- Beranda

- Komunitas

- Trading Systems

- DRFX TRADING SERVICE 2016

Advertisement

DRFX TRADING SERVICE 2016 (By DRFXTRADING )

| Gain : | +42.43% |

| Drawdown | 16.70% |

| Pips: | 786.0 |

| Trades | 18 |

| Won: |

|

| Lost: |

|

| Type: | Demo |

| Leverage: | 1:100 |

| Trading: | Manual |

Edit Your Comment

DRFX TRADING SERVICE 2016 Discussion

Member Since Nov 19, 2014

157 posts

Mar 02, 2016 at 17:00

(edited Mar 02, 2016 at 17:16)

Member Since Nov 19, 2014

157 posts

This System is based on 4 Swing Trading Strategies that target gains of 100 to 200 Pips Per Trade.

System uses the Candlesticks Signals and Patterns of the Daily and 4 Hour Charts for Entry and Exit, which are more reliable than those of the Lower Time Frames.

Holding Periods for each trade depend on the Strategy being used, but they are between 4 to 7 Days.

The goal is to show how Swing Trading is a more reliable and sustainable approach to Forex Trading over the long-term, especially when we target the best setups offered by the market each week.

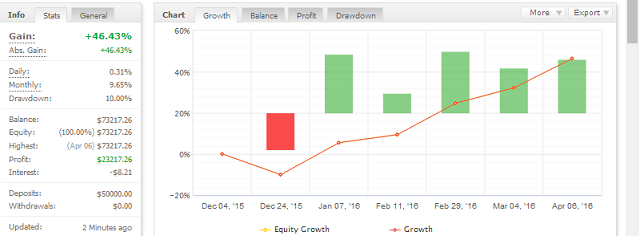

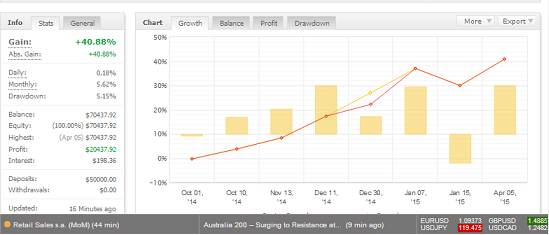

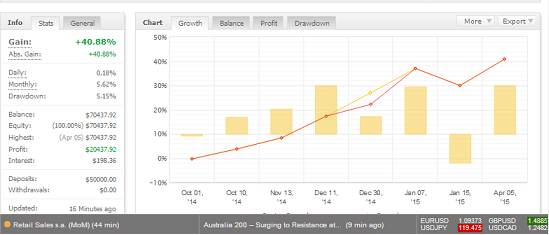

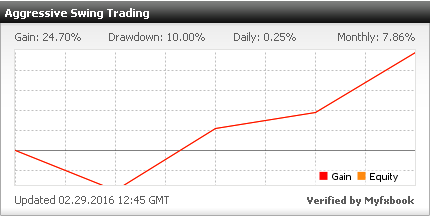

This is a more aggressive version of the previous System that generated 40% in 7 Months.

https://www.myfxbook.com/portfolio/conservative-swing-trading/1079693

Although this was good for the conservative trader, the current version offers a faster Rate of Return in a much shorter time period. With this approach, the following targets are expected to be hit in the next few weeks and months.

1. 100% Rate of Return (March 30th, 2016)

2. 200% Rate of Return (April 30th, 2016)

3. 500% Rate of Return (May 30th, 2016)

4. 1000% Rate of Return (June 30th, 2016)

By targeting the best setups that bypass Intra-Day Volatility, Swing Trading can continue to provide the best approach to Short and Long-Term Wealth.

Questions, Comments and Interest in using this system are welcome.

Duane

DRFXSWINGTRADING

System uses the Candlesticks Signals and Patterns of the Daily and 4 Hour Charts for Entry and Exit, which are more reliable than those of the Lower Time Frames.

Holding Periods for each trade depend on the Strategy being used, but they are between 4 to 7 Days.

The goal is to show how Swing Trading is a more reliable and sustainable approach to Forex Trading over the long-term, especially when we target the best setups offered by the market each week.

This is a more aggressive version of the previous System that generated 40% in 7 Months.

https://www.myfxbook.com/portfolio/conservative-swing-trading/1079693

Although this was good for the conservative trader, the current version offers a faster Rate of Return in a much shorter time period. With this approach, the following targets are expected to be hit in the next few weeks and months.

1. 100% Rate of Return (March 30th, 2016)

2. 200% Rate of Return (April 30th, 2016)

3. 500% Rate of Return (May 30th, 2016)

4. 1000% Rate of Return (June 30th, 2016)

By targeting the best setups that bypass Intra-Day Volatility, Swing Trading can continue to provide the best approach to Short and Long-Term Wealth.

Questions, Comments and Interest in using this system are welcome.

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Member Since Nov 19, 2014

157 posts

Mar 02, 2016 at 17:05

Member Since Nov 19, 2014

157 posts

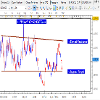

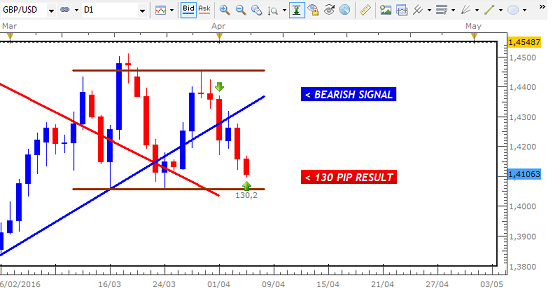

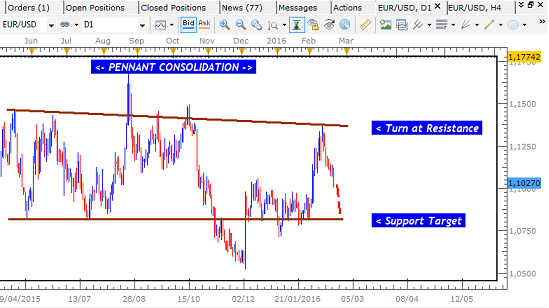

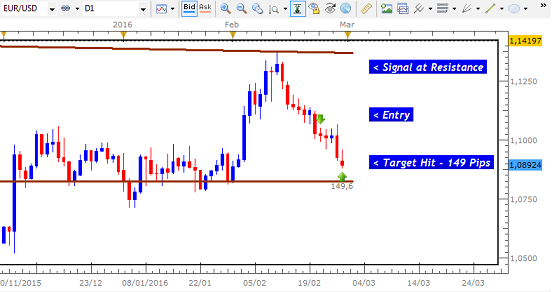

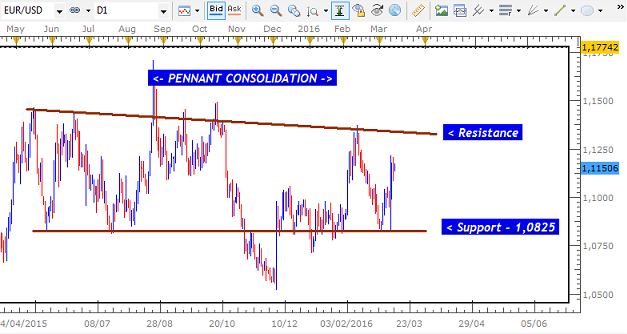

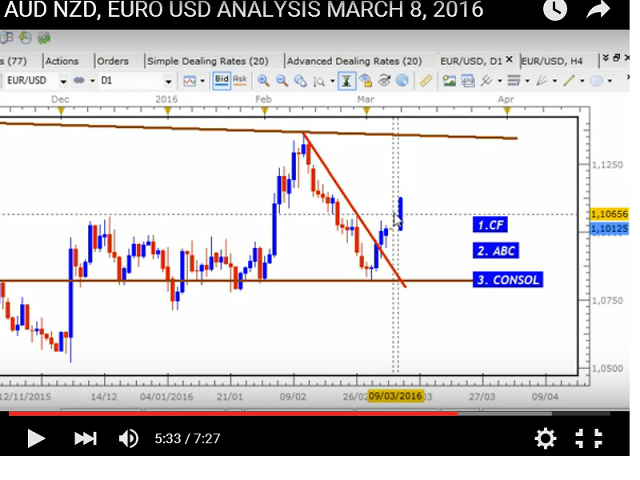

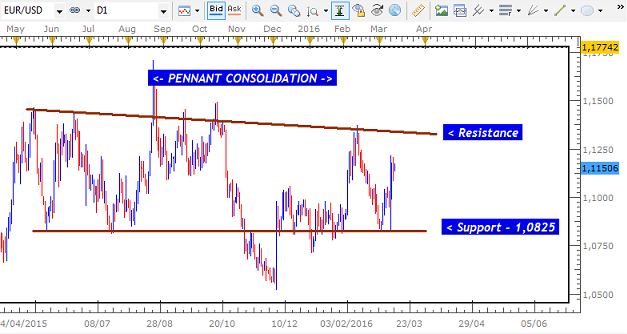

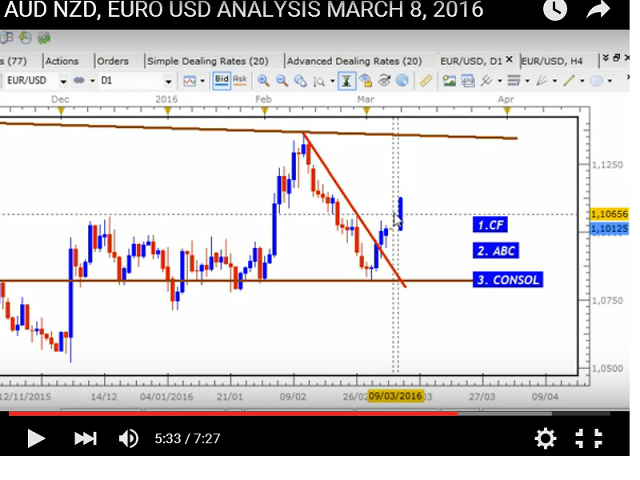

Latest trade gave us a 149 Pip gain on the EURO USD as it headed to Support of Pennant on Daily Chart.

This was the overall setup as seen in this chart and the Video Analysis

/FEB_4_2016__EURO_USD_4H_ENTRY_SETUP_Bn.png" target="_blank" rel="noopener noreferrer nofollow">

After a few days, target was hit.

Overall, Return from these Strategies is now 25%

This trade continues to show how we can better results by focusing on the larger time frames. These offer larger movements and more reliable signals to take advantage of these trends.

Stop Losses should be placed at areas that will protect trades against temporary pullbacks before our targets are hit. Support and Resistance and Trend Lines - once strong enough - great places for Stop Losses.

MAIN TECHNICAL HIGHLIGHTS OF TRADE

- Trading Within Consolidations

- Using Strong Daily Candle Signals

- Using Strong Stop Loss Areas on the 4 Hour Chart

- Waiting Patiently Until Target is Hit

- Strong Gains Possible with Swing Trading

Regards

Duane

DRFXSWINGTRADING

Trade Less, Earn More

Member Since Nov 19, 2014

157 posts

Mar 10, 2016 at 04:50

Member Since Nov 19, 2014

157 posts

How goes it traders?

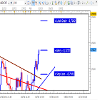

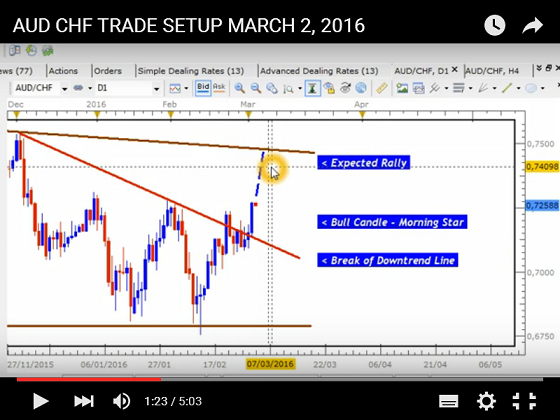

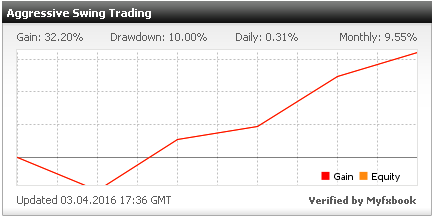

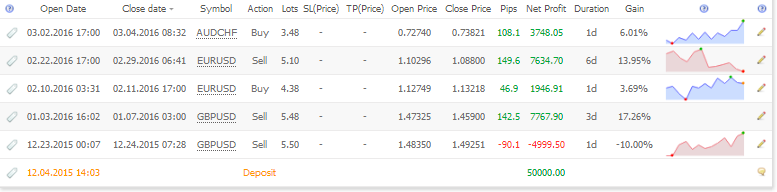

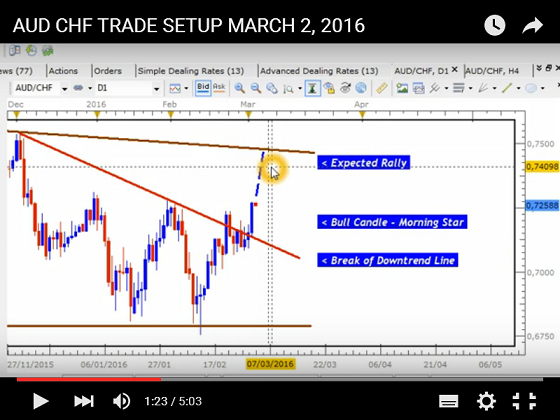

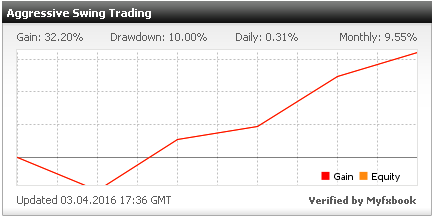

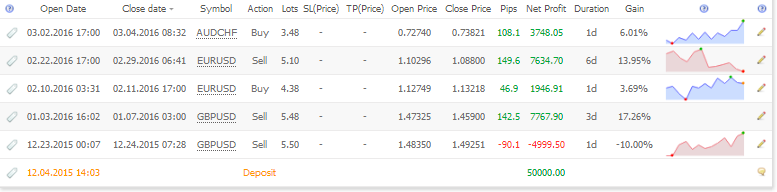

Another good trade made, AUD CHF, 108 Pips.

Return now up to 32% from just 4 trades, 2 Months, targeting 100% within next couple of weeks.

Setup for the trade was the Bullish Trend within a Large Pennant on the Daily Chart, that was taking us to the Resistance Boundary.

The Signal to get things going was that Morning Star Candlestick Formation above the broken Downtrend Line.

/MARCH_1_2016_AUD_CHF_4H_ENTRY_SETUP.png" target="_blank" rel="noopener noreferrer nofollow"> /MARCH_1_2016_AUD_CHF_4H_ENTRY_SETUP.png"/>

/MARCH_1_2016_AUD_CHF_4H_ENTRY_SETUP.png"/>

By Friday, 2 Days later, target was hit.

/MARCH_1_2016_AUD_CHF_MYFXBOOK_TRADE.png" target="_blank" rel="noopener noreferrer nofollow"> /MARCH_1_2016_AUD_CHF_MYFXBOOK_TRADE.png"/>

/MARCH_1_2016_AUD_CHF_MYFXBOOK_TRADE.png"/>

This was a very short trade compared to the others that tend to last between 3 and 5 Days.

Trades within Consolidations of the size can be extremely profitable given the wide distance between Support and Resistance. Key is to spot the signals in time - THE CORRECT SIGNALS - make sure that setup meets our/your trading rules, then trade it. However, the challenge can be the time to hold these trades, ranging from 4- 7 Days on average for these size Consolidations in most cases, so I was fortunate that this just took 2 days.

Other highlights

- Bullish Candlestick Signals (Morning Star)

- Double Bottoms (see Video)

- Breaks of Downtrend Lines

- Resistance

Duane

DRFXTRADING

Another good trade made, AUD CHF, 108 Pips.

Return now up to 32% from just 4 trades, 2 Months, targeting 100% within next couple of weeks.

Setup for the trade was the Bullish Trend within a Large Pennant on the Daily Chart, that was taking us to the Resistance Boundary.

The Signal to get things going was that Morning Star Candlestick Formation above the broken Downtrend Line.

/MARCH_1_2016_AUD_CHF_4H_ENTRY_SETUP.png" target="_blank" rel="noopener noreferrer nofollow">

By Friday, 2 Days later, target was hit.

/MARCH_1_2016_AUD_CHF_MYFXBOOK_TRADE.png" target="_blank" rel="noopener noreferrer nofollow">

This was a very short trade compared to the others that tend to last between 3 and 5 Days.

Trades within Consolidations of the size can be extremely profitable given the wide distance between Support and Resistance. Key is to spot the signals in time - THE CORRECT SIGNALS - make sure that setup meets our/your trading rules, then trade it. However, the challenge can be the time to hold these trades, ranging from 4- 7 Days on average for these size Consolidations in most cases, so I was fortunate that this just took 2 days.

Other highlights

- Bullish Candlestick Signals (Morning Star)

- Double Bottoms (see Video)

- Breaks of Downtrend Lines

- Resistance

Duane

DRFXTRADING

Trade Less, Earn More

Member Since Jan 05, 2016

1097 posts

Mar 10, 2016 at 06:37

Member Since Jan 05, 2016

1097 posts

Member Since Jan 05, 2016

1097 posts

Mar 10, 2016 at 06:42

Member Since Jan 05, 2016

1097 posts

Member Since Nov 19, 2014

157 posts

Mar 10, 2016 at 07:18

(edited Mar 10, 2016 at 07:21)

Member Since Nov 19, 2014

157 posts

Hey man, thanks for the questions/concerns

Not sure I understand the first question. Yes that 1st System was a Demo FXCM. ahm..not sure the concern.

As you would have seen in the early parts of my thread for that system, my Live Account is at Dukascopy. I explained that the JFOREX platform of Dukascopy CANNOT be tracked/linked to Myfxbook..something to do with the API. I tried linking it to another website that tracks trading results but no luck either.

That was why, for each of the Demo trades made on that system, I posted a picture of my Live Account to show that the system reflected what was taking place on my Live Account. Take a look you will see.

In the near future, I may add another Live Account at a broker/platform that can be tracked...ex FXCM..but I been with Dukascopy since 2011, no problems with them at all..so I wouldnt want to switch just to show my Live Account here.

2nd question. Scam? Youre the first to make that comment. No Scam.

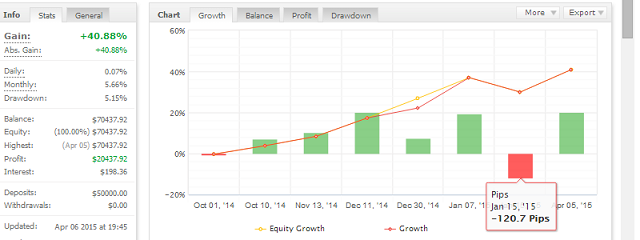

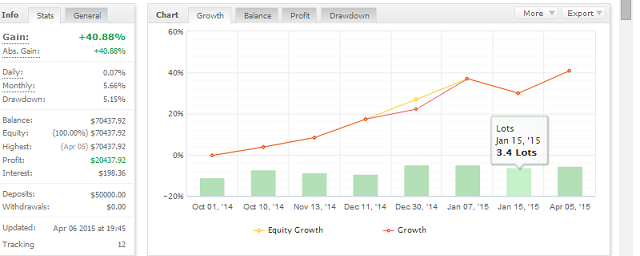

The difference between the 2 graphs is that the green bars represent the lots used per trade and the graph with the yellow bars represent gains/losses in Pips. Use your cursor to hover over them.

Hope that answers your questions...let me know

Duane

DRFXTRADING

Not sure I understand the first question. Yes that 1st System was a Demo FXCM. ahm..not sure the concern.

As you would have seen in the early parts of my thread for that system, my Live Account is at Dukascopy. I explained that the JFOREX platform of Dukascopy CANNOT be tracked/linked to Myfxbook..something to do with the API. I tried linking it to another website that tracks trading results but no luck either.

That was why, for each of the Demo trades made on that system, I posted a picture of my Live Account to show that the system reflected what was taking place on my Live Account. Take a look you will see.

In the near future, I may add another Live Account at a broker/platform that can be tracked...ex FXCM..but I been with Dukascopy since 2011, no problems with them at all..so I wouldnt want to switch just to show my Live Account here.

2nd question. Scam? Youre the first to make that comment. No Scam.

The difference between the 2 graphs is that the green bars represent the lots used per trade and the graph with the yellow bars represent gains/losses in Pips. Use your cursor to hover over them.

Hope that answers your questions...let me know

Duane

DRFXTRADING

Trade Less, Earn More

Member Since Nov 19, 2014

157 posts

Mar 14, 2016 at 01:57

Member Since Nov 19, 2014

157 posts

This EURO bad boy been in a Pennant for quite awhile..Daily Chart..

This explains most of the crazy **** moves that been happeniing over the last several months, like that on Thursday.

Even though it was set off by the ECB action, these setups often have these erratic moves as they move from Support to Resistance.

I was actually getting ready to trade this bullish, expecting one of 3 possible Signals...

/FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png" target="_blank" rel="noopener noreferrer nofollow"> /FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png"/>

/FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png"/>

Sometimes these setups can lead to losses with these types of news etc., but sometimes when you catch them at the right time with the right setup..can take our pound of flesh from them

Duane

DRFXTRADING

This explains most of the crazy **** moves that been happeniing over the last several months, like that on Thursday.

Even though it was set off by the ECB action, these setups often have these erratic moves as they move from Support to Resistance.

I was actually getting ready to trade this bullish, expecting one of 3 possible Signals...

/FEB_4_2016__EURO_USD_DAILY_149_PIPS_Z0.png" target="_blank" rel="noopener noreferrer nofollow">

Sometimes these setups can lead to losses with these types of news etc., but sometimes when you catch them at the right time with the right setup..can take our pound of flesh from them

Duane

DRFXTRADING

Trade Less, Earn More

Member Since Nov 19, 2014

157 posts

Dec 26, 2016 at 23:20

Member Since Nov 19, 2014

157 posts

Hey Traders how goes it!!,

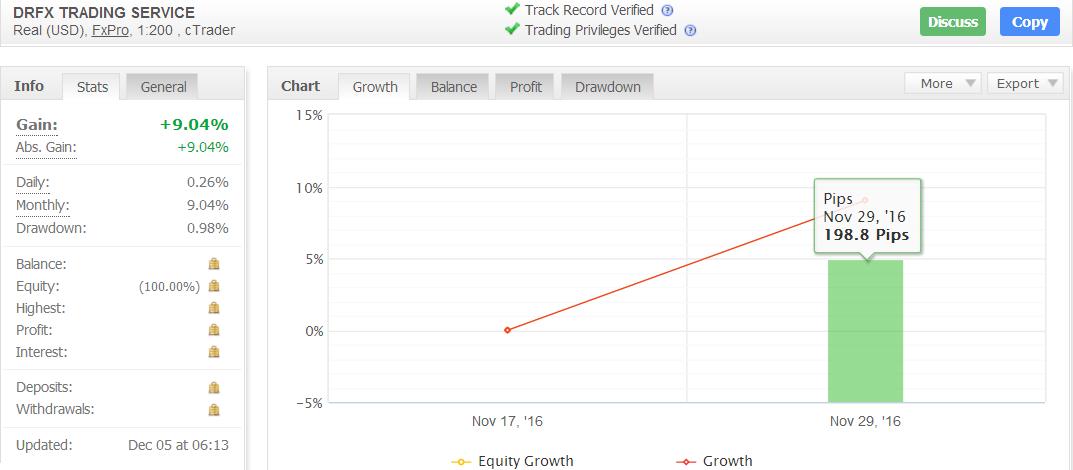

Just to give you an update/summary of this system as I close off this thread to continue it with the new Live System https://www.myfxbook.com/members/DRFXTRADING/drfx-trading-service/1865782.

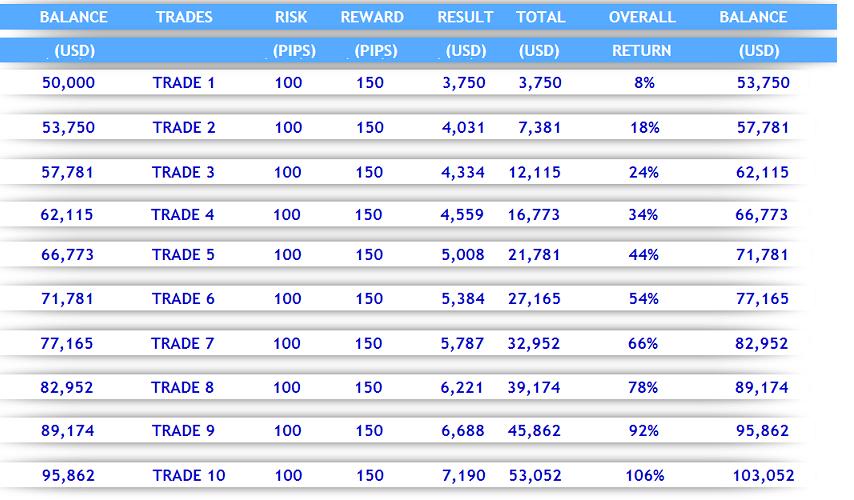

Every year, I aim to achieve a target of at least 100% Rate of Return. I think that if you can achieve these results within a Year as a Swing Trader who doesnt want/have the time to stay glued to the market, youll put yourself in a good position Long-Term.

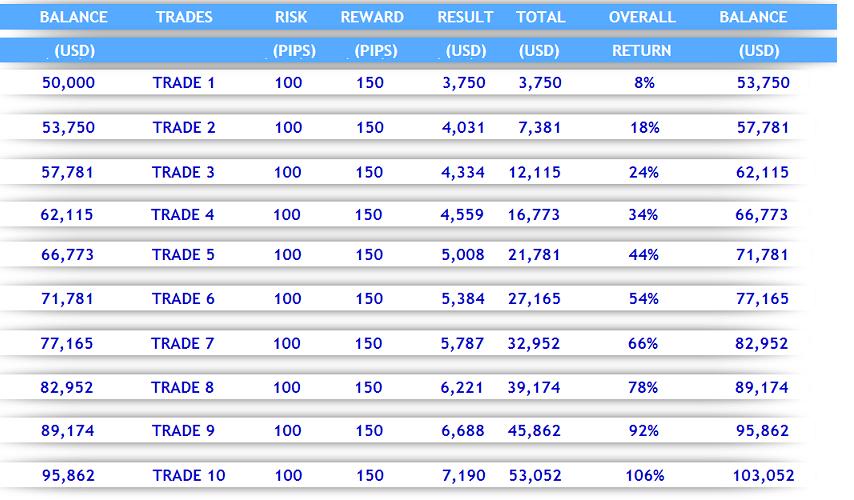

I target 100-200 Pips per trade, using Stop Losses of 100 Pips on average, trading the Daily and 4 Hour Charts. I use a 5% Risk Per Trade. The table above assumes an average gain of 150 Pips. So the idea is that you only trade a few times a month to target the best setups, that have the Highest Probability of success.

For the 2015/2016 period, I was able to earn 46.43% after just 6 trades, which based on that table, would have meant that I only needed 5 more trades to achieve that minimum target. However, due to unusually low market liquidity, return was affected over the next few months, pushing down to the mid 20%. When conditions did improve, I was able to resume hitting large Pip targets which allowed the return to end the period at 42.43%. Not bad but much lower than what I expect from my system.

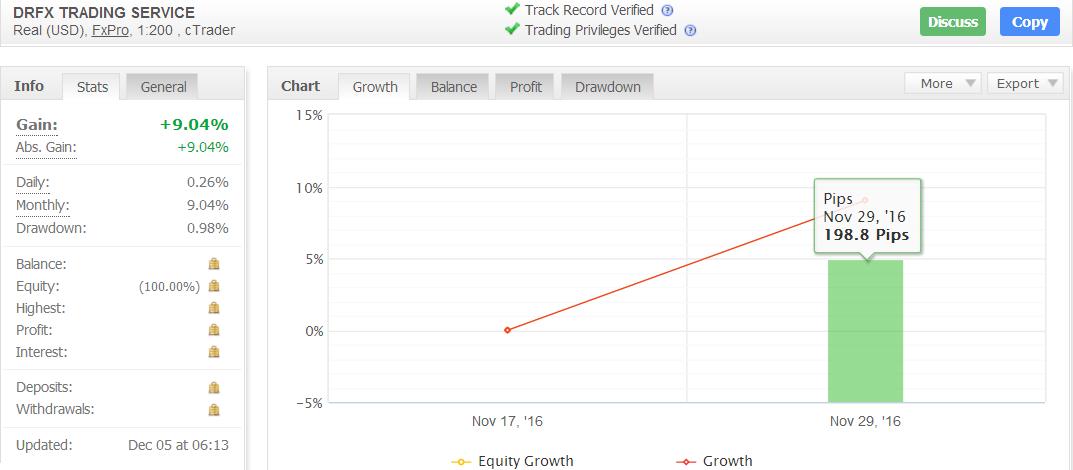

Heading into the 2016/2017 period,I am now up 9.0% after one trade of 198 Pips on the NZD JPY that you can see in the video below.

So assuming normal conditions, would now need 9 Trades to hit that target. Of course, trading losses are expected along the way, but it is expected that once the market remains liquid, will not take long to reach that goal...and more.

If you dont want to watch the market every day and battle the volatile intra-day volatility, Swing Trading is your best bet. However, in order to be successful, have to follow the rules I point out in this video...

/drfx-trading-service/1865782

Duane

DRFXSWINGTRADING

Just to give you an update/summary of this system as I close off this thread to continue it with the new Live System https://www.myfxbook.com/members/DRFXTRADING/drfx-trading-service/1865782.

Every year, I aim to achieve a target of at least 100% Rate of Return. I think that if you can achieve these results within a Year as a Swing Trader who doesnt want/have the time to stay glued to the market, youll put yourself in a good position Long-Term.

I target 100-200 Pips per trade, using Stop Losses of 100 Pips on average, trading the Daily and 4 Hour Charts. I use a 5% Risk Per Trade. The table above assumes an average gain of 150 Pips. So the idea is that you only trade a few times a month to target the best setups, that have the Highest Probability of success.

For the 2015/2016 period, I was able to earn 46.43% after just 6 trades, which based on that table, would have meant that I only needed 5 more trades to achieve that minimum target. However, due to unusually low market liquidity, return was affected over the next few months, pushing down to the mid 20%. When conditions did improve, I was able to resume hitting large Pip targets which allowed the return to end the period at 42.43%. Not bad but much lower than what I expect from my system.

Heading into the 2016/2017 period,I am now up 9.0% after one trade of 198 Pips on the NZD JPY that you can see in the video below.

So assuming normal conditions, would now need 9 Trades to hit that target. Of course, trading losses are expected along the way, but it is expected that once the market remains liquid, will not take long to reach that goal...and more.

If you dont want to watch the market every day and battle the volatile intra-day volatility, Swing Trading is your best bet. However, in order to be successful, have to follow the rules I point out in this video...

/drfx-trading-service/1865782

Duane

DRFXSWINGTRADING

Trade Less, Earn More

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.