- Strona główna

- Społeczność

- Ogólne

- what is biggest pip trade you have seen?

Advertisement

Edit Your Comment

what is biggest pip trade you have seen?

Uczestnik z Feb 22, 2011

4573 postów

Nov 18, 2019 at 12:08

Uczestnik z Feb 22, 2011

4573 postów

tacet posted:togr posted:

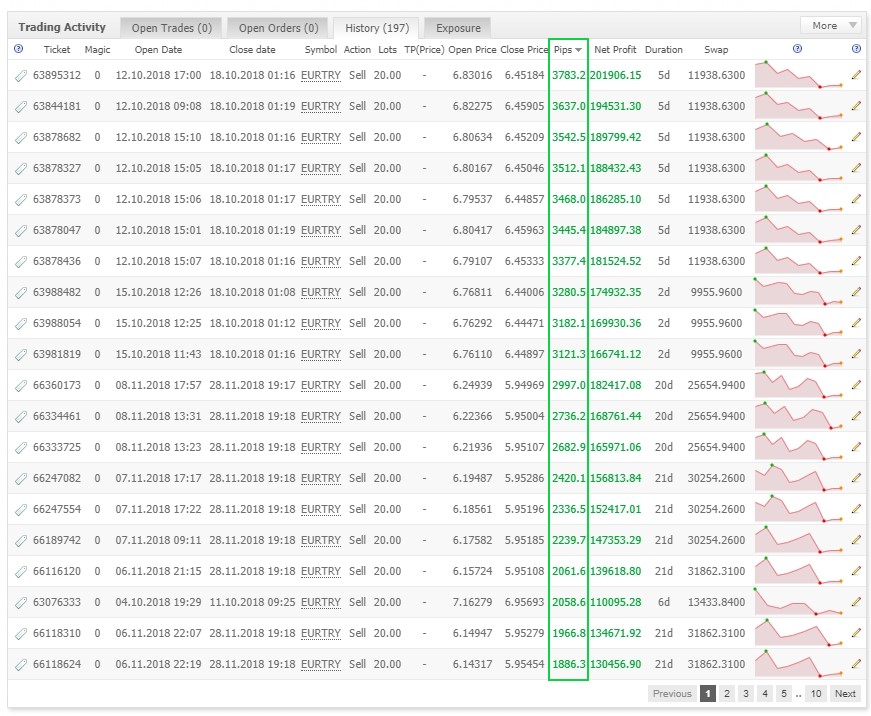

I made 20705.3 pips on my Caesar account.

That is what count, single trade even though it might be impressive does mean nothing as in context with other trades it might even be loss when you sum it up.

Imagine opening 2 trades with opposite direction at the same time, you got very big winner with lot of pips which you can post here,

but as a sum of both trades you will face the loss - if you close them both at the same time,

it might be possible to close both with profit but that would reuqire closing them at different times and not much market move,

what you said is absolutely right, but the trader who started this thread had a specific question. It's like in sports, f.e. tennis - you may play on the ATP tour, getting to semi-finals many times and winning a lot of money, but never reaching or winning in major finals like in the Opens... Trend traders do discuss/show their longest trades in pips - because for them one of the most important qualities is to run a trade from start to end! Thus the question asked in the beginning of the thread is a rightful one... Scalpers may not appreciate this topic but they should not dismiss it.

I like your Caesar trading, a good number of pips - it would correspond to a bloody long trend (2-3 years) 😄...

Yeah it is competition who has bigger gun... Than I am not winner :)

Uczestnik z Jan 25, 2010

1288 postów

Nov 18, 2019 at 20:28

(edytowane Nov 18, 2019 at 20:29)

Uczestnik z Jan 25, 2010

1288 postów

Still in First Place!

Still in Second Place!

1. Achievements of other traders ought to be admired;

2. Take the challenge and share your best trend trade with everyone!

Trading is not only a competition against others: it is a competition to improve oneself too.

tacet posted:

Outside major pairs my tops:

Still in Second Place!

BluePanther posted:

My personal best:

1. Achievements of other traders ought to be admired;

2. Take the challenge and share your best trend trade with everyone!

Trading is not only a competition against others: it is a competition to improve oneself too.

togr posted:

Yeah it is competition who has bigger gun... Than I am not winner :)

Nov 19, 2019 at 10:03

Uczestnik z Mar 10, 2019

55 postów

BluePanther posted:

1. Achievements of other traders ought to be admired;

2. Take the challenge and share your best trend trade with everyone!

Trading is not only a competition against others: it is a competition to improve oneself too.

Well said! I don't care whether I am first or last cos in the end as vtorg said the amount of $ in your wallet is the king... But to get to a good level one need to learn, and learning from the best is the best.... Nobody laughs at W Buffett for holding Coca-Cola for 73 years 😂, the Renaissance Tech hedge fund is also admired: huge 1-2 pip leveraged trades... we have to learn from them. It's like in sports running: there are sprinters and long distance runners - all good, none bad. In trading: there are scalpers and trend traders: all good, none bad... In this thread a trader asked trend traders to show their results/records - I think it's interesting and quite rare, it prompted me to start a Fundamental Analysis discussion elsewhere, which is paramount thing for trend traders. But this thread is not active because mostly in RETAIL forex it's all about scalping with EAs/cbots - great thing, no doubt, and I never met a trend trader who was critical to scalping 😎

every beautiful garden has a strong hedge around

Uczestnik z Aug 27, 2017

875 postów

Nov 30, 2019 at 15:25

Uczestnik z Aug 27, 2017

875 postów

Well; I have seen so many unrealistic trading lots size on social media; but I didn’t believe it!

keeping patience.......

Uczestnik z Jan 25, 2010

1288 postów

Mar 13, 2020 at 05:57

(edytowane Mar 13, 2020 at 05:58)

Uczestnik z Jan 25, 2010

1288 postów

BluePanther posted:

Still in First Place!tacet posted:

Outside major pairs my tops:

Still in Second Place!BluePanther posted:

My personal best:

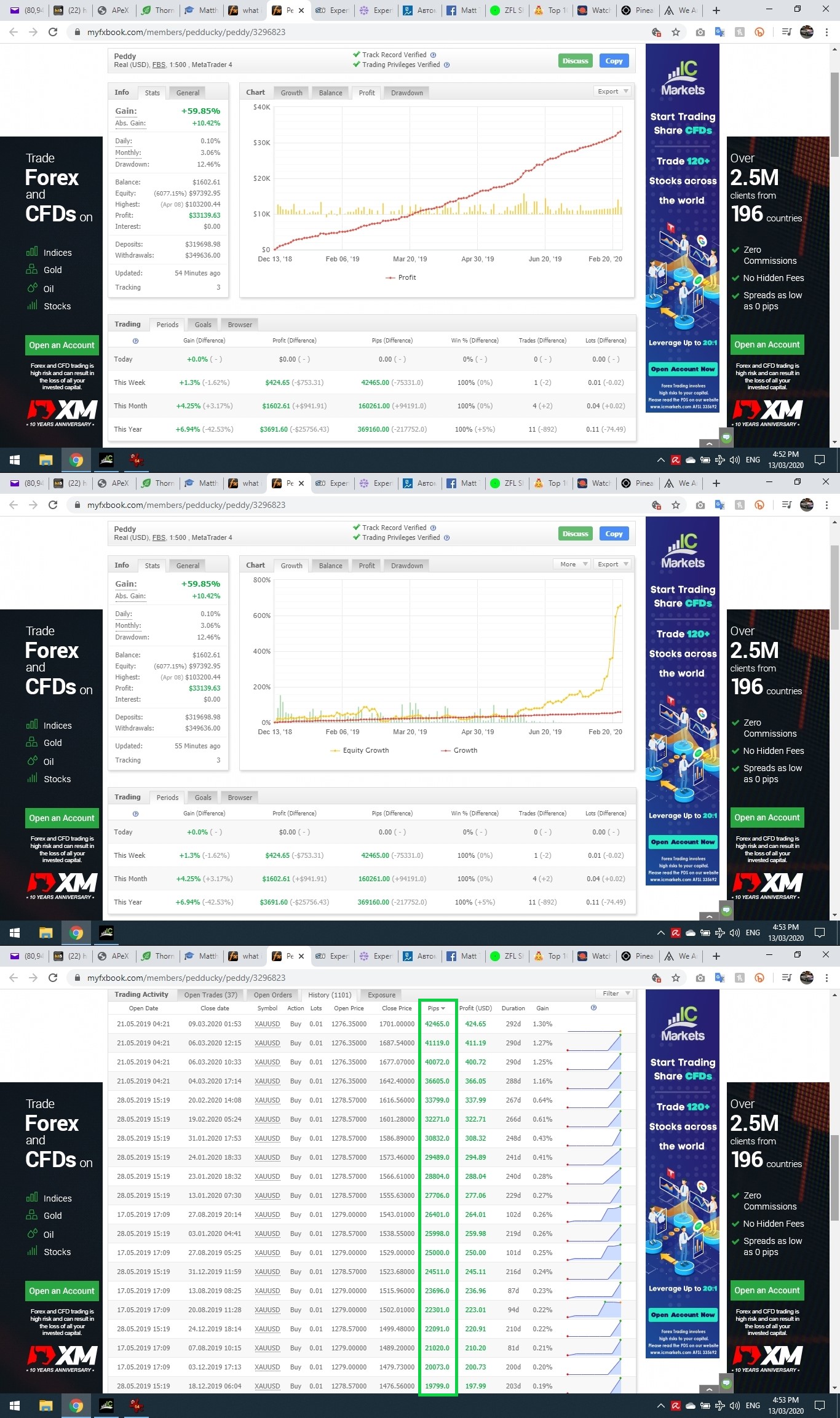

NEW FIRST PLACE! AMAZING!

https://www.myfxbook.com/members/pedducky/peddy/3296823

Uczestnik z Mar 12, 2020

3 postów

Uczestnik z Apr 01, 2020

227 postów

Jun 08, 2020 at 00:13

Uczestnik z Apr 01, 2020

227 postów

BluePanther posted:pullpotential posted:

Some big pip targets here but pips it a totally meaning less measure for profit. $$$$ and %%%% are what really matter

Take care of your pips, and the profits will take care of themselves! 😎

You are right.

Uczestnik z Jul 20, 2019

338 postów

Jun 09, 2020 at 15:30

Uczestnik z Jul 20, 2019

338 postów

The highest pip amounts you'll get with trading stocks and commodities and maybe some exotic forex pairs aswell. But be aware of the risk when trading such things using a high account leverage.

patience is the key

Uczestnik z Jul 23, 2020

816 postów

Oct 12, 2020 at 06:35

Uczestnik z Jul 23, 2020

816 postów

Arthur63265353 posted:pullpotential posted:

Some big pip targets here but pips it a totally meaning less measure for profit. $$$$ and %%%% are what really matter

I also believe that % is the most important thing to pay attention to

What percentage you gain is important rather than how much you earn. Trader should have a target like 10% monthly gain.

Uczestnik z Jun 22, 2020

38 postów

Uczestnik z Mar 17, 2021

494 postów

Oct 18, 2021 at 12:05

Uczestnik z Mar 17, 2021

494 postów

Miguelfabian posted:

My profits have been averaging around 5% the last 3 months. Need to change my strategy.

Always remember about facing losses in this market.

*Komercyjne wykorzystanie i spam są nieprawidłowe i mogą spowodować zamknięcie konta.

Wskazówka: opublikowanie adresu URL obrazu / YouTube automatycznie wstawi go do twojego postu!

Wskazówka: wpisz znak@, aby automatycznie wypełnić nazwę użytkownika uczestniczącego w tej dyskusji.