Edit Your Comment

Emotional Trading

Mar 28, 2011 at 16:49

Member Since Mar 21, 2011

3 posts

I just wrecked my portfolio tonight and lost the spirit of trading currencies. Any tips on how to recover from this very expensive learning experience? I'm humbled by what the market did to me and I think I overtraded. I was trading the EUR/USD, going long and short multiple times and I think I was trading a trend I could not even read.

Member Since Jan 14, 2010

541 posts

Mar 28, 2011 at 16:57

(edited Mar 28, 2011 at 16:57)

Member Since Jan 14, 2010

541 posts

hkheredia posted:

I just wrecked my portfolio tonight and lost the spirit of trading currencies. Any tips on how to recover from this very expensive learning experience? I'm humbled by what the market did to me and I think I overtraded. I was trading the EUR/USD, going long and short multiple times and I think I was trading a trend I could not even read.

Sorry to hear about it.

First of all, take a deep breath.

Secondly, try to figure out how did you end up in that situation and how to prevent it from happening again.

Major points to consider:

- Do you have a trading plan with exact entry and exit rules?

- Have you followed your trading plan accordingly?

- Are you using correct money management rules and not risking too much per each trade?

On top of that, how long did you demo trade before trading a real account? Has your trading appeared to be profitable with demo?

Mar 28, 2011 at 17:00

Member Since Mar 21, 2011

3 posts

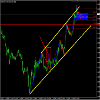

I'm a technical trader that uses major trend lines and triangles for a setup with RSI, MACD, and the tick volume to confirm. I honestly have been following my strategy for the first 3 trades I had this day and when a majour trend I thought emerged at my charts I tried to trade it. Worse, I averaged down and bailed out when it broke the trend line. Then all hell broke loose when I pulled the trigger like a cowboy.

Member Since Jan 14, 2010

541 posts

Mar 28, 2011 at 17:04

Member Since Jan 14, 2010

541 posts

hkheredia posted:

I'm a technical trader that uses major trend lines and triangles for a setup with RSI, MACD, and the tick volume to confirm. I honestly have been following my strategy for the first 3 trades I had this day and when a majour trend I thought emerged at my charts I tried to trade it. Worse, I averaged down and bailed out when it broke the trend line. Then all hell broke loose when I pulled the trigger like a cowboy.

What was the reason for "pulling the trigger like a cowboy"? Were you frustrated with your trading result? Were you in need to get back the market?

That is an excellent example of how psychology plays a big role on non-automated systems with inexperienced traders. I've been in the same situation myself, and honestly, the best thing to do is learn from it and move forward with your trading.

Mar 28, 2011 at 17:08

Member Since Mar 21, 2011

3 posts

Is it still possible to slowly recuperate my account to previous levels despite losing half of it's value without injecting more funds? Forex should only involve risk capital and I don't want to risk anything more as of the moment.

I think "pulling the trigger like a cowboy" was a result of my desperation to recuperate losses. I did relearn my lesson that this is a business with systems in place not a gambling spree in vegas.

I think "pulling the trigger like a cowboy" was a result of my desperation to recuperate losses. I did relearn my lesson that this is a business with systems in place not a gambling spree in vegas.

Member Since Jan 14, 2010

541 posts

Mar 28, 2011 at 17:15

(edited Mar 28, 2011 at 17:16)

Member Since Jan 14, 2010

541 posts

hkheredia posted:

Is it still possible to slowly recuperate my account to previous levels despite losing half of it's value without injecting more funds? Forex should only involve risk capital and I don't want to risk anything more as of the moment.

I think "pulling the trigger like a cowboy" was a result of my desperation to recuperate losses. I did relearn my lesson that this is a business with systems in place not a gambling spree in vegas.

First step is recognizing your error - since you're already aware of it, that's great progress.

I don't want to make you feel any worse, but it would be hard to get back to the starting point. In order to make back the 50% back, you would have to make 100% with your current capital. However, that is certainly possible and will take a lot of patience and a good trading system.

First rule of trading is "do not risk what you cannot afford to lose". Since you do not wish to lose anymore funds, I do not suggest adding anymore in, not at least until you're trading successfully and have a working trading system to reason the addition of funds.

Member Since Jan 14, 2010

541 posts

Mar 29, 2011 at 07:34

Member Since Jan 14, 2010

541 posts

bwizard posted:

never add to a losing position why add insult to injury run tight stops if your frustrated by a loss stop trading until you figure out your problem

I don't think tight stop losses would be of any use, if the system isn't profitable. I think you should focus on trading the system on a demo to determine the if it's worth trading, and what risk should you take with each position, in order to stay in your comfort zone.

Mar 29, 2011 at 14:12

Member Since Feb 15, 2010

51 posts

tight stops are totally useful your either wrong or right i prefer to give it 30p to find out. if im right the tight stop is not a problem if im wrong at that current time the tight stop saves my acct. you may hit more stops lose more times but as recent example i hit two stops shorting gu last week cost me 60 pips total on the third time i got short at 1.6380 and still holding at the time of this writing im up 410 pips i was right however early. now the 60p i spent was well worth the 410p profit im currently sitting on.

You will never go broke by taking profits

Member Since Jan 14, 2010

541 posts

Mar 30, 2011 at 16:01

Member Since Jan 14, 2010

541 posts

bwizard posted:

tight stops are totally useful your either wrong or right i prefer to give it 30p to find out. if im right the tight stop is not a problem if im wrong at that current time the tight stop saves my acct. you may hit more stops lose more times but as recent example i hit two stops shorting gu last week cost me 60 pips total on the third time i got short at 1.6380 and still holding at the time of this writing im up 410 pips i was right however early. now the 60p i spent was well worth the 410p profit im currently sitting on.

Well, id does slow things down if you're going down hill, however it won't turn a losing trading system into a winning one.

All I'm saying that you first need a good working trading system, with proper money management scheme.

Apr 06, 2011 at 05:43

Member Since Jan 27, 2011

98 posts

my 2 cents:

- don't trust 100% on the trend. something happened on the other side of the globe might affecting the trend. and we don't even have any clue on that

- find an EA or trading style that is robust, reliable.

I've busted my account before. I took two weeks rest, get good sleeps that I've missed before. On weekend, I gather the data:

- pips (which pairs are volatile or passive, active)

- which pair give more profits, which pair floats too long, which pair profit/pips is good. Which pair profit/lot size is good...

then modify the strategy. remove unwanted pairs. change T/P setting etc... then start to trade again. I believe I can make money from FOREX, I'll regret if I stop now...

I normally had frequent discussion with my trader buddies. discuss and discuss. exchange strategies how we play the games, share data... I gain so much from this discussion.. discussion via forum is good, and face to face is even better...

good luck with your future trading...

- don't trust 100% on the trend. something happened on the other side of the globe might affecting the trend. and we don't even have any clue on that

- find an EA or trading style that is robust, reliable.

I've busted my account before. I took two weeks rest, get good sleeps that I've missed before. On weekend, I gather the data:

- pips (which pairs are volatile or passive, active)

- which pair give more profits, which pair floats too long, which pair profit/pips is good. Which pair profit/lot size is good...

then modify the strategy. remove unwanted pairs. change T/P setting etc... then start to trade again. I believe I can make money from FOREX, I'll regret if I stop now...

I normally had frequent discussion with my trader buddies. discuss and discuss. exchange strategies how we play the games, share data... I gain so much from this discussion.. discussion via forum is good, and face to face is even better...

good luck with your future trading...

Hantam la labuuu. Harap rezeki kat FX nih...

Member Since Mar 09, 2011

4 posts

Apr 06, 2011 at 20:55

Member Since Mar 09, 2011

4 posts

We all have been there, trust me. Some say that 95% of all who try forex lose 100% of thier money. I believe that.

I have a therory about the stages each forex trader goes through. I would venture to say nearly everyone with any experience in forex would agree with me.

I call this "The Seven Stages of Tradeing Forex"

You begin by being conservative.

You start out being very carefull with your trades, keeping lots small and stops tight.

Which leads to success.

Your plan is working, and your account is seeing gains.

Which leads to overconfidence.

The plan works every time. look at the gains you are making. You must be a genius. You have found the holy grail..

Which leads to Greed.

If you can make this much with one lot, then why not trade 2 lots, right?

Of course what follows is denial.

The market will come back, right, it always does, we should just double down.

And then comes panic.

No, No, No, not a margin call.........

And then my favorite, dispair.

Its all gone, every last bit.

Some times this path is repeated with a few revenge trades thrown in. Sometimes the hit is big, sometimes it is small. But everyone takes a hit. The thing to do is learn from it and try not to go down the same path.

Pick yourself up and learn from it. You can do it.

good luck.

I have a therory about the stages each forex trader goes through. I would venture to say nearly everyone with any experience in forex would agree with me.

I call this "The Seven Stages of Tradeing Forex"

You begin by being conservative.

You start out being very carefull with your trades, keeping lots small and stops tight.

Which leads to success.

Your plan is working, and your account is seeing gains.

Which leads to overconfidence.

The plan works every time. look at the gains you are making. You must be a genius. You have found the holy grail..

Which leads to Greed.

If you can make this much with one lot, then why not trade 2 lots, right?

Of course what follows is denial.

The market will come back, right, it always does, we should just double down.

And then comes panic.

No, No, No, not a margin call.........

And then my favorite, dispair.

Its all gone, every last bit.

Some times this path is repeated with a few revenge trades thrown in. Sometimes the hit is big, sometimes it is small. But everyone takes a hit. The thing to do is learn from it and try not to go down the same path.

Pick yourself up and learn from it. You can do it.

good luck.

Member Since Jan 14, 2010

2279 posts

Jun 15, 2011 at 00:28

Member Since Jan 14, 2010

2279 posts

I wonder why to have portfoli at this stage at all.

People complain that learning is expensive. I think it is people who make it expensive.

Trade small , learn before jumping in with portfolio.

People complain that learning is expensive. I think it is people who make it expensive.

Trade small , learn before jumping in with portfolio.

Member Since Aug 10, 2011

13 posts

Aug 15, 2011 at 21:14

Member Since Jun 11, 2010

3 posts

SarahStone posted:

I think to avoid this Emotional problems you have to trade with smallest lots and don't open 1000 positions))Wait till you position will be closed in profit then open new one)

I think this is the best thing you can do. Thanks

Member Since Aug 25, 2011

14 posts

Aug 25, 2011 at 10:30

Member Since Aug 25, 2011

14 posts

i agree, use real account, no matter how small it is, the psychological factor would be the same as with a bigger account only less nerve wrecking 😀

also don't overtrade - it very easy to get caught with the exciting world of trading and it's even easier to lose your accout faster than you can realize, so make sure you have an exact trading system and that your trades follow it exactly.

also don't overtrade - it very easy to get caught with the exciting world of trading and it's even easier to lose your accout faster than you can realize, so make sure you have an exact trading system and that your trades follow it exactly.

Member Since Jan 14, 2010

2279 posts

Aug 28, 2011 at 16:29

Member Since Jan 14, 2010

2279 posts

I am coming to conclusion that trader especially intra day trader should behave like special forces sniper or Iroquois sitting in ambush waiting for that perfect moment when direction is confirmed, risk is the lowest and probability is the highest.

It all comes to experience and thousand hours of watching and trading intra day style.

It is always better to miss trade than to get in at bad price.

It is not easy to do but we must achieve 100% control over ourselves because this business is not about trading but about making money.

Patience pays.

It all comes to experience and thousand hours of watching and trading intra day style.

It is always better to miss trade than to get in at bad price.

It is not easy to do but we must achieve 100% control over ourselves because this business is not about trading but about making money.

Patience pays.

Member Since Jan 14, 2010

541 posts

Aug 29, 2011 at 14:25

Member Since Jan 14, 2010

541 posts

Chikot posted:

I am coming to conclusion that trader especially intra day trader should behave like special forces sniper or Iroquois sitting in ambush waiting for that perfect moment when direction is confirmed, risk is the lowest and probability is the highest.

Problem is, the above is know only after the fact, and if you don't take all chances, you will miss out trades.

I don't think there is a moment when risk is lowest - I think you're always in a risk when exposed to the markets.

Member Since Jan 14, 2010

2279 posts

Aug 29, 2011 at 16:41

Member Since Jan 14, 2010

2279 posts

That's true, the risk is always present but the truth is that with enough experience and hours of watching intra day action trader is getting intuitive feelings and combined with a plan it can give those lower risk entries. By lower risk i mean lower pips risk entries.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.