- Home

- Community

- Trading Systems

- KeltnerFlow

Advertisement

KeltnerFlow (By forex_trader_165856)

The user has deleted this system.

Edit Your Comment

KeltnerFlow Discussion

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 15, 2015 at 12:40

Member Since Dec 03, 2013

599 posts

What is a breakout?

It is a continuous move larger than the previous range. Often this volatility can be from news releases or simply Central Bank intervention. What is great about these events are that they can be big game changers that reverse the trend completely or offer continuous momentum in that particular direction for massive profits. Once the system identifies the breakout, you enter your position in the same direction as the breakout and KeltnerPro would continue to add more positions in this same direction just like the infamous ForexGrowthBot. How many positions should we enter? That is a question for the backtest results later discussed but it is an option for you to ultimately decide.

It is a continuous move larger than the previous range. Often this volatility can be from news releases or simply Central Bank intervention. What is great about these events are that they can be big game changers that reverse the trend completely or offer continuous momentum in that particular direction for massive profits. Once the system identifies the breakout, you enter your position in the same direction as the breakout and KeltnerPro would continue to add more positions in this same direction just like the infamous ForexGrowthBot. How many positions should we enter? That is a question for the backtest results later discussed but it is an option for you to ultimately decide.

Member Since Apr 25, 2013

102 posts

forex_trader_165856

Member Since Dec 03, 2013

599 posts

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 16, 2015 at 10:04

Member Since Dec 03, 2013

599 posts

The backtests will be on myfxbook once KeltnerFlow is released,

I just finished a running version and I wanted to get it on an account asap to see how it works.

I'll begin making adjustments and doing backtest over the weekend.

The price will start at 199 and increase on each Version update.

The purchasing link will be available once backtests are uploaded and more information will be placed on the website

https://redrhinofx.com/keltnerflow/

I just finished a running version and I wanted to get it on an account asap to see how it works.

I'll begin making adjustments and doing backtest over the weekend.

The price will start at 199 and increase on each Version update.

The purchasing link will be available once backtests are uploaded and more information will be placed on the website

https://redrhinofx.com/keltnerflow/

Member Since Apr 25, 2013

102 posts

Apr 17, 2015 at 06:40

Member Since Apr 25, 2013

102 posts

I believe that for testing purposes, it would be better to run your EA with a limited number of "max open orders", instead of something as crazy as what happened with USD/CAD, and with a larger "pip-distance" between orders/trades (at least 5 or 10 pips)... Don't you think that?

Patience, focus and self-control to win the game with diligence.

forex_trader_67253

Member Since Feb 26, 2012

92 posts

Apr 17, 2015 at 10:59

Member Since Feb 26, 2012

92 posts

Demo tests are only good to check if the bot places trades per the strategy and doesn't have any basic glitches. As you never get slippage, limited liquidity, and spread hikes on demo, the actual profit percentage is irrelevant. I've been immensely successful on demo tests with dozens of EAs only to blow live accounts with the same bots. So this test is more for the developer's reference. I'm eager to see KeltnerFlow tested on a live account with cold hard cash over the same period of time as the original KeltnerPro. Also, I could only locate the graphs of two GU 2013 backtests on the regular MetaQuotes data at the vendor's website at https://redrhinofx.com/keltnerflow/ - I hope the vendor posts his tick data backtests since 01.01.2008 until the present time on all currency pairs used.

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 17, 2015 at 13:48

Member Since Dec 03, 2013

599 posts

A big breakout needs to make a lot of money to keep the account in profit while taking small losses on the fake breakout. On a bad "fake" breakout the system doesn't have the conditions to make a profit and doesn't enter many orders, such as the AUDUSD and EURUSD which we experienced. When we have a real breakout such as the USDCAD, we capture the pips and run all the way to the bank. Thats how the system makes profits.

Cut the Red, Let the Green Grow.

I can add your suggestions, ( max orders already added), distance between orders is easy todo.

Cut the Red, Let the Green Grow.

I can add your suggestions, ( max orders already added), distance between orders is easy todo.

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 17, 2015 at 16:47

Member Since Dec 03, 2013

599 posts

btanalysis posted:

Demo tests are only good to check if the bot places trades per the strategy and doesn't have any basic glitches. As you never get slippage, limited liquidity, and spread hikes on demo, the actual profit percentage is irrelevant. I've been immensely successful on demo tests with dozens of EAs only to blow live accounts with the same bots. So this test is more for the developer's reference. I'm eager to see KeltnerFlow tested on a live account with cold hard cash over the same period of time as the original KeltnerPro. Also, I could only locate the graphs of two GU 2013 backtests on the regular MetaQuotes data at the vendor's website at https://redrhinofx.com/keltnerflow/ - I hope the vendor posts his tick data backtests since 01.01.2008 until the present time on all currency pairs used.

1. fxopen demo ecn has slippage, partial close(liquidity) and spread hikes.

2. This is not impulsive scalping, the EA trades on M5 open bars.

3. I don't use metaquote data, I import all my data as M1 bars, and convert to all TF's . Tick data isn't needed for such backtesting.

4. A system that doesn't use tick data for logical decisions or use trailing steps don't need tickdata for backtesting. All you need is quality data without missing bars.

https://www.myfxbook.com/strategies/keltnerpro-gbpusd-2013/80355

https://www.myfxbook.com/strategies/keltnerflow-gbpusd-2013/80356

so far the systems are comparable in backtests with keltnerFlow making more pips with higher Profit Factor. Now it is time to make the system as my own just like RevEnginePro.

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 17, 2015 at 16:50

Member Since Dec 03, 2013

599 posts

Tick data backtesting will only be needed when developing and testing the volume filter that I have added. However since every data feed is unique the volume filter will have mixed results and I'm not sure if it will be a solution as some think.

forex_trader_67253

Member Since Feb 26, 2012

92 posts

Apr 17, 2015 at 17:08

Member Since Feb 26, 2012

92 posts

In any case, one year of backtest on one currency pair is not sufficient - we'll need a broader picture consisting of multi-year backtests on all currency pairs used.

I would further differentiate false breakouts into sharp price movements due to the lack of liquidity and breakouts on muted markets. The current FX markets are clearly muted by a slower than expected recovery of the US economy on one hand and the Greek uncertainty on the other hand. What leads to a breakout is some major news immediately resulting in a sharp large price movements that would normally turn into a trend for some time. These days, more than often we don't get the trend part: if the EU and GU price mover is the negative US news of a slower than expected economic recovery and delayed Fed rate hikes, the Euro and the Pound don't immediately gain much for fears over Greece; if it's fears over Greece moving the market, the greenback doesn't immediately gain much for fears of the slower than expected US economic recovery and delayed Fed rate hikes. That's how we get a lot of false breakouts that wouldn't be false under truly divergent economic conditions between the US and Europe.

Any ongoing economic recovery in the US is an illusion in fact, and we all know one can't realistically conceal an illusion for too long - the recent US economic data makes it increasingly more evident (which they first blamed on bad weather but then there was no more bad weather to blame it on). Yet the conditions in Europe are crap too - that's why these US releases are not much of a market mover, and it will remain so until the shit hits the fan big time on either side of the pond (with the European one now looking more likely to be first) - hopefully sooner than later, as until then we will be stomaching choppy muted currency markets with virtually no short to medium term trends. How are you going to address this issue in your EA?

I would further differentiate false breakouts into sharp price movements due to the lack of liquidity and breakouts on muted markets. The current FX markets are clearly muted by a slower than expected recovery of the US economy on one hand and the Greek uncertainty on the other hand. What leads to a breakout is some major news immediately resulting in a sharp large price movements that would normally turn into a trend for some time. These days, more than often we don't get the trend part: if the EU and GU price mover is the negative US news of a slower than expected economic recovery and delayed Fed rate hikes, the Euro and the Pound don't immediately gain much for fears over Greece; if it's fears over Greece moving the market, the greenback doesn't immediately gain much for fears of the slower than expected US economic recovery and delayed Fed rate hikes. That's how we get a lot of false breakouts that wouldn't be false under truly divergent economic conditions between the US and Europe.

Any ongoing economic recovery in the US is an illusion in fact, and we all know one can't realistically conceal an illusion for too long - the recent US economic data makes it increasingly more evident (which they first blamed on bad weather but then there was no more bad weather to blame it on). Yet the conditions in Europe are crap too - that's why these US releases are not much of a market mover, and it will remain so until the shit hits the fan big time on either side of the pond (with the European one now looking more likely to be first) - hopefully sooner than later, as until then we will be stomaching choppy muted currency markets with virtually no short to medium term trends. How are you going to address this issue in your EA?

forex_trader_67253

Member Since Feb 26, 2012

92 posts

Apr 17, 2015 at 17:58

Member Since Feb 26, 2012

92 posts

RedRhinoLab posted:

All you need is quality data without missing bars.

https://www.myfxbook.com/strategies/keltnerpro-gbpusd-2013/80355

https://www.myfxbook.com/strategies/keltnerflow-gbpusd-2013/80356

Why are the months of April and July, 2014 missing in your backtests?

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 18, 2015 at 08:07

Member Since Dec 03, 2013

599 posts

The market didn't provide a strong breakout to trigger the logic. To address your concern above, technically speaking we can use the volume filter to enter only on increasing volume and avoid entering when the spike initiates the logic but volume falls quickly after the spike.

More importantly, we can trade every breakout and let the small stoploss and higher takeprofit work in our favor. Also by allowing multiple orders open on the good breakouts will grow our account while the small fake outs slowly take some profit back until the momentum enters again.

More importantly, we can trade every breakout and let the small stoploss and higher takeprofit work in our favor. Also by allowing multiple orders open on the good breakouts will grow our account while the small fake outs slowly take some profit back until the momentum enters again.

forex_trader_67253

Member Since Feb 26, 2012

92 posts

Apr 18, 2015 at 10:53

Member Since Feb 26, 2012

92 posts

I think market entry should be entirely volume driven. The original KeltnerPro EA enters the market on every breakout (whether genuine or false) and simply swallows any losses should the breakout prove to be false in hopes for them to be later recovered by higher profits on genuine breakouts. Yet this approach leaves us with a possibility of a huge drawdown due to a lengthy losing streak on a choppy muted market with no trends emerging.

My backtests concern remains unaddressed. You rightly state all we need is quality data without missing bars yet your own 2013 GU backtests have a whole of two months of April and July, 2014 entirely missing. Can you post longer backtests over the course of several years on the tick data with no missing months and on all of the currency pairs traded by your EA?

My backtests concern remains unaddressed. You rightly state all we need is quality data without missing bars yet your own 2013 GU backtests have a whole of two months of April and July, 2014 entirely missing. Can you post longer backtests over the course of several years on the tick data with no missing months and on all of the currency pairs traded by your EA?

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 18, 2015 at 15:26

Member Since Dec 03, 2013

599 posts

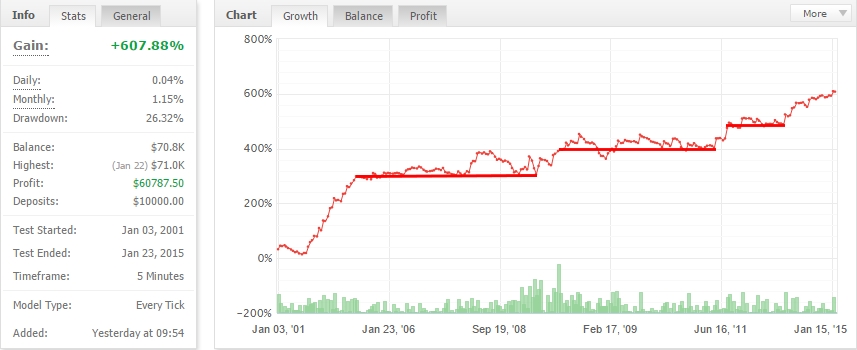

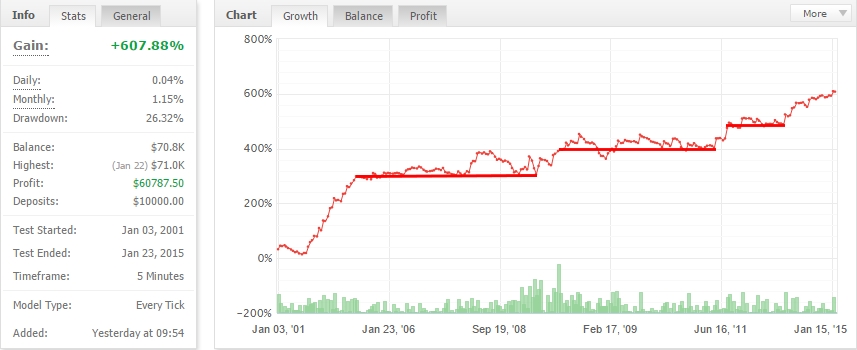

15 year backtest just for an example - https://www.myfxbook.com/strategies/keltnerflow-15-year-gbpusd/80348 - I've already changed many internals so this backtest isn't important but is used just to make a valid point that the system will not trade every month or even every year. If the logic doesnt fire a signal this does not mean I am missing data in the historical csv file.

Unfortunately, I just realized that the backtests I posted are labeled as GBPUSD but in fact the data is EURUSD, you can see by the exchange rate. I must have imported into the GBPUSD symbol and not the EURUSD. Sorry for the confusion.

When I begin my reverse engineering process, I do my best to duplicate a similar backtest as the original. While doing so, I learn about the trading system and I start making small changes here and there which turns the original system into my own as I did with RevEnginePro.

What makes KeltnerPro profitable is the risk/reward ratio and not specifically the trading logic. It will cut a trade short of the stoploss if the price action swiftly changes and it always the winners reach the takeprofit without using a trailing stop that normally cuts the trade off from running into its full potential. The adaptive part of the strategy is a dynamic TP and SL with a positive RR ratio.

Now that I have a mimicking trading system of the original I will proceed to make it better. These changes will be selectable which means you can still use the original logic or the improved logic,

I have a setting called VersionLogic in the external parameters of the EA and I am able to add addittional variations OR completely new entry/exit logic into the system while maintaining the original characteristics that make this system profitable ( Cut the Red, Let the Green grow!).

Thank you for your insight @btanalysis , you're a valuable critic and I really do appreciated your responses.

Unfortunately, I just realized that the backtests I posted are labeled as GBPUSD but in fact the data is EURUSD, you can see by the exchange rate. I must have imported into the GBPUSD symbol and not the EURUSD. Sorry for the confusion.

When I begin my reverse engineering process, I do my best to duplicate a similar backtest as the original. While doing so, I learn about the trading system and I start making small changes here and there which turns the original system into my own as I did with RevEnginePro.

What makes KeltnerPro profitable is the risk/reward ratio and not specifically the trading logic. It will cut a trade short of the stoploss if the price action swiftly changes and it always the winners reach the takeprofit without using a trailing stop that normally cuts the trade off from running into its full potential. The adaptive part of the strategy is a dynamic TP and SL with a positive RR ratio.

Now that I have a mimicking trading system of the original I will proceed to make it better. These changes will be selectable which means you can still use the original logic or the improved logic,

I have a setting called VersionLogic in the external parameters of the EA and I am able to add addittional variations OR completely new entry/exit logic into the system while maintaining the original characteristics that make this system profitable ( Cut the Red, Let the Green grow!).

Thank you for your insight @btanalysis , you're a valuable critic and I really do appreciated your responses.

forex_trader_67253

Member Since Feb 26, 2012

92 posts

Apr 18, 2015 at 17:42

Member Since Feb 26, 2012

92 posts

Thanks for posting a longer backtest. It shows why I am asking you to post backtests on all other traded pairs too over the same periods of time: on your EU backtest (with EU being the original KeltnerPro bot's best currency pair), there are lengthy stagnation periods (August 2004 - October 2008, December 2008 - April 2011) while the original KeltnerPro EA shows substantial profits on its fixed-lot December 2008 - April 2011 backtest, the equity curve of which I am attaching below (I couldn't run a tick data backtest for August 2004 - October 2008 because Dukascopy whose tick data I'm using has no tick data available prior to 01.01.2008).

Now, if your bot stagnates for so long on the main EU pair (unlike the original KeltnerPro EA), don't you agree it's vital for us to see its backtests on ALL other traded pairs over the same period of time to make sure there's enough cumulative profit, save no cumulative loss, over the above lengthy periods of your bot's EU stagnation?

Now, if your bot stagnates for so long on the main EU pair (unlike the original KeltnerPro EA), don't you agree it's vital for us to see its backtests on ALL other traded pairs over the same period of time to make sure there's enough cumulative profit, save no cumulative loss, over the above lengthy periods of your bot's EU stagnation?

forex_trader_165856

Member Since Dec 03, 2013

599 posts

Apr 18, 2015 at 19:48

Member Since Dec 03, 2013

599 posts

Yes I can provide longer backtests, The one I posted should be disregarded though because as I mentioned it was just a sample in the early stages of figuring out keltnerpro. I am positive I can improve the system but it will take some time. I'll gladly send you a Backtest Only version later this week so you can run your tick data backtests with the volume filters. We're on version 1.0 so we are just getting started on keltnerFlow. Does anyone know why KeltnerPro only trades these selected pairs? Anyone try other pairs?

forex_trader_67253

Member Since Feb 26, 2012

92 posts

Apr 18, 2015 at 21:58

Member Since Feb 26, 2012

92 posts

The KeltnerFlow fixed-lot EU backtest proves stagnant for most of the time, as shown by the red horisontal lines here:

The original KeltnerPro fixed-lot EU backtest over the same period of time on the same 90% modeling quality data does not show so much stagnation:

I feel I need to be demonstrated the benefit of KeltnerFlow over KeltnerPro more clearly.

The original KeltnerPro fixed-lot EU backtest over the same period of time on the same 90% modeling quality data does not show so much stagnation:

I feel I need to be demonstrated the benefit of KeltnerFlow over KeltnerPro more clearly.

*Commercial use and spam will not be tolerated, and may result in account termination.

Tip: Posting an image/youtube url will automatically embed it in your post!

Tip: Type the @ sign to auto complete a username participating in this discussion.