- Domov

- Komunita

- Obchodné systémy

- sPhantom Auto Trader

Advertisement

sPhantom Auto Trader (Od sPhantom )

| Zisk : | +694.0% |

| Čerpanie | 91.94% |

| Pipy: | 1266.4 |

| Obchodníci | 261 |

| Vyhrané: |

|

| Prehrané: |

|

| Typ: | Reálny |

| Páka: | 1:400 |

| Obchodovanie: | Automaticky |

Edit Your Comment

sPhantom Auto Trader Diskusia

Členom od May 08, 2012

316 príspevkov

Mar 18, 2014 at 21:51

Členom od May 08, 2012

316 príspevkov

In the long range every signal has a 50% success rate; it's still random no matter how good a backtesting looks.

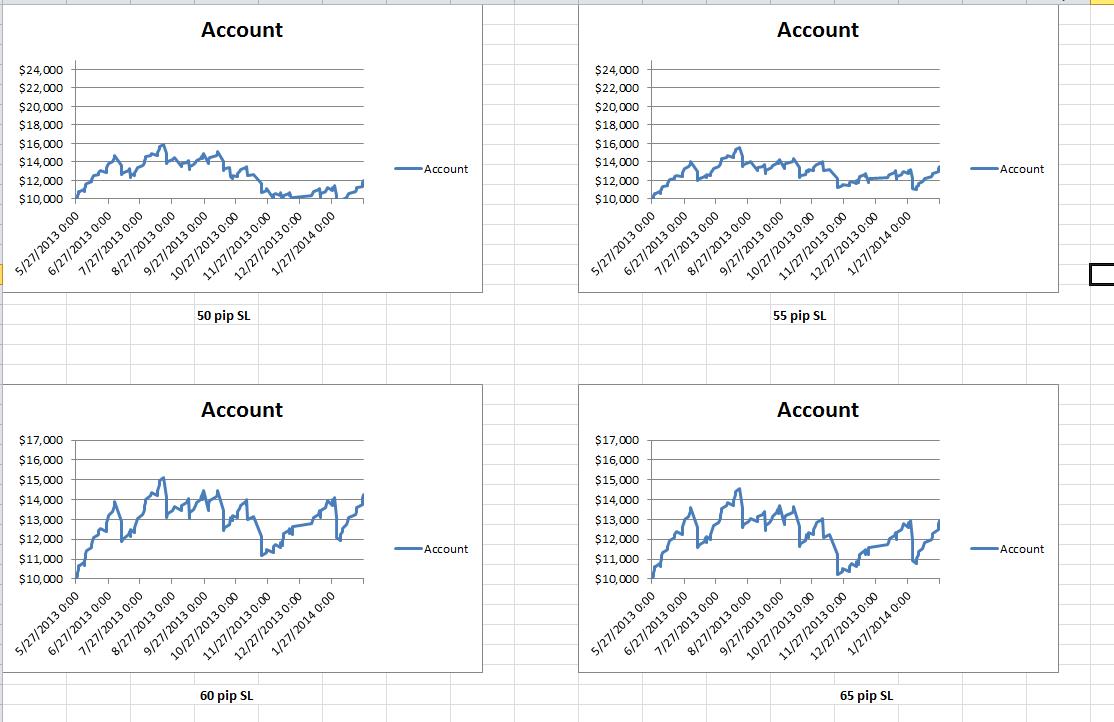

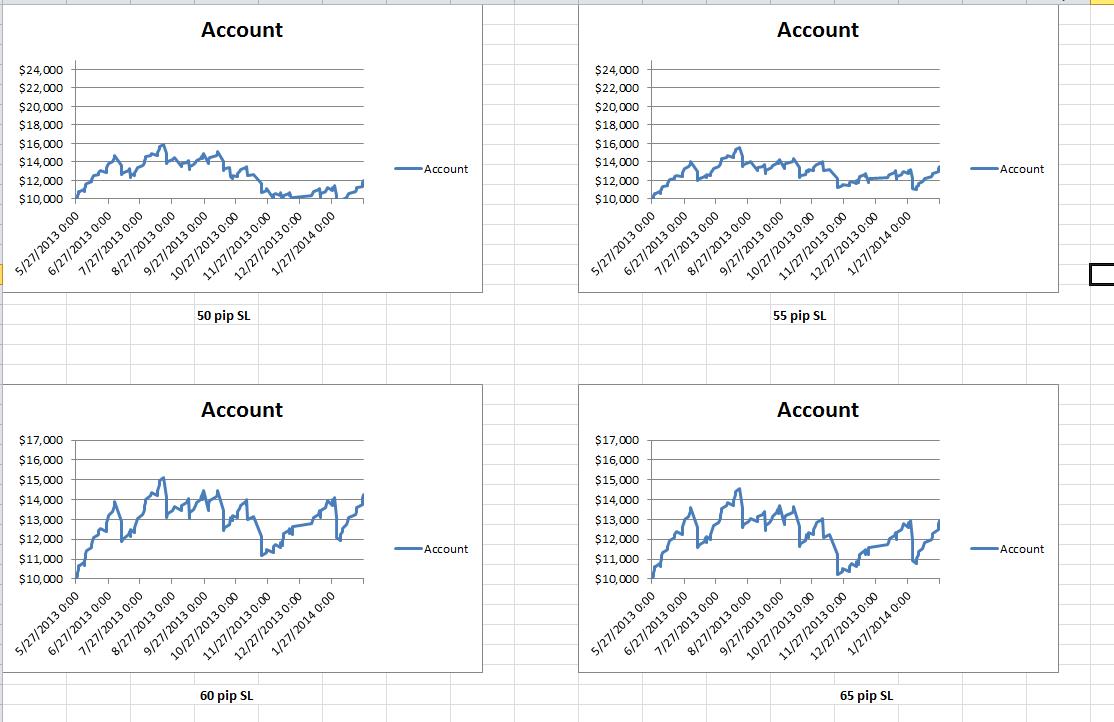

Backtesting is backtesting and money management is money management. The two really are mutually exclusive. The first thing that traders learn is to have a plan and then to track their trades. SPhantoms trades over the last 9 months have been real trades under duress, not backtests. The reporting in myfxbook allows me to track their real trades in arrears. When you pick a stop loss, you can see how many times that stop has been hit over the trading period. As you go forward in trading then, you would expect to hit the same number of stop outs within some reasonable standard deviation. The 120 pips stop I use on sPhantom hit the stops twice in 9 months and the time between hits is pretty uniform. If I hit 3 times in less than nine months, or if I hit them just a month apart, we are deviating from the norm so I know to cut my risk or get out. It is not guaranteed, nothing is. It is better than throwing darts though, and it's better than trusting sPhantom to close a bad trade properly.

My sense is sPhantom is now playing with scared money. If they take another hit like they did a month ago, I think they'll pull the plug on the whole show.

War is when your government tells you who the enemy is. Revolution is when you figure out, for yourself, who the enemy is.

Členom od May 08, 2012

316 príspevkov

Mar 18, 2014 at 22:28

(upravené Mar 18, 2014 at 22:29)

Členom od May 08, 2012

316 príspevkov

That makes a lot of sense. Do you know how to change that sl to 45 pips on sphantom? Does it require some special it skills to do that? After all I think sphantom has a huge potential if the mm is put in place, just a % of winning trades says a lot.

Someone posted the the StopReset_pw in this forum. Go find it. It works perfectly. Remember it sets in points, not pips, a 100 pip SL is 1,000 and 105 pips SL is 1,050. I misspoke, I use 105.

45 pips was just an example. Anything below 70 is pretty shitty. Its even better over 100.

Someone posted the the StopReset_pw in this forum. Go find it. It works perfectly. Remember it sets in points, not pips, a 100 pip SL is 1,000 and 105 pips SL is 1,050. I misspoke, I use 105.

45 pips was just an example. Anything below 70 is pretty shitty. Its even better over 100.

War is when your government tells you who the enemy is. Revolution is when you figure out, for yourself, who the enemy is.

Členom od Sep 20, 2013

36 príspevkov

Mar 19, 2014 at 04:05

Členom od Sep 20, 2013

36 príspevkov

Hello Michigander,

I never said I don't agree with you,so there should be no conflict between us.😄

Firstly I guessed you want to change the SL or MM to make the signal more better. Ok, It is a wrong guess.

But there are still some users who want to get more profit and little risk.

So how to enhance the signal dumb ass?😎

Now people in this forum find some methods.

1.change SL

2.change the entry direction sometimes(Buy->sell,Sell->buy)

3.avoid the big news.

But I think the best way is to waste more time to analysis and understand the trading logic for the signal from trading records.

In another word,you can be a "hacker".

Why the signal enter and exit the market?Why it buy higher and sell lower many times?

Why the sPhantom guy can not enhance the signal for several years?Why the signal be afraid of the big news?

So if you understand the trading logic and believe it is promising,how about coding one EA with better MM.

Thanks

Jiang

I never said I don't agree with you,so there should be no conflict between us.😄

Firstly I guessed you want to change the SL or MM to make the signal more better. Ok, It is a wrong guess.

But there are still some users who want to get more profit and little risk.

So how to enhance the signal dumb ass?😎

Now people in this forum find some methods.

1.change SL

2.change the entry direction sometimes(Buy->sell,Sell->buy)

3.avoid the big news.

But I think the best way is to waste more time to analysis and understand the trading logic for the signal from trading records.

In another word,you can be a "hacker".

Why the signal enter and exit the market?Why it buy higher and sell lower many times?

Why the sPhantom guy can not enhance the signal for several years?Why the signal be afraid of the big news?

So if you understand the trading logic and believe it is promising,how about coding one EA with better MM.

Thanks

Jiang

Michigander posted:jiang posted:

If you can enhance the sPhantom signal,why not try to make your EA which is similar to sPhantom?😈

Gee, what a thoughtful response. Your attitude is only exceeded by your childish ignorance. It never ceases to amaze me. I go to YOUR page and there is nothing there. No history, no experience, and no sharing of any systems. Yet you come here and take cheap shots that you think are witty? Go talk to cowpoop and jarora. They'll get off on your humor. i don't.

This is not enhancing the signal dumb ass. Its simply looking a the historical trades that have been made in live trading and evaluating the intra-trade draw down of each trade. Let me give you a simple example so even you may understand. A system made 200 trades, and 199 of those trades had a max open draw down of 40 pips but were all ultimately profitable, and one trade experienced a 250 pip stop loss . If you set your stop loss at 35 pips, every single trade would be a loser. if you set your stop at 45 pips, every trade would be a winner except 1, and you would have limited your loss on that 1 loser to 45 pips instead of 250. I made this overtly simplistic so maybe you'll at least grasp the concept. In reality you have many different intra-trade draw downs. By reviewing every real trade you can calculate the best place to run a stop loss based on those historical trades. This is not changing the signals in any way. It is merely using the available data and developing the money management aspect that most EA providers do not consider. I have seen losing systems made profitable and good systems made better through money management. So, if the historical data is available, why not use it to your advantage?

If you want to review and critique the actual results, please do so. If you're just here to just sling mud, go crawl back under your rock.

Členom od Jan 17, 2011

58 príspevkov

Mar 19, 2014 at 12:55

Členom od Jan 17, 2011

58 príspevkov

And again buy at the top, and again FOMC minutes ahead. History likes to repeat.. :)

Členom od Mar 17, 2013

9 príspevkov

Mar 19, 2014 at 13:11

Členom od Mar 17, 2013

9 príspevkov

@pilotas hahahahaha fasten your seat belt guys 😲, and I agree with you about FOMC,

Členom od Dec 31, 2012

97 príspevkov

Mar 19, 2014 at 13:13

Členom od Dec 31, 2012

97 príspevkov

Well, if it goes to shits and you aren't watching the trade this time, then it's your fault really. Or do you actually believe there's a EA that doesn't lose once in a while?

BLTW777@

Členom od Jan 17, 2011

58 príspevkov

Mar 19, 2014 at 13:20

Členom od Jan 17, 2011

58 príspevkov

Actualy i do not use this ea any more, just following

Členom od Jan 17, 2011

58 príspevkov

Mar 19, 2014 at 13:45

(upravené Mar 19, 2014 at 14:02)

Členom od Jan 17, 2011

58 príspevkov

Ken, labas

I like the way you are thinking and using data of this strategy. there is one more idea for you and every one. Majority of Phantom's trades has smaller or bigger drawdown. According data there was 47 trades with DD les than 10 pips until now. If to manage to open your position at 10 pips DD price, you would get more profit and less DD. And offcource 0 for trades wich has Dd less than 10 pips, like it was two such quick trades yesterday. I have made very quick and not so accurate calculations on that and got that sPhantoms account would be now not 567 usd but 1261 usd. 567 with that 47 trades with almost no DD, and 1261 without that 47 trades. makes sense?

it is possible to get even better results by changing displacement of your entry. let say on dd 19 profit would be 1644 usd now and only 74 trades instead of 150+

I like the way you are thinking and using data of this strategy. there is one more idea for you and every one. Majority of Phantom's trades has smaller or bigger drawdown. According data there was 47 trades with DD les than 10 pips until now. If to manage to open your position at 10 pips DD price, you would get more profit and less DD. And offcource 0 for trades wich has Dd less than 10 pips, like it was two such quick trades yesterday. I have made very quick and not so accurate calculations on that and got that sPhantoms account would be now not 567 usd but 1261 usd. 567 with that 47 trades with almost no DD, and 1261 without that 47 trades. makes sense?

it is possible to get even better results by changing displacement of your entry. let say on dd 19 profit would be 1644 usd now and only 74 trades instead of 150+

Členom od Dec 22, 2010

6 príspevkov

Mar 19, 2014 at 14:59

Členom od Dec 22, 2010

6 príspevkov

Народная инициатива !

Голосуй за создание нового закона на финансовом рынке форекс.

https://ni.kprf.ru/n/2029/

Голосуй и отправь ссылку 3-ём своим друзьями.

Кто если не мы сами будем делать своё будущее.

Голосуй за создание нового закона на финансовом рынке форекс.

https://ni.kprf.ru/n/2029/

Голосуй и отправь ссылку 3-ём своим друзьями.

Кто если не мы сами будем делать своё будущее.

Členom od Feb 13, 2013

22 príspevkov

Mar 19, 2014 at 15:50

Členom od Feb 13, 2013

22 príspevkov

enicolasgomez posted:Michigander posted:jiang posted:

If you can enhance the sPhantom signal,why not try to make your EA which is similar to sPhantom?😈

Gee, what a thoughtful response. Your attitude is only exceeded by your childish ignorance. It never ceases to amaze me. I go to YOUR page and there is nothing there. No history, no experience, and no sharing of any systems. Yet you come here and take cheap shots that you think are witty? Go talk to cowpoop and jarora. They'll get off on your humor. i don't.

This is not enhancing the signal dumb ass. Its simply looking a the historical trades that have been made in live trading and evaluating the intra-trade draw down of each trade. Let me give you a simple example so even you may understand. A system made 200 trades, and 199 of those trades had a max open draw down of 40 pips but were all ultimately profitable, and one trade experienced a 250 pip stop loss . If you set your stop loss at 35 pips, every single trade would be a loser. if you set your stop at 45 pips, every trade would be a winner except 1, and you would have limited your loss on that 1 loser to 45 pips instead of 250. I made this overtly simplistic so maybe you'll at least grasp the concept. In reality you have many different intra-trade draw downs. By reviewing every real trade you can calculate the best place to run a stop loss based on those historical trades. This is not changing the signals in any way. It is merely using the available data and developing the money management aspect that most EA providers do not consider. I have seen losing systems made profitable and good systems made better through money management. So, if the historical data is available, why not use it to your advantage?

If you want to review and critique the actual results, please do so. If you're just here to just sling mud, go crawl back under your rock.

I was REALLY interested on MEA/MFE analysis some time ago, run lots of simulations in different platforms, including my own.

I would say that it's now about making a better signal, you can build a very successfull system based in a random signal by optimization of RRR and MEA/MFE.

In the long range every signal has a 50% success rate; it's still random no matter how good a backtesting looks.

It is possible to get a statistical edge (winning probability over 50%) - sPhantom did that, but not with a proper risk management. I mean, without any risk management. :)

This robot starts to freak me out. Opening a second trade in the same direction is a very stupid thing, unless you are trading manually and find a context where you can enter with a very small SL to the second position.

I can't stand the fact that this robot does something I don't know. Maybe I should start working on my own EA or start manual trading or whatever.

NOTE: I have posted the StopReset EA earlier, here is the link again: https://ubuntuone.com/5CD24GOx9nByfFJ9oTUk7A

Others have recommended the Swiss Army EA for the same purpose.

Členom od Jan 17, 2011

58 príspevkov

Mar 19, 2014 at 18:22

Členom od Jan 17, 2011

58 príspevkov

wow, what a precise exit, just seconds in front of crash :)

Členom od Jan 17, 2011

58 príspevkov

Mar 19, 2014 at 19:37

Členom od Jan 17, 2011

58 príspevkov

actualy they didn't exited. trades hit TP. and I'm sure they wouldn't exit manualy if TP wouldn't be hit.

Ken, take a look at my message above to you

Ken, take a look at my message above to you

Členom od May 08, 2012

316 príspevkov

Mar 19, 2014 at 19:58

Členom od May 08, 2012

316 príspevkov

pilotas posted:

Ken, labas

I like the way you are thinking and using data of this strategy. there is one more idea for you and every one. Majority of Phantom's trades has smaller or bigger drawdown. According data there was 47 trades with DD les than 10 pips until now. If to manage to open your position at 10 pips DD price, you would get more profit and less DD. And offcource 0 for trades wich has Dd less than 10 pips, like it was two such quick trades yesterday. I have made very quick and not so accurate calculations on that and got that sPhantoms account would be now not 567 usd but 1261 usd. 567 with that 47 trades with almost no DD, and 1261 without that 47 trades. makes sense?

it is possible to get even better results by changing displacement of your entry. let say on dd 19 profit would be 1644 usd now and only 74 trades instead of 150+

I can't really do anything with this as none of the thoughts or suggestions are based in any fact or data. You never know which trades are going to draw down or which ones aren't, so you can't really implement a strategy based on no data and lots of maybes. The historical record of live trades that they made is all we have to go by. I cannot, I will not try to alter the exits or entries because I have no basis to do so. The only thing I can do is to manage the intratrade drawdown and maybe make a manual position close prior to the news that these idiots keep trading into.

War is when your government tells you who the enemy is. Revolution is when you figure out, for yourself, who the enemy is.

Členom od Apr 05, 2012

26 príspevkov

Mar 19, 2014 at 20:14

Členom od Apr 05, 2012

26 príspevkov

Wow is right. Could easily have been a disaster. Congrats everyone.

Členom od Nov 18, 2013

151 príspevkov

Členom od Jan 17, 2011

58 príspevkov

Mar 19, 2014 at 20:22

Členom od Jan 17, 2011

58 príspevkov

Michigander posted:pilotas posted:

Ken, labas

I like the way you are thinking and using data of this strategy. there is one more idea for you and every one. Majority of Phantom's trades has smaller or bigger drawdown. According data there was 47 trades with DD les than 10 pips until now. If to manage to open your position at 10 pips DD price, you would get more profit and less DD. And offcource 0 for trades wich has Dd less than 10 pips, like it was two such quick trades yesterday. I have made very quick and not so accurate calculations on that and got that sPhantoms account would be now not 567 usd but 1261 usd. 567 with that 47 trades with almost no DD, and 1261 without that 47 trades. makes sense?

it is possible to get even better results by changing displacement of your entry. let say on dd 19 profit would be 1644 usd now and only 74 trades instead of 150+

I can't really do anything with this as none of the thoughts or suggestions are based in any fact or data. You never know which trades are going to draw down or which ones aren't, so you can't really implement a strategy based on no data and lots of maybes. The historical record of live trades that they made is all we have to go by. I cannot, I will not try to alter the exits or entries because I have no basis to do so. The only thing I can do is to manage the intratrade drawdown and maybe make a manual position close prior to the news that these idiots keep trading into.

But you expect some drawdown and put stoploss at some place. Statistycaly majority of trades has drawdown and there is no chance that majority of trades will not have it in the future. On this expectation it is possible to make presu psion, that some part of trades will be activated with some entry point displacement. Tp should remain as original i think. This would let us have smaller dd and bigger profit, better RRR. In forst case we could have more room to maneuver ant to place tp lower than original just get bigger chance to escape fron undesirable trade like it was today.

Členom od May 08, 2012

316 príspevkov

Mar 19, 2014 at 21:15

Členom od May 08, 2012

316 príspevkov

But you expect some drawdown and put stoploss at some place. Statistycaly majority of trades has drawdown and there is no chance that majority of trades will not have it in the future. On this expectation it is possible to make presu psion, that some part of trades will be activated with some entry point displacement. Tp should remain as original i think. This would let us have smaller dd and bigger profit, better RRR. In forst case we could have more room to maneuver ant to place tp lower than original just get bigger chance to escape fron undesirable trade like it was today.

Your supposition is that you can somehow know when a trade would be placed and then delay that entry until some level of draw down occurs before placing your trade. The analysis is doable, but how do you, in an automated way, read the sPhantom trade BEFORE IT HAPPENS, keep it from happening, modify that trade to enter some x pips higher or lower and then place the trade?

Even if you could do this and did do this, it would have had no bearing on controlling what happened today. You also make too many suppositions at once...change your entry, move the stop, maybe move the TP. There are causalities that you are not aware of that you'll never be aware of until you analyze it. You have no idea how many trading concepts that I have had programmed to back test that just turned out to be brain farts.

War is when your government tells you who the enemy is. Revolution is when you figure out, for yourself, who the enemy is.

Členom od Jan 17, 2011

58 príspevkov

Mar 20, 2014 at 06:26

Členom od Jan 17, 2011

58 príspevkov

As there is no such option to shift your personal trade entry implemented in sphantom ea, you can do that manualy or by using some trade copy ea paralely. Let say you set sphantom for a minimum posible lot size, and righ after sphantom's trade is opened, you set your own pending limit order X pips away from original one. And thats it.

Členom od Dec 31, 2012

97 príspevkov

Mar 20, 2014 at 07:54

Členom od Dec 31, 2012

97 príspevkov

From my own perspective, running SP is straightforward. If it opens a position that looks nasty/stupid/illogical from a fundamental point of view, then close it. Otherwise, just let it run.

It's always better to lose out on a potential profitable trade than to potentially get into a high DD scenario, I would say this is the logic that everyone should follow when running EAs.

It's always better to lose out on a potential profitable trade than to potentially get into a high DD scenario, I would say this is the logic that everyone should follow when running EAs.

BLTW777@

Členom od Sep 18, 2010

21 príspevkov

Mar 20, 2014 at 08:54

Členom od Sep 18, 2010

21 príspevkov

Brendan777 posted:

From my own perspective, running SP is straightforward. If it opens a position that looks nasty/stupid/illogical from a fundamental point of view, then close it. Otherwise, just let it run.

It's always better to lose out on a potential profitable trade than to potentially get into a high DD scenario, I would say this is the logic that everyone should follow when running EAs.

I agree completely.

I bought SP last September and I have a good profit (including the great DD) using a 10% risk, and a SL of 75 (when I bought SP I received file with SL adjustable from them, because I did not agree 250 SL).

Other times, when in my opinion the market went in the direction of trading, I disabled SP, I changed TP (even using trailing stop) and got excellent results.

Never leave alone any EA.

However apart from all the insults sent to the SP team (many fully deserved ), it would be the case that they return here on the Forum or would allow them to communicate with their customers on a Forum.

We are all here to make money not to insult anyone, we want to understand and improve the system

*Komerčné použitie a spam nebudú tolerované a môžu viesť k zrušeniu účtu.

Tip: Uverejnením adresy URL obrázku /služby YouTube sa automaticky vloží do vášho príspevku!

Tip: Zadajte znak @, aby ste automaticky vyplnili meno používateľa, ktorý sa zúčastňuje tejto diskusie.