Brighter business sentiment in Germany

Brighter business sentiment in Germany

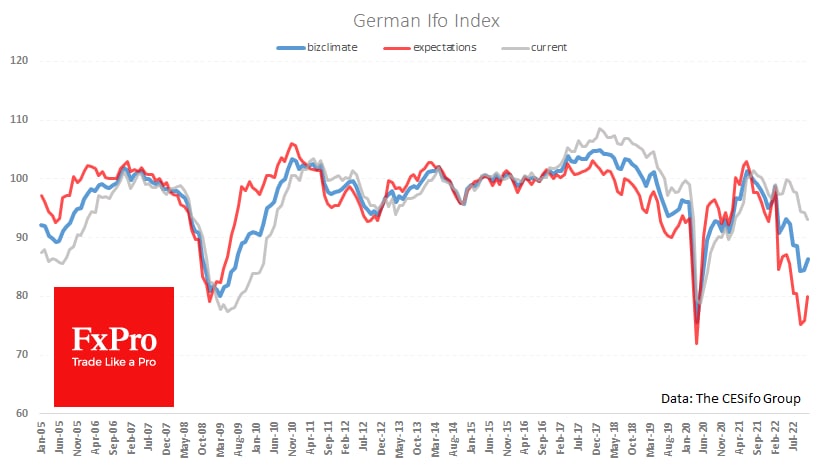

Germany’s Ifo Business Climate Index improved in November, strengthening from 84.5 to 86.3 (85.0 was expected). The overall index rose following an improvement in expectations over the last two months.

Signals that the sharpest downturn may be over and that the situation will stabilise further we also previously noted in Markit PMIs and the ZEW Indicator of Economic Sentiment.

The outcome of the Ifo index is encouraging for both economists and market participants. The same kind of reversal signalled the start of a period of economic stabilisation after almost free-falling in both 2009 and 2020. These hopes for changes are also bolded by lowering energy prices, improved consumer expectations, and rising export volumes.

Global reversals in the Ifo sentiment index coincided with EURUSD and many European stock indices hitting their cyclical lows. Improving business sentiment may provide additional reasons to remain confident in the single currency and to buy back at historically low levels.

By the FxPro Analyst Team

-11122024742.png)

-11122024742.png)