- Accueil

- Communauté

- Général

- FA: the Holy Grail of trend trading.

Advertisement

Edit Your Comment

FA: the Holy Grail of trend trading.

Nov 10, 2019 at 11:51

Membre depuis Mar 10, 2019

posts 55

FA = Fundamental Analysis. TA = Technical Analysis.

It's not a secret that FA is primary and TA is secondary for any serious trader. Even if you are a 5 pip scalper - it's way better to do it along the trend than against it.

Contribute to this thread: look at charts of the past and present. Find a trend, big or small - post it here with your opinion of fundamentals behind it.

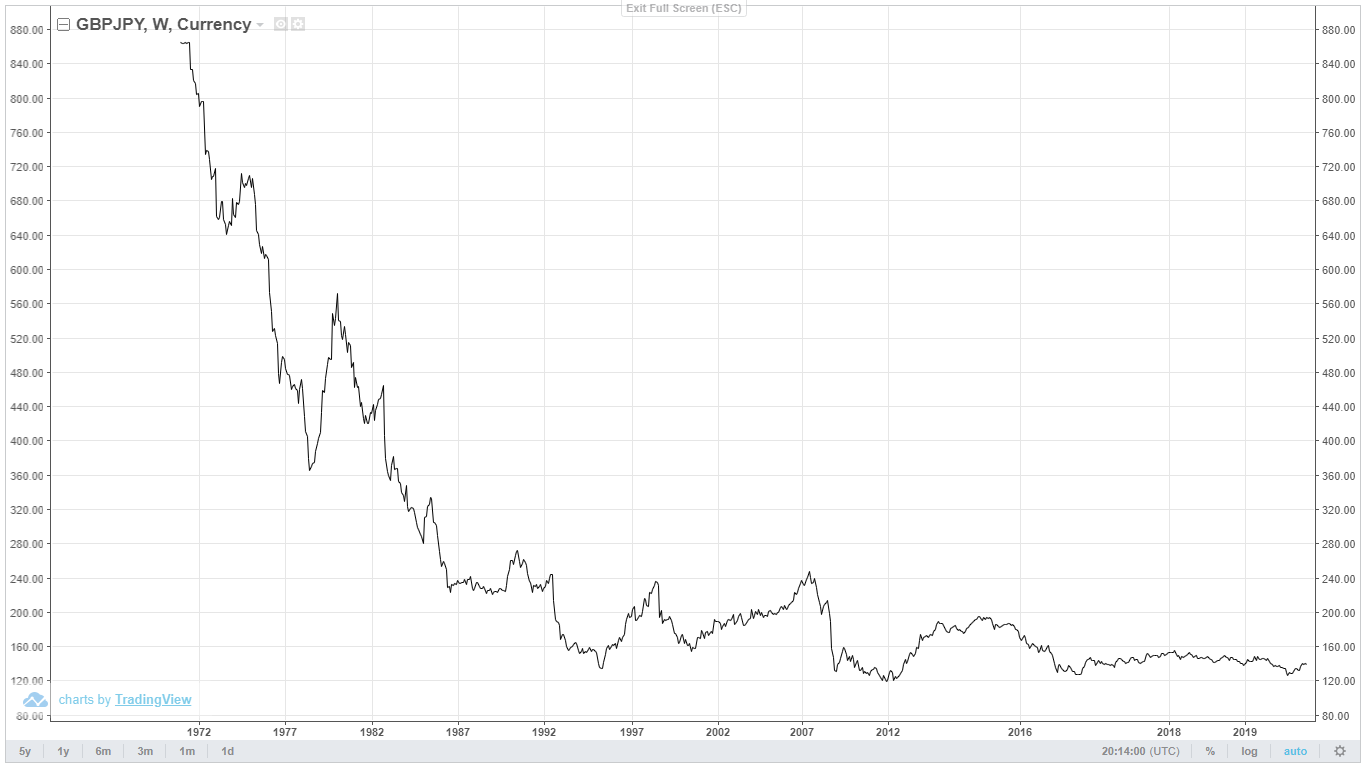

I start with: what's the major fundamental reason for the GBPCHF massive fall from ~10.30 in 1972-73 to today's below 1.30: - I know the answer, do you?

It's not a secret that FA is primary and TA is secondary for any serious trader. Even if you are a 5 pip scalper - it's way better to do it along the trend than against it.

Contribute to this thread: look at charts of the past and present. Find a trend, big or small - post it here with your opinion of fundamentals behind it.

I start with: what's the major fundamental reason for the GBPCHF massive fall from ~10.30 in 1972-73 to today's below 1.30: - I know the answer, do you?

every beautiful garden has a strong hedge around

Membre depuis Jan 05, 2016

posts 1097

Nov 10, 2019 at 21:48

Membre depuis Jan 05, 2016

posts 1097

Perhaps you could give more details and specifics as to the "holy grail" nature of your system?

While I do agree that trading with the trend can be extremely profitable, it is hardly a holy grail implementation of trading system.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Nov 11, 2019 at 08:59

Membre depuis Mar 10, 2019

posts 55

niceGLer posted:

End of Bretton-Woods system? It's just a wild guess..

not really because: why then the effect was sooooo negative for GBP (and continues today) and sooooo positive for CHF?

every beautiful garden has a strong hedge around

Nov 11, 2019 at 09:04

Membre depuis Mar 10, 2019

posts 55

Professional4X posted:

Perhaps you could give more details and specifics as to the "holy grail" nature of your system?

it's not my system. it's just me calling FA the holy grail... it's the foundation of trading... it's difficult to be good at it as we r not insiders... Like 97% can't give the right answer to the question above...

every beautiful garden has a strong hedge around

Nov 11, 2019 at 12:54

Membre depuis Dec 28, 2013

posts 160

tacet posted:niceGLer posted:

End of Bretton-Woods system? It's just a wild guess..

not really because: why then the effect was sooooo negative for GBP (and continues today) and sooooo positive for CHF?

Swiss Franc was pegged to gold until 2011. Otherwise, it could have something to do with UK's colonial past. Canada or Australia. Gold or mining industry, anyways? UK joined to EU in 1969, but I wouldn't put a blame on that.

That figure implicates that the economy of UK has been declining for decades.

Membre depuis Sep 11, 2019

posts 10

Nov 11, 2019 at 14:28

Membre depuis Mar 10, 2019

posts 55

niceGLer posted:tacet posted:niceGLer posted:

End of Bretton-Woods system? It's just a wild guess..

not really because: why then the effect was sooooo negative for GBP (and continues today) and sooooo positive for CHF?

Swiss Franc was pegged to gold until 2011. Otherwise, it could have something to do with UK's colonial past. Canada or Australia. Gold or mining industry, anyways? UK joined to EU in 1969, but I wouldn't put a blame on that.

That figure implicates that the economy of UK has been declining for decades.

Like you analysis and a good attempt with gold, but not really as only Basel 3 gave gold the upper status in 2018... well, declining for decades, but not sooo much to Swiss... or Japan...

declining for decades: not really as the UK is still the 5th world economy... You are close, just need a bit more... sometimes unthinkable represents the solution... by the way the UK joined not in 1969 but in Jan. 1973...

every beautiful garden has a strong hedge around

Nov 12, 2019 at 06:08

Membre depuis Oct 23, 2014

posts 78

Together with Germany, the Swiss pioneered monetarist theories in the 1970s: The Swiss National Bank (SNB) allowed money supply to rise only gradually, using tools like minimum reserve requirements for banks and relatively high real interest rates. that is why chf got stronger.

Nov 12, 2019 at 06:27

Membre depuis Dec 28, 2013

posts 160

rickyb posted:

Together with Germany, the Swiss pioneered monetarist theories in the 1970s: The Swiss National Bank (SNB) allowed money supply to rise only gradually, using tools like minimum reserve requirements for banks and relatively high real interest rates. that is why chf got stronger.

The case seems to be similar with JPY, however. It must have been some sort of internal reason..

- Loss of overseas territories

- Germany as a rival

- WWII era politics -> huge debts to the US

- Pound lost its position as a world reserve currency (de-pegging with gold)

- IMF loans to UK (devaluations of pound)

- Troubles in Ireland

- European Union, somehow

- something else I can't think of

Nov 12, 2019 at 07:44

Membre depuis Mar 10, 2019

posts 55

rickyb posted:

Together with Germany, the Swiss pioneered monetarist theories in the 1970s: The Swiss National Bank (SNB) allowed money supply to rise only gradually, using tools like minimum reserve requirements for banks and relatively high real interest rates. that is why chf got stronger.

a good try but not really the answer: why then JPY had a similar to CHF move against GBP... also one needs to understand that a western central bank (CB) is not allowed to use any theories to give a massive advantage to its country no mater how "pioneering" they could be - all CBs are coordinated (and rightly so)....

every beautiful garden has a strong hedge around

Membre depuis Jan 05, 2016

posts 1097

Nov 12, 2019 at 07:52

Membre depuis Jan 05, 2016

posts 1097

tacet posted:Professional4X posted:

Perhaps you could give more details and specifics as to the "holy grail" nature of your system?

it's not my system. it's just me calling FA the holy grail... it's the foundation of trading... it's difficult to be good at it as we r not insiders... Like 97% can't give the right answer to the question above...

Ok. So just to be clear. You don't have a Holy Grail system. End of discussion.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Nov 12, 2019 at 19:28

(édité Nov 12, 2019 at 19:33)

Membre depuis Mar 10, 2019

posts 55

Professional4X posted:tacet posted:Professional4X posted:

Perhaps you could give more details and specifics as to the "holy grail" nature of your system?

it's not my system. it's just me calling FA the holy grail... it's the foundation of trading... it's difficult to be good at it as we r not insiders... Like 97% can't give the right answer to the question above...

Ok. So just to be clear. You don't have a Holy Grail system. End of discussion.

mate, where on earth I said that I had a holy grail SYSTEM - man, with all respect, all I said was that FA was that HOLY GRAIL (or could be taken as one!) - this is how it is considered by many and the example I gave could be interesting for beginners 😁 ... THERE IS NO HOLY GRAIL SYSTEM (or strategy etc.) - only in the world of (illegal) insiders etc. you may have one!!! You may not want to discuss historical or present examples of FA - that is fine - concentrate on TA programming... makes more sense for you I guess - with respect to you 😎

every beautiful garden has a strong hedge around

Membre depuis Jan 05, 2016

posts 1097

Nov 13, 2019 at 01:29

(édité Nov 13, 2019 at 01:35)

Membre depuis Jan 05, 2016

posts 1097

The Holy Grail is a commonly espoused myth in the trading community that new traders often fall victim to due to their misunderstandings of how the markets really work.

If you had the Holy Grail of trading, you would have zero bad trades and an incredibly low DD% across all your live accounts.

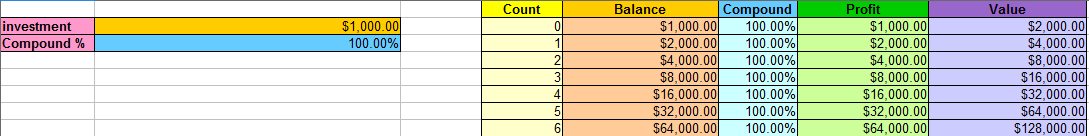

A true holy grail system would easily make 100% profit per month with little to no DD% regardless of the broker and market conditions.

You DO NOT possess the Holy Grail of trading. If you did have it, it would be a simple matter to prove it by doing the folliowing.

Sign up for a LIVE US Based account with Oanda. Not negotiable to use a different broker, and it shouldn't matter if you truly do posses the Holy Grail of trading.

Show me the account with perfect trading with US Based Oanda for 6 months with 0 losses which I can verify by logging into the FXTrade servers.

Do that and I will guarantee you investment capital beyond what you could possibly hope to earn in your entire lifetime trading at your current levels.

If you had the Holy Grail of trading, you would have zero bad trades and an incredibly low DD% across all your live accounts.

A true holy grail system would easily make 100% profit per month with little to no DD% regardless of the broker and market conditions.

You DO NOT possess the Holy Grail of trading. If you did have it, it would be a simple matter to prove it by doing the folliowing.

Sign up for a LIVE US Based account with Oanda. Not negotiable to use a different broker, and it shouldn't matter if you truly do posses the Holy Grail of trading.

Show me the account with perfect trading with US Based Oanda for 6 months with 0 losses which I can verify by logging into the FXTrade servers.

Do that and I will guarantee you investment capital beyond what you could possibly hope to earn in your entire lifetime trading at your current levels.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Membre depuis Jan 05, 2016

posts 1097

Nov 13, 2019 at 01:33

(édité Nov 13, 2019 at 01:36)

Membre depuis Jan 05, 2016

posts 1097

Membre depuis Jan 05, 2016

posts 1097

Nov 13, 2019 at 01:53

Membre depuis Jan 05, 2016

posts 1097

tacet posted:

mate, where on earth I said that I had a holy grail SYSTEM - man, with all respect, all I said was that FA was that HOLY GRAIL (or could be taken as one!) - this is how it is considered by many and the example I gave could be interesting for beginners 😁 ... THERE IS NO HOLY GRAIL SYSTEM (or strategy etc.) - only in the world of (illegal) insiders etc. you may have one!!! You may not want to discuss historical or present examples of FA - that is fine - concentrate on TA programming... makes more sense for you I guess - with respect to you 😎

You're contradicting yourself here. First you say there IS a holy grail, then you say there isn't one.

You say I do not want to discuss historical or present examples of FA and that it's ok that I should concentrate on TA programming, I find this interesting because at no point in this discussing did I say I only concentrate on TA programming. NO where.

I'm not making wild false claims about having knowledge of FA being the Holy Grail, that was entirely you.

FA = fundamental analysis = an analysis of the real world actions and events that could be attributed to the movements in a market based upon an event that took place that could have an impact upon said markets.

FA provides analysis of events that have ALREADY taken place. Based upon those PAST movements and events we can use statistical probability to determine the percentages of movements withing those markets. This however is still a rearward facing analysis and is NOT a guarantee of profitability.

A true Holy Grail system would be able to tell you the exact movements of the markets across all market conditions, regardless of what FA and TA data points would indicate. The general public does not have access to this, and neither do you. To tell people that FA is the holy grail is giving people a false understand of what FA is, and is does not give a realistic understanding of how the markets truly work.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

Nov 13, 2019 at 09:11

(édité Nov 13, 2019 at 09:12)

Membre depuis Mar 10, 2019

posts 55

My post is in the GENERAL not in the systems section... thus in my context "Holy Grail" only means as it's defined in any dictionary: any greatly desired and sought-after objective (f.e. Merriam-Webster) - nothing more nothing less... a FIGURE OF SPEECH... I though I explained it well above 😄

It's clear what you r trying to say - and I agree with you - there is no "holy grail" system and no one should claim they have it (as it was 15 years ago when many called their scammy EAs like that)... I only wanted to emphasize the paramount importance of FA, very often neglected by traders - nothing more nothing less... There is nothing/very little discussion on FA, why not do it? alternatively you may write to the moderators and ask them to remove these "Holy Grail" words from the title of this tread and replace them with something more suitable for you - I will not object 😐...

only a bit disagree with you in "FA provides analysis of events that have ALREADY taken place." - a sharp FA analysis may predict new trends and changes in present ones etc (sorry sorry not 100%)...

good trading to you 😎

It's clear what you r trying to say - and I agree with you - there is no "holy grail" system and no one should claim they have it (as it was 15 years ago when many called their scammy EAs like that)... I only wanted to emphasize the paramount importance of FA, very often neglected by traders - nothing more nothing less... There is nothing/very little discussion on FA, why not do it? alternatively you may write to the moderators and ask them to remove these "Holy Grail" words from the title of this tread and replace them with something more suitable for you - I will not object 😐...

only a bit disagree with you in "FA provides analysis of events that have ALREADY taken place." - a sharp FA analysis may predict new trends and changes in present ones etc (sorry sorry not 100%)...

good trading to you 😎

every beautiful garden has a strong hedge around

*Lutilisation commerciale et le spam ne seront pas tolérés et peuvent entraîner la fermeture du compte.

Conseil : Poster une image/une url YouTube sera automatiquement intégrée dans votre message!

Conseil : Tapez le signe @ pour compléter automatiquement un nom dutilisateur participant à cette discussion.

.png)