Edit Your Comment

Myfxbook Autotrade

Jun 26, 2017 at 12:22

Member Since May 05, 2016

11 posts

rfung posted:social_trading2 posted:

I doubt that someone is really making money from Autotrade on long term!!!

well 1 year im still okay $500 start, now at $6000.

@rfung Can you please share your AutoTrade results?

The curve on your profile seems to be a different account.

Jun 26, 2017 at 12:36

(edited Jun 26, 2017 at 12:36)

Member Since May 05, 2016

11 posts

bobby2001hk posted:

I am a PAMM manager, I found Ninja is also a PAMM too and doing well

i tested it on demo for a month

want to know how much Multiplier you use?

Only following Ninja for just over 1 month on demo.

Upped Multiplier from 0.5 to 0.8 a week ago.

37 trades, $54.55 profit. Seems fair to this point in time

Jun 27, 2017 at 10:56

Member Since Apr 18, 2017

659 posts

myfxpt posted:

Wow guys, I thought you would be a little more creative in the way you structured Myfxbook Autotrade. I don't want to be told which broker to use, and I don't want others dictating the size of my start-up capital. If I wanted that I would be using ZuluTrade.

Although, I don’t use any automatic service of myfxbook; but I am sure this is one of the most popular automatic trading service! There have so many powerful signal providers, so which traders want to use automatic service, myfxbook is a great place for them indeed!

Member Since Jan 23, 2017

17 posts

Jun 28, 2017 at 06:10

Member Since Jan 23, 2017

17 posts

Ok guys, some questions ...

I like to reduce risk with using signal providers - but myfxbook doesnt give me a good chance to do that !

I can go to settings - BUT I cannot really adjust risk settings.

Its useless to limit trading by using "Balance" - I mean my balance is at 3500 but a bad trade can get my Equity down too much so that my Margin Level gets worse and my Trader "Stop out" my trades.

Especially when having many (20+ trades) running - the BALANCE is worthless.

I wonder why they use BALANCE - they get all values from the providers like Equity, Margin Level and such.

WHY is there no REALLY Risk reducing setting like

Margin: Dont open new trades if Margin Level is below xxx% ?????

So PLEASE MYFXBOOK AT Developers - if you REALLY want do us CUSTOMERS good - ADD this feature to your settings !

Thank you !!!!

I like to reduce risk with using signal providers - but myfxbook doesnt give me a good chance to do that !

I can go to settings - BUT I cannot really adjust risk settings.

Its useless to limit trading by using "Balance" - I mean my balance is at 3500 but a bad trade can get my Equity down too much so that my Margin Level gets worse and my Trader "Stop out" my trades.

Especially when having many (20+ trades) running - the BALANCE is worthless.

I wonder why they use BALANCE - they get all values from the providers like Equity, Margin Level and such.

WHY is there no REALLY Risk reducing setting like

Margin: Dont open new trades if Margin Level is below xxx% ?????

So PLEASE MYFXBOOK AT Developers - if you REALLY want do us CUSTOMERS good - ADD this feature to your settings !

Thank you !!!!

technobilder@

Member Since Feb 22, 2011

4573 posts

Jun 28, 2017 at 12:12

Member Since Feb 22, 2011

4573 posts

PhilTrader posted:

Ok guys, some questions ...

I like to reduce risk with using signal providers - but myfxbook doesnt give me a good chance to do that !

I can go to settings - BUT I cannot really adjust risk settings.

Its useless to limit trading by using "Balance" - I mean my balance is at 3500 but a bad trade can get my Equity down too much so that my Margin Level gets worse and my Trader "Stop out" my trades.

Especially when having many (20+ trades) running - the BALANCE is worthless.

I wonder why they use BALANCE - they get all values from the providers like Equity, Margin Level and such.

WHY is there no REALLY Risk reducing setting like

Margin: Dont open new trades if Margin Level is below xxx% ?????

So PLEASE MYFXBOOK AT Developers - if you REALLY want do us CUSTOMERS good - ADD this feature to your settings !

Thank you !!!!

You can limit your DD

Drawdown Stop (%):

So if you set it to 20% than no new trades will be opened when equity is at 80%

Jun 28, 2017 at 12:15

Member Since Mar 15, 2017

16 posts

I have setups several accounts in several broker to test this autotrade. I have pleanty of data but no time to give many details right now..

From 4 accounts 1 is barely positive and all other are significantly negative (about 20%)

The problem has been in part the choice of signal providers. two very promising providers appeared a few weeks ago ASIA and now more recentely 41799.

both had a 6 months track record which I now realize is not enough.

in both cases the risk was supposed to be quite low with draw down of about 5%.

they volume track record was low volume and the numer of trades was supposed to Max. 5

Suddenly these providers just go nuts and since I was exposed to them (x1 multiplier) I took huge hits.

so be very careful because these new providers that start increasing volume 10 times and placing about 20 orders at the same time can kill you.

yes you can control the number of open positions and volume for each provider, but the first time I did not expect this sudden increase so let the provider "run free".

the previous comment about the control of risk id quite relevant. perhaps rather thatn stopping after balance reaches a certain point perhaps this could be setup for equity.

anyway I hope to recover on the long term and I will be more carefull choosing the providers. also I will restrict parameters for each one of the providers since they all seem to loose it after some time...

hope this helps

From 4 accounts 1 is barely positive and all other are significantly negative (about 20%)

The problem has been in part the choice of signal providers. two very promising providers appeared a few weeks ago ASIA and now more recentely 41799.

both had a 6 months track record which I now realize is not enough.

in both cases the risk was supposed to be quite low with draw down of about 5%.

they volume track record was low volume and the numer of trades was supposed to Max. 5

Suddenly these providers just go nuts and since I was exposed to them (x1 multiplier) I took huge hits.

so be very careful because these new providers that start increasing volume 10 times and placing about 20 orders at the same time can kill you.

yes you can control the number of open positions and volume for each provider, but the first time I did not expect this sudden increase so let the provider "run free".

the previous comment about the control of risk id quite relevant. perhaps rather thatn stopping after balance reaches a certain point perhaps this could be setup for equity.

anyway I hope to recover on the long term and I will be more carefull choosing the providers. also I will restrict parameters for each one of the providers since they all seem to loose it after some time...

hope this helps

Long term

Member Since Nov 15, 2011

15 posts

Jun 30, 2017 at 11:54

Member Since Nov 15, 2011

15 posts

spereira posted:

The problem has been in part the choice of signal providers. two very promising providers appeared a few weeks ago ASIA and now more recentely 41799.

both had a 6 months track record which I now realize is not enough.

in both cases the risk was supposed to be quite low with draw down of about 5%.

they volume track record was low volume and the numer of trades was supposed to Max. 5

Suddenly these providers just go nuts and since I was exposed to them (x1 multiplier) I took huge hits.

I don't think it's the time on the site but the time on autotrade. It seems something happens to these guys sometimes once they get approved. I like to see two months on autotrade before using.

Ask me about professional custom eas

Jun 30, 2017 at 13:36

Member Since Nov 30, 2009

135 posts

It could a new way of scamming. Trading for 6 months to create a nice looking track record. Once the system gets Autotrade approval wait to reach a certain number of investors. Then increase the volume and number of trades to maximise earnings and hoping their boosted system will last long before collapsing.

exquisite entries with calculated exits

Member Since Nov 15, 2011

15 posts

Jul 03, 2017 at 12:32

Member Since Nov 15, 2011

15 posts

jmsanc posted:

Hi just wondering is it common to miss to copy a trade from a provider? I use a live account and my account missed to copy 1 trade from night-ICmarkets. It successfully copied EUR-AUD trade missed the EUR-GBP trade.

There could have been too much slippage. The spreads can widen severely around that time and then miss the trade. Also the brokers sometimes don't have trading around that time but my trade opened 10 minutes after then open and most brokers are open by that time.

Ask me about professional custom eas

Jul 04, 2017 at 06:34

Member Since Feb 25, 2017

5 posts

I see. Thank you @bfis108137 fxtrader for clarifying that.

forex_trader_156646

Member Since Oct 16, 2013

18 posts

Jul 04, 2017 at 14:55

Member Since Oct 16, 2013

18 posts

spereira posted:

The problem has been in part the choice of signal providers. two very promising providers appeared a few weeks ago ASIA and now more recentely 41799.

both had a 6 months track record which I now realize is not enough.

in both cases the risk was supposed to be quite low with draw down of about 5%.

they volume track record was low volume and the numer of trades was supposed to Max. 5

Suddenly these providers just go nuts and since I was exposed to them (x1 multiplier) I took huge hits.

I feel your pain spereira! I was up about 50% on my live account - mostly due to NinjaTrainer and Scorpion and, at the time, Asia was doing well, but then the madness descended and first Asia completely lost his risk management and then not too long after the exact same thing happened with 41799. My +50% is now -25% and I ask myself how it could have all gone so badly wrong in the span of 2 weeks.

See, I actually made their results even worse by closing the trades manually when I just couldn't watch anymore and they kept opening position after position, so instead of recovering some of those losses, I took the worst of both of their losses. I could not have timed it any worse if I tried!

I now find myself licking the wounds and asking myself whether the same thing will eventually happen with each of the traders - including NinjaTrainer. My confidence in every single trader is completely shot.

forex_trader_156646

Member Since Oct 16, 2013

18 posts

Jul 04, 2017 at 14:56

Member Since Oct 16, 2013

18 posts

My two cents on a few of the AutoTrade systems I have been following / followed in my live Pepperstone account:

1. NinjaTrainer - fantastic results but opens / closes trades very close to market closing time, especially on Fridays, leaving you exposed to gaps over the weekend.

2. Premium Trading BB - the gains in a single month are just too big for me - seems very volatile with large up and down swings. I'm not sure how this system can be ranked 2nd.

3. Turtle EUR - performance and DD looks fantastic, BUT, he is essentially trading with no stop loss if you consider he uses 1200 pips on GBPUSD and EURUSD - seems he depends on the market eventually coming back to him, but this seems really risky to me. Such a shame the system can't show OPEN DD as this might scare of some investors.

4. Asia - I would steer clear. Irresponsible trading resulted in a massive DD before, don't think it can't happen again. It greatly concerns me if your underlying risk management is poor in times of DD. I have lost a lot of respect for myfxbook for first disqualifying the system from autotrade but then letting it back in. Irresponsible trading like this should not be 'encouraged' - even if it only happens once.

5. 41799 - same as above, I would steer very clear of this system for the same reasons above. I have also done a bit of research and found this trader has had a few different strategies on platforms such as Darwinex, which does well for a few months, then absolutely tanks. He then removes the system and starts a new one. Not someone I want to be investing in AGAIN :(

1. NinjaTrainer - fantastic results but opens / closes trades very close to market closing time, especially on Fridays, leaving you exposed to gaps over the weekend.

2. Premium Trading BB - the gains in a single month are just too big for me - seems very volatile with large up and down swings. I'm not sure how this system can be ranked 2nd.

3. Turtle EUR - performance and DD looks fantastic, BUT, he is essentially trading with no stop loss if you consider he uses 1200 pips on GBPUSD and EURUSD - seems he depends on the market eventually coming back to him, but this seems really risky to me. Such a shame the system can't show OPEN DD as this might scare of some investors.

4. Asia - I would steer clear. Irresponsible trading resulted in a massive DD before, don't think it can't happen again. It greatly concerns me if your underlying risk management is poor in times of DD. I have lost a lot of respect for myfxbook for first disqualifying the system from autotrade but then letting it back in. Irresponsible trading like this should not be 'encouraged' - even if it only happens once.

5. 41799 - same as above, I would steer very clear of this system for the same reasons above. I have also done a bit of research and found this trader has had a few different strategies on platforms such as Darwinex, which does well for a few months, then absolutely tanks. He then removes the system and starts a new one. Not someone I want to be investing in AGAIN :(

Jul 05, 2017 at 01:25

Member Since Dec 20, 2011

17 posts

Koosqwerty posted:

My two cents on a few of the AutoTrade systems I have been following / followed in my live Pepperstone account:

1. NinjaTrainer - fantastic results but opens / closes trades very close to market closing time, especially on Fridays, leaving you exposed to gaps over the weekend.

2. Premium Trading BB - the gains in a single month are just too big for me - seems very volatile with large up and down swings. I'm not sure how this system can be ranked 2nd.

3. Turtle EUR - performance and DD looks fantastic, BUT, he is essentially trading with no stop loss if you consider he uses 1200 pips on GBPUSD and EURUSD - seems he depends on the market eventually coming back to him, but this seems really risky to me. Such a shame the system can't show OPEN DD as this might scare of some investors.

4. Asia - I would steer clear. Irresponsible trading resulted in a massive DD before, don't think it can't happen again. It greatly concerns me if your underlying risk management is poor in times of DD. I have lost a lot of respect for myfxbook for first disqualifying the system from autotrade but then letting it back in. Irresponsible trading like this should not be 'encouraged' - even if it only happens once.

5. 41799 - same as above, I would steer very clear of this system for the same reasons above. I have also done a bit of research and found this trader has had a few different strategies on platforms such as Darwinex, which does well for a few months, then absolutely tanks. He then removes the system and starts a new one. Not someone I want to be investing in AGAIN :(

Very well said Leon! I totally agree with your statements.

1 tip here: If you don't wanna be exposed to gaps over the weekend, just schedule the system not to open any positions during the Friday closing hours.

For Turtle EUR - not only it's trading without stop loss, once it hit a loss, it'd open up the same losing position x7 to recover from its loss which I find very risky in a market like this.

I even sent a report to the support team requesting them to consider removing Asia from Autotrade, yet it seemed to have found its way back somehow.

Member Since Nov 15, 2011

15 posts

Jul 05, 2017 at 11:15

Member Since Nov 15, 2011

15 posts

jeffkoo posted:

I even sent a report to the support team requesting them to consider removing Asia from Autotrade, yet it seemed to have found its way back somehow.

Not only should they have removed Asia permanently, Asia imo violates the rules. It says not martingale or grid strategies. Now technically speaking it's not grid because his entries are determined by something but it is very grid like in that it keeps adding positions. Another thing that should be banned but it doesn't say is claims about your system

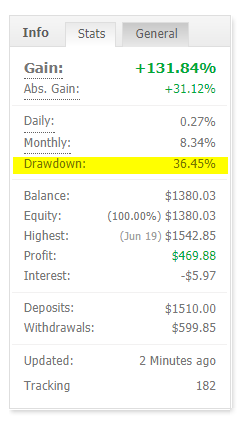

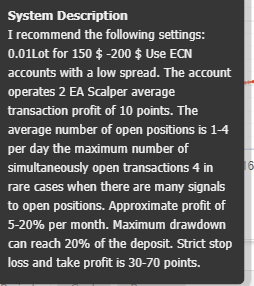

vs reality. He says no more than 4 transactions (trades) at a time but he has had around 10 and 5 or 6 on one pair. Even more disturbing is his claim of strict adherence to sl of 70 pips when he broke that rule and the biggest one of all is maximum drawdown of 20% when you can clearly see he reached 36.45%.

I think false claims in that section should get you banned at least until the provider changes that. See the screenshots.

Ask me about professional custom eas

forex_trader_156646

Member Since Oct 16, 2013

18 posts

Jul 05, 2017 at 11:39

Member Since Oct 16, 2013

18 posts

Oh yes, you are right, I didn't even notice that before! 0.14 lot size for a normal trade, but the trade following a loss is at 0.98! 😲

Yes, I did the same, for both Asia and for 41799. Asia was disqualified for about a week before he made a return! With 41799 though they told me it was still within their acceptance criteria, which I find a bit bizarre, but anyway.

I think the problem is related to open vs closed DD - you can have a system with a balance of $1000, open a trade which goes negative by 95%, then recovers and closes for a 5% loss. The DD will show as 5% on the stats, not the fact that it was down 95% - that is why it is always important to look at the equity curve and the balance vs. equity at times of DD.

Yes, I did the same, for both Asia and for 41799. Asia was disqualified for about a week before he made a return! With 41799 though they told me it was still within their acceptance criteria, which I find a bit bizarre, but anyway.

I think the problem is related to open vs closed DD - you can have a system with a balance of $1000, open a trade which goes negative by 95%, then recovers and closes for a 5% loss. The DD will show as 5% on the stats, not the fact that it was down 95% - that is why it is always important to look at the equity curve and the balance vs. equity at times of DD.

Jul 05, 2017 at 13:09

Member Since Aug 31, 2016

5 posts

Thanks to Leon, Jeff, fxtrader, (and others) for the great comments that I second strongly.

In addition to their comments;

The system that is the absolute best in the list [according to past performance in pips, which as we all know has limited value, but is all we have :) ], but has been unmentioned on this thread [as far as I know] is SLINGSHOT.

Please support this trader so he continues being a system provider on copytrader.

Hint; you can manage trade lot size in settings.

Thx.

In addition to their comments;

The system that is the absolute best in the list [according to past performance in pips, which as we all know has limited value, but is all we have :) ], but has been unmentioned on this thread [as far as I know] is SLINGSHOT.

Please support this trader so he continues being a system provider on copytrader.

Hint; you can manage trade lot size in settings.

Thx.

forex_trader_156646

Member Since Oct 16, 2013

18 posts

Jul 05, 2017 at 14:54

Member Since Oct 16, 2013

18 posts

IMHO - myfxbook should decide whether they just want to be another run of the mill signal provider offering signals where this type of irresponsible trading is allowed, or whether they want to be the premier site, offering only a small number of signal providers, but they are all of the highest quality.

There are so many websites offering signals, but most of them are rubbish, so it would be really refreshing to have a site, where only the best trades are allowed in!

There are so many websites offering signals, but most of them are rubbish, so it would be really refreshing to have a site, where only the best trades are allowed in!

Member Since Jan 23, 2017

17 posts

Jul 06, 2017 at 07:09

Member Since Jan 23, 2017

17 posts

"Please wait while we're loading live data..."

I get this for my 2 accounts with BlackBull and PeEpperstone for about 1 hour now ... cannot do anything on my accounts

WHATS WRONG WITH YOU SYSTEMS GUYS ????

GET YOUR SERVERS WORKING !!!

I get this for my 2 accounts with BlackBull and PeEpperstone for about 1 hour now ... cannot do anything on my accounts

WHATS WRONG WITH YOU SYSTEMS GUYS ????

GET YOUR SERVERS WORKING !!!

technobilder@

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.