Crypto: still got the blues

Market Overview

The crypto market fluctuated slightly over the past day, ranging from a low of $3.02 trillion before the publication of the FOMC minutes and Nvidia's earnings, to a peak of $3.16 trillion in the middle of the Asian session. However, it has now fallen back to $3.13 trillion, remaining almost unchanged for the day. The cryptocurrency market remains pessimistic, reacting eagerly to negative news and quickly deflating on positive news.

Bitcoin is trading just above $92K at the start of the day on Thursday. It has been hovering around this level for the last four days, but the last ten days have seen lower local lows (falling to $88.5K at the end of the day on Wednesday) and local highs, indicating a very aggressive sell-off. In such conditions, it is only a matter of days before the bears find stop-out levels, triggering a self-sustaining avalanche of sell-offs.

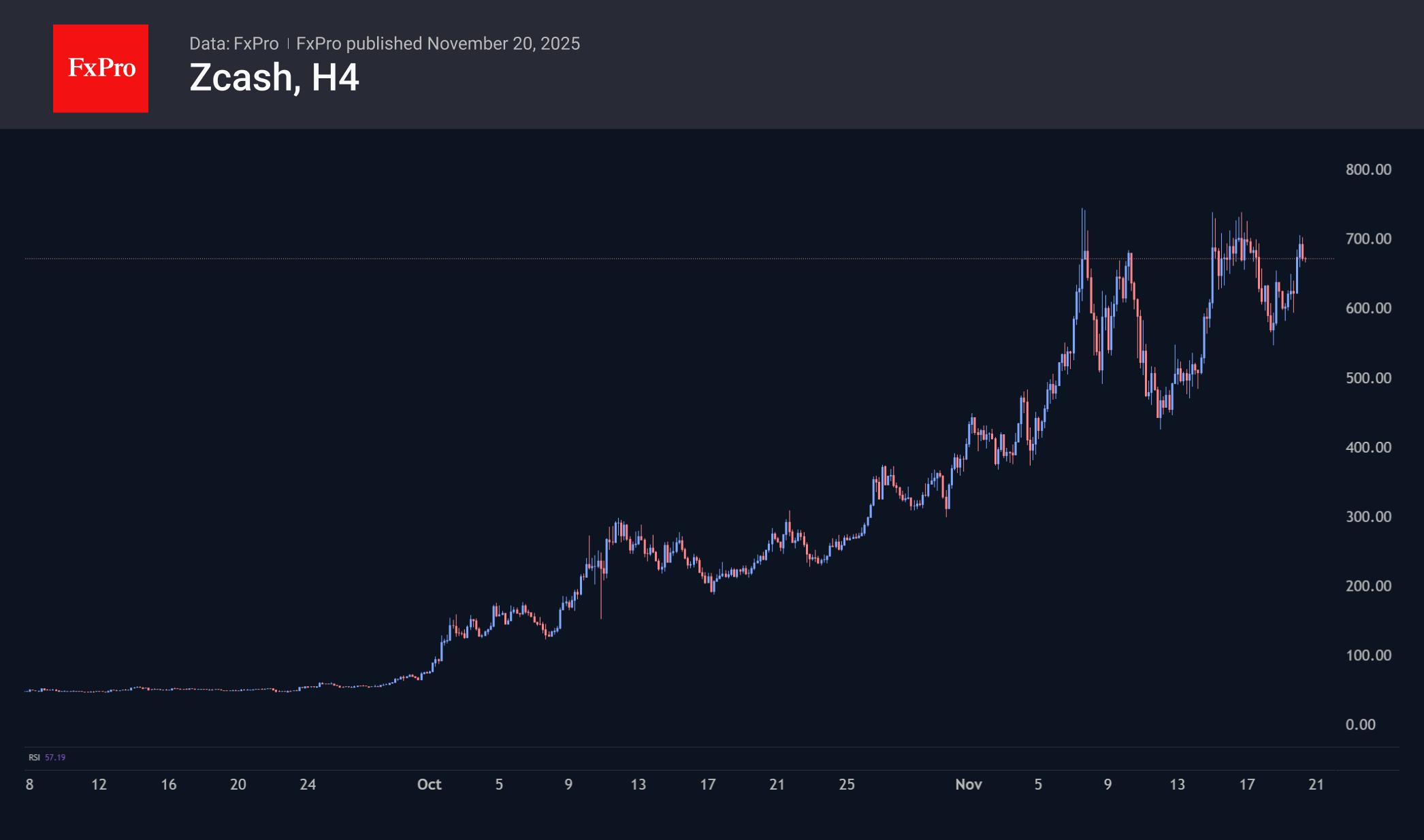

ZEC remains a standout in the crypto market. The coin quickly recovered to the multi-year highs of $700 set earlier this month. This is quite impressive, considering the retreat of Bitcoin, which affects the entire crypto market. At the same time, we are wary of this growth, given its difficult legacy, as in previous bull markets, the rise of Zcash was a harbinger of the end.

The inflow into spot Solana ETFs in the US has continued for 16 consecutive trading sessions. During this time, $420.4 million has been invested in the funds. Canary's recently launched XRP ETF in the US is also performing well, with an inflow of $276.8 million over three trading sessions; however, the bulk of the investment occurred on the first day of trading.

The inflow into spot Solana ETFs in the US has continued for 16 consecutive trading sessions. During this time, $420.4 million has been invested in the funds. Canary's recently launched XRP ETF in the US is also performing well, with an inflow of $276.8 million over three trading sessions; however, the bulk of the investment occurred on the first day of trading.

On November 18th, trading commenced on Solana-based spot exchange-traded funds from Fidelity (FSOL) and Canary Capital (SOLC) on the NYSE Arca and Nasdaq exchanges, respectively. Thus, five Solana spot ETFs are now trading in the US.

Aggressive bullish bets on the Bitcoin options market have been replaced by 'clearly bearish' positions, reflecting investors' concerns about the market correction continuing, notes CoinDesk analyst Omkar Godbole. Short-term put options with strikes of $84,000-80,000 prevail.

Some experts attribute the current decline in the crypto market to a liquidity shortage amid the US government shutdown, rather than fundamental factors such as outflows from ETFs or a decline in DAT company activity.

Some experts attribute the current decline in the crypto market to a liquidity shortage amid the US government shutdown, rather than fundamental factors such as outflows from ETFs or a decline in DAT company activity.

The FxPro Analyst Team

-11122024742.png)

-11122024742.png)