- Início

- Comunidade

- Geral

- Martingale

Advertisement

Edit Your Comment

Martingale

Membro Desde Nov 21, 2011

1601 postagens

Dec 30, 2016 at 11:49

Membro Desde Nov 21, 2011

1601 postagens

Membro Desde Nov 21, 2011

1601 postagens

Dec 30, 2016 at 12:00

Membro Desde Nov 21, 2011

1601 postagens

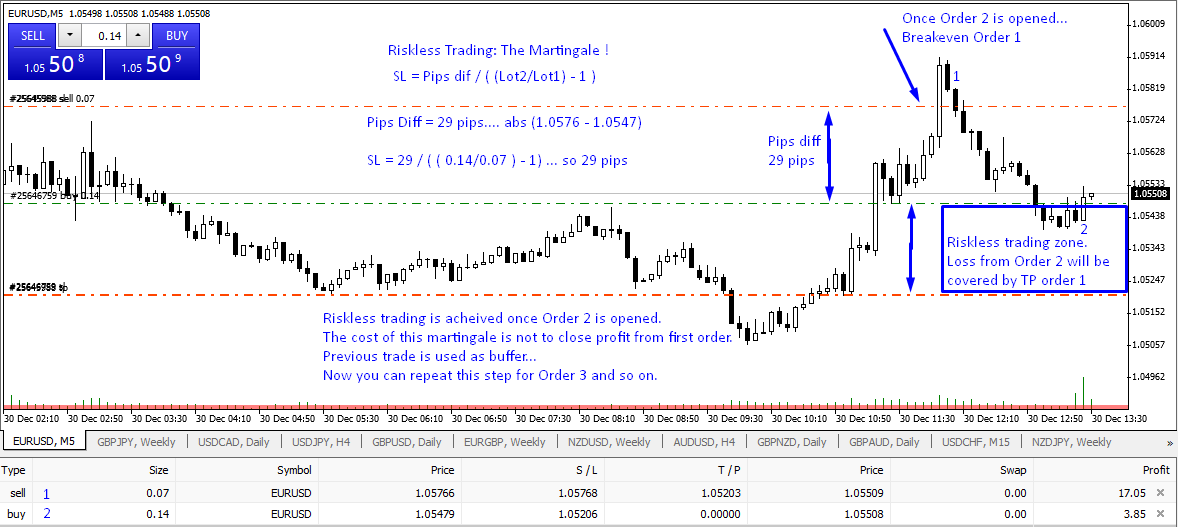

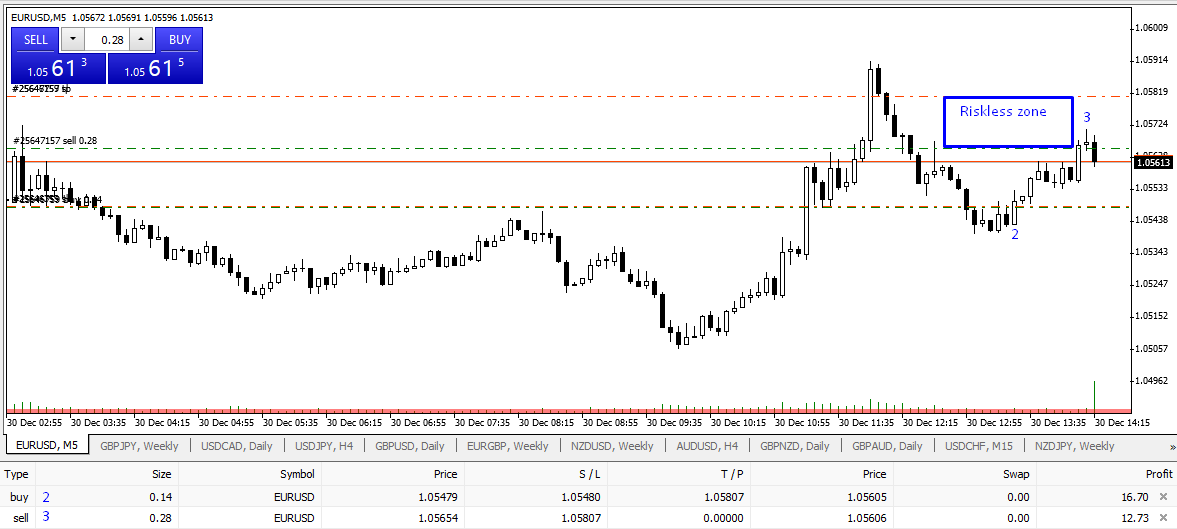

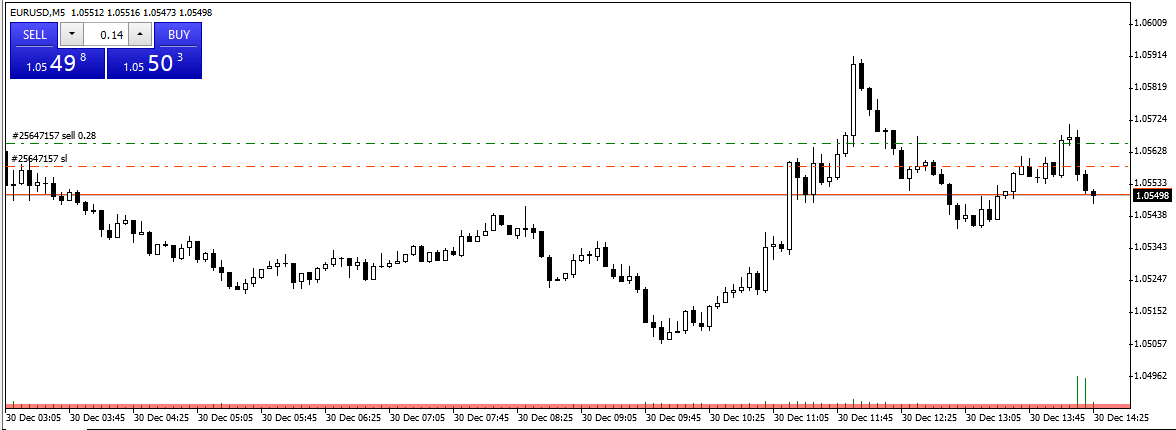

From here...

Variants of martingale are only limited to your mind.

You could wait market to retest high... Order 1 will be closed. You can re short higher while doubling Lotsize from Order 2, so (0.28)

Or close half of Order 2.... and re short by doubling from Order 2 so (0.14) (starting to make some profit)

You could also breakeven quickly Order 2 on the way up... So you can use Order 1 once again as buffer to re renter Long so Order 2 bis (Riskless zone will be reduced as Pip Diff is lower.

You could invent your way to make profit while trading riskless. only by not taking profit from first order.

Enjoy trading

Variants of martingale are only limited to your mind.

You could wait market to retest high... Order 1 will be closed. You can re short higher while doubling Lotsize from Order 2, so (0.28)

Or close half of Order 2.... and re short by doubling from Order 2 so (0.14) (starting to make some profit)

You could also breakeven quickly Order 2 on the way up... So you can use Order 1 once again as buffer to re renter Long so Order 2 bis (Riskless zone will be reduced as Pip Diff is lower.

You could invent your way to make profit while trading riskless. only by not taking profit from first order.

Enjoy trading

Membro Desde Nov 21, 2011

1601 postagens

Dec 30, 2016 at 12:21

Membro Desde Nov 21, 2011

1601 postagens

Membro Desde Nov 21, 2011

1601 postagens

Dec 30, 2016 at 12:26

(editado há Dec 30, 2016 at 12:27)

Membro Desde Nov 21, 2011

1601 postagens

Membro Desde Nov 21, 2011

1601 postagens

Dec 30, 2016 at 12:54

Membro Desde Nov 21, 2011

1601 postagens

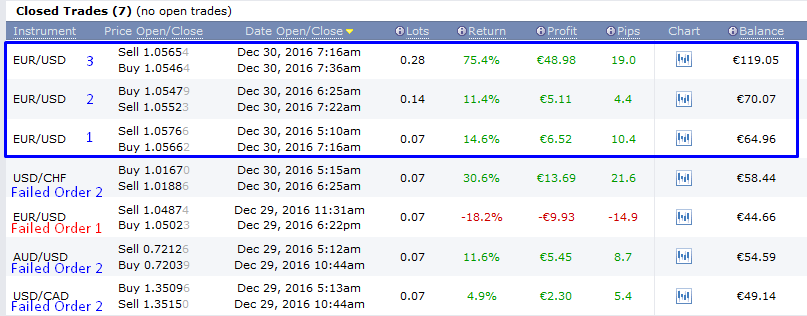

This is how I made 100% in 3 trades using matingale Up and down, increasing lotsize and trading riskless

Live account (Custum date when I started to trade exclusively with this martingale)

https://www.forexfactory.com/pipsfestival#acct.80

This martingale has been published 3 years ago:

https://crazytraderfx.blogspot.fr/2012/10/my-money-management-system.html

Live account (Custum date when I started to trade exclusively with this martingale)

https://www.forexfactory.com/pipsfestival#acct.80

This martingale has been published 3 years ago:

https://crazytraderfx.blogspot.fr/2012/10/my-money-management-system.html

Membro Desde May 24, 2010

354 postagens

Jan 02, 2017 at 09:17

Membro Desde May 24, 2010

354 postagens

CrazyTrader posted:

From here...

Variants of martingale are only limited to your mind.

You could wait market to retest high... Order 1 will be closed. You can re short higher while doubling Lotsize from Order 2, so (0.28)

Or close half of Order 2.... and re short by doubling from Order 2 so (0.14) (starting to make some profit)

You could also breakeven quickly Order 2 on the way up... So you can use Order 1 once again as buffer to re renter Long so Order 2 bis (Riskless zone will be reduced as Pip Diff is lower.

You could invent your way to make profit while trading riskless. only by not taking profit from first order.

Enjoy trading

Good idea but the problem is always the first order and low problem is spreads, commisions, swap, slippages....

Membro Desde May 04, 2012

1534 postagens

Jan 02, 2017 at 09:24

Membro Desde May 04, 2012

1534 postagens

@CrazyTrader

It is nice to make 100% on a $50 deposit and with 3 trades only, even if by Martingale...

But, with all due respect: Is it TRADING or GAMBLING...?

Betting on ""RED"" on online Roulette - using Martingale - can bring in easy 100% within 3 minutes, too...

It is nice to make 100% on a $50 deposit and with 3 trades only, even if by Martingale...

But, with all due respect: Is it TRADING or GAMBLING...?

Betting on ""RED"" on online Roulette - using Martingale - can bring in easy 100% within 3 minutes, too...

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Membro Desde Nov 21, 2011

1601 postagens

Jan 02, 2017 at 13:37

(editado há Jan 02, 2017 at 13:37)

Membro Desde Nov 21, 2011

1601 postagens

FxMasterGuru posted:

@CrazyTrader

It is nice to make 100% on a $50 deposit and with 3 trades only, even if by Martingale...

But, with all due respect: Is it TRADING or GAMBLING...?

Betting on ""RED"" on online Roulette - using Martingale - can bring in easy 100% within 3 minutes, too...

Same same but really DIFFERENT!

(I will try to explain it for the last time. With all due respect, open your mind and try to figure it out).

If I had done 2%... would you have talked about gambling? Probably not. % gain has nothing to do with the formula only because I made a small desposit to illustrate the formula.

Fisrt of all, the point wasn't to make x%... It's to show there is a variant of martingale with a formula that allows to trade riskless while you can increase lotsize on each trade. This martingale is also a way to cheat broker limitation. (Try to open 0.28 with €50) You can't due to margin level... but you can when you have already a current opened position in opposite way.

The most important is capital preservation. Unfortunately, each single trade you open, you have a risk involved. Based on your capital, if you double your lotsize, your risk is twice more.

With this theory, once you double your position by opening the second order, you are able to trade riskless into a trading zone.

How magic? You have discovered a way to trade RISKLESS. I repeat RISKLESS.

Why 90% lose money... It's just because they are facing a risk to lose on each single trade they open. Please explain How could you blow your account up if it was possible to trade riskless? (Then you would be a really bad trader as you would lose on each single trade you open)

How to acheive the riskless zone???... by a sacrifice on 0rder 1... not closing profit straigh away when you reverse the trade with Order 2

Instead of Casino... I would compare this to Chess. The greatest games ever on chess have been done by sacrifices pieces. You sacrifice pieces, your army is reduced on board but you have created such "MESS" that it smells checkmate in couple of moves.

While you sacrifice Order 1, you create such a "MESS" that what it should be natural from trading (risk) is suddenly gone. You have broken the trading law.

Is it hard to be right on the first trade???... 100% will say no!

So now you know from then how to trade without risk. Make your capital safer and make profit with much higher lotsize.

I will continue to use this martingale...

Enjoy trading... Mess it up ^^

Membro Desde May 04, 2012

1534 postagens

Jan 02, 2017 at 15:23

Membro Desde May 04, 2012

1534 postagens

@CrazyTrader

It might work out for a while, but what happens when the leverage does not allow opening an even larger Martingale position to continue with the trading plan?

Anyway, I will be curiously watching how this $50 deposit account will grow over the next months...

P.S. I made similar back-and-forth-back-and-forth type Martingale EAs, but they all failed in backtests mainly because of consuming all available maximum leverage before they could close the basket in profit. With large enough accounts these EAs were OK, but - with such large deposits - the profit % did not justify the risk (i.e. theoretically losing all).

It might work out for a while, but what happens when the leverage does not allow opening an even larger Martingale position to continue with the trading plan?

Anyway, I will be curiously watching how this $50 deposit account will grow over the next months...

P.S. I made similar back-and-forth-back-and-forth type Martingale EAs, but they all failed in backtests mainly because of consuming all available maximum leverage before they could close the basket in profit. With large enough accounts these EAs were OK, but - with such large deposits - the profit % did not justify the risk (i.e. theoretically losing all).

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

forex_trader_368735

Membro Desde Oct 13, 2016

22 postagens

Jan 02, 2017 at 15:26

Membro Desde Oct 13, 2016

22 postagens

@CrazyTrader Excellent clarification, I have been able to understand perfectly how it works. Thank you.

Success!

Success!

forex_trader_368735

Membro Desde Oct 13, 2016

22 postagens

Jan 02, 2017 at 15:26

Membro Desde Oct 13, 2016

22 postagens

owenn posted:

@CrazyTrader Wow, you're really good at martingale. Not in vain this way of trading has maintained its fame until now.

It's because he has discovered the exact point of the strategy :) that's great! Good example of using Martingala and winning!

Membro Desde Nov 21, 2011

1601 postagens

Jan 02, 2017 at 15:37

Membro Desde Nov 21, 2011

1601 postagens

FxMasterGuru posted:

@CrazyTrader

It might work out for a while, but what happens when the leverage does not allow opening an even larger Martingale position to continue with the trading plan?

The final point ins't to open positions until infinite ...But start to make profit from Order 2, 3 or 4... up to you.

FxMasterGuru posted:

Anyway, I will be curiously watching how this $50 deposit account will grow over the next months...

Not sure I will be using it everyday from now... I did to illustrate.

FxMasterGuru posted:

P.S. I made similar back-and-forth-back-and-forth type Martingale EAs, but they all failed in backtests mainly because of consuming all available maximum leverage before they could close the basket in profit. With large enough accounts these EAs were OK, but - with such large deposits - the profit % did not justify the risk (i.e. theoretically losing all).

Fair enough

Membro Desde Nov 14, 2015

315 postagens

Jan 02, 2017 at 19:00

Membro Desde Nov 14, 2015

315 postagens

You can set a cut so you don't open trades till infinity. Say you open 6 trades and double each, 1, 2, 4, 8, 16, 32 = 63 lots. Think of this as a single 63 lot position. And you can do some risk management accordingly. That way, it is no worse than trading with just one.

Membro Desde Feb 22, 2011

4573 postagens

Jan 02, 2017 at 19:05

Membro Desde Feb 22, 2011

4573 postagens

Guys,

the very principle of martingale is it is working for couple of first trades - like the 3 trades on @CrazyTrader account.

At the higher level positions are liquidated due to margin call and whole account wiped - as you can see on @CrazyTrader profile.

Hold on, it was deleted. Well I have backup thought :)

the very principle of martingale is it is working for couple of first trades - like the 3 trades on @CrazyTrader account.

At the higher level positions are liquidated due to margin call and whole account wiped - as you can see on @CrazyTrader profile.

Hold on, it was deleted. Well I have backup thought :)

Membro Desde Nov 21, 2011

1601 postagens

Jan 02, 2017 at 20:43

Membro Desde Nov 21, 2011

1601 postagens

As always, you don't miss out the opportunity to be a wanker.

I thought for 2017 you would have grown up a bit... I see, it won't be this year... Shame on you.

There is a big difference between deleted and private.

You think you are unbeatable on forex?

From your profile:

https://www.myfxbook.com/members/togr/variant-4-real/1828615

Are you still that proud of this system?

Grow up a bit... little child, if you knew something about Forex you would know that even the best trader in the world have started by blowing accounts... So what the point of your previous post?

I told you already... try not to be that useless, as you care so much about your credibility.

I thought for 2017 you would have grown up a bit... I see, it won't be this year... Shame on you.

There is a big difference between deleted and private.

You think you are unbeatable on forex?

From your profile:

https://www.myfxbook.com/members/togr/variant-4-real/1828615

Are you still that proud of this system?

Grow up a bit... little child, if you knew something about Forex you would know that even the best trader in the world have started by blowing accounts... So what the point of your previous post?

I told you already... try not to be that useless, as you care so much about your credibility.

Membro Desde May 04, 2012

1534 postagens

Jan 03, 2017 at 07:23

Membro Desde May 04, 2012

1534 postagens

@CrazyTrader

The previously illustrated winning scenario with 1st trade Sell, then 2nd trade Buy was clear. Thanks for the explanation.

But what would have been the plan if the price had moved against the #1 sell trade pushing it into loss immediately...?

The previously illustrated winning scenario with 1st trade Sell, then 2nd trade Buy was clear. Thanks for the explanation.

But what would have been the plan if the price had moved against the #1 sell trade pushing it into loss immediately...?

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Membro Desde Nov 21, 2011

1601 postagens

Jan 03, 2017 at 07:53

(editado há Jan 03, 2017 at 08:02)

Membro Desde Nov 21, 2011

1601 postagens

FxMasterGuru posted:

@CrazyTrader

The previously illustrated winning scenario with 1st trade Sell, then 2nd trade Buy was clear. Thanks for the explanation.

But what would have been the plan if the price had moved against the #1 sell trade pushing it into loss immediately...?

This happen 50% of the time.

You take your loss, 10, 20 30 pips max.

You concentrate again... waiting for good potential entry/signal and you restart from Order 1

Have a look at history tab, you will notice that 3 trades haven't trigerred the martingale... because I missed the reveral area. (Order 2) on UsdCad, AudUsd & UsdChf.

And I lost 1 trade on EurUsd (-14 pips)

Let's filter on EurUsd only.

Imagine I lose On first Order, 3 times in row before I can realize martingale up to 3 trades.

I would I lost 3*(€-9.9) So around €-30

=> See how order 3 recover all failed on first order: +19 pips = +€49

Compare this to classical martingale... every time you lose on first trade you increase risk * 2... and whatever happen, you will never create a riskless trading zone.

You guys should open a demo account and try it 10 times... and see yourself.

Membro Desde Feb 22, 2011

4573 postagens

Jan 03, 2017 at 08:33

Membro Desde Feb 22, 2011

4573 postagens

CrazyTrader posted:

As always, you don't miss out the opportunity to be a wanker.

I thought for 2017 you would have grown up a bit... I see, it won't be this year... Shame on you.

There is a big difference between deleted and private.

You think you are unbeatable on forex?

From your profile:

https://www.myfxbook.com/members/togr/variant-4-real/1828615

Are you still that proud of this system?

Grow up a bit... little child, if you knew something about Forex you would know that even the best trader in the world have started by blowing accounts... So what the point of your previous post?

I told you already... try not to be that useless, as you care so much about your credibility.

@CrazyTrader

My point is very simple,

you stated you have zero risk martingale.

You dont. If you had you were already successful trader or even millinare, you are not.

Such thing like zero risk martingale does not exist. Trying to bullshi* people like you try is very poor.

Membro Desde May 04, 2012

1534 postagens

Jan 03, 2017 at 09:30

Membro Desde May 04, 2012

1534 postagens

@CrazyTrader

How much is the success of this concept dependent on the mentioned ""waiting for good potential entry/signal""?

Why not making an EA for this strategy and running a long-term backtest to prove the hypothesis?

How much is the success of this concept dependent on the mentioned ""waiting for good potential entry/signal""?

Why not making an EA for this strategy and running a long-term backtest to prove the hypothesis?

Please click "Vouch" if you liked my post. If not, just put me on your Blocked list. :o)

Membro Desde Nov 21, 2011

1601 postagens

Jan 03, 2017 at 09:36

(editado há Jan 03, 2017 at 09:39)

Membro Desde Nov 21, 2011

1601 postagens

togr posted:

@CrazyTrader

My point is very simple,

you stated you have zero risk martingale.

You dont. If you had you were already successful trader or even millinare, you are not.

Such thing like zero risk martingale does not exist. Trying to bullshi* people like you try is very poor.

*** This is official ***

=> It's the last time I respond to you. You are useless in every single sentence you write.

I stated from Order 1, you use it as buffer/sacrifice, then the martingale up and down creates a riskless trading area while you can double each lotsize from following trades.

=> Apparently, you are the only one not to understand it. (read comments from other users... they all got it) Are you that stupid? or too frustrated from past comments I wrote about you to admit it.

Did I say you can become millionaire with this martingale?

=> I said the theory is simple but the practise is much harder for 2 reasons:

- If you open Order N+1 at the wrong time, or if you are too greedy, the martingale will end up with no profit but zero loss.

Let's say I opened Long Order 4 with 0.56.

It would be:

Order 3: €+100

Order 4: €-100

Why I don't use it personnaly since the last 3 years... it's because it is very hard to use as you have to pick up the bottom and top at the right time... which is almost impossible as nobody can't guess where this happen.

Now, I'm not successfull?

- Get this challenge: Open a thread whenever you want, and explain your strategy and trade with it for 3 months by posting real time every single trade you take:

Let's see if you are profitable:

https://www.forexfactory.com/showthread.php?t=593831

https://www.myfxbook.com/members/CrazyTrader/sentiment-traders-mt4-indi-3/1334894

- Or you can simply refer to the first page of this thread...

Beleive the power of the trend on UsdJpy... market is still above 200 pips from initial target.

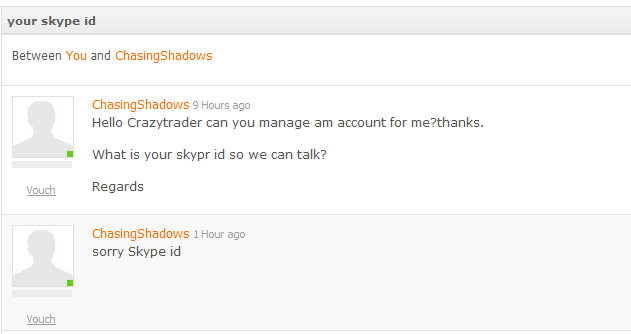

Why people want me to trade for them while I'm not looking to manage money from others?

mail sent 9 hours ago.

Anyway... I'm done with you! ^^

*Não serão tolerados uso comercial ou spam. O não cumprimento desta regra poderá resultar na exclusão da conta.

Dica: Ao adicionar uma URL de imagem/youtube, você estará automaticamente incorporando-a à sua postagem!

Dica: Digite o símbolo @ para que o nome de um usuário que participe desta discussão seja completado automaticamente.