- Domů

- Komunita

- Obchodní systémy

- Gold Trader

Advertisement

Gold Trader

Uživatel odstranil tento systém.

Edit Your Comment

Gold Trader diskuse

Členem od Mar 09, 2019

1 příspěvků

Apr 24, 2020 at 13:55

Členem od Mar 09, 2019

1 příspěvků

Hi jamesbillionaire, I can attest to Cameron's trading: precision entries, quick exits, and very solid returns. I've been copying his trades for 3 months now and never had a SINGLE day stuck in DD. Nothing short of amazing. If this keeps up I'm cashing in my 401K.

NB: I don't know the guy other than a few messages back and forth. Just sharing my experience. Good luck!

NB: I don't know the guy other than a few messages back and forth. Just sharing my experience. Good luck!

Členem od Aug 16, 2011

106 příspěvků

Apr 24, 2020 at 23:12

Členem od Aug 16, 2011

106 příspěvků

jamesbillionaire posted:

Hi Provider (camerongill),

I like your way of trading. You are responsive and two-way communication.

Can I join your other channel for keeping in touch with you? E.g.; WeChat / Telegram / Facebook Page / FB Group ... etc?

Is this your SignalStart page?

https://www.signalstart.com/analysis/gold-trader/63516

Question:

#1 Why in SignalStart your Drawdown is 16.68% and in myfxbook only 0.91%?

#2 Why you click the red color box in the middle (Drawdown) area, it does not show the Data in Signalstart.

Printscreen example: https://prntscr.com/s55maw

I want to copy your trade!

Hi James,

Thank you for the contact, comments and feedback.

I do not post to social media as such, however do have a Patreon page.

Yes, that link is my SignalStart page, and answers to your questions;

#1 - Myfxbook had a different DD and then for some reason it changed to 0.91%, this has happened within the last 2 weeks as before it was something like 14.6%. The real draw-down from a trade a month or so into the live history was from a crazy move and 16.6% is the correct figure.

#2 - I have no idea why the draw-down is not shown and would think it show a historical graph.

Regards,

Cameron

Členem od Aug 16, 2011

106 příspěvků

Apr 24, 2020 at 23:19

Členem od Aug 16, 2011

106 příspěvků

sasakikojiro posted:

Hi jamesbillionaire, I can attest to Cameron's trading: precision entries, quick exits, and very solid returns. I've been copying his trades for 3 months now and never had a SINGLE day stuck in DD. Nothing short of amazing. If this keeps up I'm cashing in my 401K.

NB: I don't know the guy other than a few messages back and forth. Just sharing my experience. Good luck!

Hello Sasakikojiro,

Thank you for the positive feedback, I appreciate it.

The last month has been quite difficult with the high spread on gold pairs and has had an impact on performance.

Regards,

Cameron

PS - I am not a financial advisor and out of respect, please do not trade money you cannot afford to lose. The markets are crazy at the moment and the dollar is being devalued at an increasing speed. Are you able to buy silver bullion in the US? Here in Australia you cannot buy cast bullion, only minted coins (at a premium).

Členem od Aug 16, 2011

106 příspěvků

Apr 28, 2020 at 02:43

Členem od Aug 16, 2011

106 příspěvků

Hello followers,

We have seen a massive sell-off on gold today and am closing off Gold Trader for the next few days. The reason for closing is as follows; 1) end of month tends to see more volatility on gold pairs, 2) we have FOMC interest rate decision on Wed, 3) the spread is still an issue on gold pairs (across multiple brokers), and 4) we should be seeing a NFP reading on Friday (otherwise will be the following Friday).

The Gold Trader EA does not trade on Fridays, however this is not activated at the moment.

We have seen a massive sell-off on gold today and am closing off Gold Trader for the next few days. The reason for closing is as follows; 1) end of month tends to see more volatility on gold pairs, 2) we have FOMC interest rate decision on Wed, 3) the spread is still an issue on gold pairs (across multiple brokers), and 4) we should be seeing a NFP reading on Friday (otherwise will be the following Friday).

The Gold Trader EA does not trade on Fridays, however this is not activated at the moment.

Členem od Aug 16, 2011

106 příspěvků

Apr 30, 2020 at 02:11

Členem od Aug 16, 2011

106 příspěvků

Hello followers,

We are getting dangerously close to breaking the lower trend-line on the XAUUSD pair. There have been a couple of attempts and am waiting for outcomes from the FOMC meeting to be analysed by the market.

Bitcoin had a massive bullish move yesterday and would have thought that gold would have picked up on this, however it has mainly been in a sideways pattern for a couple of days now after that sell off earlier in the week.

Will be interesting to see what happens over the next few days.

We are getting dangerously close to breaking the lower trend-line on the XAUUSD pair. There have been a couple of attempts and am waiting for outcomes from the FOMC meeting to be analysed by the market.

Bitcoin had a massive bullish move yesterday and would have thought that gold would have picked up on this, however it has mainly been in a sideways pattern for a couple of days now after that sell off earlier in the week.

Will be interesting to see what happens over the next few days.

forex_trader_493424

Členem od Jan 30, 2018

33 příspěvků

Apr 30, 2020 at 11:20

Členem od Jan 30, 2018

33 příspěvků

sasakikojiro posted:

Hi jamesbillionaire, I can attest to Cameron's trading: precision entries, quick exits, and very solid returns. I've been copying his trades for 3 months now and never had a SINGLE day stuck in DD. Nothing short of amazing. If this keeps up I'm cashing in my 401K.

NB: I don't know the guy other than a few messages back and forth. Just sharing my experience. Good luck!

Thank you for your comment.

forex_trader_493424

Členem od Jan 30, 2018

33 příspěvků

Apr 30, 2020 at 11:26

Členem od Jan 30, 2018

33 příspěvků

camerongill posted:jamesbillionaire posted:

Hi Provider (camerongill),

I like your way of trading. You are responsive and two-way communication.

Can I join your other channel for keeping in touch with you? E.g.; WeChat / Telegram / Facebook Page / FB Group ... etc?

Is this your SignalStart page?

https://www.signalstart.com/analysis/gold-trader/63516

Question:

#1 Why in SignalStart your Drawdown is 16.68% and in myfxbook only 0.91%?

#2 Why you click the red color box in the middle (Drawdown) area, it does not show the Data in Signalstart.

Printscreen example: https://prntscr.com/s55maw

I want to copy your trade!

Hi James,

Thank you for the contact, comments and feedback.

I do not post to social media as such, however do have a Patreon page.

Yes, that link is my SignalStart page, and answers to your questions;

#1 - Myfxbook had a different DD and then for some reason it changed to 0.91%, this has happened within the last 2 weeks as before it was something like 14.6%. The real draw-down from a trade a month or so into the live history was from a crazy move and 16.6% is the correct figure.

#2 - I have no idea why the draw-down is not shown and would think it show a historical graph.

Regards,

Cameron

Can I follow your Patreon page, please?

Členem od Feb 29, 2020

2 příspěvků

May 05, 2020 at 06:12

Členem od Feb 29, 2020

2 příspěvků

Hi, i’m follower and had some question about TP, Why when you set profit already, but you still early manually exited? Because i feel every trading is low TP high SP.

Členem od Feb 29, 2020

2 příspěvků

May 05, 2020 at 08:25

Členem od Feb 29, 2020

2 příspěvků

howardp posted:

Hi, i’m follower and had some question about TP, Why when you set profit already, but you still early manually exited? Because i feel every trading is low TP high SP. i mean why you don’t wait for the price touch TP?

Členem od Aug 16, 2011

106 příspěvků

May 05, 2020 at 09:55

Členem od Aug 16, 2011

106 příspěvků

howardp posted:

Hi, i’m follower and had some question about TP, Why when you set profit already, but you still early manually exited? Because i feel every trading is low TP high SP.

Hi Howard,

Thank you for the feedback.

The stop and profit are only indicative and I am monitoring all open trades. The stop is pushed out and if price dropped then would have closed out earlier (less than 20% dd).

Whilst I am long term bullish on gold I am expected further downward pressure and exited the trades early today to lock in a small profit rather than risk a bigger loss.

You may have noticed that since the trades closed the price went up, came down, then had a pinbar up and down. Now at pretty much the same price of the entries today.

In normal conditions I would aim to get the TP triggered.

Plus we still have those issues with the spreads that are making entries harder, and trades less profitable.

Regards,

Cameron

Členem od Aug 16, 2011

106 příspěvků

May 06, 2020 at 01:28

Členem od Aug 16, 2011

106 příspěvků

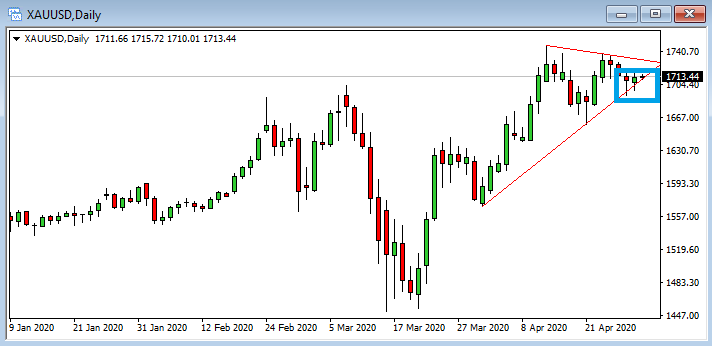

The daily gold (XAUUSD) chart is in another triangular pattern. So now it is a matter of waiting to see which line will be broken. Given the money printing underway it could be a matter of having a small pickup, then move down to lower trend-line and then a more solid move back up to take out previous highs. See blue line below.

If there is a break of the lower trend-line then we could see a move back to the 1560 territory.

It was also interesting to see the comparison between XAUUSD and XAUEUR yesterday. There is obvious bullish sentiment on USD, however it later evened out again.

Členem od Aug 16, 2011

106 příspěvků

May 09, 2020 at 03:12

Členem od Aug 16, 2011

106 příspěvků

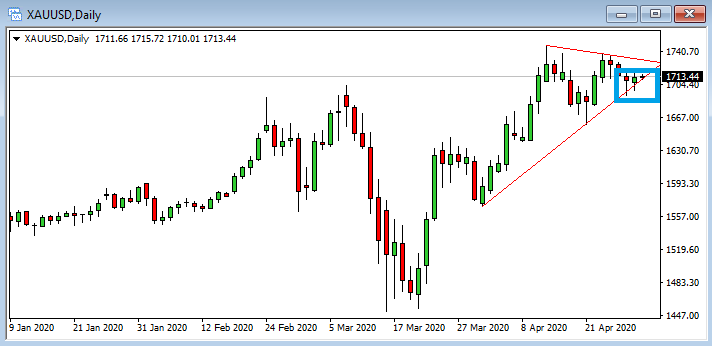

We have seen a continued sideways movement on gold over the last week with the price coming back to the 1700 mark over and over.

What is odd however is the economic data coming out of the US and the impact on the price of gold. Last week we had ADP Employment going from -27K to -20236K and on Friday had the popular NFP reading from -701K to -20500K with the glimmer of hope being the average hourly earning rate increasing. However, and please note that I am not an economist (and I also believe that economists have no idea what is going on!), this just does not make sense that gold is not stronger.

The NFP yesterday (Fri) we saw the price of gold weaken. Either there is some major manipulation going on or I am clearly missing something. Yesterday gold dropped against both USD and EUR, so it is not USD specific.

Am patiently waiting for trade signals to appear and you can see we are in the middle of the wedge on the daily chart. Still there is going to be a future break of this wedge either to to the upside or downside.

Členem od Aug 16, 2011

106 příspěvků

May 13, 2020 at 05:31

Členem od Aug 16, 2011

106 příspěvků

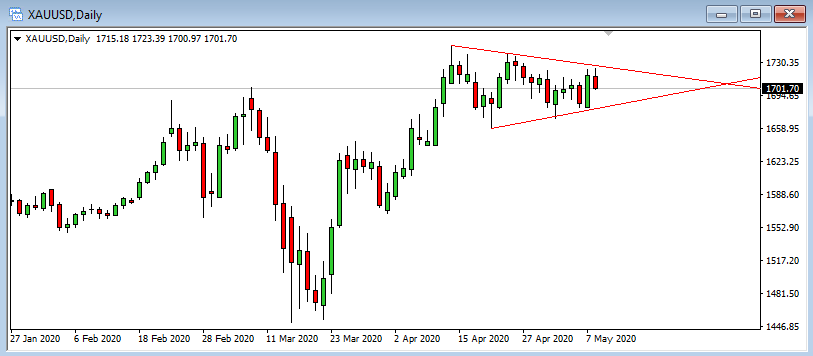

The dollar strengthening is continuing. If you have time go to YouTube and look up a chap by the name of Brent Johnson (Santiago Capital) and his talks on the 'dollar milkshake theory'.

What is interesting though is that Gold is holding up with the strengthening dollar.

Gold has been moving sideways for some time now and we are all waiting to see which trend-line is broken to determine the direction.

Členem od Aug 16, 2011

106 příspěvků

May 15, 2020 at 03:24

Členem od Aug 16, 2011

106 příspěvků

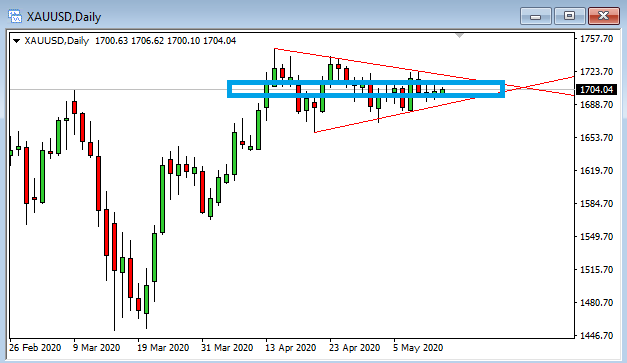

Yesterday we finally saw the breakout on the daily chart and it was a strong move upwards.

What normally happens now is that the price comes back to re-test the back of the upper trend-line, which is around the 1710 to 1750 territory before a stronger move upwards. Will wait and see...

Unfortunately Gold Trader did not pick this move as the over-sold condition was not met and trades are not actioned during that time frame (due to common volatility). Gold Trader tends to pick up the range-bound long trades and not the big moves (up or down).

Členem od Aug 16, 2011

106 příspěvků

May 21, 2020 at 23:57

Členem od Aug 16, 2011

106 příspěvků

There was quite a bull-trap on XAUUSD yesterday and massive sell-off due to the strengthening USD (on worse jobless figures!). Normally on gold you get those sorts of moves as bear-traps, so perhaps the bias is changing.

The gold bull in me is looking for a move down to the $1710 region and then bounce off the lower trend-line upwards. However a decent break of the lower trend-line could be on the cards and in that case will reassess.

It is definitely a gold bull market when you look at the daily chart and have seen some crazy moves over the last few months. The longer term traders out there that bought XAUUSD on that dip down to $1450 would be sleeping well at night, same with those that bought Bitcoin when it crashed to $4000!

*Komerční použití a spam nebudou tolerovány a mohou vést ke zrušení účtu.

Tip: Zveřejněním adresy URL obrázku /služby YouTube se automaticky vloží do vašeho příspěvku!

Tip: Zadejte znak @, abyste automaticky vyplnili jméno uživatele, který se účastní této diskuse.