the trade; otherwise don't. The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;)

I apologize for my English.

Hello!"The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;) "

Your statement is absolutely true. There is no reason to argue about this!

But there is another part of the problem. It is clearly stated in the direction of the discussion.

Can forex trading make you rich?

And it seems to me that it is desirable to get rich not in the next decade, but in the near future.

Who will argue with me about this !?

Biedrs kopš

20 ieraksti

Jan 04, 2018 at 08:02

Biedrs kopš

20 ieraksti

BluePanther posted:Ciprian_Moraru posted:

Hi

I would advise you never to expose more than 10% of balance for margin (this is how you can determine the trading volumes) and 5% of the balance for risk, with a risk-reward ratio of at least 1:1.5. A set of rules should be a basic condition for you as a trader. After this look at the chart, draw some trend channels, some levels, resistance and support trend lines, use an indicator to look for divergences, etc. If all conditions are met, then and only then take the trade; otherwise don't. The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;)

Market may be here next decade, but many folks want to be rich tomorrow. 😉

I think the same way.

Biedrs kopš

20 ieraksti

Jan 04, 2018 at 08:09

Biedrs kopš

20 ieraksti

Ciprian_Moraru posted:

Hi

I would advise you never to expose more than 10% of balance for margin (this is how you can determine the trading volumes) and 5% of the balance for risk, with a risk-reward ratio of at least 1:1.5. A set of rules should be a basic condition for you as a trader. After this look at the chart, draw some trend channels, some levels, resistance and support trend lines, use an indicator to look for divergences, etc. If all conditions are met, then and only then take the trade; otherwise don't. The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;)

I apologize for my English.

Hello!"The market will be here tomorrow too, and the day after, also next week, next year, next decade and so on. ;) "

Your statement is absolutely true. There is no reason to argue about this!

But there is another part of the problem. It is clearly stated in the direction of the discussion.

Can forex trading make you rich?

And it seems to me that it is desirable to get rich not in the next decade, but in the near future.

Who will argue with me about this !?

Biedrs kopš

4573 ieraksti

Jan 04, 2018 at 08:15

Biedrs kopš

4573 ieraksti

I am pretty sure noone posting images here became rich on Forex :)

Biedrs kopš

6 ieraksti

Jan 07, 2018 at 07:08

Biedrs kopš

6 ieraksti

If you still want to try your luck in the Forex market, it would be prudent to use a couple of premises that you should take into account when making Forex Trading: Limit leverage, keep curbing tight losses Use a reputable currency broker. Have a good broker and that is well regularized and capitalized. Although the odds are still against you, at least, these measures can help level the playing field to a certain extent.

Transactions made through the Forex market can make you rich if you are a hedge fund with a lot of money or a professional operator with some experience and support through a financial company.

Transactions made through the Forex market can make you rich if you are a hedge fund with a lot of money or a professional operator with some experience and support through a financial company.

Biedrs kopš

20 ieraksti

Jan 07, 2018 at 07:12

Biedrs kopš

20 ieraksti

I apologize for my English. I use machine translation.

You want me to trade even more aggressively !? Then there is a risk of losing ...😄

My forecast is published. Will there be a profit or loss? It is necessary to wait a little ...

togr posted:

I am pretty sure noone posting images here became rich on Forex :)

You want me to trade even more aggressively !? Then there is a risk of losing ...😄

My forecast is published. Will there be a profit or loss? It is necessary to wait a little ...

Biedrs kopš

19 ieraksti

Jan 07, 2018 at 08:09

Biedrs kopš

19 ieraksti

Currency trading can be a bit difficult for new traders to understand, but in reality, the operation itself is very simple. Unlike traditional trading in the stock market where you buy a position within a company through shares, currency trading is based on the difference between two international currency values and you earn profits by being on the right side of their valuation movements. In essence, a bet is being made on a set of currency pairs, trusting that the chosen one will be the one with the highest value.

Biedrs kopš

20 ieraksti

Jan 07, 2018 at 08:19

Biedrs kopš

20 ieraksti

TrumpsForexHack posted:

I recently withdrew 89k usd over the last two months but only because of one small change to my tradi ng. What was the change? Simply me telling myself " Stick to your system". Clearly if I do that then I am one of the best scalpers on the net but sef defeating actions will hurt you eventually. Clearly one has to have a good system but taking trades against your system will stunt your g rowth as a trader especially with being able to make modifications to your system to avoid future loses.

Hello! I use the machine translation of your message. In consequence of this, not everything was correctly understood.

1) Congratulations on a good win!

2) I'm not a trader. I forecast forex.

3) I believe that my published forecast has the chances of exact execution. Let's wait patiently?

Biedrs kopš

20 ieraksti

Jan 07, 2018 at 08:19

Biedrs kopš

20 ieraksti

Gentlemen!

I read all your messages. Thank you for your attention.

I will not be able to respond quickly to everyone. My prediction, which aroused the interest of the community, has not yet been fulfilled. Let's wait a little. Let the clarity come.

I read all your messages. Thank you for your attention.

I will not be able to respond quickly to everyone. My prediction, which aroused the interest of the community, has not yet been fulfilled. Let's wait a little. Let the clarity come.

Biedrs kopš

6 ieraksti

Jan 07, 2018 at 08:27

Biedrs kopš

6 ieraksti

In recent years commodities, currencies, and indices. My most used instrument are derivatives as well as Forex for its agility and leverage.

All markets offer us great routes, if we stop to see the currencies and commodities are incredible. Silver, copper and oil in these two years have been my favorites.

All markets offer us great routes, if we stop to see the currencies and commodities are incredible. Silver, copper and oil in these two years have been my favorites.

Biedrs kopš

1288 ieraksti

Jan 07, 2018 at 12:57

Biedrs kopš

1288 ieraksti

"Welcome to 2018."

Welcome back and Happy New Year!

So how are you going to approach 2018? What are you going to do differently? What are you going to look to improve? How are you going to behave as a trader and what are the specific trades you are looking for? These are important questions to answer and it’s not a complicated process.

What are you going to do differently? Let’s get realistic, if 2017 wasn’t a profitably year you have two options: Continue to do what you did last year and get a similar if not worse result. Or make a commitment to a new approach and turn things around. But what is it that you need to do differently? A common mistake that novice traders often make is thinking that more trades equals more money and therefore they feel it’s imperative they take a trade every day. In some cases, multiple trades every day. They trade like a duck hunter standing in the weeds shooting at anything that flies up out of the duck pond. If you want to improve your trading in 2018 then start to act like a sniper. Snipers have a clear strategic target they want to hit and they are prepared to wait for it, often days until it shows up. Snipers rarely miss, duck hunters are constantly missing and are using a shot gun pellet approach hoping that part of their cartridge hits the target. If you are going to do something different this year then keep it simple and remember the duck hunter vs sniper approach. My money is on the sniper winning every time.

What are you going to improve? To give yourself the best opportunity to make profits in 2018 it doesn’t mean having to improve in multiple areas. One aspect of your trading that can have the biggest impact on your trading is your improved risk management skills. I’m not talking about improving your strike rate of winning trades, I’m talking about simply making more money on your winning trades than your losing trades. It sounds so simple but make more on your winning trades than your losing trades and you don’t even need to be 50% successful over 100 trades and you’ll make meaningful money. Commit to staying with every trade to the profit target and for goodness sake: ensure your average winning trade is simply bigger than your average losing trade. It’s not difficult to do, it’s simply about controlling your inner demons and emotions and focusing on what is going to give you the best result. Only ever take profit if the trade exceeds what you were risking.

How are you going to behave? Yes, your behaviour. It’s going to have the single biggest impact on your trading in 2018. Your results won’t come down to what trade set ups you take because over the 19 years I’ve been trading, personal trading behaviour is what defines traders, not the trade set up technically or fundamentally. Are you prepared to be disciplined? Really disciplined? If you treat trading like a hobby then you are destined to lose. Treat your trading behaviour seriously because it’s going to define you as a trader in 2018 and it will have the single biggest impact on your final result.

What specific trades are you going to look for? Let me ask you a question that will help answer the question I just asked: Do you know anyone that became rich and successful trying to run multiple businesses, juggling them all at the one time? Sure, you might know of a few who have diversified into other businesses once they reached a certain level of success, but I bet every single one of the people you know that are rich financially and live a rich life was at some point a specialist in one field to begin with, then they diversified into other things later. Any by the way, when they did [diversify] most of the time they would be happy to admit they would have been better continuing to focus on what they are good at. Trade a strategy that makes sense to you. Trade a strategy that fits your lifestyle. Trade to live, not live to trade. I advise spending your time focusing on one or two strategies in 2018. Stick to them, learn how to maximise bigger profits out of those strategies. Become a master of one or two strategies and don’t be sucked into the duck hunter approach. Just keep it really simple. Trading is not a complicate process, in fact it’s very simple, not easy but simple. It’s a numbers game that simply requires you to choose up or down. The key to making meaningful profits is keeping it simple and using a technique you believe in, that you understand, and ensure that on average, over time you make more on each trade than you lose. You decide what trades you want to take in 2018, but don’t keep switching between strategies at the first sign of failure. You must maintain a consistent approach, and if you focus on one thing focus on your risk to reward.

Here’s to a great 2018.

Andrew Barnett

LTG GoldRock

Biedrs kopš

20 ieraksti

Jan 08, 2018 at 15:00

Biedrs kopš

20 ieraksti

I apologize for my English. I use machine translation.

Dear gentlemen!

My calculated forecast was fulfilled. I want to remind you that my calculated forecast was published a few days earlier. (Higat Jan 03 at 14:12) You can see it if you want. In my game on forex, there is no trickery. You can easily know the date of publication of the forecast and the date of its execution. You can be sure that the profit of more than 50% of the balance was reached within a few days. The accuracy of the forecast is sufficient to not apply insurance.

Do you agree that my forecasting system gives me hope to get rich from forex?

I'm ready to listen to your criticism. It will be better if you look for my partnership

Dear gentlemen!

My calculated forecast was fulfilled. I want to remind you that my calculated forecast was published a few days earlier. (Higat Jan 03 at 14:12) You can see it if you want. In my game on forex, there is no trickery. You can easily know the date of publication of the forecast and the date of its execution. You can be sure that the profit of more than 50% of the balance was reached within a few days. The accuracy of the forecast is sufficient to not apply insurance.

Do you agree that my forecasting system gives me hope to get rich from forex?

I'm ready to listen to your criticism. It will be better if you look for my partnership

Biedrs kopš

4573 ieraksti

Jan 08, 2018 at 15:07

Biedrs kopš

4573 ieraksti

Higat posted:

I apologize for my English. I use machine translation.

Dear gentlemen!

My calculated forecast was fulfilled. I want to remind you that my calculated forecast was published a few days earlier. (Higat Jan 03 at 14:12) You can see it if you want. In my game on forex, there is no trickery. You can easily know the date of publication of the forecast and the date of its execution. You can be sure that the profit of more than 50% of the balance was reached within a few days. The accuracy of the forecast is sufficient to not apply insurance.

Do you agree that my forecasting system gives me hope to get rich from forex?

I'm ready to listen to your criticism. It will be better if you look for my partnership

It is very easy.

This site does allow very advanced trade analyses.

Open and account and publish your results here so everybody can see,

It is stupid to publish images on such site, where you can share complex trades info and results.

*Spams netiks pieļauts, un tā rezultātā var slēgt kontu.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.