Another three-week pullback for Bitcoin after reaching new highs?

Market Picture

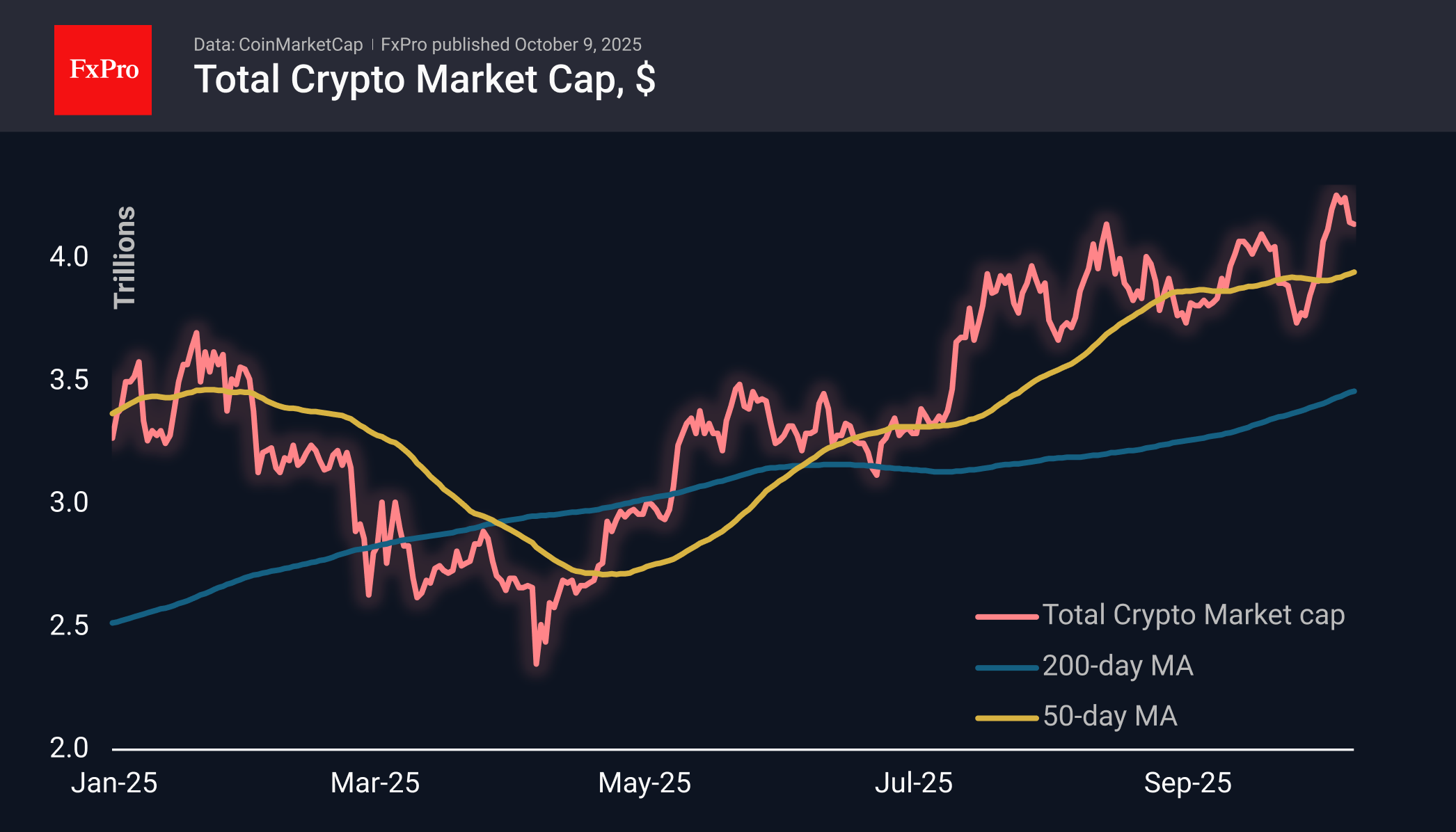

The crypto market cap has fallen by 0.5% over the past 24 hours to $4.14 trillion. This is a pullback to levels that acted as resistance in August and September. Altcoins are having a tough time, as pressure on them has intensified against the background of Bitcoin's slump. Once again, we are reminded that cryptocurrencies can be the first to react to fluctuations in risk appetite, and the current sluggishness may be the first sign that players have had their fill of risk.

Bitcoin is trading near $121.5K, retreating from Monday's peak of $126.1K. After peaking in July, the price fell 9% over the next three weeks before turning upwards. In August, the decline took almost the same amount of time but took away about 14.5%. A repeat of this pattern suggests a pullback to the $107–115K range by the end of the month. However, even attempts to move below the upper limit of this range will cause quite a lot of concern in the markets, with a crucial date on the horizon – the Fed's decision on the key rate on 29 October.

News Background

News Background

Spot Bitcoin ETFs in the US will attract record capital inflows in the fourth quarter, according to Bitwise. Major banks have already started offering cryptocurrency products in more risky investor portfolios.

Seller pressure in the derivatives market has eased significantly, according to CryptoQuant.

Consensys CEO Joseph Lubin said storing corporate reserves in Ethereum is more profitable than in Bitcoin. ETH provides higher returns and offers broad investment opportunities.

The queue for withdrawals from Ethereum staking has reached a record 2.4 million ETH, worth over $10 billion. Due to the sharp increase in requests, the waiting time for withdrawals has exceeded 41 days, which is about five times longer than the queue for deposits. This situation creates risks of pressure on the ETH exchange rate.

Binance founder Changpeng Zhao announced the start of the meme coin season on BNB Chain. According to Dune, over the past 24 hours, users of the Four.meme platform have created over 10,000 new tokens.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)