A worrisome lull in crypto

A worrisome lull in crypto

Market Picture

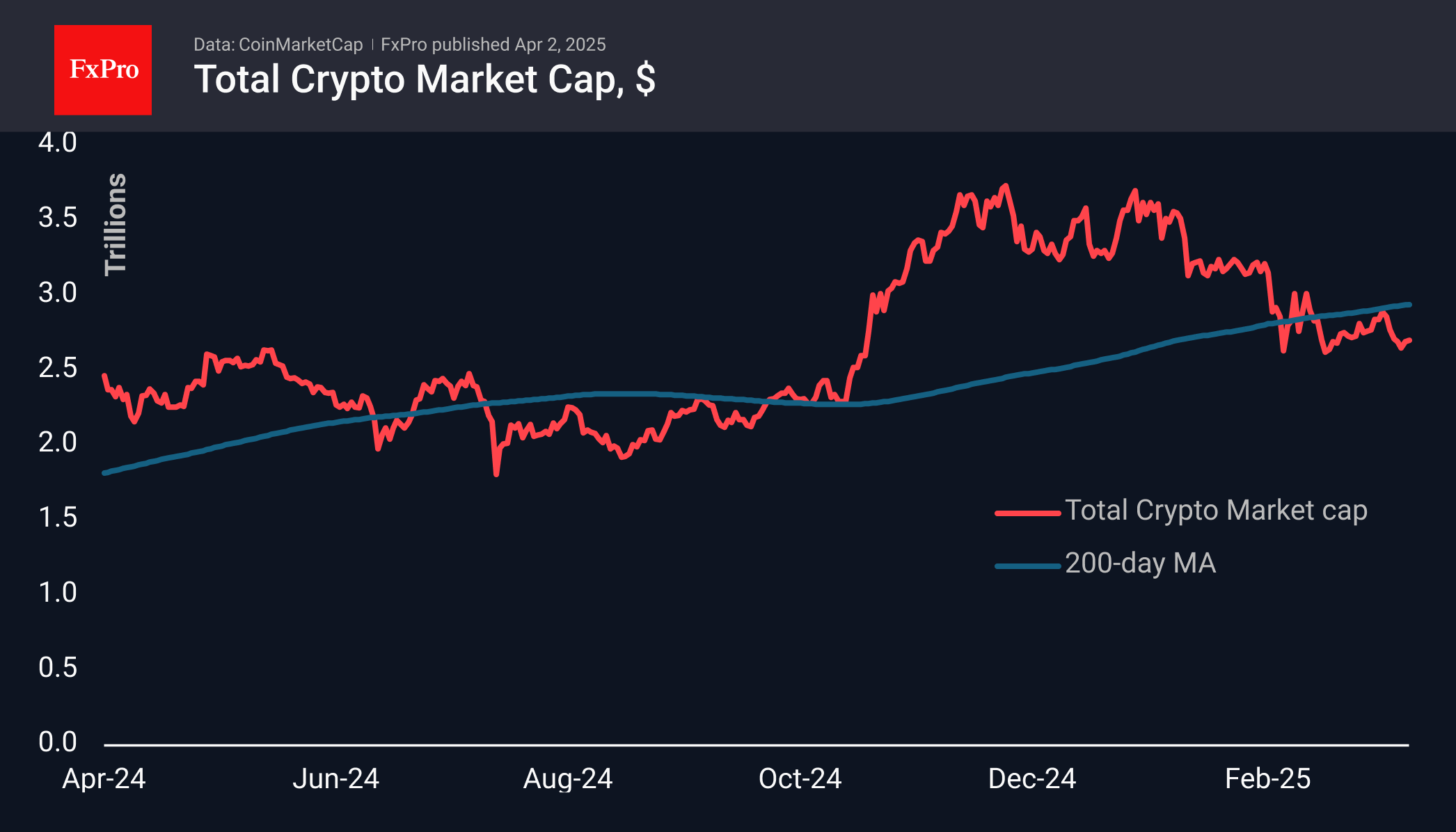

The crypto market cap was virtually unchanged over the past day, remaining near the $2.70 trillion level. Media reports suggest that all markets are frozen in anticipation of the tariffs and bracing for volatility. We see this as a continuation of a prolonged pause, allowing the bears to accumulate liquidity before a new attack. We will see confirmation of this bearish scenario if market capitalisation falls below $2.62 trillion - the area of previous lows.

The Crypto Market Sentiment Index jumped 10 points to 44 because of the lull, which is close to the upper limit of the fear zone. However, this rise is due to a pause in the sell-off rather than an active recovery.

Bitcoin gained more than 3.5% on Tuesday but paused near $85,300. Once again, the upside momentum was lost on the approach to the 200-day moving average, which is now above $86,400. This is a case where the lack of growth is setting the stage for a decline. At the same time, we prefer to look at Friday's employment data rather than tariffs to find the fundamental reasons for the next move. The former is a more reliable source of information.

News Background

Several on-chain indicators point to a gradual shift in sentiment, a return to buying and 'structural strength in the market', notes Bitcoin Magazine Pro. However, BTC remains 'closely tied to macro liquidity trends and equity markets'.

Cycle tops occur every four years in November-December. There is scope for the pattern to repeat itself this year, with Bitcoin rising to $150,000, the Cyclop analyst expects.

Tether, which issues the USDT stablecoin, bought 8,888 BTC for $734 million, bringing its reserves to 92,646 BTC. In line with its strategy, Tether adds to its reserves at the end of each quarter.

On 1 April, around ten small-cap altcoins, such as ACT, DEXE and HIPPO, saw their prices plummet by up to 50%. The community linked the crash to market maker Wintermute's sell-offs, but the company's founder denied its involvement in the collapse.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)