TechTrading (由 quicksilver )

該使用者已經刪除了這個系統。

Edit Your Comment

TechTrading討論

會員從Jan 09, 2013開始

39帖子

Jan 09, 2013 at 14:41

會員從Jan 09, 2013開始

39帖子

NZDUSD: This pair has been quite nicely. After some successful trades (which I closed a bit early), NZDUSD was hovering near the key 0.8400 level. However, since this was a strong resistance, the downtrend would prevail.

The price could potentially touch the daily support level 1 at 0.8339. A potential breach of this support level could see the price fall further below to the second support level of 0.8314. On the upside, is the 0.8339 holds, the pair could set itself up on a upward trend and could breach the 0.8400 level quite easily.

On the fundamental side, Thursday will see the Kiwi unemployment rate details. This will be key to watch as the US economic calendar seems to be quite dry without any major market announcements.

The price could potentially touch the daily support level 1 at 0.8339. A potential breach of this support level could see the price fall further below to the second support level of 0.8314. On the upside, is the 0.8339 holds, the pair could set itself up on a upward trend and could breach the 0.8400 level quite easily.

On the fundamental side, Thursday will see the Kiwi unemployment rate details. This will be key to watch as the US economic calendar seems to be quite dry without any major market announcements.

會員從Jan 09, 2013開始

39帖子

Jan 09, 2013 at 14:43

會員從Jan 09, 2013開始

39帖子

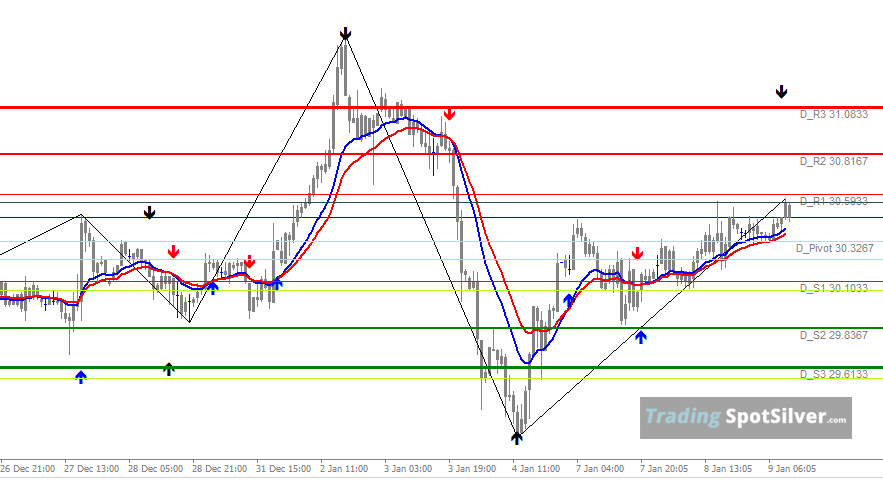

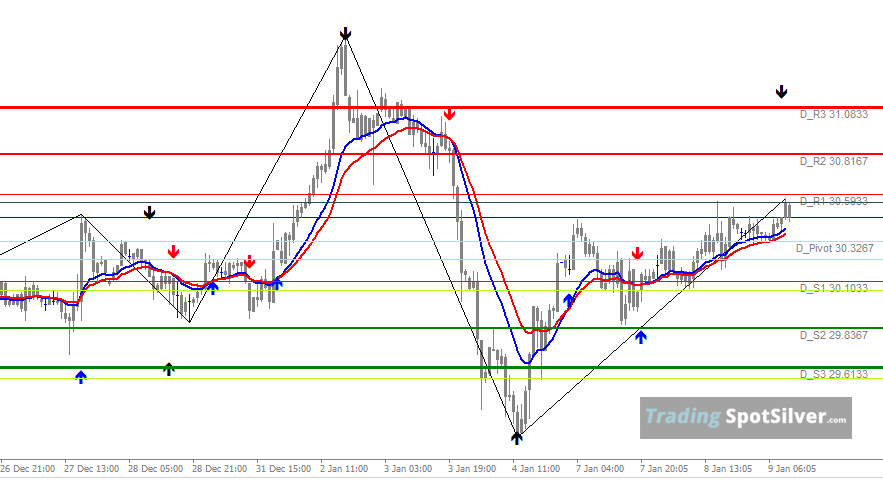

XAGUSD - 09/01/2012

Silver hit its lows around mid December and has been trying to move to the upside ever since. The biggest factors that influenced silver prices was the critical US fiscal cliff. Now that this has been postponed and also we know that QE will potentially end in 2013, Silver could see a gradual rise over time.

Currency trading at 30.4, today's trade set up would be as follows:

The immediate resistance level for silver is at 30.5933. This level was breached earlier today once. Expect a downward trend in Silver, with price potentially reaching the daily Support 1 @ 30.1033

Price could potentially bounce off this level and see an upward trend with the possibility of reaching the daily Resistance2 level at 30.81.

Silver hit its lows around mid December and has been trying to move to the upside ever since. The biggest factors that influenced silver prices was the critical US fiscal cliff. Now that this has been postponed and also we know that QE will potentially end in 2013, Silver could see a gradual rise over time.

Currency trading at 30.4, today's trade set up would be as follows:

The immediate resistance level for silver is at 30.5933. This level was breached earlier today once. Expect a downward trend in Silver, with price potentially reaching the daily Support 1 @ 30.1033

Price could potentially bounce off this level and see an upward trend with the possibility of reaching the daily Resistance2 level at 30.81.

會員從Jan 09, 2013開始

39帖子

Jan 09, 2013 at 14:45

會員從Jan 09, 2013開始

39帖子

NZDUSD - In trade analysis

The pair is currently testing the daily pivot @ 0.8360 for support.

1. A critical bounce off this could set the pair in an upward trend.

If the price moves 25 - 50 pips above 0.8360 will likely see the pair finding its next resistance at 0.8395 potentially moving closer to 0.8400. This long trade needs a bit more confirmation. Consider this a more risky trade so set the stop loss at 0.83540

2. A breach of this price could see the pair moving downwards.

Taking a short position 10/25 pips below the pivot (0.8360) with TP at 0.8338 will see some gains being made.

A good point to close any high position/aggressive trades right now and wait for the moving averages to confirm the crossover.

The pair is currently testing the daily pivot @ 0.8360 for support.

1. A critical bounce off this could set the pair in an upward trend.

If the price moves 25 - 50 pips above 0.8360 will likely see the pair finding its next resistance at 0.8395 potentially moving closer to 0.8400. This long trade needs a bit more confirmation. Consider this a more risky trade so set the stop loss at 0.83540

2. A breach of this price could see the pair moving downwards.

Taking a short position 10/25 pips below the pivot (0.8360) with TP at 0.8338 will see some gains being made.

A good point to close any high position/aggressive trades right now and wait for the moving averages to confirm the crossover.

會員從Jan 09, 2013開始

39帖子

Jan 09, 2013 at 14:45

會員從Jan 09, 2013開始

39帖子

XAGUSD - Pre trade analysis

Correction to my earlier comments on XAGUSD. There are two key price areas to note. The first being the Daily Pivot @ 30.32 and the Weekly Pivot @ 30.29

Entering a trade at these prices is risky. A modification to my earlier recommendation would be to go short at 30.28 - 30.25 with take profit at 30.10. A healthy stop loss would be ideal at 30.35 - 30.38.

Correction to my earlier comments on XAGUSD. There are two key price areas to note. The first being the Daily Pivot @ 30.32 and the Weekly Pivot @ 30.29

Entering a trade at these prices is risky. A modification to my earlier recommendation would be to go short at 30.28 - 30.25 with take profit at 30.10. A healthy stop loss would be ideal at 30.35 - 30.38.

會員從Jan 09, 2013開始

39帖子

Jan 09, 2013 at 14:45

會員從Jan 09, 2013開始

39帖子

Post trade analysis - NZDUSD

A test trade was taken up @0.8355. The trend was unclear and also the fact that the pair was trading close to the daily pivot @ 0.8360. The price bounced back and the trade closed at the stop loss level of 0.83660. This trade was ok to lose as the amount at risk was 105.

Earlier on, a trade on XAGUSD was taken up as a measure to protect potential losses on the NZDUSD trial trade. This trade managed to make 550.. so with the loss of 105, both these trades combined managed to profit 445.

There is another big trade coming up for the XAGUSD. However, this pair too is uncertain, trading at the daily pivot @ 30.32

If the downtrend on spot silver is clear then the next trade should be quite profitable.

A test trade was taken up @0.8355. The trend was unclear and also the fact that the pair was trading close to the daily pivot @ 0.8360. The price bounced back and the trade closed at the stop loss level of 0.83660. This trade was ok to lose as the amount at risk was 105.

Earlier on, a trade on XAGUSD was taken up as a measure to protect potential losses on the NZDUSD trial trade. This trade managed to make 550.. so with the loss of 105, both these trades combined managed to profit 445.

There is another big trade coming up for the XAGUSD. However, this pair too is uncertain, trading at the daily pivot @ 30.32

If the downtrend on spot silver is clear then the next trade should be quite profitable.

會員從Jan 09, 2013開始

39帖子

Jan 10, 2013 at 07:57

會員從Jan 09, 2013開始

39帖子

Yesterday's Silver trading quite had its ups and downs. Upon opening the first trade, the price was falling and due to a tight stop loss, the trade closed down. The ideal situation for such scenarios is to wait till a resistance or support level is reached. In this case, silver touched the daily support level of 30 before bouncing back. Opening a buy order on the retracement managed to make up for the losses.

Today's trading will be mostly light.

Today's trading will be mostly light.

會員從Jan 09, 2013開始

39帖子

會員從Jan 09, 2013開始

39帖子

會員從Jan 09, 2013開始

39帖子

Jan 17, 2013 at 08:37

會員從Jan 09, 2013開始

39帖子

The overall trend for Silver is shaping up to be bullish. On the 1 hour charts, we see that the daily pivot of 31.35 is holding up quite nicely, taking a long position here with the first take profit between 31.559 (38.2% Fib) and 31.6443 is ideal.

If the resistance breaks, the price could well head into 32.285, however, being conservative, expect to see some sideways movement near the TP levels mentioned above. A likely retracement to the Weekly R2 @ 31.4823 from either the D_R1 @ 31.6334 or Fib level 38.2 @ 31.559 could happen. Should this occur, the next TP level would be near daily resistance of 31.644.

*商業用途和垃圾郵件將不被容忍,並可能導致帳戶終止。

提示:發佈圖片/YouTube網址會自動嵌入到您的帖子中!

提示:鍵入@符號,自動完成參與此討論的用戶名。