- Inicio

- Comunidad

- Sistemas de Trading

- DRFX TRADING SERVICE 2015

Advertisement

DRFX TRADING SERVICE 2015 (de DRFXTRADING )

| Ganancia : | +40.88% |

| Disminución | 5.15% |

| Pips: | 712.2 |

| Transacciones | 8 |

| Ganado: |

|

| Perdido: |

|

| Tipo: | Demo |

| Apalancamiento: | 1:100 |

| Trading: | Manual |

Edit Your Comment

Discusión DRFX TRADING SERVICE 2015

Miembro desde Nov 19, 2014

posts 157

Nov 21, 2014 at 07:59

Miembro desde Nov 19, 2014

posts 157

THE METHODOLOGY

The trades that are shown here were developed from a Price Action-based strategy that uses the most accurate Candlestick Patterns and Signals of the Daily and 4 Hour Charts. These time frames provide more stable and reliable trading patterns and are thus more amenable to consistent profitability. Specific combinations of Chart Patterns and Signals on these charts have been found to continuously provide the most profitable trading opportunities across all Currency Pairs in the Forex Market. Once these signals are identified and traded within the context of established Rules and Parameters, larger rates of returns are more likely for all levels of traders.

The trades that are shown here were developed from a Price Action-based strategy that uses the most accurate Candlestick Patterns and Signals of the Daily and 4 Hour Charts. These time frames provide more stable and reliable trading patterns and are thus more amenable to consistent profitability. Specific combinations of Chart Patterns and Signals on these charts have been found to continuously provide the most profitable trading opportunities across all Currency Pairs in the Forex Market. Once these signals are identified and traded within the context of established Rules and Parameters, larger rates of returns are more likely for all levels of traders.

Trade Less, Earn More

Miembro desde Nov 19, 2014

posts 157

Nov 24, 2014 at 07:48

Miembro desde Nov 19, 2014

posts 157

METHODOLOGY

- Waiting on the Daily Chart for Candlestick Entry Signals;

- Entry and Stop Losses using the 4 Hour Chart;

- Targeting 100 to 200 Pips Per Trade;

- Holding Trades for Specified Holding Periods;

- Risking 5% Per Trade

LIVE ACCOUNT TRADES AT DUKASCOPY (REPLICATED HERE ON FXCM - 3 TRADES BEHIND)

AUD NZD TRADES

CHF JPY TRADES

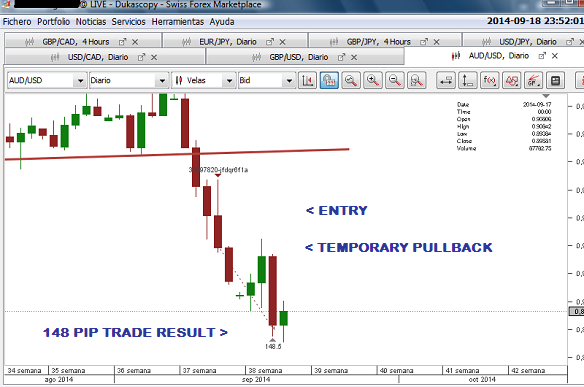

AUD USD TRADE

- Waiting on the Daily Chart for Candlestick Entry Signals;

- Entry and Stop Losses using the 4 Hour Chart;

- Targeting 100 to 200 Pips Per Trade;

- Holding Trades for Specified Holding Periods;

- Risking 5% Per Trade

LIVE ACCOUNT TRADES AT DUKASCOPY (REPLICATED HERE ON FXCM - 3 TRADES BEHIND)

AUD NZD TRADES

CHF JPY TRADES

AUD USD TRADE

Trade Less, Earn More

Miembro desde Nov 19, 2014

posts 157

Nov 24, 2014 at 07:50

Miembro desde Nov 19, 2014

posts 157

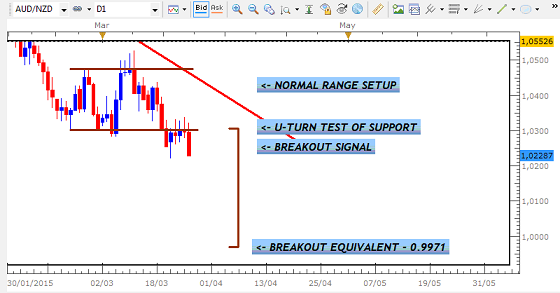

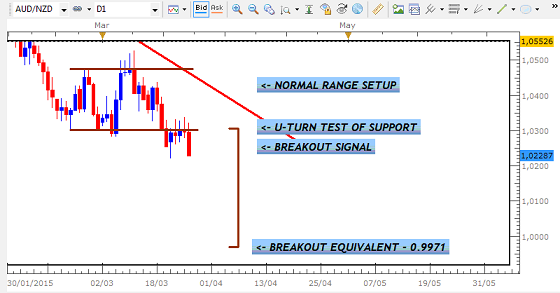

AUD NZD - TRADE 1

- Breakout from a Small Range above the Resistance of a large Pennant Consolidation;

- Trade Exited ahead of the unexpected reversal- anticipated by criteria of strategy;

AUD NZD - TRADE 2

- Trading within a Medium Pennant Consolidation above the large Pennant Consolidation;

- Entry based on the Candlestick Signal at Resistance;

CHF JPY - TRADE 3

- Early exit and loss on short trade due to initial hesitation about the trade;

CHF JPY TRADE 4

- Re-Entered short position after confirmation that trade conformed to Methodology;

- Exited at Support as part of the False Consolidation Breakout Reversal;

AUD USD TRADE 5

- Consolidation Breakout Trade

MAIN ASPECTS OF TRADES AND METHODOLOGY

- All Trades are executed so long as they comply with the criteria set out in the Strategy Document;

- Trade decisions do not consider the short-term nor long-term economic fundamentals of the currency pairs

- Statistical Indicators are not part of the Methodology;

- Trades are selected from 25 of the most liquid pairs;

- Trades are not analyzed or monitored until the end of the Holding Period/Trade Closed

Duane Shepherd

DRFXTRADING

Trade Less, Earn More

Miembro desde Nov 19, 2014

posts 157

Dec 08, 2014 at 10:58

Miembro desde Nov 19, 2014

posts 157

In my 6 years of trading I have yet to make consistent profits from Day Trading. It was only when I switched to Swing Trading was I profitable. Spent most of this year developing a Methodology and now I am back trading Live using only the Daily and 4 Hour Charts. With almost 400 Pips from the last 6 trades, I am up 13.0%, with only 9 trades left for a 100% Return. The Demo Account here tracks my Live Dukascopy Account but is behind by 3 trades (https://www.myfxbook.com/members/DRFXTRADING/duane/1079693)

Given that most people believe that Day Trading is the way to go, I am curious to know what % Return from Swing Trading would convince you to switch to this style of trading?

Given that most people believe that Day Trading is the way to go, I am curious to know what % Return from Swing Trading would convince you to switch to this style of trading?

Trade Less, Earn More

Miembro desde Nov 19, 2014

posts 157

Jan 09, 2015 at 17:00

(editado Jan 09, 2015 at 17:05)

Miembro desde Nov 19, 2014

posts 157

LATEST TRADES

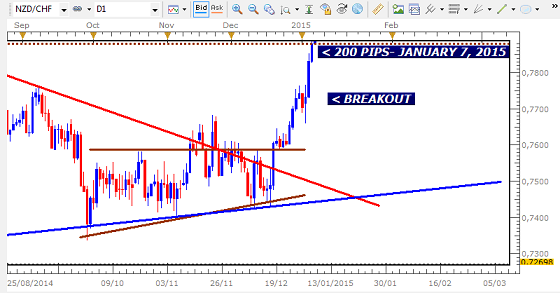

NZD CHF - BREAK OF CONSOLIDATION DAILY CHART

231 PIPS - 4 DAYS - LIVE ACCOUNT (Dukascopy)

194 PIPS - 7 DAYS - FXCM DEMO ACCOUNT

EURO CAD - FALSE CONSOLIDATION BREAKOUT, HEADING BACK TO SUPPORT

73 PIPS - 7 DAYS - LIVE ACCOUNT (Dukascopy)

74 PIPS - 7 DAYS - FXCM DEMO ACCOUNT

NZD CHF - BREAK OF CONSOLIDATION DAILY CHART

231 PIPS - 4 DAYS - LIVE ACCOUNT (Dukascopy)

194 PIPS - 7 DAYS - FXCM DEMO ACCOUNT

EURO CAD - FALSE CONSOLIDATION BREAKOUT, HEADING BACK TO SUPPORT

73 PIPS - 7 DAYS - LIVE ACCOUNT (Dukascopy)

74 PIPS - 7 DAYS - FXCM DEMO ACCOUNT

Trade Less, Earn More

Miembro desde Nov 06, 2014

posts 115

Miembro desde Nov 19, 2014

posts 157

Miembro desde Nov 19, 2014

posts 157

Apr 09, 2015 at 14:36

Miembro desde Nov 19, 2014

posts 157

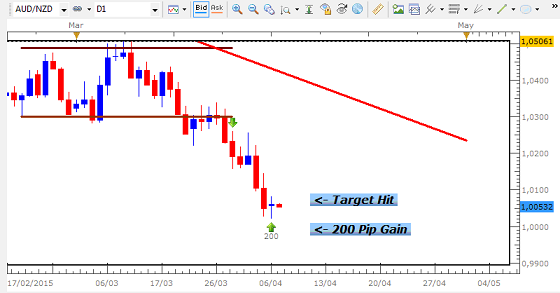

Following a loss on the EUR CAD trade of 130 Pips...

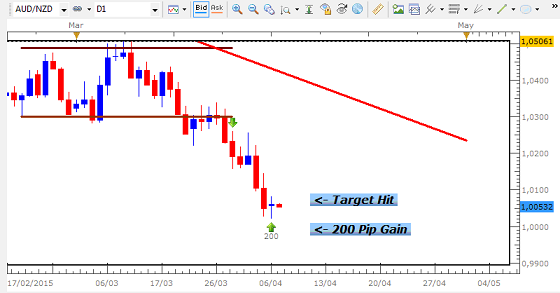

... the Methodology bounced back with a 200 Pip Trade on the AUD NZD as the pair broke the Consolidation Range on its Daily Chart.

After a few days, the target was hit..

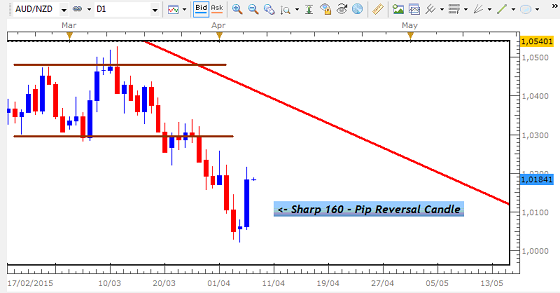

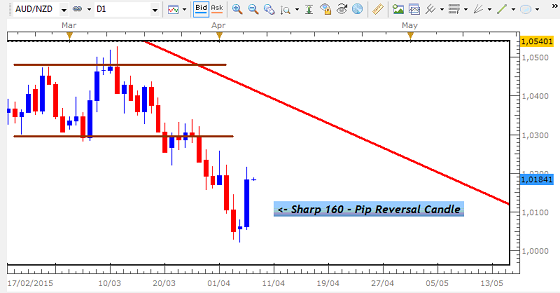

The sharp reversal that took place afterwards (market reaction to RBA Interest Rate Statement and Decision), confirmed the accuracy of this exit...

Main Highlights/Technical Theories of Trade;

- Consolidation Breakouts;

- Evening Star Bearish Signal;

- U-Turn Tests of Consolidation Boundaries;

- Obey Maximum Limit of Trade Targets;

- Swing Trading Tests your Patience, but the gains make it worthwhile in the end;

Duane

... the Methodology bounced back with a 200 Pip Trade on the AUD NZD as the pair broke the Consolidation Range on its Daily Chart.

After a few days, the target was hit..

The sharp reversal that took place afterwards (market reaction to RBA Interest Rate Statement and Decision), confirmed the accuracy of this exit...

Main Highlights/Technical Theories of Trade;

- Consolidation Breakouts;

- Evening Star Bearish Signal;

- U-Turn Tests of Consolidation Boundaries;

- Obey Maximum Limit of Trade Targets;

- Swing Trading Tests your Patience, but the gains make it worthwhile in the end;

Duane

Trade Less, Earn More

Miembro desde Nov 19, 2014

posts 157

Aug 08, 2015 at 19:02

Miembro desde Nov 19, 2014

posts 157

Hello all,

This System is being continued in Swing Trading Part 2. https://www.myfxbook.com/members/DRFXTRADING/swing-trading-part-2/1316112

Thanks, please feel free to ask me questions on the Methodology.

Duane

This System is being continued in Swing Trading Part 2. https://www.myfxbook.com/members/DRFXTRADING/swing-trading-part-2/1316112

Thanks, please feel free to ask me questions on the Methodology.

Duane

Trade Less, Earn More

*El uso comercial y el spam no serán tolerados y pueden resultar en el cierre de la cuenta.

Consejo: Al publicar una imagen o una URL de YouTube, ésta se integrará automáticamente en su mensaje!

Consejo: Escriba el signo @ para completar automáticamente un nombre de usuario que participa en esta discusión.