Advertisement

LUX (bei MarcellusLux )

| Gewinn : | +33148.17% |

| Drawdown | 13.78% |

| Pips: | 16679.7 |

| Trades | 558 |

| Gewonnen: |

|

| Verloren: |

|

| Typ: | Real |

| Hebel: | 1:500 |

| Trading: | Unbekannt |

Edit Your Comment

LUX Diskussion

Mitglied seit May 19, 2020

321 Posts

Dec 04, 2023 at 10:37

Mitglied seit May 19, 2020

321 Posts

Raven1209 posted:

What result does your trading system show on news events with high volatility?

LUX performs quite well during volatile movements, since it is based on working with probable movement options. At the moment, the disadvantage that I am working on is false breakouts and instant pullbacks. These are quite complex trading moments that are difficult to track and predict. But at the moment, I know how to protect the system from losses during high volatility and watching the trading results this year, my ideas are working.

@Marcellus8610

Mitglied seit May 19, 2020

321 Posts

Dec 04, 2023 at 10:51

Mitglied seit May 19, 2020

321 Posts

Raven1209 posted:

Algorithms may misjudge market behavior, leading to unnecessary trades and loss of funds. How do you deal with this in your system?

I use an algorithm to calculate probabilities adjusted according to news analysis. But even after calculating the probability of a false breakout or rollback on news releases, the problem is to properly set up risk management. At the moment, I have managed to develop a stable system for working with stop losses and I am working to make earnings in a volatile market more stable. But I can admit that such trading is not the basis for my income. If I see an increased probability of losses, most likely I will just take a break from trading.

@Marcellus8610

Mitglied seit Aug 19, 2022

51 Posts

Jan 03, 2024 at 12:32

Mitglied seit Aug 19, 2022

51 Posts

Building a stable system for managing stop losses is a significant achievement especially in a volatile market. Your decision to step back when the risk of losses is high is a prudent approach to risk management showcasing a thoughtful and disciplined trading strategy. Is there an algorithm in place for exiting the market when risks increase or is this something that needs to be done manually?

Mitglied seit May 19, 2020

321 Posts

Jan 25, 2024 at 10:29

Mitglied seit May 19, 2020

321 Posts

Michel_Dubois posted:

Building a stable system for managing stop losses is a significant achievement especially in a volatile market. Your decision to step back when the risk of losses is high is a prudent approach to risk management showcasing a thoughtful and disciplined trading strategy. Is there an algorithm in place for exiting the market when risks increase or is this something that needs to be done manually?

Thanks. I have several developed algorithms that allow me to timely assess the possible risk and make a decision to exit the market. So I collect data and process it manually.

@Marcellus8610

Mitglied seit May 19, 2020

321 Posts

Mitglied seit May 19, 2020

321 Posts

Jan 29, 2024 at 12:29

Mitglied seit May 19, 2020

321 Posts

kondoboy posted:MarcellusLux posted:Alfiani posted:

Work with 100% ea?

The LUX trading system is a system of several algorithms that I have developed, but trading is manual.

Congrats on the drawdown.

Are you currently funded by a prop firm ?

Thank you.

No, I am not funded by prop firm.

This is a pamm account, contact [email protected] to get more information.

@Marcellus8610

Mitglied seit May 19, 2020

321 Posts

Feb 02, 2024 at 04:41

Mitglied seit May 19, 2020

321 Posts

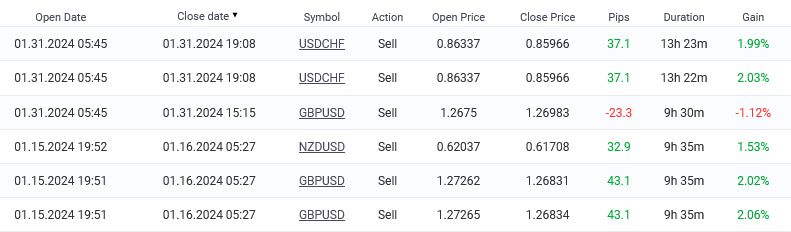

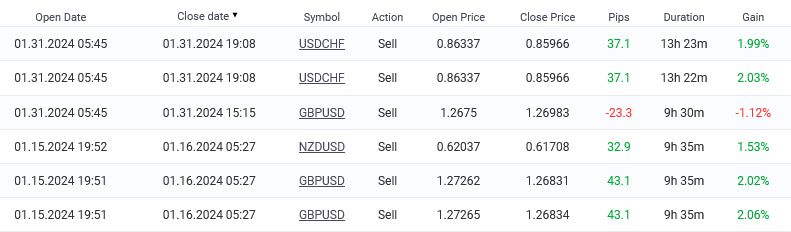

Let's summarize the results of the first trading month of 2024.

6 trades and all of them are sell.

5 of 6 trades were profitable (83%).

The account growth is 8.78%.

All profitable trades are quite accurate and confident.

Considering that LUX had holidays trading pause in January, I believe that the result is very good and can be characterized as a projection of the work done last year.

LUX starts the year very confidently and precisely.

Detailed trading information is published on myfxbook account page.

6 trades and all of them are sell.

5 of 6 trades were profitable (83%).

The account growth is 8.78%.

All profitable trades are quite accurate and confident.

Considering that LUX had holidays trading pause in January, I believe that the result is very good and can be characterized as a projection of the work done last year.

LUX starts the year very confidently and precisely.

Detailed trading information is published on myfxbook account page.

@Marcellus8610

Mitglied seit Aug 25, 2023

8 Posts

Feb 02, 2024 at 09:51

(bearbeitet Feb 02, 2024 at 09:52)

Mitglied seit Aug 25, 2023

8 Posts

i have invested money for almost 4 months. so far result is good. which I like most is that LUX do not hold trade for a long time. if getting loses, he always closes it in 1% or less than 1% lose trade.

BTW LUX do you think you can consider reducing the fees? Maybe 20%?

and nice starting for the year.

BTW LUX do you think you can consider reducing the fees? Maybe 20%?

and nice starting for the year.

Mitglied seit May 19, 2020

321 Posts

Feb 06, 2024 at 08:21

Mitglied seit May 19, 2020

321 Posts

ShahpariGreen posted:

i have invested money for almost 4 months. so far result is good. which I like most is that LUX do not hold trade for a long time. if getting loses, he always closes it in 1% or less than 1% lose trade.

BTW LUX do you think you can consider reducing the fees? Maybe 20%?

and nice starting for the year.

Thanks for your feedback. I pay a lot of attention to risk management and over the past year my base goal has been to increase consistency. This great work done turns into high-quality profitable trading.

I don't plan to change the fees, because in my opinion the current percentage is fair and beneficial for both investors and me.

Thank you for your question and opinion.

@Marcellus8610

Mitglied seit Aug 25, 2023

8 Posts

Mitglied seit May 19, 2020

321 Posts

Feb 12, 2024 at 08:53

Mitglied seit May 19, 2020

321 Posts

ShahpariGreen posted:

ermm any particular reason for making the myxbook trading system page private?

Hello. This was only a temporary inconvenience as some investors were provided with an investor password for check. The account was constantly connected and updated during this period and is now provided with public access.

@Marcellus8610

Mitglied seit Aug 19, 2021

203 Posts

forex_trader_3596980

Mitglied seit Feb 08, 2024

25 Posts

Feb 14, 2024 at 15:11

Mitglied seit Feb 08, 2024

25 Posts

WhiteWitcher posted:

Oh if I were you, I wouldn’t give anyone an investor password at all. Do you know how many scammers use your name and offer EAs showing your account as their own???

I don't give out investors password too to anyone, Because it's firm account, but I bridge it to copy out directly to mt4 accounts or mt4.

Mitglied seit Aug 19, 2021

203 Posts

Feb 20, 2024 at 20:28

Mitglied seit Aug 19, 2021

203 Posts

Oh if you are selling signals, then there is no point in giving the investor a password, this goes without saying. Well, in general, since MyFxBook connects using an investor password, I don’t even see the point of asking for it separately. Everything is already there, and in a convenient format. lol.

Mitglied seit Aug 25, 2023

8 Posts

Mar 14, 2024 at 23:14

Mitglied seit Sep 10, 2012

5 Posts

posted:WhiteWitcher posted:

Oh if I were you, I wouldn’t give anyone an investor password at all. Do you know how many scammers use your name and offer EAs showing your account as their own???

I don't give out investors password too to anyone, Because it's firm account, but I bridge it to copy out directly to mt4 accounts or mt4.

how are you getting x500 leverage with that much balance?

*Kommerzielle Nutzung und Spam werden nicht toleriert und können zur Kündigung des Kontos führen.

Tipp: Wenn Sie ein Bild/eine Youtube-Url posten, wird diese automatisch in Ihren Beitrag eingebettet!

Tipp: Tippen Sie das @-Zeichen ein, um einen an dieser Diskussion teilnehmenden Benutzernamen automatisch zu vervollständigen.

.png)