- Beranda

- Komunitas

- New Traders

- Your opinion needed - regarding my choice of indicators

Advertisement

Edit Your Comment

Your opinion needed - regarding my choice of indicators

Sep 25, 2009 at 13:08

Member Since Sep 16, 2009

8 posts

Hello all,

I am considering trading on daily charts. For this purpose i am planning to use Stochastics Oscillator(default settings) for entry signals and ADX(default settings) for trend confirmation. Is it correct to use these indicator for the above purpose? If not can you suggest any alternative?

Your inputs much appreciated

Thanking you

I am considering trading on daily charts. For this purpose i am planning to use Stochastics Oscillator(default settings) for entry signals and ADX(default settings) for trend confirmation. Is it correct to use these indicator for the above purpose? If not can you suggest any alternative?

Your inputs much appreciated

Thanking you

Member Since Sep 23, 2009

17 posts

Sep 25, 2009 at 17:28

(edited Sep 25, 2009 at 17:29)

Member Since Sep 23, 2009

17 posts

Shankar,

No one can really answer that question for you. There are so many variables here we would have to write a book. First and foremost is the volatility you will encounter taking signals from a daily data-point. It means you will typically be in a trade for weeks while things develop. This can lead to very deep draw-downs. Proper account funding use of leverage are paramount here.

Your best bet here is to sit down and learn first and foremost how to properly test a system, then apply your questions to the test method and see what returns are generated. You will need significant data to back test and you need to know how to extract the right information from that. Read Evidence Based Technical Analysis as a start for your testing and expand from there.

In your style of trading Data Mining and Parameter Optimization, from a statistically significant data sample, are your friends.

Remember; Good Trading, like Brain Surgery, is the result of hard work, diligent research and study. You don't start there, that's where you end up.

No one can really answer that question for you. There are so many variables here we would have to write a book. First and foremost is the volatility you will encounter taking signals from a daily data-point. It means you will typically be in a trade for weeks while things develop. This can lead to very deep draw-downs. Proper account funding use of leverage are paramount here.

Your best bet here is to sit down and learn first and foremost how to properly test a system, then apply your questions to the test method and see what returns are generated. You will need significant data to back test and you need to know how to extract the right information from that. Read Evidence Based Technical Analysis as a start for your testing and expand from there.

In your style of trading Data Mining and Parameter Optimization, from a statistically significant data sample, are your friends.

Remember; Good Trading, like Brain Surgery, is the result of hard work, diligent research and study. You don't start there, that's where you end up.

forex_trader_2062

Member Since Oct 24, 2009

178 posts

Oct 24, 2009 at 23:56

Member Since Oct 24, 2009

178 posts

You can use any indicator as long as you know what those mean, how they work etc, now, you are mentioning a daily chart,if you have a lot of money in your account, good, otherwise, use the daily to ID the trend and use 1Hr for placing trades.

Good trading

Good trading

Nov 20, 2009 at 22:30

Member Since Nov 20, 2009

20 posts

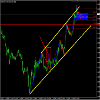

I use the stocastic-slow but the setting is not on default it is on 36 days, the reason being, the forex market is 6days a week multiplied by 6 = 36days that is a square root number which works good in forex per W.D. Gann, he was a wiz when it came to #'s and 36 days is a month and a week so its a good indicator for me, because it shows when the trends are begining and ending levels above 80 are over bought and levels below 20 are over sold, I hope this helps, I'm a price action trader also but I trade on the 5 minute chart. 25minutes in and out, 5 candles, target hit! but sometimes hr and 4hr charts to get major swings, my indicators are ichimoku, 20 moving avg and stocastic 36days, along with Gann lines as support and resistance, heres a live trade from last week on 11/09-11/10/2009 that took 15hr on hr chart +99pip.......gann lines are green, blue lines are open and close of the trade red lines are resistance and support.......the cloud, red,blue, and white lines are the ichimoku, and the green line is a 20day moving average I put up two charts so it won't look confusing but just look @ the stocastic telling you the swing is about to happen, and if you notice price crossed below the 20MA, when price crosses 20ma tenkan/kijun all at once generally you'll have a swing, thats 1 price action method😁

Early Birds get the worms!!!

Nov 20, 2009 at 22:51

Member Since Sep 20, 2009

16 posts

your indicators are good for the purpose you describe and providing you are using the stochs to trigger entries after pullbacks in a trend you should be ok. I would use 5.3.3 setting for a quick response from the stochs. I would suggest including price action and technical analysis to find trends and entry levels. Eventually, with practice and experience, you will out perform the indicators by a wide margin

Nov 26, 2009 at 16:53

Member Since Nov 09, 2009

27 posts

YOU DON'T NEED INDICATORS!

The only thing you need is a SMA - but its not much useful.

Indicators suck!

The market moves UP and DOWN. This movements (up and down) are based on opened trades and the trades that are executing right now.All technical indicators takes these movements and draws something on your screen. But these movements are different in days, weeks, months and years. So for example, if you see today something with your indicators and you see the same before 2 days - these thing are based on different data and this information is useless for you.

All EAs and strategies, based on technical indicators, ARE DOOMED!

if you see working EAs here - they are on demo accounts... its different when you play on live account.

Memento mori!

Nov 26, 2009 at 17:17

(edited Nov 26, 2009 at 17:17)

Member Since Aug 06, 2009

386 posts

mettall posted:

YOU DON'T NEED INDICATORS!

The only thing you need is a SMA - but its not much useful.

Indicators suck!

The market moves UP and DOWN. This movements (up and down) are based on opened trades and the trades that are executing right now.All technical indicators takes these movements and draws something on your screen. But these movements are different in days, weeks, months and years. So for example, if you see today something with your indicators and you see the same before 2 days - these thing are based on different data and this information is useless for you.

All EAs and strategies, based on technical indicators, ARE DOOMED!

if you see working EAs here - they are on demo accounts... its different when you play on live account.

i agree with you metall, i believe that most of the successful traders do not use indicators at all.

Street Pipz, i've just noticed your chart, and quite frankly i would like to know how are you handling so many indicators and so many different colors 😱? i've stared at it for 10 seconds and already felt a migraine starting to work its way😀.

Sleep is for the weak.

Nov 28, 2009 at 09:32

Member Since Nov 20, 2009

20 posts

It's very simple, each color represents something different (there are only three up on the chart), you are both totally right you don't need any indicators, BUT the traders that are on Paternoster Square, and 2-1 Nihombashi, probaly have indicators, or they would lose they're jobs, and every propfessional trader that I know (as in I can go to their houses, not heard of), uses indicators also, when I mean pro, I mean people that their only source of income is trading........................so we kinda want to mirror those guy that use $1000.00 pips right? besides I get my info from the streetz!!! but the most important thing in trading are not even on the charts, it's called money management/risk management, if you can't master those two tactics and have them written down and follow them in every trade you will always fail in the long run, and that is something that I have not seen alot on this site.......managing your denero is the most important substance in trading, thats why you have people that have alot of drawdowns.....Shankar make sure everytime you click, you have a stop/loss and take profit in place always, think about it, some people think if you have a s/l and t/p in place on your orders that the trade may go against them to fast or that they dont want to loss that trade....then maby you shouldn't place that one, you should only press that mouse if you are confident that you won't loss and if you do, that you already know where and how much you are going to loss, does anyone have a trading plan in place written down?

Early Birds get the worms!!!

Nov 28, 2009 at 10:23

Member Since Nov 20, 2009

20 posts

I just looked at your RSI breakout post and I thought you don't use any indicators? when u said that in reply to my post, I thought u meant, you use a price line, no candlesticks, no indicators, no trend lines, nothing on your chart but just raw intellect, using price action? so you don't use fibonacci tools neither huh?

biz0101 posted:

mettall posted:

YOU DON'T NEED INDICATORS!

The only thing you need is a SMA - but its not much useful.

Indicators suck!

The market moves UP and DOWN. This movements (up and down) are based on opened trades and the trades that are executing right now.All technical indicators takes these movements and draws something on your screen. But these movements are different in days, weeks, months and years. So for example, if you see today something with your indicators and you see the same before 2 days - these thing are based on different data and this information is useless for you.

All EAs and strategies, based on technical indicators, ARE DOOMED!

if you see working EAs here - they are on demo accounts... its different when you play on live account.

i agree with you metall, i believe that most of the successful traders do not use indicators at all.

Street Pipz, i've just noticed your chart, and quite frankly i would like to know how are you handling so many indicators and so many different colors 😱? i've stared at it for 10 seconds and already felt a migraine starting to work its way😀.

Early Birds get the worms!!!

Member Since Nov 18, 2009

27 posts

Nov 29, 2009 at 00:22

(edited Nov 29, 2009 at 00:29)

Member Since Nov 18, 2009

27 posts

Hi Shankar.

A couple of things to think about.

1. When you open a position, ANY position, you need to know that if all goes wrong, that you can fully afford to lose the amount you have your stop loss set to.

This sounds like obvious logic, and it is, but often one tends to try risk more than what is safe to get that extra dollar. So it often gets pushed into the background. Don't allow your greed gland to overide the obvious.

2. On daily charts, the movement that the price ranges between means that you can only safely trade with fractions of a percent of your balance, and you are looking at trading long term rather than catching the short term money. So if you intend to trade on the daily charts you need to look first at the monthly charts to get a longer term view.

3. As far as indicators go, they are all hindsight instruments. They are delayed by their very nature, and can only represent patterns based on past movements. The bars themselves are the closest you can get to real time indicators, and even they are past tense.

4. If you are trading short term trades, do not EVER forget to be aware of when the various News events are due to occur. It often happens that a perfectly good trend for a quick 20 pip trade gets turned on it's ear by a news situation. If you are in a trade and a news event is about to happen, it is always good to tighten up your stop losses.

5. Most important of it all..... If you rush, you crush.

On this Friday just past, I was in a long trade on AudUsd and it was going way south. So I was hedge scalping with NzdUsd shorts to keep it alive till the retrace. All was fine. About 20 minutes before market close, I began to calculate exactly how many lots of NzdUsd I would need to go short with to keep an even keel till Sunday opening. I then put in my short, only to discover that I overlooked WHICH pair I was opening the trade with. It ended up being AudUsd. I trade with Navigator (not MT4) so going short with an live long in the same currency closes the long, while on MT4 it would have said 'Hedging not allowed'. So basically by one 'small' oversight, I trashed my account.

The two things I did not pay attention to which are paramount. I traded with more than I could afford to lose. I rushed what should have been a simple trade.

Lance.

A couple of things to think about.

1. When you open a position, ANY position, you need to know that if all goes wrong, that you can fully afford to lose the amount you have your stop loss set to.

This sounds like obvious logic, and it is, but often one tends to try risk more than what is safe to get that extra dollar. So it often gets pushed into the background. Don't allow your greed gland to overide the obvious.

2. On daily charts, the movement that the price ranges between means that you can only safely trade with fractions of a percent of your balance, and you are looking at trading long term rather than catching the short term money. So if you intend to trade on the daily charts you need to look first at the monthly charts to get a longer term view.

3. As far as indicators go, they are all hindsight instruments. They are delayed by their very nature, and can only represent patterns based on past movements. The bars themselves are the closest you can get to real time indicators, and even they are past tense.

4. If you are trading short term trades, do not EVER forget to be aware of when the various News events are due to occur. It often happens that a perfectly good trend for a quick 20 pip trade gets turned on it's ear by a news situation. If you are in a trade and a news event is about to happen, it is always good to tighten up your stop losses.

5. Most important of it all..... If you rush, you crush.

On this Friday just past, I was in a long trade on AudUsd and it was going way south. So I was hedge scalping with NzdUsd shorts to keep it alive till the retrace. All was fine. About 20 minutes before market close, I began to calculate exactly how many lots of NzdUsd I would need to go short with to keep an even keel till Sunday opening. I then put in my short, only to discover that I overlooked WHICH pair I was opening the trade with. It ended up being AudUsd. I trade with Navigator (not MT4) so going short with an live long in the same currency closes the long, while on MT4 it would have said 'Hedging not allowed'. So basically by one 'small' oversight, I trashed my account.

The two things I did not pay attention to which are paramount. I traded with more than I could afford to lose. I rushed what should have been a simple trade.

Lance.

"Whatever you focus your attention on, your consciousness becomes." - Lex Lungold.

Nov 30, 2009 at 20:30

Member Since Nov 09, 2009

27 posts

streepips posted:

...but the most important thing in trading are not even on the charts, it's called money management/risk management, if you can't master those two tactics and have them written down and follow them in every trade you will always fail in the long run, and that is something that I have not seen alot on this site.......managing your denero is the most important substance in trading, thats why you have people that have alot of drawdowns....

yes, this is the most important...

Only with constant rules for money management and risk management you can survive in the most volatile market.

Memento mori!

Dec 02, 2009 at 22:18

Member Since Nov 20, 2009

20 posts

yes mettall they are rules, that one should follow, I've seen it time and time again, even when I first start trading I was using more than 2% of my account balance blowing it out badly, naturally the markets are driven by fear and greed so you are right in your first emotions whether it be to buy or to sell but sometimes we don't go by our instints, no more than 2% on any trade is the best policy!!!

Early Birds get the worms!!!

Jan 31, 2010 at 16:51

Member Since Jan 16, 2010

4 posts

i think the very best way is to trade with NO indicators :) Look at http://www.nobrainertrades.com/ i use this technics.

Remember

trading is simple but not easy !!!

on this acc i'm trading very agressive. Hard progress.

https://www.myfxbook.com/portfolio/agresive-one-topfxsignalscompl/14166

Remember

trading is simple but not easy !!!

on this acc i'm trading very agressive. Hard progress.

https://www.myfxbook.com/portfolio/agresive-one-topfxsignalscompl/14166

forex_trader_6207

Member Since Jan 27, 2010

55 posts

Mar 27, 2010 at 11:50

Member Since Jan 27, 2010

55 posts

Indicators can be useful for an experienced trader that already understands the markets cycles, but A beginner will never achieve their goals by relying on indicators. Your best bet, is focus on a clean chart and multiple time frame analysis. Good Luck.

Member Since Sep 04, 2009

849 posts

Mar 27, 2010 at 14:30

Member Since Sep 04, 2009

849 posts

pipinvestment0 posted:

Indicators can be useful for an experienced trader that already understands the markets cycles, but A beginner will never achieve their goals by relying on indicators. Your best bet, is focus on a clean chart and multiple time frame analysis. Good Luck.

Since u seem to be such an experienced adviser show us plz your myfxbook account.....😉

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.