Advertisement

Consumer Confidence Rebounds Sharply, Weighs on Gold in the Short Term but Mid

On Tuesday, the U.S. Conference Board reported a significant rebound in May's Consumer Confidence Index, jumping from a previous reading of 85.7 to 98—well above market expectations and ending a five-month downtrend. The data indicates improved consumer sentiment regarding the economic and employment outlook, offering short-term support for the U.S. dollar.

Meanwhile, key global economies have shown signs of easing trade tensions. The U.S. has reached temporary tariff agreements with both China and the EU, alleviating fears of an escalating trade war and suppressing market demand for safe-haven assets. In addition, Japan's government took emergency action in the bond market to stabilize yield volatility, further boosting risk appetite across financial markets.

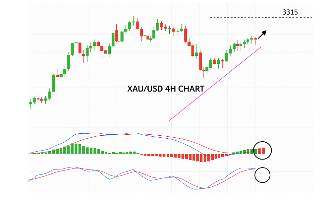

Under these combined pressures, gold prices have pulled back, currently finding short-term support between the $3,290 and $3,300 levels. However, despite near-term headwinds, several factors could lend support to gold over the medium term—such as lingering uncertainty over the final outcome of U.S. tariff policies, ongoing economic challenges, inflation concerns, and the unresolved U.S. debt ceiling issue. These risks may underpin gold’s long-term appeal as a hedge.

Trading Outlook: For risk-tolerant investors, a short-term long position around $3,300 may be considered, with a take-profit target of $3,315 and a stop-loss at $3,285. Conservative investors are advised to remain on the sidelines for now and await clearer market signals.

This analysis is provided by a financial analyst at "Tradia Capital" and is intended for reference only. Investors should make decisions based on their individual risk tolerance. Markets are risky—proceed with caution.