Edit Your Comment

how to get good return on investment.

會員從Jul 11, 2019開始

1帖子

Jul 15, 2019 at 08:53

會員從Jul 11, 2019開始

1帖子

Hi Everyone,

We always would like to invest money and get great returns. There are different ways of investing money for this kind of return. You need to be practical and patient to get great returns over the long-term. One of the simplest ways of investing money is investing in your own home. While burying the home you shall consider both its comfort and future value. If you are able to identify a location who is having a future value, you are definitely going to make good money. Our primary intention is making a good return over the investment and having a great home is not a priority in this case. The advantage of investing money in your own home is you are free from the capital gains tax when you are selling it out. The basic reason for this is you are not bought it as a business and it is for your own living. Any way you shall prove this intention to the target is to get the tax exemption. The other advantage is with respect to a newly built house you are going to get an exemption on value-added taxes. Here you shall find a balance between the beautiful homes that you want to live and the money that you wish to make.

We always would like to invest money and get great returns. There are different ways of investing money for this kind of return. You need to be practical and patient to get great returns over the long-term. One of the simplest ways of investing money is investing in your own home. While burying the home you shall consider both its comfort and future value. If you are able to identify a location who is having a future value, you are definitely going to make good money. Our primary intention is making a good return over the investment and having a great home is not a priority in this case. The advantage of investing money in your own home is you are free from the capital gains tax when you are selling it out. The basic reason for this is you are not bought it as a business and it is for your own living. Any way you shall prove this intention to the target is to get the tax exemption. The other advantage is with respect to a newly built house you are going to get an exemption on value-added taxes. Here you shall find a balance between the beautiful homes that you want to live and the money that you wish to make.

會員從Jul 16, 2019開始

7帖子

會員從Jan 05, 2016開始

1097帖子

Jul 16, 2019 at 22:05

會員從Jan 05, 2016開始

1097帖子

Alexander654 posted:

What if you do not own your own home and need to get funds together so that you can buy your own home?

Opening an account with the understanding you are going to make enough to buy your own home isn't a good way to make money. Investing should never be done with money you cannot afford to lose. If you cannot afford a home right now, then you probably shouldn't count on Forex to do it for you. There simply isn't any guarantee a person is going to make a profit.

Think about this for a moment.... If suddenly today you lost your current primary stream of income how long would you be able to survive financially before it had a significant impact on your life if it could not be quickly replaced? 1 day? 1 week? 1 month? 6 months?

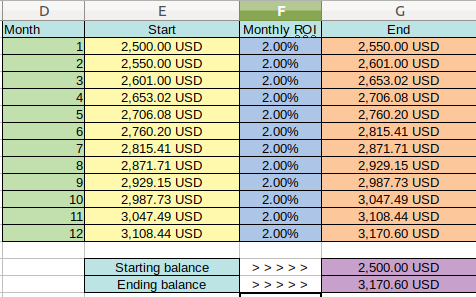

Now think for a moment about the fact that you are intending to open a live trading account with enough funds to be able to start trading at a reasonable level to make a small profit each month. Let's say that you've managed to save up $2500.00 for your opening deposit into your live account. And now think about the fact that there is an extremely high probability that you are going to lose your investment capital.

Let's say that you make $15.00 USD per hour and you work 40 hours a week.

40 hours X $15.00 USD = $600.00 USD before taxes.

In 4 weeks you would make $2400.00 USD before taxes

After you've made your rent payment, insurance payments, food to eat, internet, other utilities, how much money do you have left over? I'm guessing that the answer is going to be something similar to "not much left".

Can you honestly say that suddenly losing your initial investment capital is not going to have an impact on your life?

Investing should NEVER be done with money you cannot afford to lose.

In my opinion, it would be best to simply start small and invest over time slowing, and use strong risk management.

2% gain per month is a solid safe return on your investment.

If it looks too good to be true, it's probably a scam! Let the buyer beware.

會員從Aug 27, 2017開始

875帖子

會員從Jul 19, 2020開始

283帖子

會員從Mar 17, 2021開始

494帖子

會員從Jan 05, 2021開始

12帖子

會員從Jan 07, 2021開始

15帖子

會員從Jul 23, 2020開始

696帖子

會員從Mar 16, 2021開始

447帖子

Jun 08, 2021 at 09:05

(已編輯Jun 08, 2021 at 09:13)

會員從Jun 02, 2021開始

1帖子

Hello. To get the desired return on investment, you need to carefully study the market and carefully choose the most promising direction. Recently, I only invest in real estate because it is constantly becoming more expensive. Of course, this is not an easy task. You need to have the buying and selling skills to be legally equipped. If you are a beginner, you can resort to the help of specialists in this matter.

會員從Jul 23, 2020開始

816帖子

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。